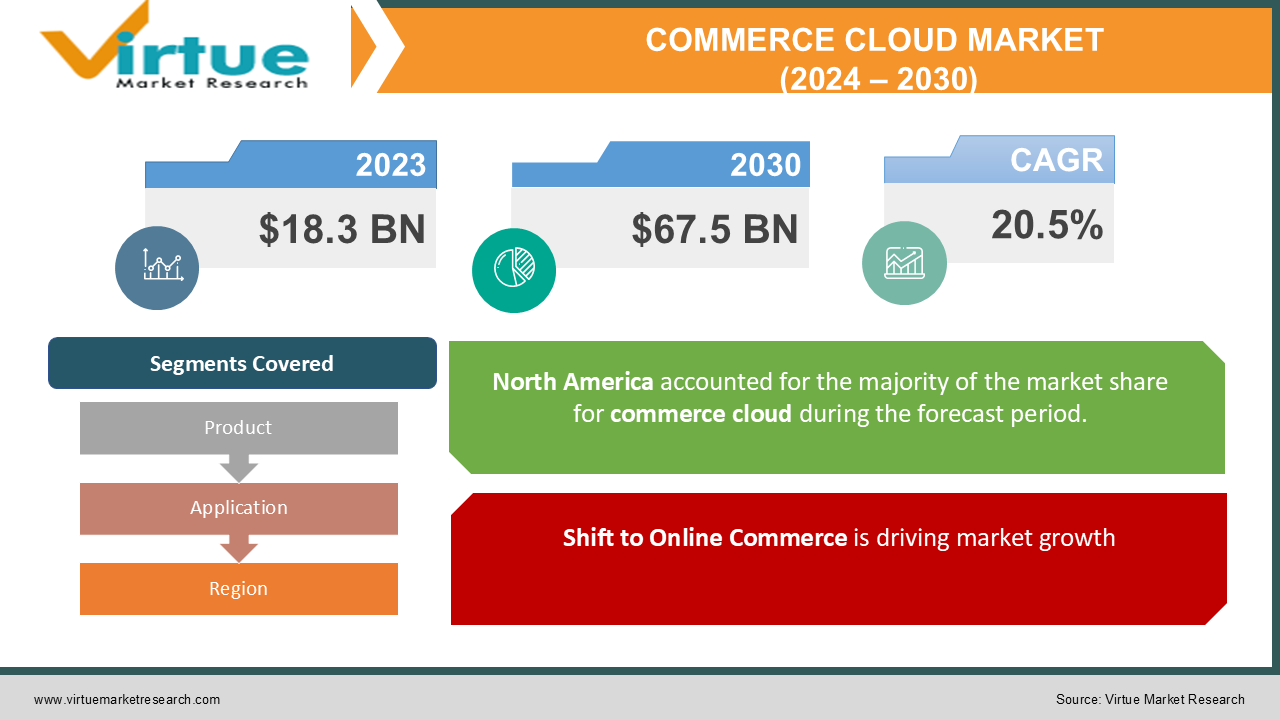

Commerce Cloud Market Size (2024 – 2030)

The Global Commerce Cloud Market was valued at USD 18.3 billion in 2023 and is expected to grow at a CAGR of 20.5% from 2024 to 2030. By 2030, the market is projected to reach USD 67.5 billion.

Commerce Cloud is a cloud-based platform designed to provide businesses with a range of solutions for enhancing their e-commerce capabilities. It includes services like customer engagement, order management, personalization, and real-time data analytics, enabling businesses to improve their digital presence. The market's growth is being driven by the rapid shift towards online commerce, digital transformation, and the increasing adoption of cloud technology by retail, B2B, and direct-to-consumer industries.

Key Market Insights:

-

In 2023, North America held the dominant market share accounting for over 40% of the total revenue. The region's dominance is attributed to the high adoption of cloud technologies, a mature e-commerce market, and the presence of major cloud service providers.

-

The Asia-Pacific region is expected to exhibit the highest CAGR during the forecast period, driven by the booming e-commerce industry, especially in China and India, coupled with increasing internet penetration and mobile commerce.

-

Retail is the dominant industry adopting commerce cloud solutions, accounting for more than 45% of the market share in 2023. Retailers are focusing on enhancing customer engagement and streamlining their online operations.

-

The subscription-based revenue model is gaining traction, with more companies opting for SaaS-based Commerce Cloud solutions that provide flexibility and scalability. This model allows businesses to manage costs better while upgrading their technology as per need.

-

The integration of Commerce Cloud platforms with CRM systems is becoming a key trend, offering businesses the ability to provide seamless customer service, improve communication channels, and gain deeper insights into customer behavior.

-

Data privacy concerns and regulatory challenges, particularly around GDPR and CCPA, are posing potential restraints for the Commerce Cloud Market, especially for businesses operating across multiple regions.

Global Commerce Cloud Market Drivers:

Shift to Online Commerce is driving market growth:

With consumers increasingly turning to online platforms for their shopping needs, businesses are racing to enhance their digital presence. Commerce Cloud solutions enable businesses to quickly establish scalable online stores, manage large volumes of transactions, and optimize the customer experience across multiple channels. The ability to handle multichannel operations—such as web, mobile, and social commerce—has become crucial for businesses to remain competitive. Additionally, features like omnichannel management, customer journey mapping, and data analytics allow retailers to meet evolving consumer expectations. This shift to online shopping is a primary driver of the Commerce Cloud Market.

Rising Adoption of AI and Automation is driving market growth:

Artificial Intelligence (AI) and machine learning (ML) are transforming e-commerce, particularly in automating routine tasks and enhancing personalization. Commerce Cloud platforms are increasingly integrating AI to offer features like chatbots, personalized product recommendations, predictive analytics, and dynamic pricing. These capabilities are helping businesses create unique and customized experiences for their customers, driving customer loyalty and repeat business. Furthermore, AI-driven insights enable companies to optimize their supply chain, inventory management, and marketing strategies, providing a competitive edge. The increasing demand for these AI-powered features is a significant driver for the Commerce Cloud Market.

Scalability and Flexibility of Cloud Solutions is driving market growth:

One of the key drivers of the Commerce Cloud Market is the flexibility and scalability offered by cloud-based solutions. As businesses grow or experience seasonal spikes in demand, they need platforms that can scale quickly and efficiently without requiring substantial upfront investment in infrastructure. Commerce Cloud solutions provide this flexibility, allowing companies to easily add features or capacity as their needs evolve. In addition, the subscription-based pricing model associated with cloud services allows companies to better manage their IT budgets, only paying for what they use. This ability to scale seamlessly is particularly important for businesses operating in dynamic and competitive markets, further driving the adoption of commerce cloud platforms.

Global Commerce Cloud Market Challenges and Restraints:

Data Security and Privacy Concerns is restricting market growth:

While cloud solutions offer several advantages, they also present significant data security and privacy challenges. As businesses store sensitive customer data, including personal and financial information, in cloud environments, they become vulnerable to cyber-attacks, data breaches, and unauthorized access. With rising incidents of cybercrime, businesses are increasingly concerned about the security of their cloud infrastructure. Additionally, compliance with data protection regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) has become more stringent, especially for companies operating in multiple regions. As a result, concerns around data security and privacy are acting as restraints on the growth of the Commerce Cloud Market.

Integration Complexity with Legacy Systems is restricting market growth:

Another challenge facing the Commerce Cloud Market is the complexity associated with integrating new cloud-based solutions with existing legacy systems. Many businesses, particularly large enterprises, rely on legacy IT infrastructure for critical operations. Migrating to cloud platforms while maintaining compatibility with these older systems can be time-consuming, costly, and technically challenging. Moreover, businesses often face disruptions during the transition period, which can affect day-to-day operations. Companies must invest in skilled personnel and robust IT architecture to ensure smooth integration, which can be a barrier to adopting commerce cloud solutions for some organizations.

Market Opportunities:

The rise of digital-first consumers is creating significant opportunities in the Commerce Cloud Market. As consumers increasingly prefer online shopping, companies are focusing on improving their digital customer experience by leveraging commerce cloud platforms. Opportunities exist in the expansion of personalized shopping experiences through AI and machine learning, offering businesses the chance to differentiate themselves from competitors. The growth of mobile commerce (m-commerce) also provides a lucrative opportunity, especially in emerging markets where smartphone penetration is high. The shift toward B2B commerce is another major area of growth, with companies looking for cloud solutions that enable seamless interactions between businesses. Furthermore, the growing interest in sustainable and ethical consumption patterns can be harnessed by companies that utilize cloud-based analytics to monitor supply chain transparency and offer eco-friendly products. These evolving consumer preferences are opening doors for commerce cloud providers to innovate and capture new market segments.

COMMERCE CLOUD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Salesforce, Adobe, SAP, Oracle, Shopify, BigCommerce, IBM Magento, Microsoft Azure, AWS |

Commerce Cloud Market Segmentation: By Product

-

Platform-as-a-Service (PaaS)

-

Software-as-a-Service (SaaS)

-

Infrastructure-as-a-Service (IaaS)

-

Others

SaaS is the most dominant segment in the product category, accounting for more than 50% of the market share in 2023 due to its cost-effectiveness, ease of deployment, and scalability.

Commerce Cloud Market Segmentation: By Application

-

B2B Commerce

-

B2C Commerce

-

Retail

-

Wholesale and Distribution

-

Others

B2C Commerce is the most dominant application, with over 60% of the market share, driven by the rapid growth of online shopping and consumer preferences for personalized, convenient shopping experiences.

Commerce Cloud Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the Commerce Cloud Market, driven by a mature e-commerce ecosystem, advanced cloud infrastructure, and the presence of major cloud service providers like Amazon Web Services, Salesforce, and Microsoft Azure. The region accounted for over 40% of the market share in 2023.

COVID-19 Impact Analysis on the Commerce Cloud Market:

The COVID-19 pandemic significantly accelerated the adoption of e-commerce, driving demand for commerce cloud solutions. With physical stores forced to close during lockdowns, consumers rapidly shifted to online shopping, prompting businesses to quickly scale their digital operations. This surge in demand led many companies to seek out commerce cloud platforms that offer essential scalability and flexibility. To stay competitive, businesses also focused on enhancing digital customer experiences by integrating advanced technologies such as AI, machine learning, and omnichannel capabilities. Cloud-based platforms became vital in helping companies maintain operations, manage customer relationships, and drive sales during this challenging period. The pandemic's impact on consumer behavior and business operations has resulted in a lasting transformation of the commerce landscape. As companies continue to prioritize digital strategies and invest in technology, the commerce cloud market is expected to experience sustained growth in the post-pandemic years. This evolution not only reshapes how businesses operate but also establishes a new standard for customer engagement and service delivery, paving the way for future innovations in the digital commerce space.

Latest Trends/Developments:

A key trend in the Commerce Cloud Market is the integration of AI and machine learning to create personalized shopping experiences. Businesses are leveraging AI tools for tailored product recommendations, dynamic pricing, and predictive analytics, significantly enhancing customer engagement. Another notable trend is the rising demand for headless commerce platforms, which enable companies to separate the front-end user experience from the back-end infrastructure. This decoupling offers greater flexibility in delivering content across various devices and channels. Moreover, businesses are prioritizing seamless omnichannel experiences, ensuring customers can effortlessly switch between platforms—whether mobile, desktop, or in-store—without interruption. Additionally, the increasing adoption of blockchain technology for supply chain transparency and security is gaining traction, fostering consumer trust in online shopping. These trends reflect a significant shift in how businesses approach e-commerce, emphasizing personalization, flexibility, and security in an increasingly digital marketplace.

Key Players:

-

Salesforce

-

Adobe

-

SAP

-

Oracle

-

Shopify

-

BigCommerce

-

IBM

-

Magento

-

Microsoft Azure

-

AWS

Chapter 1. Commerce Cloud Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Commerce Cloud Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Commerce Cloud Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Commerce Cloud Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Commerce Cloud Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Commerce Cloud Market – By Product

6.1 Introduction/Key Findings

6.2 Platform-as-a-Service (PaaS)

6.3 Software-as-a-Service (SaaS)

6.4 Infrastructure-as-a-Service (IaaS)

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Commerce Cloud Market – By Application

7.1 Introduction/Key Findings

7.2 B2B Commerce

7.3 B2C Commerce

7.4 Retail

7.5 Wholesale and Distribution

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Commerce Cloud Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Product

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Commerce Cloud Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Salesforce

9.2 Adobe

9.3 SAP

9.4 Oracle

9.5 Shopify

9.6 BigCommerce

9.7 IBM

9.8 Magento

9.9 Microsoft Azure

9.10 AWS

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Commerce Cloud Market was valued at USD 18.3 billion in 2023 and is projected to reach USD 67.5 billion by 2030, growing at a CAGR of 20.5% from 2024 to 2030.

Key drivers include the shift toward online commerce, the rising adoption of AI and automation, and the scalability and flexibility of cloud-based solutions.

The market is segmented by product (SaaS, PaaS, IaaS) and application (B2B Commerce, B2C Commerce, Retail, Wholesale and Distribution).

North America is the most dominant region, accounting for over 40% of the market share in 2023, driven by a mature e-commerce ecosystem and advanced cloud infrastructure.

Leading players include Salesforce, Adobe, SAP, Oracle, Shopify, and IBM, among others.