Commercial Aircraft In-Seat Power System Market Size (2024-2030)

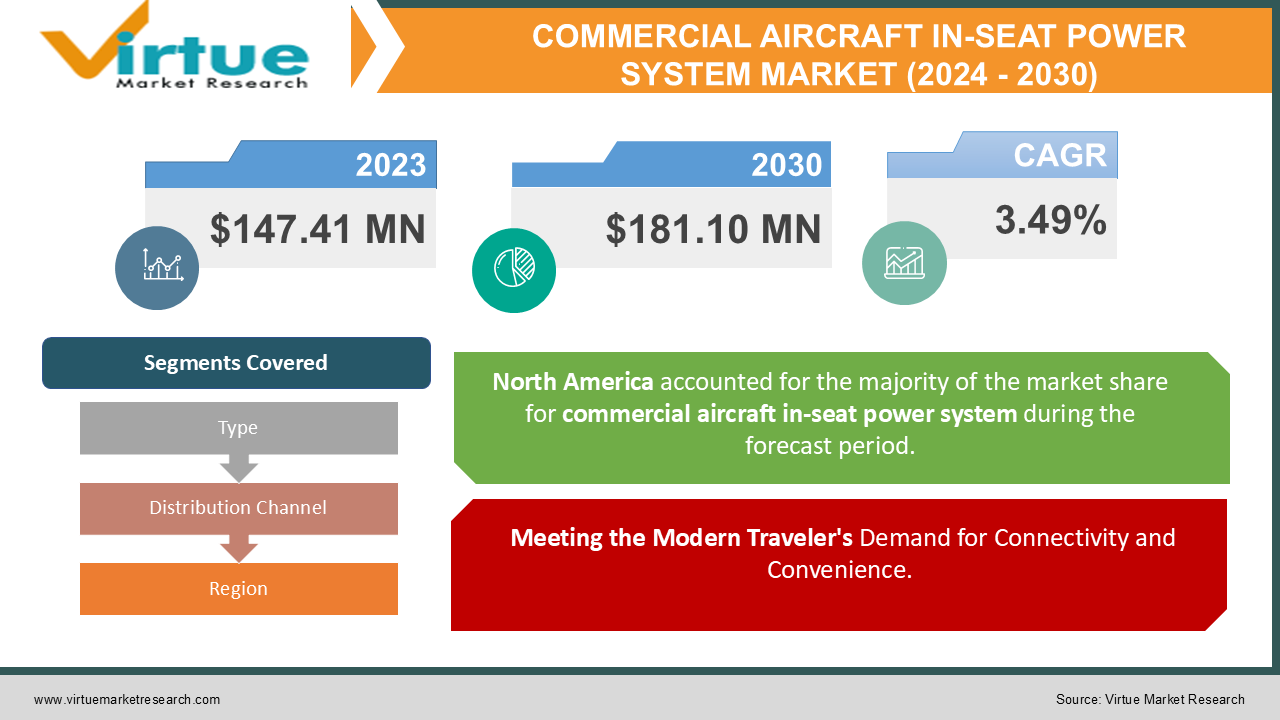

The Commercial Aircraft In-Seat Power System Market was valued at USD 147.41 Million in 2024 and is projected to reach a market size of USD 181.10 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.49%.

The commercial aircraft in-seat power system market represents a crucial segment of the aviation industry, focused on providing passengers with convenient access to electrical power during flights. These systems have evolved from simple DC power outlets to sophisticated solutions incorporating USB ports, wireless charging capabilities, and smart power management features. The market has seen significant transformation driven by increasing passenger expectations for continuous device connectivity and the growing prevalence of personal electronic devices in air travel.

Key Market Insights:

- Approximately 85% of long-haul aircraft had in-seat power systems installed by the end of 2023.

- The average cost of installing in-seat power systems per seat ranged between $500 and $1,200.

- Airlines reported a 20% increase in customer satisfaction in 2023 due to the availability of in-seat power systems.

- Over 30 million in-seat power outlets were active globally in commercial aircraft by the end of 2023.

- The demand for wireless charging-enabled seats rose by 15% in 2023 compared to 2022.

- Premium economy cabins saw the highest in-seat power usage, at 90% adoption rates among passengers.

Commercial Aircraft In-Seat Power System Market Drivers:

In-Seat Power Systems: Meeting the Modern Traveler's Demand for Connectivity and Convenience.

Modern traveller's routinely carry multiple devices, including smartphones, tablets, laptops, and other electronic accessories, creating an unprecedented demand for continuous power access during flights. This shift in passenger behaviour has made in-seat power systems transition from a luxury amenity to an essential service. Business travellers, in particular, view flight time as productive work hours, making reliable power access crucial for their choice of airline. The average passenger now carries 2.8 devices on long-haul flights, with usage patterns showing consistent power requirements throughout the journey. Airlines have recognized this trend's impact on customer satisfaction and brand loyalty. Studies indicate that power availability influences airline choice for 72% of business travellers and 54% of leisure travellers. This driver has led to accelerated adoption rates, with airlines prioritizing power system installations in their fleet upgrade programs. The increasing power requirements of modern devices, particularly with the adoption of USB-C and fast-changing technologies, have pushed manufacturers to develop more capable systems. This has resulted in the development of intelligent power management systems that can automatically detect device requirements and optimize power delivery.

Technological innovation has significantly enhanced the capability and efficiency of in-seat power systems while reducing their impact on aircraft performance.

Modern systems incorporate advanced power conversion technologies, intelligent load management, and sophisticated monitoring capabilities. The development of lightweight materials and more efficient power conversion methods has reduced the weight penalty associated with these systems, making them more attractive to airlines concerned about fuel efficiency. New-generation systems are up to 40% lighter than their predecessors while delivering higher power outputs. Integration of smart monitoring systems allows for predictive maintenance and real-time system health monitoring, reducing downtime and maintenance costs. Advanced diagnostic capabilities enable quick identification and resolution of issues, improving overall system reliability and reducing maintenance overhead. The emergence of universal power solutions capable of handling multiple voltage standards and charging protocols has simplified system design and reduced complexity. This standardization has led to more cost-effective manufacturing and easier maintenance procedures.

Commercial Aircraft In-Seat Power System Market Restraints and Challenges:

The commercial aircraft in-seat power system market faces several significant challenges that impact its growth and implementation. Primary among these is the substantial initial investment required for system installation, which can be particularly burdensome for smaller airlines operating with tight profit margins. The installation process itself presents logistical challenges, requiring aircraft downtime that disrupts regular operations and results in revenue loss. Technical challenges include the need to balance power delivery capabilities with aircraft electrical system limitations. The additional weight of power systems, though reduced through technological advances, still impacts fuel efficiency and operating costs. This creates a complex cost-benefit analysis for airlines considering installation or upgrades. Regulatory compliance presents another significant challenge, with varying international standards and safety requirements necessitating extensive certification processes. The certification timeline can extend implementation schedules and increase costs, particularly when introducing new technologies or features. Maintenance complexity is another considerable challenge, as these systems add another layer of maintenance requirements to aircraft operations. The need for specialized training for maintenance personnel and the stocking of spare parts increases operational overhead. System reliability and durability in the demanding aviation environment remain ongoing challenges. Exposure to vibration, temperature variations, and continuous use requires robust design and regular maintenance, adding to operational costs.

Commercial Aircraft In-Seat Power System Market Opportunities:

The commercial aircraft in-seat power system market presents numerous opportunities for growth and innovation. The increasing focus on passenger experience provides opportunities for advanced power delivery solutions, including wireless charging technologies and smart power management systems. The retrofit market offers significant potential, particularly in regions with aging aircraft fleets. As airlines seek to extend the service life of existing aircraft while maintaining competitive amenities, the demand for retrofit solutions continues to grow. Emerging technologies such as gallium nitride (GaN) power systems present opportunities for developing more efficient and lighter power solutions. These advancements could lead to systems with higher power density and improved thermal management. The trend toward sustainable aviation creates opportunities for power systems with reduced environmental impact. This includes the development of more energy-efficient solutions and the use of recyclable materials in system components. Integration with aircraft connectivity systems presents opportunities for smart power management and usage analytics, enabling airlines to optimize power distribution and maintain system health proactively.

COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.49% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ans. Astronics Corporation, Burrana Pty Ltd, Safran SA, IFPL Group, KID-Systeme GmbH, Mid-Continent Instrument Co., Inflight Canada, Imagik International Corp, Tellus Aerospace, Axis Aerospace Technologies. |

Commercial Aircraft In-Seat Power System Market Segmentation

Commercial Aircraft In-Seat Power System Market Segmentation: By Type:

- AC Power Systems

- DC Power Systems

- Combined AC/DC Systems

- USB-Only Systems

- Wireless Charging Systems

Wireless Charging Systems have emerged as the fastest-growing segment, driven by the increasing adoption of wireless charging capabilities in consumer devices and the convenience they offer to passengers.

Combined AC/DC Systems currently dominate the market, offering maximum flexibility for passengers with various device charging requirements.

Commercial Aircraft In-Seat Power System Market Segmentation: By Distribution Channel:

- Direct OEM Installation

- Aftermarket Installation

- Third-party Integrators

- Authorized Service Centers

Third-party Integrators represent the fastest-growing channel due to their ability to offer customized solutions and competitive pricing.

Direct OEM Installation remains the dominant channel, particularly for new aircraft deliveries.

Commercial Aircraft In-Seat Power System Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

North America maintains its market leadership through a combination of factors including a large commercial aircraft fleet, high passenger expectations for in-flight amenities, and early adoption of new technologies. The region's airlines have been at the forefront of implementing passenger experience improvements, with in-seat power systems being a key component of their service offering. The presence of major aircraft manufacturers and system suppliers in the region has facilitated faster adoption and implementation of new technologies. Strong regulatory frameworks and standardized certification processes have also contributed to market growth.

The Asia-Pacific region represents the fastest-growing market, driven by rapid expansion of airline fleets, increasing air travel demand, and rising passenger expectations for in-flight amenities. The region's airlines are increasingly focusing on passenger experience enhancement to differentiate their services in a competitive market. The growth is further supported by significant investments in aviation infrastructure and the presence of numerous low-cost carriers upgrading their service offerings to compete with full-service airlines.

COVID-19 Impact Analysis on the Commercial Aircraft In-Seat Power System Market:

The COVID-19 pandemic significantly impacted the commercial aircraft in-seat power system market, causing immediate disruptions to installation programs and new orders. Airlines faced severe financial constraints, leading to the postponement or cancellation of fleet upgrade projects and power system installations. However, the pandemic also accelerated certain trends beneficial to the market. The increased focus on touchless technologies has driven interest in wireless charging solutions. Additionally, changes in passenger behaviour, including greater reliance on personal devices for entertainment and reduced interaction with shared surfaces, have heightened the importance of reliable in-seat power. The recovery phase has seen renewed emphasis on passenger experience enhancement, with airlines recognizing the need to differentiate their services in a competitive market. This has led to accelerated adoption of power systems as part of broader cabin modernization programs. Supply chain disruptions during the pandemic highlighted the need for more resilient supplier networks and local manufacturing capabilities. This has resulted in strategic shifts in procurement and manufacturing strategies within the industry.

Latest Trends and Developments:

The commercial aircraft in-seat power system market is experiencing several significant trends shaping its evolution. The integration of artificial intelligence for power management and predictive maintenance has emerged as a key development, enabling more efficient system operation and reduced maintenance costs. Sustainability initiatives have driven the development of more energy-efficient systems and the use of environmentally friendly materials. Manufacturers are increasingly focusing on reducing the environmental impact of their products throughout their lifecycle. The trend toward higher power delivery capabilities continues, driven by the increasing power requirements of modern devices. This has led to the development of systems capable of supporting fast charging technologies while maintaining safety and efficiency. Modular design approaches have gained prominence, allowing for easier updates and maintenance while reducing installation time and costs. This trend aligns with airlines' needs for flexible solutions that can be easily upgraded as technology evolves. Integration with aircraft connectivity systems has become more sophisticated, enabling better monitoring and management of power usage patterns. This integration provides valuable data for system optimization and maintenance planning.

Key Players:

- Astronics Corporation

- Burrana Pty Ltd

- Safran SA

- IFPL Group

- KID-Systeme GmbH

- Mid-Continent Instrument Co.

- Inflight Canada

- Imagik International Corp

- Tellus Aerospace

- Axis Aerospace Technologies

- Aviation Power Systems

- Sky power Solutions

- AES Aircraft Elektro/Elektronik System GmbH

- Thales Group

- Cobham Limited

Chapter 1. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET– BY Type

6.1. Introduction/Key Findings

6.2. AC Power Systems

6.3. DC Power Systems

6.4. Combined AC/DC Systems

6.5. USB-Only Systems

6.6. Wireless Charging Systems

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET– BY DISTRIBUTION CHANNEL

7.1. Introduction/Key Findings

7.2. Direct OEM Installation

7.3. Aftermarket Installation

7.4. Third-party Integrators

7.5. Authorized Service Centers

7.6. Y-O-Y Growth trend Analysis By DISTRIBUTION CHANNEL

7.7. Absolute $ Opportunity Analysis By DISTRIBUTION CHANNEL , 2024-2030

Chapter 8. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channel

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channel

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channel

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channel

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL COMMERCIAL AIRCRAFT IN-SEAT POWER SYSTEM MARKET – Company Profiles – (Overview, Product Type s Portfolio, Financials, Strategies & Development

9.1. Astronics Corporation

9.2. Burrana Pty Ltd

9.3. Safran SA

9.4. IFPL Group

9.5. KID-Systeme GmbH

9.6. Mid-Continent Instrument Co.

9.7. Inflight Canada

9.8. Imagik International Corp

9.9. Tellus Aerospace

9.10. Axis Aerospace Technologies

9.11. Aviation Power Systems

9.12. Sky power Solutions

9.13. AES Aircraft Elektro/Elektronik System GmbH

9.14. Thales Group

9.15. Cobham Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Modern travelers prioritize staying connected during flights, leading to a surge in demand for in-seat power systems that can charge electronic devices like smartphones, tablets, and laptops.

Retrofitting older aircraft with in-seat power systems is expensive and often requires significant downtime.

Astronics Corporation, Burrana Pty Ltd, Safran SA, IFPL Group, KID-Systeme GmbH, Mid-Continent Instrument Co., Inflight Canada, Imagik International Corp, Tellus Aerospace, Axis Aerospace Technologies.

North America currently holds the largest market share, estimated at around 35%.

Asia-Pacific has shown significant room for growth in specific segments.