Commercial Lawn Mower Market Size (2024-2030)

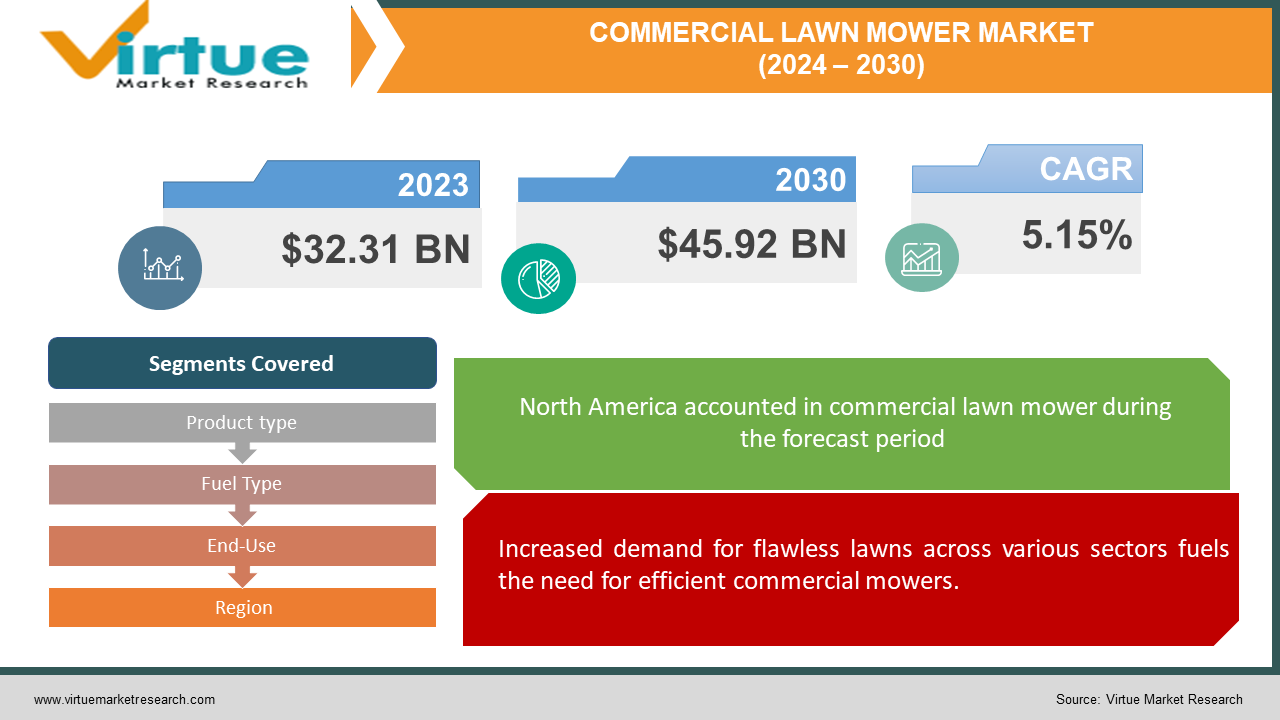

The Commercial Lawn Mower Market was valued at USD 32.31 billion in 2023 and is projected to reach a market size of USD 45.92 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.15%.

The commercial lawn mower market thrives on keeping expansive lawns beautiful across various sectors. From manicured fairways of golf courses to sprawling landscapes of corporate campuses, these mowers are essential for maintaining green spaces. The market is driven by a few key trends. First, the demand for pristine lawns in landscaping services, sports complexes, and institutions continues to rise. Second, smart city initiatives that emphasize aesthetics and green spaces are creating a need for efficient lawnmowers. Finally, the growing preference for automation is fueling the rise of robotic mowers.

Key Market Insights:

Environmental consciousness is playing a role in the commercial lawn mower market. As awareness of environmental issues grows, the demand for eco-friendly mowers is rising. This could lead to a significant increase in electric and battery-powered mowers, potentially replacing a substantial portion of the traditional gas-powered models currently dominating the market. User experience is another focus area for manufacturers. They are developing mowers that are easy to use, require minimal maintenance, and offer enhanced comfort features for professional landscapers who spend long hours operating the equipment. Looking ahead, the commercial lawn mower market shows regional variations. North America currently holds the leading position, but Asia Pacific is expected to experience significant growth.

The Commercial Lawn Mower Market Drivers:

Increased demand for flawless lawns across various sectors fuels the need for efficient commercial mowers.

The desire for beautifully maintained lawns in various sectors like landscaping services, sports complexes, golf courses, and institutions is a core driver. This ongoing demand necessitates efficient and reliable commercial mowers to uphold aesthetics and functionality.

A focus on aesthetics and green spaces in smart cities creates a fresh wave of demand for commercial lawn mowers.

The development of smart cities with a focus on aesthetics and green spaces is creating a fresh wave of demand. Efficient and eco-friendly mowers are crucial for maintaining these urban green spaces, propelling the commercial lawn mower market.

Rise of robotic mowers driven by labor shortages and the desire for autonomous solutions.

The growing preference for automation across industries is impacting lawn care. Robotic lawn mowers are gaining significant traction due to labor shortages and the desire for autonomous solutions, particularly in smart city projects. This trend is expected to significantly impact the market.

Environmental concerns push for eco-friendly mowers, with electric and battery-powered models gaining traction.

Growing awareness of environmental issues is pushing the demand for eco-friendly mowers. This could lead to a rise in electric and battery-powered mowers, replacing traditional gas-powered models and driving innovation in sustainable lawn care solutions.

Manufacturers prioritize comfort and ease of use for professional landscapers, impacting purchasing decisions.

Manufacturers are increasingly focusing on user experience by developing mowers that are easy to use, maintain, and offer enhanced comfort features. This caters to professional landscapers who spend long hours operating the equipment, leading to higher productivity and potentially influencing purchasing decisions.

The Commercial Lawn Mower Market Restraints and Challenges:

The commercial lawn mower market, despite its growth trajectory, faces hurdles that need to be addressed. A significant challenge is the high initial investment required for advanced models boasting automation or eco-friendly features. This can strain the budgets of landscaping businesses and municipalities. While automation is gaining ground, operating, and maintaining complex mowers, especially robotic ones, still necessitates skilled labour. A shortage of such technicians can pose a challenge for some businesses.

Furthermore, the market faces the whims of nature. Periods of drought or excessive rain can significantly impact the demand for lawn mowers and their overall use. Additionally, stringent regulations come into play. Strict emission standards and increasing noise pollution limitations can restrict the development and adoption of certain mower types, particularly gas-powered models.

Finally, the growing demand for electric and battery-powered mowers is restricted by the lack of widespread charging infrastructure in many areas. This limited infrastructure can hinder the practicality and adoption rates of these eco-friendly alternatives, potentially slowing down the transition towards a more sustainable future for the commercial lawn mower market.

The Commercial Lawn Mower Market Opportunities:

The commercial lawn mower market isn't just about keeping up with demand, it's brimming with opportunities. The rise of automation presents a fertile ground for innovation in user-friendly robotic mowers with advanced features. Imagine robotic mowers with obstacle detection and remote control capabilities, catering to a broader customer base. Environmentally conscious consumers are driving a focus on sustainability, opening doors for advancements in electric and battery-powered mowers with extended range and efficiency. Biofuels could even emerge as a viable alternative fuel source. The concept of smart cities creates a unique opportunity for mowers that seamlessly integrate with smart city management systems, allowing for optimized scheduling, route planning, and valuable data collection. Furthermore, specialized solutions can cater to the diverse needs of various sectors. Imagine mowers with precision cutting for golf courses, slope management for uneven sports complexes, or noise reduction for public parks. Finally, manufacturers who prioritize user experience will win big. Ergonomic designs, easy maintenance features, and operator comfort will translate to increased productivity and satisfied customers, keeping the commercial lawn mower market flourishing.

COMMERCIAL LAWN MOWER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.15% |

|

Segments Covered |

By Product type, Fuel Type, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Deere & Company, Honda Motor Company, The Toro Company, Husqvarna Group, Kubota Corporation, MTD Products, Robert Bosch GmbH, STIGA Group, AGCO Corporation, AL-KO Gardentech |

Commercial Lawn Mower Market Segmentation: By Product Type

-

Ride-on Mowers

-

Zero-turn Mowers

-

Walk-behind Mowers

-

Robotic Mowers

The dominant segment in the commercial lawn mower market by product type is ride-on mowers, currently leading the market due to their speed and efficiency in handling large areas. However, zero-turn mowers are gaining significant traction due to their superior maneuverability. On the other hand, robotic mowers are the fastest-growing segment, driven by factors like labor shortages and the increasing demand for autonomous solutions.

Commercial Lawn Mower Market Segmentation: By Fuel Type

-

Gas-powered

-

Electric and Battery-powered

-

Propane-powered

The dominant segment by fuel type in the commercial lawn mower market is currently Gas-powered. However, Electric and Battery-powered is the fastest-growing segment driven by environmental concerns and advancements in battery technology. This trend is expected to continue as consumers and businesses prioritize sustainability.

Commercial Lawn Mower Market Segmentation: By End-Use

-

Professional Landscaping Services

-

Municipalities

-

Golf Courses and Sports Complexes

-

Educational Institutions and Corporate Campuses

The commercial lawn mower market caters to diverse users through segmentation. Professional landscaping services, the current dominant segment by end-use, require durable and reliable mowers for frequent use. In contrast, the fastest-growing segment is robotic mowers, driven by automation preferences and labor shortages. This trend is expected to have a significant impact on the market as autonomous solutions gain traction.

Commercial Lawn Mower Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: Currently holding the crown, North America boasts the largest market share for commercial lawn mowers. This dominance is fueled by two key factors: well-established landscaping industries that require a constant stream of reliable equipment, and a strong cultural emphasis on maintaining manicured lawns in homes, businesses, and public spaces.

Europe: Europe represents a significant market with a growing appetite for both automation and eco-friendly solutions. Stringent environmental regulations in the region are pushing manufacturers to innovate and develop mowers that comply with stricter emission standards and noise pollution limitations. This focus on sustainability is shaping the future of the European commercial lawn mower market.

Asia Pacific: This region is brimming with potential for explosive growth in the commercial lawn mower market. The rise of urbanization, coupled with increasing disposable income, is creating a new wave of demand for well-maintained green spaces. Furthermore, the development of smart cities across Asia Pacific is opening doors for the integration of automated lawn care solutions, presenting exciting opportunities for the future.

COVID-19 Impact Analysis on the Commercial Lawn Mower Market:

The COVID-19 pandemic cast a long shadow over the commercial lawn mower market, disrupting its smooth operation. Lockdowns and travel restrictions tangled global supply chains, leading to a critical shortage of parts and materials. This domino effect impacted production timelines and delivery schedules for commercial mowers, leaving landscapers and other users waiting. Furthermore, key sectors that heavily rely on these mowers, like hospitality and sports facilities, experienced significant shutdowns, or reduced operations during the pandemic. This resulted in a temporary decline in demand for new equipment, as existing mowers sat idle in storage bays. The financial strain of the pandemic also impacted purchasing decisions. Landscaping businesses, with resources stretched thin, may have delayed equipment purchases or focused their budgets on maintaining their existing fleets of mowers. These further dampened sales of new commercial mowers.

However, amidst the challenges, some silver linings emerged. The rise of e-commerce provided a lifeline for the market as brick-and-mortar stores faced closures or limited operations. This trend might have accelerated the shift towards online equipment purchases, offering a new avenue for mower sales. Additionally, with people spending more time at home due to lockdowns, there was an increased focus on maintaining personal lawns. This potentially led to a rise in demand for smaller commercial mowers suitable for residential landscapes. As restrictions eased and people ventured back outdoors, the demand for outdoor activities surged. Parks, golf courses, and sports complexes reopened, leading to a renewed need for proper lawn maintenance. This resurgence in activity potentially boosted the demand for commercial mowers in these sectors.

In conclusion, the COVID-19 pandemic's impact on the commercial lawn mower market was a mixed bag of challenges and opportunities. While it caused initial disruptions, the market is expected to recover and resume its growth trajectory, potentially with a stronger emphasis on online sales channels and a renewed focus on maintaining vibrant green spaces for both commercial and residential use.

Latest Trends/ Developments:

The commercial lawn mower market isn't just about keeping grass trimmed, it's embracing innovation at a rapid pace. One of the hottest trends is the rise of robotic mowers. These are no longer science fiction; advancements are making them user-friendly with features like obstacle detection, remote control, and improved navigation. Expect even smarter and more efficient robotic mowers in the future. Environmental concerns are also driving the market towards eco-friendly solutions. Electric and battery-powered mowers are gaining traction, with manufacturers focusing on improved range, efficiency, and faster charging times. Biofuels are even being explored as a potential alternative fuel source. The concept of smart cities creates a unique opportunity for mowers to seamlessly integrate with smart city management systems, allowing for optimized scheduling, route planning, and valuable data collection. This integration will be a major selling point for future mowers. Additionally, specialization is becoming key. Instead of a one-size-fits-all approach, manufacturers are developing mowers with features tailored to specific sectors. Imagine mowers with precision cutting for golf courses, superior slope management for sports complexes, or noise reduction technology for public parks. Finally, manufacturers are recognizing the importance of user experience. Ergonomic designs, comfortable seating, and easy maintenance are becoming a priority. Features that reduce operator fatigue and improve overall comfort will be key differentiators in a competitive market. These trends paint a vibrant picture of the future for the commercial lawn mower market, where innovation and user needs go hand-in-hand with keeping green spaces flourishing in a sustainable way.

Key Players:

-

Deere & Company

-

Honda Motor Company

-

The Toro Company

-

Husqvarna Group

-

Kubota Corporation

-

MTD Products

-

Robert Bosch GmbH

-

STIGA Group

-

AGCO Corporation

-

AL-KO Gardentech

Chapter 1. Commercial Lawn Mower Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Commercial Lawn Mower Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Commercial Lawn Mower Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Commercial Lawn Mower Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Commercial Lawn Mower Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Commercial Lawn Mower Market – By Product Type

6.1 Introduction/Key Findings

6.2 Ride-on Mowers

6.3 Zero-turn Mowers

6.4 Walk-behind Mowers

6.5 Robotic Mowers

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Commercial Lawn Mower Market – By Fuel Type

7.1 Introduction/Key Findings

7.2 Gas-powered

7.3 Electric and Battery-powered

7.4 Propane-powered

7.5 Y-O-Y Growth trend Analysis By Fuel Type

7.6 Absolute $ Opportunity Analysis By Fuel Type, 2024-2030

Chapter 8. Commercial Lawn Mower Market – By End-Use

8.1 Introduction/Key Findings

8.2 Professional Landscaping Services

8.3 Municipalities

8.4 Golf Courses and Sports Complexes

8.5 Educational Institutions and Corporate Campuses

8.6 Y-O-Y Growth trend Analysis By End-Use

8.7 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. Commercial Lawn Mower Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Fuel Type

9.1.4 By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Fuel Type

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Fuel Type

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Fuel Type

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Fuel Type

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Commercial Lawn Mower Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Deere & Company

10.2 Honda Motor Company

10.3 The Toro Company

10.4 Husqvarna Group

10.5 Kubota Corporation

10.6 MTD Products

10.7 Robert Bosch GmbH

10.8 STIGA Group

10.9 AGCO Corporation

10.10 AL-KO Gardentech

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Commercial Lawn Mower Market was valued at USD 32.31 billion in 2023 and is projected to reach a market size of USD 45.92 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.15%.

Rising Demand for Pristine Lawns, Smart City Initiatives, Automation on the Rise, Environmental Concerns, Focus on User Experience.

Professional Landscaping Services, Municipalities, Golf Courses and Sports Complexes, Educational Institutions and Corporate Campuses.

North America reigns supreme in the commercial lawn mower market, holding the largest market share due to established landscaping industries and a high demand for manicured lawns.

Deere & Company, Honda Motor Company, The Toro Company, Husqvarna Group, Kubota Corporation, MTD Products, Robert Bosch GmbH, STIGA Group, AGCO Corporation, AL-KO Gardentech.