Cold Storage Market Size (2024 – 2030)

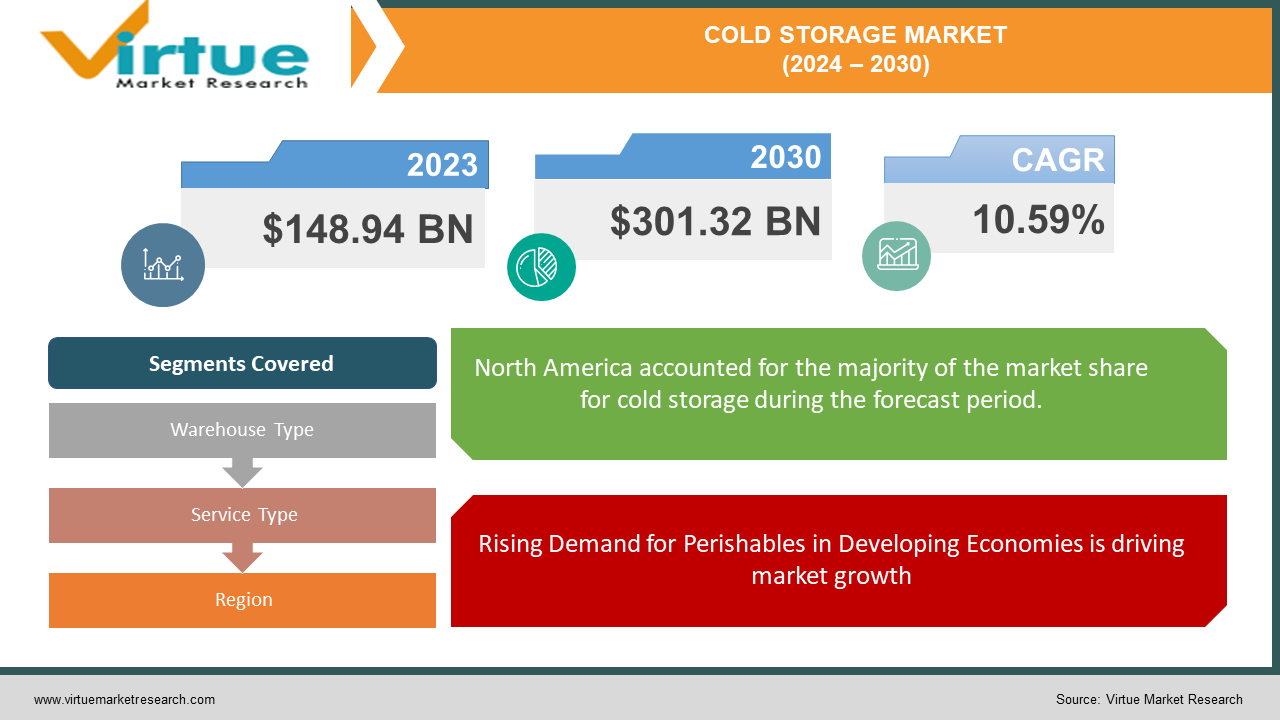

The Global Cold Storage Market was valued at USD 148.94 billion in 2023 and will grow at a CAGR of 10.59% from 2024 to 2030. The market is expected to reach USD 301.32 billion by 2030.

The cold storage market deals with the infrastructure and services needed to preserve perishable goods. It's driven by rising demand for fresh produce, meat, and dairy in developing economies, the boom in online grocery shopping requiring efficient cold chains, and stricter regulations for pharmaceuticals. This market offers various temperature-controlled storage solutions, with refrigerated warehouses dominating for fruits, vegetables, and dairy. Businesses can choose between public warehousing for flexibility, private warehousing for control, or contract warehousing for managed storage.

Key Market Insights:

The growing popularity of online grocery shopping with its emphasis on fresh produce is boosting demand for cold storage facilities.

North America with a 35 % market share holds the dominant position in the cold storage market. This is due to a well-developed infrastructure, a strong presence of major food and beverage corporations, and a high consumer demand for fresh and frozen food products.

However, Asia Pacific is expected to witness the fastest growth rate. Rising demand for perishable food products in developing economies like China and India is a major driver.

Technological advancements like automation and IoT sensors are improving efficiency and driving market growth, with a focus on minimizing food waste and ensuring optimal conditions for these vital products.

Global Cold Storage Market Drivers:

Rising Demand for Perishables in Developing Economies is driving market growth

The booming populations and growing wealth in developing countries like China and India are significantly impacting the cold storage market. As millions relocate to urban centers, their dietary habits shift towards more fresh produce, meat, and dairy. These perishable items necessitate proper cold storage infrastructure to maintain quality and prevent spoilage. This urgency is especially evident in China, where the perishable food market is projected to reach a staggering USD 2.2 trillion by 2027. To meet this rising demand, the cold storage industry is poised for significant growth, with new facilities and advancements in technology playing a critical role in ensuring fresh, high-quality food reaches consumers across these developing economies.

Evolving Food Retail Landscape is driving the market growth

The surge in online grocery shopping, particularly with its emphasis on fresh produce, is pushing the boundaries of traditional cold storage. Gone are the days of simple brick-and-mortar grocery visits. Today's consumers expect farm-fresh quality delivered straight to their doorsteps. This shift necessitates a robust cold chain infrastructure for online grocers. From the moment a juicy tomato is picked to the time it lands on your doorstep, it needs to be maintained at optimal temperature and humidity. This intricate "cold chain" ensures minimal spoilage and ultimately translates to satisfied customers. To achieve this, online grocers are heavily reliant on efficient cold storage solutions. These facilities not only house fresh produce but also act as strategic hubs for efficient order fulfillment. By investing in advanced cold storage technology, online grocers can guarantee the freshness of their products, leading to a win-win situation for both businesses and happy, produce-loving customers.

Advancements in Cold Storage Technology are driving the market growth

The face of cold storage is transforming thanks to a wave of technological advancements. Automation and robotics are taking center stage, minimizing manual labor costs and streamlining operations. Gone are the days of relying solely on human effort for tasks like moving pallets and picking orders. These automated systems not only enhance efficiency but also improve safety in often frigid environments. Further adding to this transformation is the Internet of Things (IoT). Sensors embedded throughout the facility provide real-time data on temperature and humidity levels, ensuring optimal storage conditions for all products. This eliminates guesswork and potential spoilage, leading to significant cost savings. The impact of this technological revolution is undeniable. The market for automated storage and retrieval systems (AS/RS) in cold storage facilities is expected to reach a staggering USD 6.8 billion by 2027, highlighting the industry's embrace of these advancements. As technology continues to evolve, we can expect even more intelligent and efficient solutions to emerge, shaping the future of cold storage.

Global Cold Storage Market challenges and restraints:

Lack of reliable power grids or proper transportation infrastructure is restricting the market growth

In developing countries, the lack of reliable power grids and proper transportation infrastructure creates significant disruptions in the 'cold chain,' the system of temperature-controlled storage and transportation that ensures food safety and quality. Imagine perishable fruits and vegetables harvested at a remote farm. Without reliable electricity, they may spoil before reaching a cold storage facility. Even if they reach storage, inadequate transportation infrastructure, like poor roads or a lack of refrigerated trucks, can further expose them to unsafe temperatures. This cold chain disruption leads to significant food spoilage, impacting both farmers' profits and consumers' access to fresh produce. Not only does spoilage hurt farmers' incomes, but it also contributes to malnutrition, as fewer nutritious fruits and vegetables reach consumers.

Traditional refrigeration systems rely on hydrofluorocarbons (HFCs) which are potent greenhouse gases

While traditional refrigeration relies on HFCs, these potent greenhouse gasses contribute to climate change, putting pressure on the industry to adopt greener solutions. Unfortunately, these sustainable alternatives often come with a hefty upfront cost. Developing new refrigerants with lower global warming potential (GWP) or exploring entirely different cooling technologies like ammonia or CO2 systems requires significant research and development. Additionally, redesigning existing infrastructure to accommodate these new technologies can be expensive. While the long-term benefits like reduced energy consumption and environmental impact are undeniable, convincing businesses to make the switch requires navigating this initial financial hurdle. Governments and international organizations are stepping in with subsidies and regulations to incentivize the transition, but overcoming the cost barrier remains a significant challenge in the race for sustainable refrigeration

Market Opportunities:

The cold storage market presents a multitude of exciting opportunities. Evolving consumer habits, like the growing demand for organic produce and online grocery shopping with fresh food options, are driving the need for expanded cold storage capacity. This creates opportunities for companies to build new facilities or upgrade existing ones to cater to specific temperature requirements. Additionally, the rise of the pharmaceutical and life sciences industries is creating a surge in demand for cold storage suited to medicines and biological samples. Furthermore, advancements in automation and robotics can optimize warehouse operations, improving efficiency and reducing costs. Emerging technologies like Internet of Things (IoT) sensors can provide real-time monitoring of temperature and humidity within cold storage facilities, minimizing product spoilage and maximizing energy use. Finally, there's immense potential in developing markets where a lack of cold storage infrastructure presents an opportunity for companies to bridge the gap and create a more robust cold chain, minimizing food waste and ensuring better access to fresh produce and essential goods. By addressing these opportunities and navigating the challenges, the cold storage market is poised for significant growth.

COLD STORAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.59% |

|

Segments Covered |

By Warehouse Type, Service Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lineage Logistics, Americold, US Cold Storage, Agro Merchants Group, Burris Logistics, Nichirei Corporation, NewCold, Kloosterboer, Tippmann Group, VersaCold Logistics Services |

Cold Storage Market Segmentation - by Warehouse Type

-

Refrigerated Warehouses

-

Frozen Warehouses

Refrigerated warehouses hold the dominant position within the cold storage market. These facilities, ideal for storing fruits, vegetables, and dairy products, cater to a wider range of perishable items compared to frozen warehouses. While frozen storage is crucial for meat, seafood, and frozen meals, it represents a more specific need. The sheer variety of fresh produce and dairy products requiring chilled storage pushes refrigerated warehouses to the forefront, making them the most commonly built and utilized type of cold storage facility.

Cold Storage Market Segmentation - By Service Type

-

Public Warehousing

-

Private Warehousing

-

Contract Warehousing

Public warehousing offers the most flexibility, catering to various clients with diverse storage requirements. This is ideal for companies with fluctuating inventory levels or those dealing with a range of products with different temperature needs. However, companies with high-volume, predictable storage needs might find private warehousing more cost-effective. Here, they have complete control over the facility and can tailor it to their specific products. Contract warehousing provides a middle ground, offering the expertise of a third-party logistics provider who manages the storage but doesn't require the full investment of a private facility. Ultimately, the most dominant warehousing type depends on the specific needs and priorities of each business.

Cold Storage Market Segmentation - Regional Analysis

-

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

-

North America holds the dominant position in the cold storage market. This is due to a combination of factors: well-developed infrastructure, a strong presence of major food and beverage corporations, and a high consumer demand for fresh and frozen food products. Additionally, advancements in automation and the adoption of new technologies are prevalent in North America, further propelling its market growth. However, the Asia-Pacific region is expected to witness the fastest growth rate in the coming years. This is driven by factors like rising disposable incomes, urbanization, and a growing demand for processed and convenient foods in developing countries within the region.

COVID-19 Impact Analysis on the Global Cold Storage Market

The COVID-19 pandemic delivered a mixed bag of impacts for the cold storage market. On the one hand, disruptions in traditional supply chains and lockdowns led to initial challenges. Food spoilage increased due to a disconnect between farmers, storage facilities, and consumers. Furthermore, labor shortages due to safety protocols also caused operational slowdowns. However, the pandemic also presented significant growth opportunities. The surge in demand for stockpiling essential food and beverages, coupled with the rise of e-commerce grocery shopping, necessitated increased cold storage capacity. Pharmaceutical cold storage boomed as well, with the need to store vaccines and temperature-sensitive medicine on a large scale. This led to a rise in cold storage construction and expansion projects. Looking ahead, the long-term impact of COVID-19 is expected to be positive for the cold storage market. Increased focus on food security and the continued growth of e-commerce groceries will likely lead to sustained demand for cold storage solutions.

Latest trends/Developments

The cold storage market is witnessing a wave of innovation. Automation and robotics are taking center stage, with facilities deploying automated storage and retrieval systems (AS/RS) and robots to streamline operations, improve efficiency, and address labor shortages. Sustainability is a major focus, with companies exploring eco-friendly refrigerants, solar power integration, and energy-saving insulation materials to reduce their environmental footprint and operating costs. To meet the growing e-commerce demand, cold storage facilities are strategically located in urban areas and adopting taller, vertically designed warehouses for maximized storage capacity. Emerging technologies like Internet of Things (IoT) sensors are being implemented for real-time monitoring of temperature and humidity, allowing for better control over product quality and energy use. These trends highlight the industry's commitment to optimizing cold chain efficiency, minimizing environmental impact, and catering to the evolving needs of the market.

Key Players:

-

Lineage Logistics

-

Americold

-

US Cold Storage

-

Agro Merchants Group

-

Burris Logistics

-

Nichirei Corporation

-

NewCold

-

Kloosterboer

-

Tippmann Group

-

VersaCold Logistics Services

Chapter 1. Cold Storage Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cold Storage Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cold Storage Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cold Storage Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cold Storage Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cold Storage Market – By Warehouse Type

6.1 Introduction/Key Findings

6.2 Refrigerated Warehouses

6.3 Frozen Warehouses

6.4 Y-O-Y Growth trend Analysis By Warehouse Type

6.5 Absolute $ Opportunity Analysis By Warehouse Type, 2024-2030

Chapter 7. Cold Storage Market – By Service Type

7.1 Introduction/Key Findings

7.2 Public Warehousing

7.3 Private Warehousing

7.4 Contract Warehousing

7.5 Y-O-Y Growth trend Analysis By Service Type

7.6 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 8. Cold Storage Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Warehouse Type

8.1.3 By Service Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Warehouse Type

8.2.3 By Service Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Warehouse Type

8.3.3 By Service Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Warehouse Type

8.4.3 By Service Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Warehouse Type

8.5.3 By Service Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cold Storage Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lineage Logistics

9.2 Americold

9.3 US Cold Storage

9.4 Agro Merchants Group

9.5 Burris Logistics

9.6 Nichirei Corporation

9.7 NewCold

9.8 Kloosterboer

9.9 Tippmann Group

9.10 VersaCold Logistics Services

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cold Storage Market was valued at USD 148.94 billion in 2023 and will grow at a CAGR of 10.59% from 2024 to 2030. The market is expected to reach USD 301.32 billion by 2030.

Rising Demand for Perishables in Developing Economies and the evolving Food Retail Landscape are the reasons that are driving the market.

Based on warehouse type it is divided into two segments – Refrigerated Warehouses, and frozen warehouses.

North America is the most dominant region for the Cold Storage Market.

NewCold, Kloosterboer, Tippmann Group, VersaCold Logistics Services