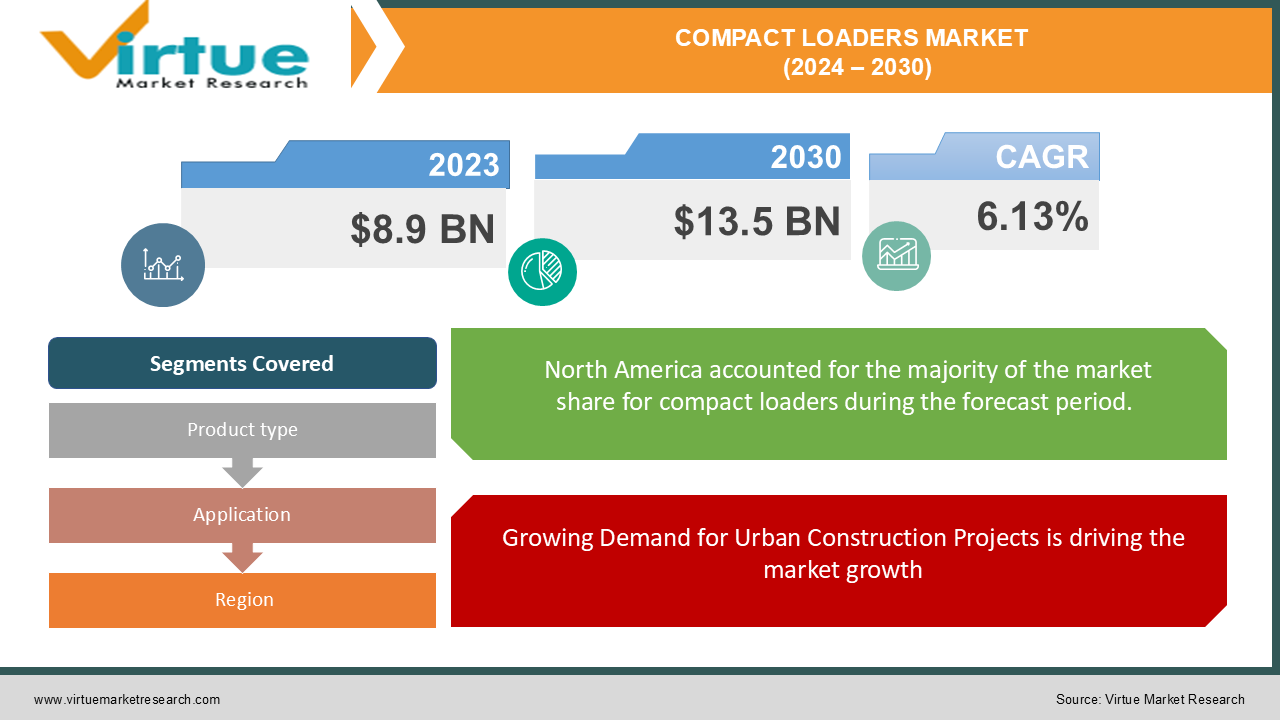

Compact Loaders Market Size (2024 – 2030)

As of 2023, the Global Compact Loaders Market is valued at approximately USD 8.9 billion and is projected to reach USD 13.5 billion by 2030, expanding at a compound annual growth rate (CAGR) of 6.13% during the forecast period.

Compact loaders, which include skid-steer loaders, compact track loaders, and backhoe loaders, are small, highly maneuverable machines designed for material handling, excavation, and other earthmoving tasks. The market's growth is largely attributed to the rising adoption of compact loaders in urban construction projects, where space constraints and the need for maneuverability favor smaller, versatile machines. In addition to construction, compact loaders are widely used in agriculture for tasks such as loading, trenching, and excavation, as well as in landscaping, where their size and flexibility allow for efficient work in confined spaces. The market is characterized by continuous advancements in equipment design, such as the integration of electric and hybrid power systems, improved safety features, and enhanced operator comfort. Key players in the compact loaders market are focusing on product innovation, expanding their distribution networks, and offering a wide range of equipment to cater to various end-user needs.

Key Market Insights:

-

Skid-steer loaders hold the largest share of the compact loaders market, accounting for over 40% of total revenue, due to their versatility, ease of operation, and wide range of attachments.

-

The construction sector is the dominant application segment, driven by the increasing need for compact equipment in urban projects and residential construction.

-

North America is the leading region, contributing over 35% of the global market share, supported by strong demand from the construction and agriculture sectors, as well as the presence of key market players.

Global Compact Loaders Market Drivers

Growing Demand for Urban Construction Projects is driving the market growth

The demand for compact loaders is strongly linked to the increasing number of urban construction projects, particularly in densely populated cities where space is limited. As urbanization accelerates, the need for residential, commercial, and infrastructure development is rising, creating a high demand for compact, versatile, and efficient construction equipment. Compact loaders are favored for their ability to operate in tight spaces, navigate narrow pathways, and perform a variety of tasks such as digging, lifting, loading, and grading. Skid-steer loaders, in particular, are highly valued in urban construction due to their maneuverability, ease of operation, and compatibility with multiple attachments that enhance their versatility. As urban areas continue to expand, the construction sector's reliance on compact loaders is expected to grow, driving market demand.

Adoption in the Agriculture and Landscaping Sectors is driving the market growth

Beyond construction, compact loaders are increasingly being adopted in the agriculture and landscaping sectors. In agriculture, compact loaders are used for tasks such as moving soil, feed, or other materials, digging trenches, and maintaining farm infrastructure. The machines’ small size and high maneuverability make them ideal for working in confined spaces such as barns, stables, and greenhouses. Similarly, in landscaping, compact loaders are favored for projects that require precision and flexibility, such as garden construction, tree planting, and hardscaping. As the demand for sustainable landscaping and precision agriculture continues to grow, compact loaders are becoming essential tools for improving productivity and operational efficiency.

Technological Advancements in Compact Loader Design is driving the market growth

Technological advancements in compact loader design are playing a significant role in driving market growth. Manufacturers are focusing on improving the performance, safety, and sustainability of compact loaders by incorporating innovations such as electric and hybrid powertrains, advanced telematics, and operator-assist technologies. Electric and hybrid compact loaders are gaining traction as industries seek to reduce carbon emissions and improve fuel efficiency. These machines offer quieter operation, lower maintenance costs, and reduced environmental impact, making them an attractive option for urban construction and other applications where sustainability is a priority. Additionally, the integration of telematics systems in compact loaders allows operators and fleet managers to monitor equipment performance, track maintenance needs, and optimize usage, enhancing overall operational efficiency.

Global Compact Loaders Market Challenges and Restraints

High Initial Costs and Maintenance Expenses is restricting the market growth

One of the primary challenges facing the compact loaders market is the high initial cost of equipment, particularly for small and medium-sized enterprises (SMEs) in construction, agriculture, and landscaping. The purchase of new compact loaders can be a significant financial burden for businesses with limited capital. In addition to the upfront cost, the ongoing expenses associated with maintenance, repair, and fuel consumption can further add to the total cost of ownership. While technological advancements, such as electric and hybrid loaders, promise lower maintenance costs and fuel savings, the initial investment required for these machines remains a barrier for widespread adoption, particularly in price-sensitive markets.

Limited Awareness and Availability in Emerging Markets is restricting the market growth

Although compact loaders are widely used in developed regions, such as North America and Europe, their adoption in emerging markets is relatively limited. Many businesses in developing regions are still reliant on traditional, larger equipment for material handling and earthmoving tasks, due to a lack of awareness about the benefits of compact loaders and limited access to affordable financing options. Additionally, the availability of compact loaders in some emerging markets is constrained by underdeveloped distribution networks and the presence of fewer established manufacturers. To address this challenge, companies are focusing on expanding their distribution channels, offering financing solutions, and educating potential customers about the advantages of compact loaders in terms of efficiency, versatility, and cost savings.

Environmental Regulations and Emission Standards is restricting the market growth

Stringent environmental regulations and emission standards pose a challenge for the compact loaders market, particularly for diesel-powered machines. Governments and regulatory bodies worldwide are implementing stricter emission limits to reduce the environmental impact of construction and agricultural equipment. Compliance with these regulations requires manufacturers to invest in cleaner, more efficient engines, which can increase production costs and, ultimately, the price of compact loaders. While electric and hybrid loaders offer a solution to meet emission standards, the limited availability of charging infrastructure and higher costs associated with battery technology remain significant barriers to adoption in some regions.

Market Opportunities

The growing trend towards electrification and hybrid technology in compact loaders presents significant opportunities for market growth. Electric and hybrid compact loaders offer numerous benefits, including reduced emissions, lower operating costs, and quieter operation, making them ideal for use in urban environments, indoor applications, and environmentally sensitive areas. With increasing regulatory pressure to reduce carbon emissions and the growing demand for sustainable construction and agriculture practices, the adoption of electric and hybrid compact loaders is expected to rise. Manufacturers that invest in the development of electric and hybrid models and offer flexible financing options will be well-positioned to capitalize on this emerging trend. The integration of advanced telematics and automation technologies in compact loaders is another key opportunity for market growth. Telematics systems provide real-time data on equipment performance, usage patterns, and maintenance needs, allowing operators and fleet managers to optimize machine usage and reduce downtime. Automation technologies, such as operator-assist systems, precision controls, and remote operation capabilities, enhance the productivity and safety of compact loaders by reducing operator fatigue and improving task accuracy. As industries continue to adopt digital solutions and automation in their operations, the demand for compact loaders equipped with advanced telematics and automation features is expected to increase, creating new opportunities for manufacturers.

COMPACT LOADERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.13% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Caterpillar Inc., Bobcat Company (Doosan Group), JCB, Komatsu Ltd., CNH Industrial N.V., Volvo Construction Equipment, Deere & Company, Kubota Corporation, Yanmar Holdings Co., Ltd., Hitachi Construction Machinery Co., Ltd. |

Compact Loaders Market Segmentation - By Product Type

-

Skid-Steer Loaders

-

Compact Track Loaders

-

Backhoe Loaders

-

Others

Skid-steer loaders hold the largest market share due to their versatility, ease of operation, and wide range of compatible attachments. These loaders are commonly used in construction, agriculture, and landscaping for tasks such as grading, lifting, and material handling. Compact track loaders, which are similar to skid-steer loaders but equipped with tracks instead of wheels, are gaining popularity for their ability to operate on rough, uneven terrain. These machines are ideal for use in soft soil conditions, such as agriculture and landscaping, where traction and stability are essential.

Compact Loaders Market Segmentation - By Application

-

Construction

-

Agriculture

-

Landscaping

-

Mining

-

Others

The construction sector is the largest application segment for compact loaders, driven by the growing demand for urban development, residential housing, and infrastructure projects. Compact loaders are used for a variety of tasks in construction, including earthmoving, material handling, grading, and trenching. The agriculture sector is another significant application area, where compact loaders are used for farm maintenance, material transport, and land preparation.

Compact Loaders Market Segmentation - Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America leads the global compact loaders market, accounting for over 35% of the total revenue. The region’s dominance is driven by the strong demand for compact construction equipment, particularly in the U.S., where the residential housing market and urban infrastructure development are key drivers. The presence of established manufacturers and a well-developed distribution network also support market growth in North America.

COVID-19 Impact Analysis on Compact Loaders Market

The COVID-19 pandemic had a mixed impact on the global compact loaders market. While the construction and agriculture sectors experienced disruptions due to lockdowns, supply chain interruptions, and labor shortages, the demand for compact loaders remained relatively stable in some regions. The pandemic accelerated the shift towards mechanization in agriculture and construction as businesses sought to improve productivity and reduce dependence on manual labor. Additionally, government stimulus packages aimed at infrastructure development in various countries supported the recovery of the compact loaders market. As the global economy recovers from the pandemic, the demand for compact loaders is expected to rebound, driven by ongoing infrastructure projects, urban development, and the growing focus on sustainable agriculture.

Latest Trends/Developments

Several key trends and developments are shaping the future of the compact loaders market. One significant trend is the increasing adoption of electric and hybrid compact loaders, driven by the growing demand for sustainable and environmentally friendly construction and agricultural equipment. Electric and hybrid loaders offer reduced emissions, lower fuel consumption, and quieter operation, making them ideal for use in urban areas and indoor applications. Another trend is the integration of advanced telematics systems and automation technologies, which enhance the productivity, efficiency, and safety of compact loaders. Telematics systems provide real-time data on machine performance and usage, allowing operators to optimize equipment utilization and reduce downtime. The rise of autonomous and operator-assist technologies is also transforming the market, as businesses seek to improve task accuracy and reduce operator fatigue. Furthermore, the trend towards customization of compact loaders is gaining traction, as manufacturers offer a wide range of attachments and configurations to meet the specific needs of end-users in different industries.

Key Players

-

Caterpillar Inc.

-

Bobcat Company (Doosan Group)

-

JCB

-

Komatsu Ltd.

-

CNH Industrial N.V.

-

Volvo Construction Equipment

-

Deere & Company

-

Kubota Corporation

-

Yanmar Holdings Co., Ltd.

-

Hitachi Construction Machinery Co., Ltd.

Chapter 1. Compact Loaders Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Compact Loaders Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Compact Loaders Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Compact Loaders Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Compact Loaders Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Compact Loaders Market – By Product Type

6.1 Introduction/Key Findings

6.2 Skid-Steer Loaders

6.3 Compact Track Loaders

6.4 Backhoe Loaders

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Compact Loaders Market – By Application

7.1 Introduction/Key Findings

7.2 Construction

7.3 Agriculture

7.4 Landscaping

7.5 Mining

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Compact Loaders Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Compact Loaders Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Caterpillar Inc.

9.2 Bobcat Company (Doosan Group)

9.3 JCB

9.4 Komatsu Ltd.

9.5 CNH Industrial N.V.

9.6 Volvo Construction Equipment

9.7 Deere & Company

9.8 Kubota Corporation

9.9 Yanmar Holdings Co., Ltd.

9.10 Hitachi Construction Machinery Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As of 2023, the Global Compact Loaders Market is valued at approximately USD 8.9 billion and is projected to reach USD 13.5 billion by 2030, growing at a CAGR of 6.13% during the forecast period.

Key drivers include increasing demand for urban construction projects, adoption in agriculture and landscaping, and technological advancements in compact loader design.

Major challenges include high initial costs, limited awareness in emerging markets, and stringent environmental regulations.

North America holds the largest market share due to strong demand for compact construction equipment, particularly in the U.S.

Leading players include Caterpillar Inc., Bobcat Company, JCB, Komatsu Ltd., and CNH Industrial N.V.