GLOBAL COMPOSITE-CLAD MATERIALS MARKET (2024 - 2030)

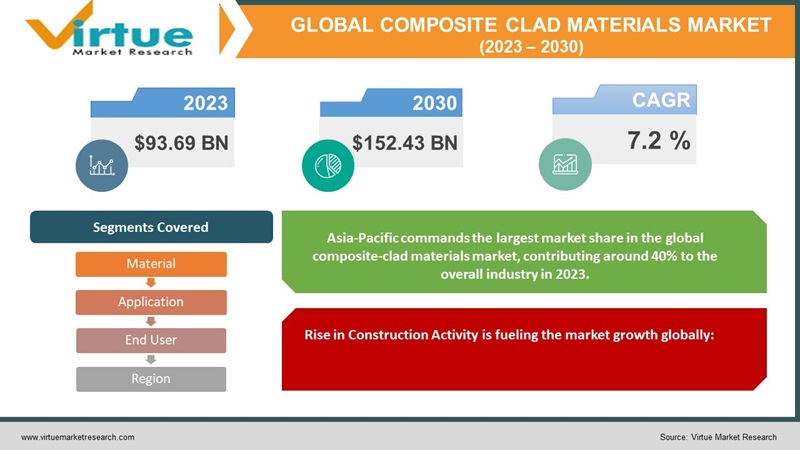

The Global Composite-Clad Materials Market was valued at USD 93.69 billion in 2023 and is projected to reach a market size of USD 152.43 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.2%.

The Global Composite-Clad Materials Market is characterized by key market insights highlighting drivers, restraints, and trends shaping the industry. The rise in construction activity, growth in residential and commercial buildings, and the emergence of eco-preferred cladding materials are driving market expansion. However, challenges such as geopolitical events, supply chain disruptions, cost fluctuations in raw materials, environmental regulations, and competitive landscapes with technological advancements are crucial considerations. The market is segmented by material, application, and end-users, revealing insights into the dominance of steel, the prevalence of walls in applications, and the majority share held by non-residential buildings. Regionally, Asia-Pacific commands the largest market share, driven by rapid urbanization and extensive construction activities.

Key Market Insights:

The Global Composite-Clad Materials Market is experiencing robust growth driven by several key drivers. Firstly, there is a substantial increase in construction activity worldwide, particularly in developing countries such as China, India, and the USA. This surge in construction is contributing to the adoption of composite-clad materials, which are favored for their thermal insulation properties, weather resistance, and aesthetic enhancement, thereby expanding the cladding systems market. Additionally, the growth in residential and commercial buildings, including high-end apartments, houses, and skyscrapers, is a key driver for the market. Modern architecture and building design demand materials that provide both functionality and visual appeal, leading to increased use of composite-clad materials. The global economic recovery is influencing the market, with an anticipated rebound in construction activities as the global economy stabilizes, further driving demand for composite-clad materials. Furthermore, the emergence of eco-preferred cladding materials, such as timber cladding, is shaping the market, as companies actively develop sustainable options to cater to environmentally-conscious consumers.

However, the market faces significant restraints and challenges. Geopolitical events, such as the Russia-Ukraine war, introduce uncertainties and disruptions to the global supply chain, impacting the availability and cost of raw materials for composite-clad materials. Supply chain disruptions, including those caused by natural disasters, global pandemics, or trade disputes, pose challenges for manufacturers and may lead to increased production costs. Fluctuations in the prices of raw materials, including steel, aluminum, zinc, copper, and plastic panels, can impact production costs and profit margins for manufacturers, creating volatility in the market. Additionally, environmental regulations and sustainability concerns present challenges, as meeting stringent sustainability standards may require significant investments in research, development, and production processes. The competitive landscape and technological advancements in alternative materials also pose challenges for traditional composite-clad material providers, requiring continuous investment in research and development to stay competitive.

Global Composite-Clad Materials Market Drivers:

Rise in Construction Activity is fueling the market growth globally:

The global demand for composite-clad materials is propelled by a significant increase in construction activities worldwide. As the construction sector, particularly in developing countries such as China, India, and the USA, continues to grow, there is a parallel surge in the adoption of composite-clad materials. Builders are increasingly utilizing these materials for their thermal insulation properties, weather resistance, and aesthetic enhancement, contributing to the expansion of the cladding systems market. The construction of new residential and commercial buildings is a key driver for the global composite-clad materials market. With the rise in high-end apartments, houses, and skyscrapers, the demand for materials that provide both functionality and visual appeal is escalating. Composite-clad materials, including steel, aluminium, zinc, copper, and plastic panels, are being favored to meet the requirements of modern architecture and building design, fostering the growth of the market.

Global Economic Recovery Influences are pushing and expanding the global market:

The market for composite-clad materials is intricately linked to global economic conditions. While the Russia-Ukraine war and subsequent economic sanctions have temporarily disrupted the chances of a swift recovery from the COVID-19 pandemic, the overall trajectory suggests a positive outlook. As the global economy stabilizes, there is an anticipated rebound in construction activities, leading to increased demand for composite-clad materials.

The emergence of Eco-Preferred Cladding Materials is boosting the demand for composite-clad materials:

A notable trend shaping the composite-clad materials market is the increasing preference for eco-friendly options. Companies are actively developing eco-preferred cladding materials, such as timber cladding, to cater to environmentally-conscious consumers. Timber cladding, known for its effective sound and heat insulation, along with its renewable and waste-free characteristics, is gaining popularity. This shift towards sustainable building practices is driving the market for composite-clad materials.

Global Composite-Clad Materials Market Restraints and Challenges:

Geopolitical events, such as the Russia-Ukraine war, have introduced uncertainties and disruptions to the global supply chain. Economic sanctions and trade restrictions stemming from geopolitical tensions can adversely affect the availability and cost of raw materials, impacting the composite-clad materials market. Fluctuations in commodity prices and supply chain disruptions pose significant challenges for manufacturers and may lead to increased production costs.

The composite-clad materials market is susceptible to supply chain disruptions, particularly in the wake of unexpected events like natural disasters, global pandemics, or trade disputes. The COVID-19 pandemic has already highlighted the vulnerabilities in global supply chains. Interruptions in the production and transportation of raw materials can lead to delays in manufacturing and construction projects, affecting the overall demand and distribution of composite-clad materials.

The composite-clad materials industry relies heavily on various raw materials, including steel, aluminium, zinc, copper, and plastic panels. Fluctuations in the prices of these raw materials can impact production costs and profit margins for manufacturers. Volatility in commodity prices, influenced by factors such as market demand, geopolitical events, and economic conditions, poses a challenge for businesses operating in the composite-clad materials market.

While there is a growing trend towards eco-preferred cladding materials, the industry is also facing increased scrutiny and compliance requirements related to environmental regulations. Meeting stringent sustainability standards can be challenging for manufacturers, especially if it involves transitioning away from traditional materials with established market presence. Adapting to these regulations may require significant investments in research, development, and production processes.

The composite-clad materials market is highly competitive, with several major players vying for market share. Rapid technological advancements and innovations in alternative materials pose a challenge for traditional composite-clad material providers. Staying competitive requires continuous investment in research and development to introduce new and improved materials that meet evolving industry standards and customer preferences.

GLOBAL COMPOSITE-CLAD MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2 % |

|

Segments Covered |

By Material, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arconic Corporation, Boral Limited, CSR Limited, Etex Group, Nichiha Corporation Tata Steel Limited, Compagnie de Saint-Gobain S.A., Dupont, Hindalco Industries Limited, Glen-Gery Corporation |

Global Composite-Clad Materials Market Segmentation:

Market Segmentation: By Material

- Steel

- Aluminium

- Zinc

- Copper

- Plastic Panels

Steel dominates the composite-clad materials market, holding the majority share. With a market share of approximately 40% in 2023, steel is the preferred material for cladding systems. Its widespread use is attributed to its durability, versatility, and ability to provide both structural support and aesthetic appeal in construction projects. The demand for steel cladding systems remains high in both residential and non-residential buildings, contributing significantly to its substantial market share.

Plastic panels are experiencing a notable surge in demand, indicating a rising trend in the composite-clad materials market. With a growing market share of around 15%, plastic panels are gaining popularity due to their lightweight nature, cost-effectiveness, and versatility in design. The increasing emphasis on sustainable and energy-efficient construction practices is driving the adoption of plastic panels, especially in residential buildings.

Market Segmentation: By Application

- Walls

- Roofs

Walls dominate the market share in the application segment, accounting for approximately 60% of the composite-clad materials market in 2023. The preference for cladding systems in walls is driven by the need for both functional and aesthetic enhancements in building structures. Cladding on walls provides thermal insulation, weather resistance, and architectural appeal, making it a crucial component in residential and commercial construction projects.

Roofs are witnessing a rising trend in the market, capturing an increasing market share of around 25%. The demand for cladding systems on roofs is escalating as builders recognize the importance of weather-resistant and durable materials for overhead structures. The emphasis on sustainable roofing solutions is also contributing to the growth of roof cladding systems, especially in regions prone to extreme weather conditions..

Market Segmentation: By End Users

- Residential Buildings

- Non-Residential Buildings

Non-Residential Buildings command the majority market share in the end-user segment, holding approximately 55% of the composite-clad materials market in 2023. The robust demand from commercial and industrial construction projects is driving the use of cladding systems in non-residential buildings. The need for durable and visually appealing exteriors in offices, malls, and industrial facilities contributes to the dominance of this segment.

Residential Buildings are witnessing a growing market share, capturing around 30% of the composite-clad materials market. The increasing focus on aesthetic customization and energy efficiency in residential construction is fueling the demand for cladding systems. Homeowners are opting for materials that enhance the curb appeal of their houses while providing practical benefits such as insulation and weather protection.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific commands the largest market share in the global composite-clad materials market, contributing around 40% to the overall industry in 2023. The region's dominance is driven by the rapid pace of urbanization, extensive construction activities, and a surge in infrastructure development, particularly in countries like China and India.

North America is experiencing an upward trend in market share, representing approximately 25% of the composite-clad materials market. The growth is propelled by increasing investments in sustainable construction practices and renovations. The demand for innovative and eco-friendly cladding materials is on the rise, leading to the expansion of the market in the North American region.

COVID-19 Impact Analysis on the Global Composite-Clad Materials Market:

The global composite-clad materials market underwent a significant impact due to the COVID-19 pandemic. The onset of the pandemic in 2020 led to disruptions across the entire construction industry, resulting in delays, project cancellations, and supply chain challenges. As countries implemented lockdown measures to curb the spread of the virus, construction activities were halted or slowed down, directly affecting the demand for composite-clad materials. The initial phases of the pandemic saw a decline in market growth, attributed to uncertainties, financial constraints, and a cautious approach adopted by builders and developers. Supply chain disruptions, labor shortages, and logistical challenges further compounded the difficulties faced by the composite-clad materials market. The postponement of construction projects, especially in the non-residential sector, created a ripple effect, impacting the entire value chain of composite-clad material production and distribution.

However, as the world adapted to the new normal and construction activities resumed, the market began to recover. The emphasis on resilient and sustainable construction practices gained prominence during the post-pandemic recovery phase, driving the demand for composite-clad materials. The industry demonstrated resilience by leveraging digital technologies for remote collaboration, accelerating the adoption of innovative and eco-friendly materials. The pandemic-induced shift towards remote working also influenced residential construction trends, contributing to a rise in the demand for composite-clad materials in the residential building sector. The market dynamics evolved as builders and manufacturers adapted to the changing demands of a post-pandemic world, emphasizing the importance of materials that offer durability, energy efficiency, and aesthetic appeal.

While the impact of COVID-19 posed challenges to the global composite-clad materials market, the industry demonstrated adaptability and resilience in navigating through the uncertainties. The recovery phase witnessed a renewed focus on sustainable construction practices, providing opportunities for growth and innovation within the composite-clad materials sector.

Latest Trends/ Developments:

Recent trends and developments in the global composite-clad materials market reflect a dynamic landscape shaped by evolving consumer preferences, technological advancements, and a heightened focus on sustainability.

The emergence of Eco-Preferred Cladding Materials stands out as a prominent trend, driven by increasing environmental consciousness. Companies in the market are actively developing and promoting cladding materials that align with sustainable practices. Timber cladding, in particular, has gained traction due to its effective sound and heat insulation properties, coupled with its renewable and waste-free characteristics. This trend is indicative of a broader shift toward eco-friendly building solutions. In response to the demand for innovative materials, there has been a notable surge in the use of Plastic Panels. These lightweight and versatile panels are gaining popularity, especially in residential construction. With approximately 15% of the market share, plastic panels are becoming a preferred choice for their cost-effectiveness and adaptability in design, reflecting a shift towards modern, customizable architecture.

A noteworthy development is the increasing emphasis on Technological Advancements within the composite-clad materials industry. The market is witnessing ongoing research and development efforts to introduce new and improved materials that meet evolving industry standards and consumer preferences. The integration of advanced technologies in manufacturing processes is enhancing the performance, durability, and energy efficiency of composite-clad materials. Market Consolidation and Acquisitions are shaping the competitive landscape of the industry. Key players are strategically acquiring complementary businesses to expand their product portfolios and gain a competitive edge. A significant trend influencing market dynamics is the growing focus on Customization and Aesthetics in cladding systems. Builders and homeowners are increasingly seeking materials that not only offer functional benefits such as thermal insulation and weather resistance but also contribute to the visual appeal of the structure. This trend is driving innovation in design and material choices, offering a wide range of options for architectural expression.

Key Players:

- Arconic Corporation

- Boral Limited

- CSR Limited

- Etex Group

- Nichiha Corporation

- Tata Steel Limited

- Compagnie de Saint-Gobain S.A.

- Dupont

- Hindalco Industries Limited

- Glen-Gery Corporation

Chapter 1. GLOBAL COMPOSITE-CLAD MATERIALS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL COMPOSITE-CLAD MATERIALS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL COMPOSITE-CLAD MATERIALS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL COMPOSITE-CLAD MATERIALS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL COMPOSITE-CLAD MATERIALS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL COMPOSITE-CLAD MATERIALS MARKET – By Material

6.1. Steel

6.2. Aluminium

6.3. Zinc

6.4. Copper

6.5. Plastic Panels

Chapter 7. GLOBAL COMPOSITE-CLAD MATERIALS MARKET – By Application

7.1. Walls

7.2. Roofs

Chapter 8. GLOBAL COMPOSITE-CLAD MATERIALS MARKET – By End User

8.1. Residential Buildings

8.2. Non – Residential Buildings

Chapter 9. GLOBAL COMPOSITE-CLAD MATERIALS MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Material

9.1.3. By Application

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Material

9.2.3. By Application

9.2.4. By End User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Material

9.3.3. By Application

9.3.4. By End User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By material

9.4.3. By Application

9.4.4. By End User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Material

9.5.3. By Application

9.5.4. By End User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL COMPOSITE-CLAD MATERIALS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Arconic Corporation

10.2. Boral Limited

10.3. CSR Limited

10.4. Etex Group

10.5. Nichiha Corporation

10.6. Tata Steel Limited

10.7. Compagnie de Saint-Gobain S.A.

10.8. Dupont

10.9. Hindalco Industries Limited

10.10. Glen-Gery Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Composite-Clad Materials Market was valued at USD 93.69 billion in 2023 and is projected to reach a market size of USD 152.43 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.2%.

The Global Composite-Clad Materials Market drivers include the rise in construction activity, growth in residential and commercial buildings, global economic recovery influences, and the emergence of eco-preferred cladding materials.

The segments under the Global Composite-Clad Materials Market By Material include steel, aluminium, zinc, copper, and plastic panels.

Asia-Pacific currently holds the majority market share in the Global Composite-Clad Materials Market.

The leading players in the Global Composite-Clad Materials Market include Arconic Corporation, Boral Limited, CSR Limited, Etex Group, Nichiha Corporation, Tata Steel Limited, Compagnie de Saint-Gobain S.A., Dupont, Hindalco Industries Limited, and Glen-Gery Corporation.