Cold-Pressed Oil Market Size (2024 – 2030)

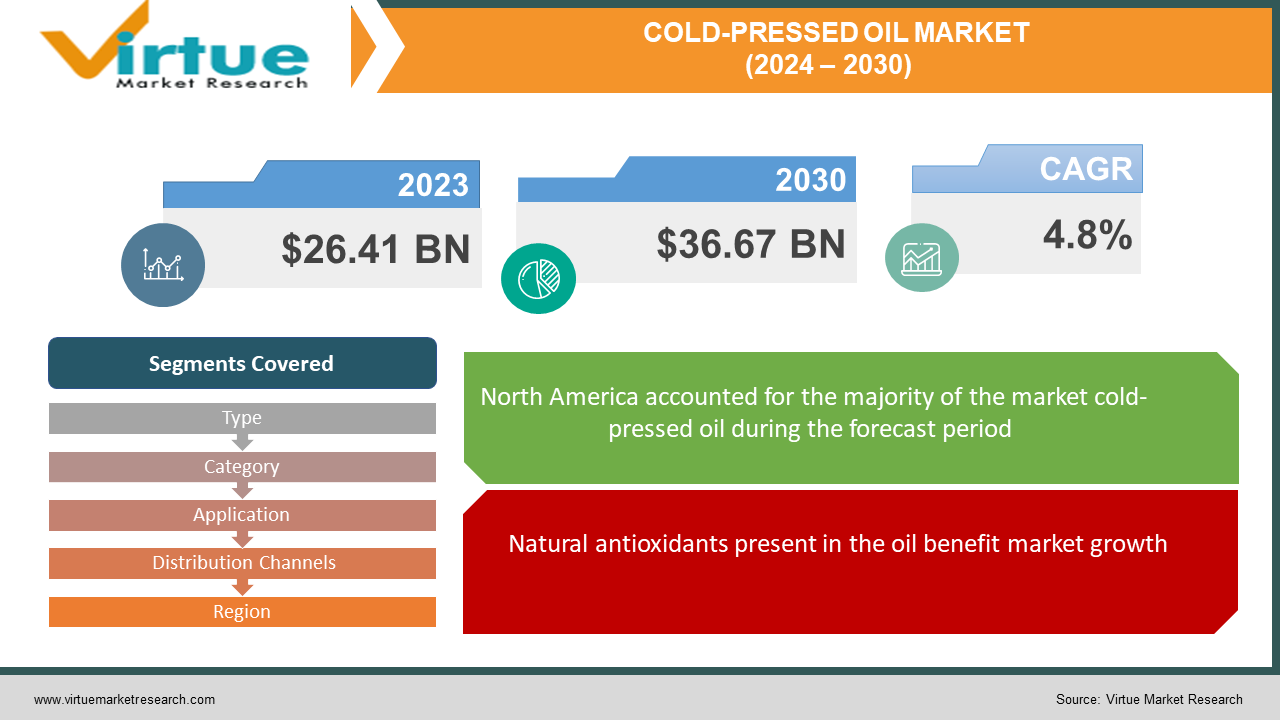

The Cold-Pressed Oil Market was valued at USD 26.41 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 36.67 billion by 2030, growing at a CAGR of 4.8%. Cold-pressed oil is derived from nuts or seeds without the application of heat or chemical solvents. The extraction process involves pressing, maintaining a low temperature to prevent damage to the ingredients. The term "cold-pressed" reflects this extraction method. The temperature during extraction should not exceed 49 °C (120 °F) to qualify as cold-pressed. Oils obtained through this method retain their original flavor, aroma, and nutritional content.

Key Market Insights:

The market is witnessing substantial growth in response to the heightened demand for cold-pressed oils across various sectors, encompassing personal care, food and beverages, and animal nutrition. The market expansion is notably fueled by the considerable nutritional value and enhanced flavor associated with these oils. Cold press extraction, classified as a mechanical extraction process, stands out for its energy efficiency when compared to alternative oil extraction methods.

Cold-pressed oils are naturally produced or obtained by mechanically extracting oil from sun-dried seeds or nuts such as ground nuts, coconut, sesame, castor, sunflower, mustard, or olive at ambient temperatures. This traditional cold pressing method involves the crushing of seeds or nuts and the subsequent extraction of oil through pressure, devoid of any additives, preservatives, or external heat.

Cold-Pressed Oil Market Drivers:

Natural antioxidants present in the oil benefit market growth.

Cold-pressed oils inherently preserve the natural antioxidants present in the seeds from which they are derived. Notably, this extraction method mitigates the detrimental effects associated with conventional oil extraction processes. Additionally, the utilization of cold press methods for production at lower temperatures underscores its environmental friendliness, facilitating the attainment of high-quality oils.

Cold pressed oils, distinguished by their safety compared to hot pressed oils, mitigate the adverse effects induced by high temperatures. Furthermore, they exhibit superior nutritive properties in comparison to refined oils. However, global growth in the cold-pressed oil market may encounter limitations due to factors such as low productivity and consumer allergies triggered by soybean seed, rapeseed, coconut, and similar sources. Health concerns, including symptoms like itchy palms and feet, shortness of breath, and nasal blockage, also pose challenges to market expansion.

Conversely, the positive attributes of cold-pressed oils contribute significantly to a healthy lifestyle, given their non-refined nature, cholesterol-free composition, and absence of harmful solvent residues. These factors have the potential to propel the global cold-pressed oil market forward.

Cold-Pressed Oil Market Restraints and Challenges:

The industry grapples with the formidable challenge of elevated production costs, leading to increased retail prices. This issue stems from the necessity for specialized equipment and labor-intensive methodologies, compounded by constraints in the availability of raw materials.

Cold-Pressed Oil Market Opportunities:

Increasing health benefits increase the opportunities for market growth.

An expansive global consumer base has gained heightened awareness of personal health, leading to significant shifts in dietary patterns and eating habits. This increased consciousness regarding health and well-being is notably advantageous for the demand of cold-pressed oil, contributing to a prospective rise in market sales during the forecast period.

Consumers, driven by a preference for health-conscious choices, exhibit a willingness to pay premium prices for products and ingredients with elevated nutritional value. The growth trajectory of the cold-pressed oil market is further propelled by the substantial expansion of the healthy eating categories, contrasting with the slower growth observed in indulgent categories.

COLD-PRESSED OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Type, Category, Application, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bunge Limited, Statfold Seed Oils Ltd., Cargill Inc., Wilmar International Ltd, FreshMill Oils, Gramiyum Wood Pressed Oils, China Agri-Industries Holdings Limited, Archer Daniels Midland Company (ADM), The healthy Home Economist, Naissance Natural Healthy Living |

Cold-Pressed Oil Market Segmentation: By Type

-

Coconut Oil

-

Cottonseed Oil

-

Olive Oil

-

Palm Oil

-

Palm Kernel Oil

-

Peanut Oil

-

Rapeseed Oil

-

Soybean Oil

-

Sunflower Seed Oil

The palm oil segment has asserted dominance in the cold-pressed oil market, contributing a substantial share and projecting a higher Compound Annual Growth Rate (CAGR) of 5.9%. This prominence is attributed to the health benefits it offers consumers, including cholesterol reduction, enhanced brain health, and the promotion of skin and hair well-being. Consequently, the palm oil segment is poised to make a significant contribution to the global market throughout the forecast period.

The soybean oil-based segment is anticipated to exhibit the second fastest CAGR of 5.8%. This growth is underpinned by the stable increase in global soybean oil demand over the past decade, driven by heightened requirements from the food industry. Additionally, soybean oil is experiencing demand growth for industrial applications, particularly in biodiesel production. The economic viability of soybean oil compared to other edible oils such as olive oil, groundnut oil, and coconut oil further positions the soybean oil segment for substantial growth in the forecast period.

Cold-Pressed Oil Market Segmentation: By Category

-

Organic

-

Conventional

The market is witnessing the dominance of organic oil, which is produced through organic farming methods. In contrast, non-organic products are frequently manufactured using pesticides, fertilizers, or other potentially harmful chemicals. This distinction underscores the growing consumer preference for organic oils, driven by concerns about sustainability, environmental impact, and a desire for products cultivated without synthetic additives.

Cold-Pressed Oil Market Segmentation: By Application

-

Food industry

-

Agriculture

-

Cosmetics and Personal Care Industry

The primary application of cold-pressed oil is in the food industry, where it finds extensive use among food product manufacturers, hotels, restaurants, cafes, and households. The dominance of the food industry in the application segment is attributable to the widespread adoption of cold-pressed oil across various culinary contexts. This factor is expected to significantly contribute to the expansion of key trends and opportunities within the cold-pressed oil market during the forecast period.

Cold-Pressed Oil Market Segmentation: By Distribution Channels

-

Convenience stores

-

Departmental stores

-

Modern trade units

-

Online retail

The distribution channel of hypermarkets and supermarkets has claimed the largest market share, accounting for approximately 45% in 2023. This segment is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period. Hypermarkets and supermarkets offer advantages such as personalized attention from sales staff, immediate product availability without the need for delivery wait times, and efficient returns, contributing to their prominence. The offline segment's robust revenue generation is further supported by well-established distribution channels globally and a prevailing preference among older demographics for in-store purchases compared to younger generations.

Conversely, the online distribution channel is poised to register the fastest CAGR of 6.5%. This accelerated growth is attributed to the convenience offered by online selling, reducing consumer search costs by facilitating effective product and price comparisons. Additionally, online channels introduce new distribution technologies capable of reducing supply chain and distribution costs. The increasing frequency of customer engagement with online distribution channels is driven by advantages such as time-efficiency, competitive prices or discounts, a broader product variety, and convenient comparison options. These factors collectively contribute to the rising market demand through the online distribution channel.

Cold-Pressed Oil Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is anticipated to experience a Compound Annual Growth Rate (CAGR) of 6.2%. The growth is fueled by an increasing awareness of health among the population, leading to a preference for a healthier lifestyle. Additionally, concerns about maintaining a clean and pollution-free environment are expected to drive market development in the well-established region of North America throughout the forecast period.

The Asia Pacific market commands a substantial share, exceeding 40.0%, and is projected to grow at a rate of 6.4%. This growth is attributed to the readily available raw materials and lower labor costs in the region. Significant contributions to the market are expected from countries such as China, India, and Indonesia. The widespread use of cold-pressed oil in the Asia Pacific region can be attributed to its high nutritional value, coupled with superior taste and aroma qualities.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic continues to shape the trajectory of various industries, and its immediate impact has been diverse. Lockdowns, disruptions in demand, supply chain challenges, and shifts in consumer behavior have collectively exerted a significant influence on the cold-pressed oils market. The rapid growth of the foodservice industry has particularly impacted the demand for cold-pressed oils, driven by consumer preferences for healthier food options to enhance immunity.

Latest Trends/ Developments:

In January 2022, Acacia Communications officially terminated its $2.6 billion merger agreement with Cisco Systems. The manufacturer of optical interconnection products made the decision to end the deal, which was initially reached over a year and a half ago, citing the lack of approval from the Chinese government's State Administration for Market Regulation by the specified deadline. In response, Cisco has notified Acacia of its intention to challenge Acacia's ability to unilaterally terminate the merger agreement.

Key Players:

These are top 10 players in the Cold-Pressed Oil Market: -

-

Bunge Limited

-

Statfold Seed Oils Ltd.

-

Cargill Inc.

-

Wilmar International Ltd

-

FreshMill Oils

-

Gramiyum Wood Pressed Oils

-

China Agri-Industries Holdings Limited

-

Archer Daniels Midland Company (ADM)

-

The healthy Home Economist

-

Naissance Natural Healthy Living

Chapter 1. Cold-Pressed Oil Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cold-Pressed Oil Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cold-Pressed Oil Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cold-Pressed Oil Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cold-Pressed Oil Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cold-Pressed Oil Market – By Type

6.1 Introduction/Key Findings

6.2 Coconut Oil

6.3 Cottonseed Oil

6.4 Olive Oil

6.5 Palm Oil

6.6 Palm Kernel Oil

6.7 Peanut Oil

6.8 Rapeseed Oil

6.9 Soybean Oil

6.10 Sunflower Seed Oil

6.11 Y-O-Y Growth trend Analysis By Type

6.12 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Cold-Pressed Oil Market – By Application

7.1 Introduction/Key Findings

7.2 Food industry

7.3 Agriculture

7.4 Cosmetics and Personal Care Industry

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Cold-Pressed Oil Market – By Category

8.1 Introduction/Key Findings

8.2 Organic

8.3 Conventional

8.4 Y-O-Y Growth trend Analysis By Category

8.5 Absolute $ Opportunity Analysis By Category, 2024-2030

Chapter 9. Cold-Pressed Oil Market – By Distribution Channels

9.1 Introduction/Key Findings

9.2 Convenience stores

9.3 Departmental stores

9.4 Modern trade units

9.5 Online retail

9.6 Y-O-Y Growth trend Analysis By Distribution Channels

9.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 10. Cold-Pressed Oil Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Application

10.1.3 By Category

10.1.4 By Technology

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Application

10.2.4 By Category

10.2.5 By Distribution Channels

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Application

10.3.4 By Category

10.3.5 By Distribution Channels

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Application

10.4.4 By Category

10.4.5 By Technology

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Application

10.5.4 By Category

10.5.5 By Distribution Channels

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Cold-Pressed Oil Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Bunge Limited

11.2 Statfold Seed Oils Ltd.

11.3 Cargill Inc.

11.4 Wilmar International Ltd

11.5 FreshMill Oils

11.6 Gramiyum Wood Pressed Oils

11.7 China Agri-Industries Holdings Limited

11.8 Archer Daniels Midland Company (ADM)

11.9 The healthy Home Economist

11.10 Naissance Natural Healthy Living

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market expansion is notably fueled by the considerable nutritional value and enhanced flavor associated with these oils.

Top Players operating in the Cold-Pressed Oil Market are - Bunge Limited, Statfold Seed Oils Ltd., Cargill Inc., Wilmar International Ltd, FreshMill Oils, Gramiyum Wood Pressed Oils, China Agri-Industries Holdings Limited, Archer Daniels Midland Company (ADM), The Healthy Home Economist, Naissance Natural Healthy Living.

The COVID-19 pandemic continues to shape the trajectory of various industries, and its immediate impact has been diverse. Lockdowns, disruptions in demand, supply chain challenges, and shifts in consumer behavior have collectively exerted a significant influence on the cold-pressed oils market.

The increased consciousness regarding health and well-being is notably advantageous for the demand of cold-pressed oil, contributing to a prospective rise in market sales during the forecast period.

The Asia Pacific market commands a substantial share, exceeding 40.0%, and is projected to grow at a rate of 6.4%. This growth is attributed to the readily available raw materials and lower labor costs in the region.