Cold Mix Asphalt Additive Market Size (2024 – 2030)

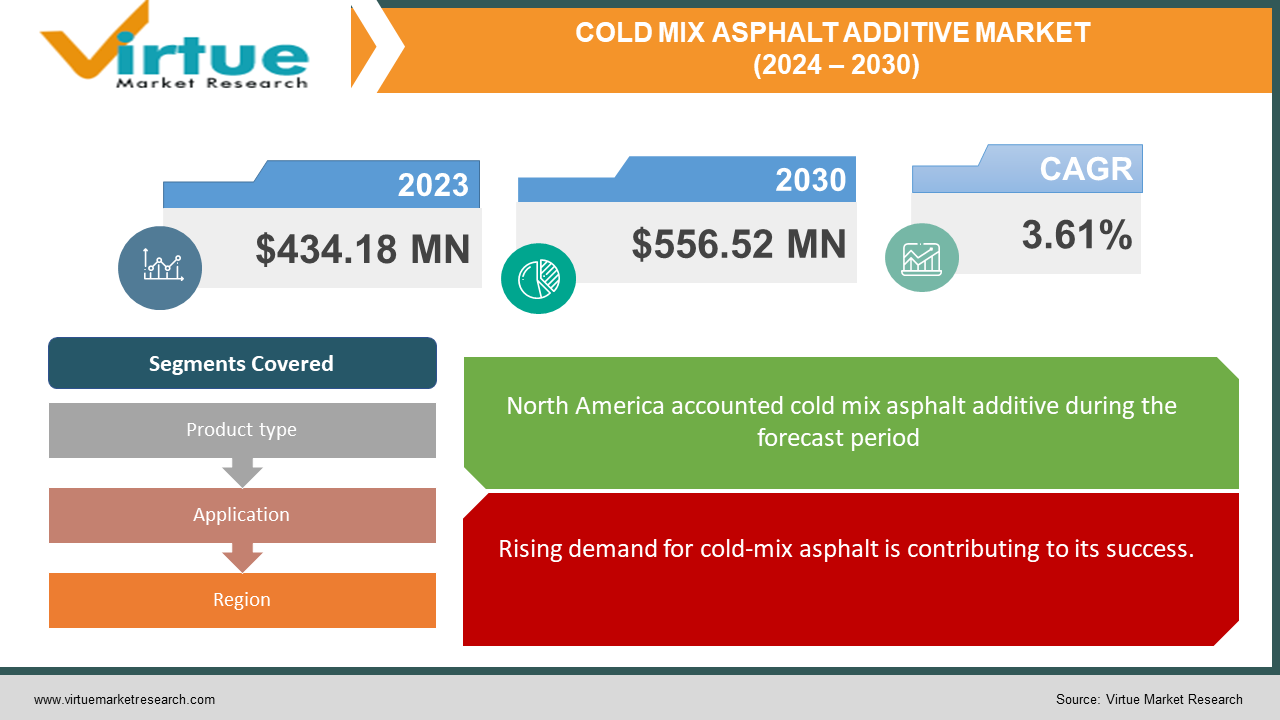

The global cold mix asphalt additive market was valued at USD 434.18 million in 2023 and will grow at a CAGR of 3.61% from 2024 to 2030. The market is expected to reach USD 556.52 million by 2030.

The quality of CMA, or cold-mixed asphalt, is increased by adding additives. CMA is an environmentally friendly method of creating new pavements that can be produced at room temperature, which is between 0 and 40 °C. Asphalt is emulsified with water and an emulsifier chemical to create CMA, which is further combined with aggregates. Reclaimed asphalt pavement or virgin materials can be used to make the aggregates. Aggregates, binding material, water, and solvent are the major parts of CMA.

Key Market Insights:

Recent company reports indicate a surge in the adoption of cold mix asphalt additives by road construction companies, with a notable increase of over 15% in sales volume over the past two years, attributed to their superior performance in adverse weather conditions and cost-efficiency (Source: NCC Infra Annual Report).

According to reports by Statista, a shift towards the adoption of cold mix asphalt additives in emerging economies, with regions such as Asia-Pacific witnessing the fastest growth rate, expected to capture over 40% of the market share by 2027, fueled by escalating infrastructure development initiatives

Cold Mix Asphalt Additive Market Drivers:

Rising demand for cold-mix asphalt is contributing to its success.

The global cold mix asphalt additive market is flourishing alongside the rising demand for cold mix asphalt itself. Compared to traditional hot mix, cold mix offers a trifecta of benefits: environmental friendliness, cold-weather usability, and lower energy consumption during production. This eco-conscious alternative utilizes cold aggregates, emulsions, or cutback asphalts, eliminating the need for heating plants that release harmful emissions. Furthermore, cold mix shines in colder climates, where hot mix application becomes impractical. The ease of use extends to storage, as cold mix doesn't require immediate application and can be stockpiled for repairs, minimizing material waste. Finally, the cold production process significantly reduces energy consumption, making the cold mix a more sustainable option for environmentally responsible construction projects. This surge in cold mix asphalt adoption is undeniably propelling the market for cold mix asphalt additives, essential components that enhance the performance and longevity of these eco-friendly pavements.

Growing infrastructure development is facilitating the expansion.

A global infrastructure boom is fueling the demand for cold-mix asphalt additives. As governments worldwide pour resources into roads, bridges, and airports, the need for asphalt surges. This presents a significant opportunity for cold mix asphalt, a compelling alternative to traditional hot mix. The cold mix offers a win-win for both efficiency and sustainability in infrastructure projects. Unlike hot mix, which requires scorching temperatures for production and application, cold mix thrives in cooler weather conditions. This eliminates weather-related delays and extends the construction window in regions with colder climates. Additionally, cold mix boasts a smaller environmental footprint. Its production process consumes less energy and releases fewer emissions compared to the hot mix, aligning with growing environmental concerns. This eco-friendly aspect, coupled with its cold-weather applicability, makes cold-mixed asphalt an increasingly attractive option for contractors. As a result, the rise in infrastructure development, combined with the expanding popularity of cold-mix asphalt, is expected to create a ripple effect, propelling the demand for cold-mix asphalt additives, the crucial ingredients that optimize the performance and durability of these greener pavements.

Ease of use and storage is accelerating the growth rate.

Cold-mix asphalt boasts a game-changing advantage over hot-mix asphalt: extended shelf life. Unlike hot mix, which rapidly hardens and becomes unusable after production, cold mix can be stockpiled for extended periods without hardening. This translates to remarkable convenience and cost-effectiveness, particularly for emergency repairs. Cold mix can be readily retrieved from stockpiles, allowing for immediate repair and minimizing traffic disruptions. This eliminates the need for emergency hot mix production runs, saving time and resources. Furthermore, stockpiling cold mix asphalt empowers proactive maintenance strategies. By having readily available material on hand, crews can address minor cracks or imperfections before they escalate into major road problems. This preventive approach extends the lifespan and reduces the overall need for emergency repairs. Ultimately, the extended storage capability of cold-mix asphalt offers a significant edge in terms of responsiveness, cost-efficiency, and proactive pavement maintenance.

Global Cold Mix Asphalt Additive Market Challenges and Restraints:

Higher initial costs are a major barrier.

A hurdle for wider cold mix asphalt adoption is the upfront cost of the additives. While cold mix asphalt offers long-term economic advantages due to factors like reduced energy consumption and stockpiling capabilities, the initial price tag of the special additives can be higher compared to hot mix asphalt. This can be a significant barrier for contractors, particularly those undertaking smaller projects with tighter budgets. The cost difference might seem less substantial for large-scale infrastructure projects where the long-term benefits outweigh the initial investment. However, for smaller repairs or maintenance jobs, the upfront cost of cold mix additives can be a deciding factor, pushing contractors towards the more readily available and cheaper hot mix option, even if it means sacrificing some environmental benefits and cold-weather applicability. To bridge this gap, continued innovation in additive formulations is crucial to bring down their costs and make cold mix asphalt a more economically attractive option across project sizes.

Limited awareness is causing hindrances.

Cold mix asphalt technology is a young contender in the road construction arena compared to the well-established hot mix method. This relative novelty can create a knowledge gap among some key decision-makers. Contractors accustomed to hot mix practices might not be fully aware of the advantages cold mix offers, such as environmental friendliness, cold-weather usability, and stockpiling benefits. Similarly, road authorities responsible for specifying materials might lack complete information on cold mix asphalt and its performance with various additives. This knowledge gap can hinder wider adoption, particularly in regions where the traditional hot mix reigns supreme. To overcome this hurdle, educational initiatives targeting contractors, road authorities, and engineers are essential. Workshops, webinars, and demonstrations can bridge the knowledge gap by showcasing the practical and environmental benefits of cold-mixed asphalt and its additives. This will empower informed decision-making and encourage the integration of cold mix technology into new construction and maintenance projects.

Stringent regulations create complexities.

The road to adopting cold-mixed asphalt can be difficult due to the ever-changing landscape of environmental regulations regarding asphalt additives. These regulations can vary significantly depending on the location, with some regions imposing stricter limitations on the types and quantities of additives permitted in asphalt mixes. This complexity can be a major headache for contractors and suppliers alike. Navigating the legalities can add significant time and effort to the procurement process, requiring careful research and consultation with regulatory bodies to ensure that the chosen additives comply with local environmental standards. Furthermore, staying abreast of evolving regulations necessitates ongoing monitoring and potential adjustments to sourcing strategies. This can be particularly challenging for contractors working across multiple regions with differing regulations. To streamline the process, increased collaboration between regulatory bodies and the asphalt industry is crucial. Standardized guidelines with clear parameters for acceptable additives would go a long way in simplifying procurement and encouraging wider adoption of environmentally friendly cold mix asphalt technologies.

Global Cold Mix Asphalt Additive Market Opportunities:

With the emergence of eco-friendly bio-based additives, greater tolerance to temperature in a wider range of climates, the possibility of new building uses, and the expansion of infrastructure, the cold mix asphalt additive industry is poised for explosive growth. Digitalization for optimized production and cost reductions through lower energy consumption, stockpiling capabilities, and extended pavement life are further propelling this market. As research drives down additive costs and optimizes performance, cold-mix asphalt additives are poised to become the go-to solution for sustainable and cost-effective road construction and maintenance.

COLD MIX ASPHALT ADDITIVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.61% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ArrMaz, Sinopec, Kraton Performance Polymers, Colasphalt, Evonik, Huntsman, Ingevity, Dow AkzoNobel, Arkema Group |

Cold Mix Asphalt Additive Market Segmentation: By Application

-

Cold Patch Stockpile Mix

-

Cold Mix Paving

Cold patch stockpile mix is the largest and fastest-growing application, utilizing these additives to create stockpiled asphalt mixtures ideal for quick repairs. This translates to immediate patching of potholes, cracks, and other road imperfections, minimizing traffic disruptions and ensuring road safety. Unlike hot mixes, which harden quickly, cold mixes with additives can be stockpiled for long periods, ready to be deployed whenever needed.

Cold Mix Asphalt Additive Market Segmentation: By Product Type

-

Emulsion-based Cold-mix Mix additives

-

Solvent-based Cold Mix Asphalt Additives

The largest and fastest-growing category is emulsion-based additives, the eco-friendly champions. These water-based heroes activate and bind asphalt cement with aggregates at lower temperatures, making them perfect for cold-weather applications. They boast excellent workability, meaning they're easy to use, and their storage stability ensures that stockpiled cold mix remains usable for extended periods. Their water base significantly reduces harmful emissions compared to their counterparts, solvent-based cold mix additives. While solvent-based additives offer similar binding capabilities, their declining use is a clear reflection of growing environmental concerns. As regulations tighten and sustainability becomes a priority, emulsion-based additives, with their eco-friendly edge, are poised to maintain their reign in the cold-mix asphalt additive market.

Cold Mix Asphalt Additive Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia

-

South America

-

Middle East and Africa

The cold-mix asphalt additive market is a tale of three continents. North America, with its vast road network and harsh winters, reigns supreme as the largest market, heavily reliant on cold patch stockpile mixes for quick repairs using environmentally friendly emulsion-based additives. Europe, a previous leader, is now challenged by North America's dominance but remains a significant player utilizing cold mix for both repairs and new construction projects, with similar preferences for emulsion-based additives due to strict regulations. The fastest growth, however, is happening in the Asia Pacific region, fueled by China's infrastructure boom. This market demands cold mix solutions for both repairs and paving, with a growing preference for emulsion-based additives as environmental awareness rises. South America, the Middle East & Africa, while smaller markets show potential for future growth driven by infrastructure development. Their focus lies on cost-effective cold patch repairs, with emulsion-based additives gaining traction due to environmental considerations. Overall, emulsion-based additives dominate globally due to regulations and their eco-friendly edge.

COVID-19 Impact Analysis on the Global Cold Mix Asphalt Additive Market

The COVID-19 pandemic threw a curveball at the cold-mix asphalt additive market. Lockdowns and restrictions on movement halted construction projects worldwide, leading to a significant drop in demand for both cold-mix asphalt and its additives. This impact was particularly severe for the cold mix paving segment, as new construction projects were put on hold. However, the market showed resilience in the cold patch repair segment. As potholes and cracks didn't disappear during the pandemic, the need for quick repairs remained. This, coupled with the extended storage life of cold mix asphalt, helped the cold patch segment weather the storm better. As economies recovered and infrastructure projects resumed, the demand for cold-mixed asphalt additives began to rebound during the second half of the pandemic. While the market hasn't yet fully reached pre-pandemic levels, it's expected to experience a steady growth trajectory in the coming years, driven by factors like rising infrastructure development and increasing adoption of cold mix asphalt for its environmental and efficiency benefits.

Latest Trends/Developments

The global cold mix asphalt additive market is experiencing a wave of innovation focused on sustainability and performance. Bio-based additives derived from renewable resources are gaining traction as a response to environmental concerns and tightening regulations on traditional solvent-based additives. These eco-friendly options offer comparable performance without harmful emissions. Additionally, research is ongoing to develop cold-mix asphalt additives that enhance long-term pavement performance. This includes additives that improve resistance to cracking, rutting, and fatigue, particularly for cold mixes used in high-traffic areas. Furthermore, advancements in cold mix technology are enabling its use in wider temperature ranges. New cold mix additives are being formulated to perform effectively in both extremely cold and hot weather conditions, expanding the geographic reach and application potential of cold mix asphalt. The market is also witnessing a growing focus on digitalization. The use of cloud-based platforms to monitor and optimize cold mix production and storage is gaining momentum, allowing for better quality control and efficient resource management. These trends, coupled with rising infrastructure projects and increasing awareness of cold mix asphalt's benefits, are paving the way for a promising future for the global cold mix asphalt additive market.

Key Players:

-

ArrMaz

-

Sinopec

-

Kraton Performance Polymers

-

Colasphalt

-

Evonik

-

Huntsman

-

Ingevity

-

Dow

-

AkzoNobel

-

Arkema Group

Chapter 1. COLD MIX ASPHALT ADDITIVE MARKET– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. COLD MIX ASPHALT ADDITIVE MARKET– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. COLD MIX ASPHALT ADDITIVE MARKET– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. COLD MIX ASPHALT ADDITIVE MARKET- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. COLD MIX ASPHALT ADDITIVE MARKET– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. COLD MIX ASPHALT ADDITIVE MARKET– By Product Type

6.1 Introduction/Key Findings

6.2 Emulsion-based Cold-mix Mix additives

6.3 Solvent-based Cold Mix Asphalt Additives

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. COLD MIX ASPHALT ADDITIVE MARKET– By Application

7.1 Introduction/Key Findings

7.2 Cold Patch Stockpile Mix

7.3 Cold Mix Paving

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. COLD MIX ASPHALT ADDITIVE MARKET, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. COLD MIX ASPHALT ADDITIVE MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ArrMaz

9.2 Sinopec

9.3 Kraton Performance Polymers

9.4 Colasphalt

9.5 Evonik

9.6 Huntsman

9.7 Ingevity

9.8 Dow

9.9 AkzoNobel

9.10 Arkema Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global cold mix asphalt additive market was valued at USD 434.18 million in 2023 and will grow at a CAGR of 3.61% from 2024 to 2030. The market is expected to reach USD 556.52 million by 2030.

Rising demand, growing infrastructure development, ease of use, and storage are the reasons that are driving the market.

Based on application, the market is divided into two segments: patch stockpile mix and cold mix paving.

North America is the most dominant region for the global cold mix asphalt additive market.

ArrMaz, Sinopec, Kraton Performance Polymers, Colasphalt, and Evonik are the major players in the global cold mix asphalt additive market.