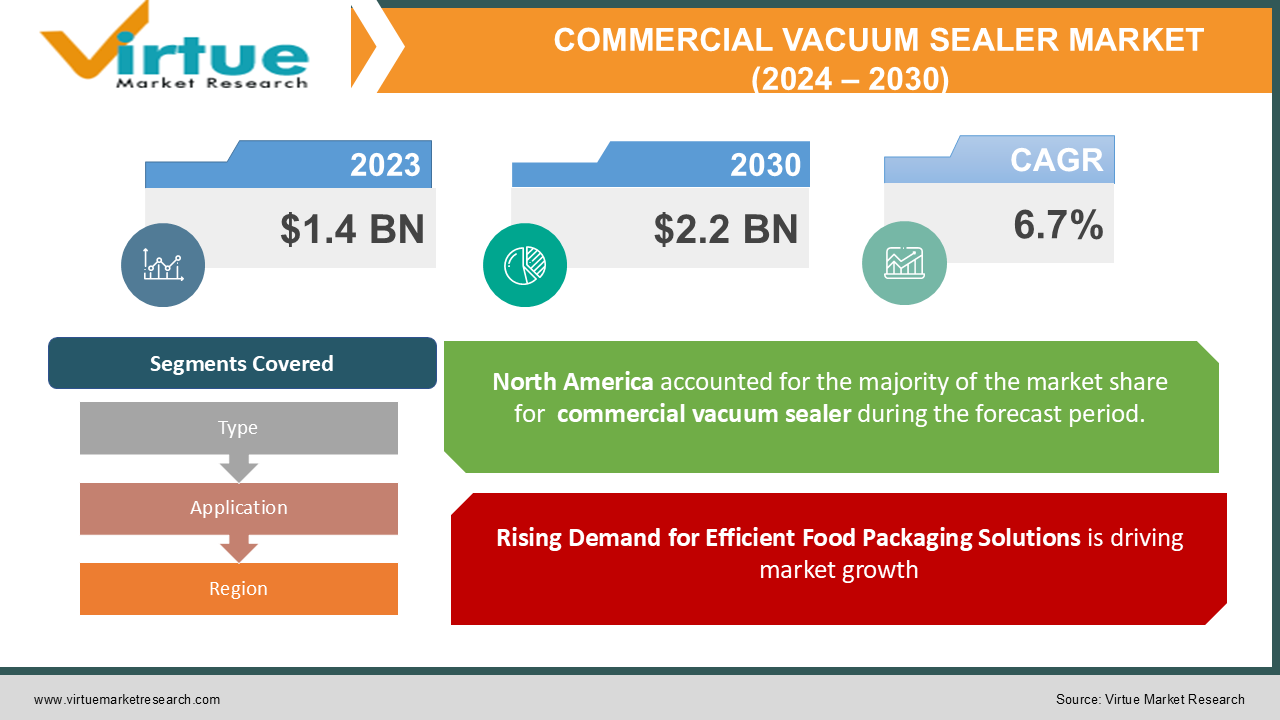

Commercial Vacuum Sealer Market Size (2024–2030)

The Global Commercial Vacuum Sealer Market was valued at USD 1.4 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030, reaching an estimated USD 2.2 billion by 2030.

Commercial vacuum sealers are widely used in various industries, particularly in food packaging, where they help preserve product quality, extend shelf life, and reduce spoilage by removing air from the packaging. This market has seen significant growth due to increasing demand from the food processing, retail, and hospitality sectors.

The rising emphasis on food safety and hygiene, combined with the growing need for efficient packaging solutions to minimize food waste, has contributed to the expansion of the commercial vacuum sealer market. Additionally, the non-food packaging segment, which includes industries like pharmaceuticals, electronics, and chemicals, has increasingly adopted vacuum sealing technology to protect sensitive products from moisture, oxidation, and contamination.

Key Market Insights:

-

The chamber vacuum sealer segment is projected to hold the largest share of the market, accounting for 55% of the total revenue in 2023, due to its versatility and suitability for packaging both dry and liquid products.

-

The food packaging application segment dominates the market, contributing approximately 65% of the total revenue in 2023, driven by the demand for efficient packaging solutions in the food processing and retail industries.

-

North America leads the global commercial vacuum sealer market, accounting for 38% of total revenue in 2023, due to the strong presence of food processing and retail industries in the region.

-

The Asia-Pacific region is expected to witness the highest growth rate, with a projected CAGR of 7.2% during the forecast period, driven by increasing industrialization and the growing demand for packaged food.

-

Technological advancements, such as automated vacuum sealing systems, are gaining popularity, especially among large-scale food processing units, due to their ability to increase operational efficiency and reduce labor costs.

Global Commercial Vacuum Sealer Market Drivers:

Rising Demand for Efficient Food Packaging Solutions is driving market growth: One of the primary drivers of the global commercial vacuum sealer market is the increasing demand for efficient food packaging solutions. As the global population grows, so does the need for packaged food, which has led to a surge in demand for vacuum sealers that can preserve food quality and extend shelf life. Vacuum sealing technology removes air from packaging, which slows down the oxidation process, prevents the growth of bacteria and mold, and preserves the freshness of food products. The food processing and retail industries, in particular, rely heavily on vacuum sealing solutions to ensure that their products remain fresh from the time they are packaged to the point of sale. By reducing the amount of air inside the packaging, vacuum sealers help to prevent spoilage, maintain product quality, and reduce food waste. This has become especially important as global food supply chains grow longer and more complex, making it essential to preserve food products during transportation and storage.

Growing Awareness of Food Safety and Hygiene Standards is driving the market growth: Food safety and hygiene have become top priorities for both consumers and businesses, driving the adoption of commercial vacuum sealers across various sectors. Vacuum sealing helps to protect food products from contamination by creating an airtight seal that prevents the entry of external contaminants such as bacteria, dust, and moisture. This not only ensures the safety of the food but also maintains its nutritional value and flavor. In response to growing concerns over foodborne illnesses and contamination, regulatory authorities in many countries have introduced stringent food safety standards. Businesses operating in the food processing, packaging, and retail industries are required to adhere to these regulations, which has led to the widespread adoption of vacuum sealing technology as a means of ensuring compliance.

Technological Advancements in Vacuum Sealing Equipment are driving the market growth: Technological advancements in vacuum sealing equipment have played a crucial role in driving the growth of the global commercial vacuum sealer market. Manufacturers are continuously innovating to develop more efficient, reliable, and user-friendly vacuum sealers that cater to the needs of various industries. One of the key innovations in this space is the integration of digital controls and sensor-based automation in vacuum sealing machines. Automated vacuum sealing systems offer several advantages over manual systems, including increased operational efficiency, reduced labor costs, and improved consistency in packaging quality. These systems are particularly beneficial for large-scale food processing units that handle high volumes of products and require precise and consistent packaging. Sensor-based automation allows for the precise control of vacuum levels and sealing times, ensuring that each package is sealed to the exact specifications required to maintain product quality.

Global Commercial Vacuum Sealer Market Challenges and Restraints:

High Initial Costs and Maintenance Requirements restrict the market growth: One of the primary challenges facing the global commercial vacuum sealer market is the high initial cost of vacuum sealing equipment, particularly for advanced models with automated features. For small and medium-sized enterprises (SMEs) operating in the food packaging or retail industries, the cost of investing in commercial vacuum sealers can be prohibitive. While the long-term benefits of vacuum sealing, such as reduced food waste and extended shelf life, may justify the investment, the upfront costs can be a significant barrier to entry for smaller businesses. In addition to the initial purchase cost, commercial vacuum sealers require regular maintenance to ensure they continue to function effectively. Maintenance costs can include the replacement of vacuum pump components, sealing gaskets, and other wear-and-tear parts, as well as routine servicing to prevent equipment breakdowns. For businesses with tight budgets, these ongoing maintenance requirements can add to the overall cost of ownership, making it challenging to justify the investment in vacuum sealing technology.

Environmental Concerns Related to Plastic Packaging is restricting the market growth While vacuum sealing offers numerous benefits in terms of preserving food quality and extending shelf life, it also presents challenges related to environmental sustainability, particularly the use of plastic packaging materials. Vacuum sealing typically requires the use of plastic bags or films to create an airtight seal, and the widespread use of plastic packaging has raised concerns about its environmental impact. The growing awareness of plastic pollution and its harmful effects on the environment has led to increased scrutiny of packaging practices across industries. Consumers are becoming more conscious of the environmental footprint of the products they purchase, and many are seeking out eco-friendly alternatives. This shift in consumer preferences presents a challenge for businesses that rely on vacuum sealing technology, as they must balance the need for effective packaging with the demand for sustainable solutions.

Market Opportunities:

The global commercial vacuum sealer market offers several growth opportunities, particularly in the areas of sustainability, automation, and expanding applications. One of the most significant opportunities lies in the development of sustainable packaging materials that are compatible with vacuum sealing technology. As environmental concerns continue to drive consumer preferences, businesses are seeking out eco-friendly alternatives to traditional plastic packaging. Vacuum sealer manufacturers that can offer biodegradable or compostable packaging options stand to benefit from this growing demand. In addition to sustainable materials, there is a growing opportunity for automated vacuum sealing systems. Automation is becoming increasingly important in industries that require high-volume packaging, such as food processing and pharmaceuticals. Automated vacuum sealers offer the ability to increase efficiency, reduce labor costs, and ensure consistent packaging quality, making them an attractive option for large-scale operations. As more businesses look to streamline their packaging processes, the demand for automated vacuum sealing systems is expected to rise. Another area of opportunity is the expansion of vacuum sealing applications beyond food packaging. While the food industry remains the dominant user of vacuum sealers, other sectors such as pharmaceuticals, electronics, and chemicals are increasingly adopting vacuum sealing technology to protect sensitive products from moisture, oxidation, and contamination. The growing demand for vacuum-sealed packaging in these industries presents a significant growth opportunity for the commercial vacuum sealer market.

COMMERCIAL VACUUM SEALER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Henkelman BV, Promarks, Inc., ULMA Packaging, Multivac Group, VACMASTER (ARY, Inc.), Henkovac International BV, Vogvigo, VacPak-It, PolyScience Culinary, Sealer Sales, Inc. |

Commercial Vacuum Sealer Market Segmentation: By Type

-

Chamber Vacuum Sealer

-

External Vacuum Sealer

The chamber vacuum sealer segment dominates the global market, accounting for 55% of total revenue in 2023. Chamber vacuum sealers are preferred for their versatility and ability to handle both dry and liquid products, making them ideal for a wide range of applications, particularly in the food industry.

Commercial Vacuum Sealer Market Segmentation: By Application

-

Food Packaging

-

Non-food Packaging

The food packaging application is the largest segment, contributing 65% of total revenue in 2023. Vacuum sealing is widely used in food packaging to preserve freshness, extend shelf life, and reduce spoilage, particularly in the food processing and retail industries.

Commercial Vacuum Sealer Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest share of the global commercial vacuum sealer market, accounting for 38% of total revenue in 2023. The region's dominance is driven by the strong presence of the food processing industry, the adoption of advanced packaging technologies, and a growing demand for food safety and hygiene solutions.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a significant impact on the global commercial vacuum sealer market. The disruption in supply chains, manufacturing shutdowns, and restrictions on movement initially hampered market growth. However, the pandemic also created new opportunities for the vacuum sealer market, particularly in the food industry. As consumers became more concerned about food safety and hygiene, the demand for vacuum-sealed food products increased. During the pandemic, food manufacturers and retailers sought out vacuum sealing solutions to ensure the safe and hygienic packaging of food products. The rise of e-commerce and online food delivery services further fueled the demand for vacuum-sealed packaging, as businesses needed to preserve the freshness and quality of food during transportation. As a result, the commercial vacuum sealer market experienced a resurgence in demand, particularly in the second half of 2020 and beyond. Looking ahead, the long-term impact of the pandemic is expected to drive further growth in the vacuum sealer market, as businesses prioritize food safety and hygiene, and consumers continue to seek out products that offer greater protection from contamination.

Latest Trends/Developments:

Several key trends are shaping the future of the global commercial vacuum sealer market. One of the most notable trends is the increasing demand for clean-label packaging solutions. Consumers are becoming more conscious of the ingredients in their food and the packaging materials used. As a result, businesses are seeking out vacuum sealing solutions that align with clean-label initiatives, which emphasize transparency, simplicity, and the use of natural or minimally processed materials. Another key trend is the rise of functional packaging, particularly in the food and beverage industry. Functional packaging goes beyond preserving the product's freshness and quality by offering additional benefits such as convenience, ease of use, and sustainability. Vacuum sealing is increasingly being used as part of functional packaging solutions, as it allows manufacturers to offer longer-lasting, high-quality products while minimizing the use of preservatives and additives. The development of advanced vacuum sealing technologies, including automated systems and sensor-based controls, is also driving innovation in the market. These technologies allow for more precise control of vacuum levels, sealing times, and packaging quality, making them ideal for high-volume production environments. As businesses seek to improve operational efficiency and reduce labor costs, the demand for these advanced systems is expected to grow.

Key Players:

-

Henkelman BV

-

Promarks, Inc.

-

ULMA Packaging

-

Multivac Group

-

VACMASTER (ARY, Inc.)

-

Henkovac International BV

-

Vogvigo

-

VacPak-It

-

PolyScience Culinary

-

Sealer Sales, Inc.

Chapter 1. Commercial Vacuum Sealer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Commercial Vacuum Sealer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Commercial Vacuum Sealer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Commercial Vacuum Sealer Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Commercial Vacuum Sealer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Commercial Vacuum Sealer Market – By Type

6.1 Introduction/Key Findings

6.2 Chamber Vacuum Sealer

6.3 External Vacuum Sealer

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Commercial Vacuum Sealer Market – By Application

7.1 Introduction/Key Findings

7.2 Food Packaging

7.3 Non-food Packaging

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Commercial Vacuum Sealer Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Commercial Vacuum Sealer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Henkelman BV

9.2 Promarks, Inc.

9.3 ULMA Packaging

9.4 Multivac Group

9.5 VACMASTER (ARY, Inc.)

9.6 Henkovac International BV

9.7 Vogvigo

9.8 VacPak-It

9.9 PolyScience Culinary

9.10 Sealer Sales, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global commercial vacuum sealer market was valued at USD 1.4 billion in 2023 and is projected to reach USD 2.2 billion by 2030, growing at a CAGR of 6.7%.

Key drivers include the rising demand for efficient food packaging solutions, growing awareness of food safety and hygiene standards, and technological advancements in vacuum sealing equipment.

The market is segmented by type (chamber vacuum sealer, external vacuum sealer) and application (food packaging, non-food packaging).

North America is the dominant region, accounting for 38% of the market share in 2023, driven by a strong presence in the food processing industry.

Leading players include Henkelman BV, Promarks, ULMA Packaging, Multivac Group, VACMASTER, and Henkovac International.