Commercial Dishwasher Market Size (2024 – 2030)

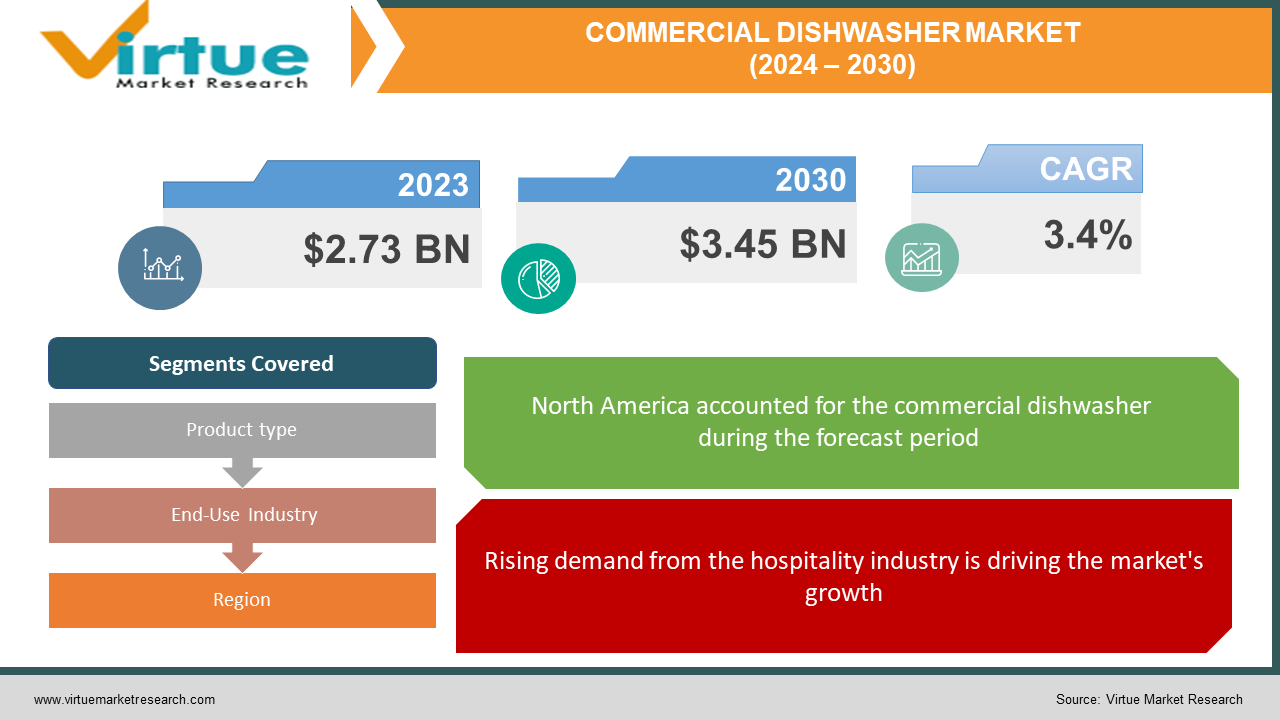

The global commercial dishwasher market was valued at USD 2.73 billion in 2023 and will grow at a CAGR of 3.4% from 2024 to 2030. The market is expected to reach USD 3.45 billion by 2030.

A commercial dishwasher is a sizable industrial dishwashing apparatus that can wash several pots, pans, glasses, and other dishes simultaneously. To swiftly wash dishes, restaurants and other establishments utilize commercial dishwashers. Less than 0.4 gallons of water are used by certain models on each rack. Cups and utensils are covered by a water-churning mechanism in commercial dishwashers. After giving the dishes a thorough washing with pure water, they may be sanitized using an additive solution that remains on them while they dry. Certain models can retain cleaning efficacy by adding soap to the primary wash water tank.

Key Market Insights:

The commercial dishwasher market is experiencing steady growth, driven by increasing demand from restaurants, hotels, and healthcare facilities. Energy efficiency and water conservation are key factors influencing purchasing decisions, with advancements in technology leading to eco-friendly models. Rising labor costs are pushing businesses towards automation, making dishwashers a more attractive solution. The market also sees a growing preference for under-counter and conveyor dishwashers due to space constraints and high-volume needs. However, factors like initial investment costs and maintenance requirements can be deterrents for some businesses. Overall, the market presents a promising outlook with a focus on innovation, efficiency, and catering to diverse operational needs.

Commercial Dishwasher Market Drivers:

Rising demand from the hospitality industry is driving the market's growth.

With the travel and hospitality industry bouncing back from the pandemic, restaurants, hotels, and cafes are experiencing a surge in customer traffic. This translates to a mountain of dishes needing to be cleaned efficiently and hygienically. To meet these demands, commercial dishwashers are becoming increasingly crucial. These machines not only free up valuable staff time but also ensure consistent sanitation through powerful wash cycles and high temperatures. This focus on hygiene becomes even more important as businesses prioritize customer safety and well-being in a post-pandemic world. As a result, the demand for commercial dishwashers is expected to rise steadily alongside the continued recovery of the travel and hospitality sector.

The growing preference for under-counter and conveyor dishwashers is facilitating the expansion.

Space constraints and dishwashing volume are shaping preferences in the commercial dishwasher market. Undercounter dishwashers are gaining popularity in restaurants with limited floor space. These compact machines offer a powerful cleaning solution without sacrificing valuable real estate. On the other hand, high-volume kitchens in hotels, cafes, and large restaurants are increasingly opting for conveyor dishwashers. These workhorses continuously clean a steady stream of dishes, ensuring efficient dishwashing during peak hours. This trend highlights the market's ability to cater to diverse operational needs, with both space-saving and high-capacity solutions driving growth.

Manufacturers are constantly innovating and integrating more advanced and efficient technologies into dishwashers.

Commercial dishwasher technology is undergoing a revolution, with manufacturers prioritizing performance, efficiency, and sustainability. Wash cycles are becoming more sophisticated, utilizing higher temperatures, targeted jets, and specialized detergents to tackle even the toughest grime, ensuring superior cleaning and sanitation. To optimize chemical usage and reduce costs, automatic dispensing systems are being integrated, ensuring a precise amount of detergent is used for each wash. Furthermore, environmental consciousness is a growing concern. Manufacturers are developing features like variable-speed wash motors and improved insulation to minimize energy and water consumption. These advancements not only benefit the environment but also translate to significant cost savings on utility bills for businesses.

Global Commercial Dishwasher Market Challenges and Restraints:

Commercial dishwashers are expensive to purchase and install, which is limiting market growth.

The high cost of commercial dishwashers, both upfront and during operation, presents a significant hurdle for small businesses. The initial purchase price and installation can be daunting, especially for startups or businesses with tight budgets. While the superior cleaning and efficiency of these machines can save on labor and water usage in the long run, the initial investment can be prohibitive. This can lead some businesses to cling to traditional hand-washing methods, even though they may be less efficient and hygienic. This cost barrier limits the potential benefits that commercial dishwashers offer, particularly for businesses that could greatly benefit from their speed and sanitation capabilities.

Operational costs are another major barrier.

The financial commitment to a commercial dishwasher goes beyond the initial purchase. Daily operation necessitates regular purchases of detergents, rinse aids, and chemicals to ensure proper cleaning and sanitation. Water and energy consumption also contribute to ongoing costs, although advancements in technology have led to more efficient models. Businesses need to carefully consider these operational expenses alongside potential water and labor savings. While energy-efficient models can help mitigate some ongoing costs, they may also come with a higher upfront price tag. Finding the right balance between initial investment and long-term operational expenses is crucial for businesses to maximize the return on their commercial dishwasher.

Global Commercial Dishwasher Market Opportunities:

Despite the challenges, the commercial dishwasher market presents exciting growth opportunities. The increasing focus on hygiene and sanitation in restaurants, hotels, and healthcare facilities is driving demand for reliable and effective dishwashing solutions. This is particularly relevant in the post-pandemic world, where hygiene protocols are a top priority. Furthermore, rising labor costs globally are prompting businesses to explore automation solutions, and high-performance commercial dishwashers can significantly reduce labor needs in dishwashing areas. Additionally, advancements in technology are creating opportunities for manufacturers. The development of more energy- and water-efficient models can address operational cost concerns, while features like smart controls and self-cleaning cycles can enhance the user experience and reduce maintenance time. Furthermore, there's potential for innovation in catering to specific niches within the market. For instance, compact and under-counter dishwashers can be ideal for smaller cafes or coffee shops, while high-capacity and rapid-wash models can cater to large restaurants or catering businesses. By addressing the cost barrier through potential financing options or leasing programs and by effectively communicating the long-term return on investment through water and labor savings, manufacturers can unlock the full potential of this growing market.

COMMERCIAL DISHWASHER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.4% |

|

Segments Covered |

By Product type, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, MEIKO International, Hobart Corporation, Jackson WWS, Miele Professional, Electrolux Professional, Fagor, Showa, Washtech, Insinger Machine, Winterhalter, MVP Group |

Commercial Dishwasher Market Segmentation: By Product Type

-

Undercounter Dishwashers

-

Conveyor Dishwashers

-

Door-type Dishwashers

Undercounter dishwashers are the largest growing type. In the commercial dishwasher market, under-counter dishwashers are a modest but effective option that is best suited for areas with limited space or smaller food service enterprises. Because of their ability to tidily nestle under counters, these dishwashers are perfect for kitchens where maximizing available space is crucial. Undercounter dishwashers are compact appliances that provide dependable performance and efficient dishwashing while taking up little floor space. They are preferred because of their practicality, simplicity of installation, and capacity to manage mild dishwashing requirements, meeting the requirements of small eateries, bars, and other similar places. Door-type dishwashers are the fastest-growing segment. Their versatility makes them suitable for a wide range of applications, from mid-sized restaurants and cafes to busy kitchens in hospitals or schools. Unlike under-counter models, they offer more capacity for dishwashing, and they aren't as space-consuming or expensive as high-volume conveyor dishwashers. This balance between size, functionality, and cost makes them a popular choice for a large portion of the commercial kitchen market.

Commercial Dishwasher Market Segmentation: By End-Use Industry

-

Hotels & Restaurants

-

Catering Units

-

Cafes & Bakeries

The hotel & restaurant segment is the largest and fastest-growing consumer of commercial dishwashers due to their sheer size and varied needs. Within this segment, door-type dishwashers likely reign supreme. They offer a middle ground between the compact under-counter models and the high-capacity conveyor dishwashers. This versatility allows them to cater to a wide range of establishments, from fine-dining restaurants with smaller dishwashing needs to mid-sized cafes with a moderate dishwashing volume. Catering units undoubtedly require high-capacity and rapid-wash models, but these businesses represent a smaller niche compared to the vast number of hotels and restaurants globally. While cafes and bakeries might utilize under-counter models or specialized units for specific needs, door-type dishwashers offer a more comprehensive solution for the broader hotel and restaurant industry.

Commercial Dishwasher Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the largest share due to its established hospitality industries. Commercial dishwashers are in high demand in North America, with the region housing a wide range of end-user industries, such as bakeries, cafés, restaurants, and hotels. The market is expanding because of technological advances, including the incorporation of energy-efficient solutions and smart features, which help organizations minimize operating costs and optimize operations. Furthermore, strict laws governing food safety and cleanliness encourage the use of high-performance dishwashing machines, fostering innovation and competitiveness in the market. However, the fastest-growing region is likely Asia-Pacific. This growth is driven by a booming hospitality sector, rising disposable incomes leading to more dining out, and stricter hygiene regulations. China, a major player in this region, has a large domestic market and a growing manufacturing base for commercial dishwashers, further propelling Asia-Pacific's dominance in terms of growth.

COVID-19 Impact Analysis on the Global Commercial Dishwasher Market

The COVID-19 pandemic delivered a mixed bag of impacts for the global commercial dishwasher market. Initially, lockdowns and restrictions on the hospitality sector caused a significant decline in demand. Restaurants, hotels, and cafes shut down or operate at limited capacity, leading to a reduced need for commercial dishwashers. However, as the pandemic progressed, an interesting shift emerged. With heightened hygiene concerns, once restrictions eased, there was a surge in demand for dishwashers. People returning to restaurants prioritized establishments with strong sanitation practices, and commercial dishwashers became a symbol of cleanliness and safety. Additionally, labor shortages within the hospitality industry pushed businesses towards automation, making dishwashers a more attractive solution for reducing reliance on manual labor. Supply chains faced disruptions during the pandemic, leading to temporary price fluctuations and delayed deliveries. However, the overall outlook remains positive. The ongoing recovery of the hospitality industry and the growing focus on hygiene are expected to be major drivers for the commercial dishwasher market. Manufacturers are likely to benefit as they adapt their offerings to address space constraints through under-counter models and cater to high-volume kitchens with efficient conveyor dishwashers. While the pandemic caused a temporary setback, it ultimately accelerated the adoption of commercial dishwashers within the hospitality sector, paving the way for a period of steady growth in the coming years.

Latest trends/Developments

The commercial dishwasher market is bubbling with innovation driven by efficiency, sustainability, and catering to diverse kitchen needs. Energy-saving features like improved insulation and variable speed motors are top priorities, alongside water conservation advancements such as sensor-controlled wash cycles that adjust water usage based on load size and soil level. Some models even boast heat recovery systems that capture and reuse heat from wastewater, minimizing environmental impact. Hygiene remains paramount, with manufacturers developing high-temperature wash cycles and targeted jets for superior cleaning and sanitation. Automation is another key trend, with automatic chemical dispensing systems ensuring the precise use of detergents and reducing costs. These advancements are particularly attractive in today's climate of rising labor costs, where commercial dishwashers offer a cost-effective solution for stretched staff. Understanding spatial limitations, manufacturers are creating space-saving under-counter dishwashers ideal for smaller restaurants, while high-volume kitchens are increasingly opting for conveyor dishwashers that continuously clean a steady stream of dishes. The market is not just about dishwashers themselves; smart connectivity is emerging as a trend, with some models allowing remote monitoring and cycle adjustments through smartphones, enhancing operational efficiency for busy kitchens. Overall, the commercial dishwasher market is experiencing exciting developments that prioritize performance, sustainability, and adaptability to the various needs of the modern commercial kitchen.

Key Players:

-

Robert Bosch GmbH

-

MEIKO International

-

Hobart Corporation

-

Jackson WWS

-

Miele Professional

-

Electrolux Professional

-

Fagor

-

Showa

-

Washtech

-

Insinger Machine

-

Winterhalter

-

MVP Group

Chapter 1. COMMERCIAL DISHWASHER MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. COMMERCIAL DISHWASHER MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. COMMERCIAL DISHWASHER MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. COMMERCIAL DISHWASHER MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. COMMERCIAL DISHWASHER MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. COMMERCIAL DISHWASHER MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Undercounter Dishwashers

6.3 Conveyor Dishwashers

6.4 Door-type Dishwashers

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. COMMERCIAL DISHWASHER MARKET – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Hotels & Restaurants

7.3 Catering Units

7.4 Cafes & Bakeries

7.5 Y-O-Y Growth trend Analysis By End-Use Industry

7.6 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 8. COMMERCIAL DISHWASHER MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By End-Use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By End-Use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By End-Use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By End-Use Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By End-Use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. COMMERCIAL DISHWASHER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Robert Bosch GmbH

9.2 MEIKO International

9.3 Hobart Corporation

9.4 Jackson WWS

9.5 Miele Professional

9.6 Electrolux Professional

9.7 Fagor

9.8 Showa

9.9 Washtech

9.10 Insinger Machine

9.11 Winterhalter

9.12 MVP Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global commercial dishwasher market was valued at USD 2.73 billion in 2023 and will grow at a CAGR of 3.4% from 2024 to 2030. The market is expected to reach USD 3.45 billion by 2030.

Rising demand from the hospitality industry and growing preference for under-counter as well as conveyor dishwashers are the reasons that are driving the market.

Based on product type, the market is divided into three segments – under-counter dishwashers, conveyor dishwashers, and door-type dishwashers.

North America is the most dominant region for the global commercial dishwasher market.

Robert Bosch GmbH, MEIKO International, Hobart Corporation, Jackson WWS, and Miele Professional are some of the leading players in this market.