Coleslaw Market Size (2024 – 2030)

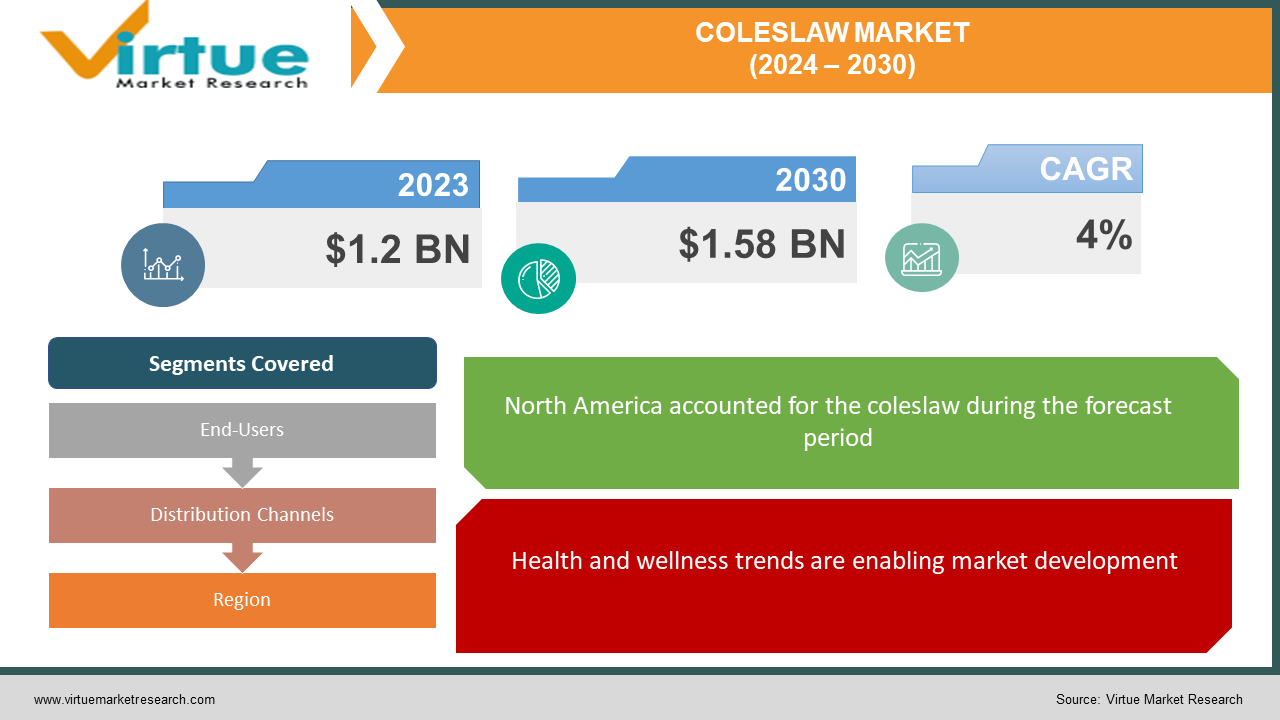

The global coleslaw market was valued at USD 1.2 billion and is projected to reach a market size of USD 1.58 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.

Shredded cabbage and occasionally other vegetables are combined to make a salad or side dish called coleslaw. The phrase cabbage salad in Dutch is called coleslaw. In the 18th century, the dish first appeared in the Netherlands. Coleslaw is frequently served with a sandwich, fried fish, or grilled pork. The majority of coleslaws are seasoned with oil and vinegar or made creamy by adding mayonnaise. In the past, this was a side dish popular only in European countries. Additionally, the varieties were limited. Presently, there is a growing demand due to better availability and diversification. In the future, with a focus on innovation and personalization of ingredients, a notable upsurge is anticipated.

Key Market Insights:

Coleslaw is served in 13.35% (135,136) of establishments. One cup of coleslaw has 226 calories. Private-label salad, fruit, and coleslaw brands had the greatest sales values in 2023, totaling over $186.3 million in the 12 weeks that ended on January 29, 2023. As per Tastewise, pickle coleslaw is expected to be the most popular coleslaw dish in 2024. The most popular flavor combinations for coleslaw include pulled pork, salmon, potatoes, whisky, and beer.Growing cabbage needs around 15 gallons of water per head. This manufacturing of coleslaw ingredients, especially cabbage, may contribute to environmental problems, including water use and pesticide pollution. To tackle this, farmers are being encouraged to use water conservation methods like drip irrigation and soil moisture sensors.

Coleslaw Market Drivers:

Health and wellness trends are enabling market development.

Over the years, people have become more aware of what they consume. This is because of the increasing incidence of chronic illnesses. This dish provides a lot of health advantages to the human body. Firstly, this is a great source of fiber that can help decrease cholesterol and encourage regularity. Additionally, this fiber aids in a healthy digestive system. Secondly, it is abundant in vitamins C and A. While vitamin C is an antioxidant that can help shield cells from harm, vitamin A is necessary for healthy skin and eyes. Coleslaw's vitamins and minerals can support a robust and healthy immune system. These vitamins and minerals also help reduce inflammation in our bodies. A strong immunity is built by this. Thirdly, it is a good calcium source as well. In addition to being essential for maintaining healthy bones, calcium helps ward off osteoporosis. Moreover, the body is also detoxified. Sulfur is present in cabbage in coleslaw and aids in the body's detoxification. Furthermore, there are vital antioxidants that can reduce the risk of cancer. Besides this, the red kind of cabbage is high in potassium. This variety helps in lowering high blood pressure and maintaining a healthy range. Apart from this, it has about 36 anthocyanins, which are a type of flavonoids that are very beneficial to heart health.

An increasing demand for cultural food diversity has been boosting the market.

Social media has helped spread the popularity of unique and authentic dishes around the world. A lot of people are interested in experimenting with their food. Coleslaw is being used in many other meals, apart from being used as a side dish, due to the rising appeal of fusion cuisine and ethnic culinary trends. The market for creative coleslaw recipes is growing as chefs and food experts experiment with new flavor profiles and ingredients. Examples of these experiments include fiery Tex-Mex coleslaw with lime and jalapeños or Asian-inspired coleslaw with sesame dressing. Coleslaw is being creatively incorporated into menu items by restaurants and food service companies. Some of these innovative methods include utilizing it as a topping for tacos, burgers, and sandwiches, as well as adding it to wraps and bowls. This variety of menu items appeals to customers looking for unusual flavor combinations and helps the coleslaw industry as a whole expand.

Coleslaw Market Restraints and Challenges:

Health concerns, limited shelf life, and lack of awareness are the main issues that the market is currently facing.

Coleslaw recipes contain mayonnaise toppings and dressings. Mayonnaise is rich in calories and fat. This increases the risk of heart disease, obesity, and diabetes. This can lead to a decline in demand due to increasing health consciousness. Secondly, this dish has a short shelf life. It is very vital to preserve the freshness of cabbage to prevent a rotten and pungent smell. As such, it cannot be stored for a longer duration and should be consumed immediately. Thirdly, the popularity of this dish is limited. This product is popular only in certain countries, like the Netherlands and North and South Carolina. People in other countries are unaware of this. This can create a hindrance to market growth. Manufacturers must take suitable measures to address these difficulties for the market to expand.

Coleslaw Market Opportunities:

Convenient food options have gained immense popularity. This is because of hectic lifestyles. Dual income has become the new norm. People look for options as a result. To support this, many restaurants, hotels, fast food chains, and other eateries have been offering coleslaw. Online retail has been very beneficial. A lot of people go for this option because of its availability. Innovations in ingredients are helping the market. Asian seasoning and spices are very popular. Chefs have started to diversify their offerings by adding all these ingredients to enhance the taste. Promotion through social media is another opportunity. A lot of users are registered on these platforms. By presenting a unique product through these channels, a broader consumer base can be achieved. Furthermore, there is a growing demand for veganism. Vegans consume only plant-based products. This has elevated the demand for coleslaw, which has dairy-free dressings. These options include a wide range of exotic vegetables, making them an attractive option.

COLESLAW MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By End-Users, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fresh Express, Dole Food Company, Taylor Farms, Reser's Fine Foods, The Kraft Heinz Company, Del Monte Foods, Church Brothers Farms, Ready Pac Foods, Bonduelle Group, Mann Packing Company |

Coleslaw Market Segmentation: By End-Users

-

Foodservice Industry

-

Households

-

Others

The service industry is the largest growing end-user. Coleslaw is widely used as a flexible side dish and topping in a variety of places, including restaurants, cafés, fast-food chains, and catering services. Foodservice operators find coleslaw to be a convenient and affordable addition to their menus, and it enhances the flavor and texture of a variety of main dishes. The consumer demand for trying out different cultural products has been accelerating the growth rate. Economic progress has led to global outreach and a greater number of eateries, enabling the expansion. However, the fastest-growing end-user sector is households. This is mainly due to rising consumer demand for pre-packaged coleslaw salads and deli-style coleslaw for consumption at home. This food is fulfilling and is a very convenient option. The busy lifestyles and the growing preference for healthy food items have been contributing to the success.

Coleslaw Market Segmentation: By Distribution Channels

-

Offline

-

Supermarkets/Hypermarkets

-

Foodservice (Restaurants, Hotels, and Others)

-

-

Online

The offline segment is the largest growing segment. Supermarkets & hypermarkets are the main offline distribution channels in the coleslaw industry. These stores make it easy for customers to buy coleslaw in addition to other items since they provide a large selection of coleslaw. Customers can visually inspect the product to assess its quality. They can clarify their doubts with the shopkeeper. It is also possible to bargain through this channel. Online channels are the fastest-growing category. Customers are increasingly resorting to online platforms to buy cabbage as e-commerce and online grocery shopping continue to grow in popularity. Online stores let customers explore and buy coleslaw from the comfort of their homes since they provide ease, flexibility, and a large assortment of items. The COVID-19 pandemic has also accelerated growth since digitalization became the new normal. Besides this, deals and discounts are provided regularly, driving customers to choose this channel.

Coleslaw Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest market. The United States is the leading country. It's tasty, flavorful, and simple to make, carry, and serve. In addition, it is affordable, healthy, and takes up little room in the refrigerator. Southern US residents love coleslaw, especially when it's paired with pulled pork barbecue. Coleslaw is a side dish that many restaurants provide because it cools the palate and helps in the easy digestion of meat. In the US, buttermilk, carrot, and mayonnaise or its replacement are frequently added to coleslaw. Nonetheless, there are several regional varieties, and mayonnaise and prepared mustard or vinegar without dairy products are also popular. Many prominent companies are present in this area. They have a global presence, which increases revenue. A few of them are Fresh Express, Dole Food Company, Taylor Farms, and Reser's Fine Foods. Europe is the fastest-growing market. Countries like Poland, Austria, and Hungary are at the forefront. Since the Roman era, shredded cabbage seasoned with spices has been a staple of nearly every European cuisine. Coleslaw is a multipurpose dish that goes well with many different types of meals and is a staple of many European cuisines. Coleslaw brings texture, taste, and freshness to any dish. It goes well with grilled meats, sandwiches, fish and chips, and burger toppings. It's frequently made at home as well as on menus in delis, cafés, and restaurants. When considering side dishes, cole slaw is frequently thought to be healthier than options like potato salad or fries. Because it can be cooked with milder sauces and is mostly composed of fresh veggies, it's a popular option for people who are trying to eat more vegetables.

COVID-19 Impact Analysis on the Global Coleslaw Market:

The viral pandemic caused damage to the market. Among the new norms were social isolation, movement restrictions, and lockdowns. This affected supply chain management, logistics, and transportation. Import-export activities suffered as a result. The closure of all hotels and restaurants was necessary to stop the virus from spreading. This resulted in the suspension of production and other activities. Remote work was given top priority to stop the virus from spreading. The economy was so unstable that layoffs were commonplace in a lot of places. Many people lost their jobs. Applications related to healthcare were given the most funding. This caused delays in collaborations and launches. People started to avoid junk and outside food. Home-cooked meals gained prominence. Post-pandemic, the market has begun to recover due to the opening of fast-food chains and dineries. Relaxation of rules and regulations has helped with normal functioning. Online retail has helped improve availability and accessibility for customers globally.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. Coleslaw with clean-label ingredients and few chemicals are in demand as consumers seek out food items with greater transparency and simplicity. In response, producers are crafting coleslaw recipes that use only natural and whole-food components. Artificial flavors, colors, and preservatives are being avoided.

Key Players:

-

Fresh Express

-

Dole Food Company

-

Taylor Farms

-

Reser's Fine Foods

-

The Kraft Heinz Company

-

Del Monte Foods

-

Church Brothers Farms

-

Ready Pac Foods

-

Bonduelle Group

-

Mann Packing Company

Chapter 1. COLESLAW MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. COLESLAW MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. COLESLAW MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. COLESLAW MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. COLESLAW MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. COLESLAW MARKET – By End-Users

6.1 Introduction/Key Findings

6.2 Foodservice Industry

6.3 Households

6.4 Others

6.5 Y-O-Y Growth trend Analysis By End-Users

6.6 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 7. COLESLAW MARKET – By Distribution Channels

7.1 Introduction/Key Findings

7.2 Offline

7.3 Supermarkets/Hypermarkets

7.4 Foodservice (Restaurants, Hotels, and Others)

7.5 Online

7.6 Y-O-Y Growth trend Analysis By Distribution Channels

7.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 8. COLESLAW MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Users

8.1.3 By Distribution Channels

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Users

8.2.3 By Distribution Channels

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Users

8.3.3 By Distribution Channels

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Users

8.4.3 By Distribution Channels

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Users

8.5.3 By Distribution Channels

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. COLESLAW MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Fresh Express

9.2 Dole Food Company

9.3 Taylor Farms

9.4 Reser's Fine Foods

9.5 The Kraft Heinz Company

9.6 Del Monte Foods

9.7 Church Brothers Farms

9.8 Ready Pac Foods

9.9 Bonduelle Group

9.10 Mann Packing Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global coleslaw market was valued at USD 1.2 billion and is projected to reach a market size of USD 1.58 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.

Health and wellness trends, as well as an increasing demand for cultural food diversity, are the main factors propelling the global coleslaw market.

Based on distribution channels, the global coleslaw market is segmented into offline and online.

North America is the most dominant region in the global coleslaw market.

Fresh Express, Dole Food Company, and Taylor Farms are the key players operating in the global coleslaw market.