Coinage Metals Market Size (2023-2030)

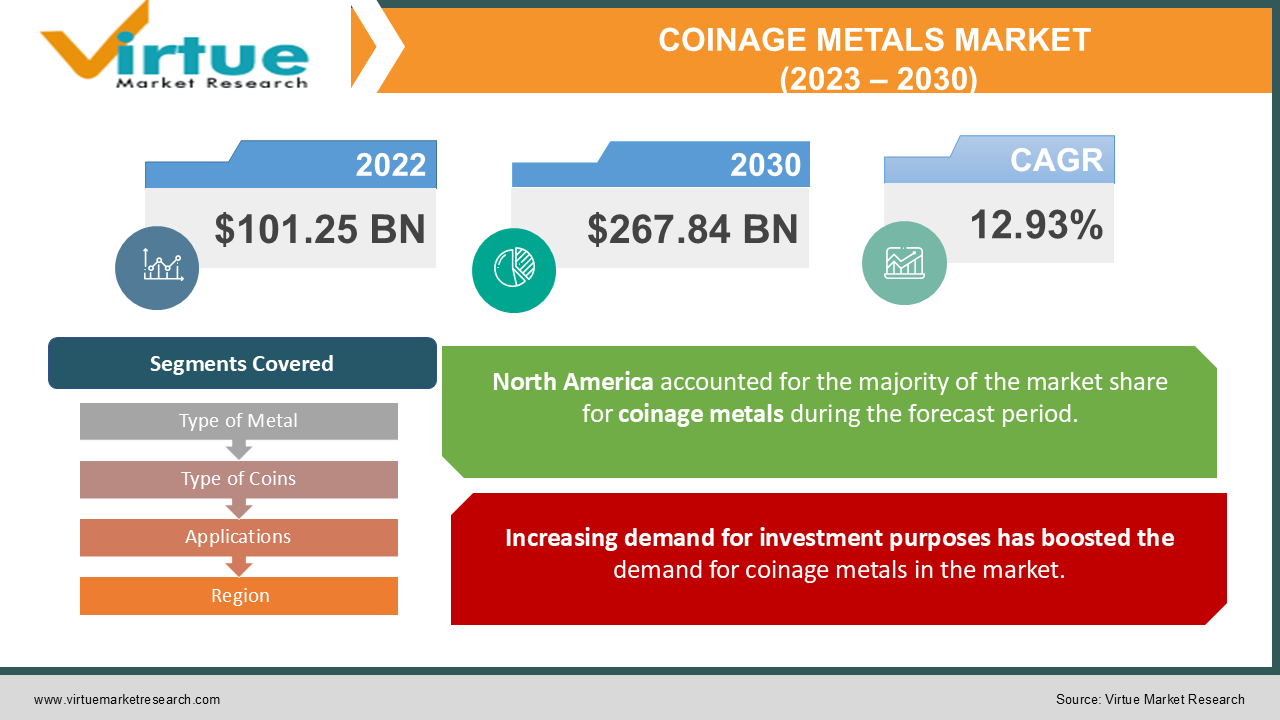

In 2022, the Global Coinage Metals Market was valued at 101.25 billion, and is projected to reach a market size of $267.84 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 12.93%.

Coinage metals are a group of metals that were used to mint coins during historic times. Coinage metals are used in the study of coins or numismatics and metallurgy which study the properties of metals to prepare coins. Further, the most common metals used for preparing coins were gold, silver, platinum, copper, bronze, and others. Moreover, the choice of metals is dependent on the production and purpose of coins such as coins used as a medium of exchange, in jewelry, coins used for trading, in collectibles and artifacts, industrial applications, and others. Further, excellent properties of metals such as durability, malleability, ductility, portability, resistance to corrosion, and temperature have contributed to the growth of coinage metals in the market.

Global Coinage Metals Market Drivers:

Increasing demand for investment purposes has boosted the demand for coinage metals in the market.

Coinage metals such as gold and silver are increasingly demanded for investment purposes in the financial markets. Furthermore, economic fluctuations have increased the desire to preserve and invest in wealth that can help individuals overcome economic uncertainties. Moreover, during market instability periods, investors often consider safe assets such as coinage metals, particularly gold and silver to park their funds. In addition, the availability of ETFs (Exchange Traded Funds) allows investors to invest in gold and silver ETFs and mutual funds, without physically owning the metals. Further, ETFs buy and store bullion on behalf of the investors and allow easy access to the investment process. Moreover, inflation reduces the purchasing power of paper currencies over time, which increases the demand for coinage metals such as gold and silver as their prices tend to increase with inflation and protect investors from the adverse effects of inflation.

The rising demand for coin collections by numismatists and collectors has contributed to the demand for coinage metals in the market.

Numismatists and coin collectors often seek coins of historical significance that depict important figures, rulers of specific eras, and others. These coins are made of precious metals such as gold, silver, palladium, and others that offer high value to coin collectors. Moreover, the rarity and uniqueness of coins such as coins with low mintages or coins made from rare metals and materials have attracted coin collectors and history enthusiasts. Further, well-preserved, high-grade, and intact coins are increasingly demanded by numismatists for studying specific eras or reigns of dynasties during the ancient period. Further, this has given rise to coin gradings services that assess the quality, condition, and authenticity of coins and provide information to coin collectors that can influence their demand decisions.

Global Coinage Metals Market Challenges:

Fluctuations in metal prices can reduce the demand for coinage metals in the market. Fluctuations due to geopolitical events, inflation, uncertain market downfall, and others can decline the market demand for coinage metals, especially metals used for bullion coins.

Furthermore, competition from digital currencies such as cryptocurrency can reduce the consumer demand for coinage metals as these digital currencies offer easy investment methods with large returns, thus declining the demand for precious metals coins as investment assets.

Global Coinage Metals Market Opportunities:

The Global Coinage Metals Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, the increasing demand for coinage metals as an investment asset such as bullion coins is predicted to develop the market for Coinage Metals and enhance its future growth opportunities.

COVID-19 Impact on the Global Coinage Metals Market:

The pandemic hurt the coinage metals market. Due to the lockdown, minting operations of government and private entities were closed, which resulted in delayed production of coins and hence supply chain disruptions in the market. Further, market fluctuations such as inflation and stock market crashes reduced the demand for bullion coins during the pandemic. In addition, physical movement restrictions and social distancing norms gave rise to trading and investment in digitized coins such as bitcoin and other cryptocurrencies, resulting in declined demand for coinage metals in the market during the pandemic.

COINAGE METALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12.93% |

|

Segments Covered |

By Type of Metal, Type of Coins, Applications and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Jindal Stainless, Rashtriya Metal, The South African Mint Company, Epirus Metalworks, Arcotech LTd, Mauquoy Token Company NV |

Global Coinage Metals Market Segmentation: By Type of Metal

-

Gold

-

Silver

-

Palladium

-

Others

Based on market segmentation by type of metal, gold occupies the highest share in the market. Gold is a widely used metal used in coinage since ancient times. Its unique properties such as malleability, ductility, rarity, near-indestructibility, and authenticity make it a popular metal in the preparation of coins. Further, due to their high-financial value, they are increasingly used as investment assets that can hedge against market uncertainties and fluctuations. In addition, they are also traded as bullion in the financial market to earn high-financial returns.

The fastest-growing metal during the forecast period is silver. Silver is widely used in the production of coins since ancient times due to its affordability compared to other metals, high intrinsic value, and lustrous appearance, compact size allowing for easy day-to-day transactions, malleability, ductility, and resistance to atmospheric oxidation.

Global Coinage Metals Market Segmentation: By Type of Coins

-

Bullion Coins

-

Collectible Coins

-

Others

Based on market segmentation by type of coins, bullion coins occupy the highest share in the market. Bullion coins are used for trading and investment purposes and are usually produced by government minting facilities. These coins are minted in large quantities that have specific weight, metal purity, and high intrinsic value. Moreover, these coins are purchased by investors as an investment asset that hedges them against economic uncertainties. Metals used in the production of bullion coins include gold, silver, platinum, and others.

The collectible coins segment is the fastest-growing coin during the forecast period. These coins, also known as numismatics coins are valued due to their historical and cultural significance and are increasingly demanded by coin collectors. Further, they are produced either by government minting facilities or private minting companies and are often produced in limited quantities. Moreover, the designs, artistic appeal, and rarity of coins have contributed to their growth in the market. Designs of collectible coins with famous historic figures, events, dynasties, and cultural symbols are popular among coin collectors. Metals used in the production of collectible coins include gold, silver, silver alloy, copper, bronze, nickel, and others.

Global Coinage Metals Market Segmentation: By Applications

-

Investment

-

Numismatics

-

Others

Based on market segmentation by application, investment occupies the highest share of the market. Coinage metals, particularly gold and silver are considered investment assets that protect investors from market fluctuations. These metals hold high-intrinsic value, making them a popular choice to produce and trade coins in the market. Moreover, they are used to produce bullion coins that can be used as a form of investment in the market. In addition, gold coins are increasingly used in the spot market to gain immediate and high returns.

The numismatics segment is the fastest-growing segment during the forecast period. The rarity and historical significance of coins have contributed to the demand for coinage metals in the market by historic coin collectors. Coins with rare inscriptions and unique designs are increasingly demanded by numismatists to study the historic period and derive valuable conclusions. Further, coins for special occasions such as ruler anniversaries, to mark honor and valor, or other significant events are highly demanded by historic coin collectors due to their historical significance and visual appeal.

Global Coinage Metals Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

Based on market segmentation by region, North America occupies the highest share of the market. Monetary and investment policies, market fluctuations, and government support has contributed to the demand for coinage metals in the market. For instance, government support in the form of schemes and programs such as The United States Mint, Royal Canadian Mint, and others produce a variety of coinage metals in large volumes, which includes bullion coins, collector coins, commemorative coins, and others. In addition, minting programs such as the circulating coin program in the USA to mark specific events in history have further contributed to the demand for coinage metals in the region.

Asia-Pacific is the fastest-growing region during the forecast period. The prevalence of rich historic culture, an abundance of metals, and a rising numismatic collector community have increased the demand for coinage metals in the region.

Global Coinage Metals Market Key Players:

-

Jindal Stainless

-

Rashtriya Metal

-

The South African Mint Company

-

Epirus Metalworks

-

Arcotech LTd

-

Mauquoy Token Company NV

Chapter 1. Coinage Metals Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Coinage Metals Market - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Coinage Metals Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Coinage Metals Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Coinage Metals Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Coinage Metals Market - By Technology Type

6.1 Immunofluorescence Assays (IFA)

6.2 Enzyme-Linked Immunosorbent Assays (ELISA)

6.3 Molecular Diagnostics (PCR-based)

Chapter 7. Coinage Metals Market - By Diagnostic Test

7.1 Antinuclear Antibody (ANA) Test

7.2 Autoantibody Test

7.3 Compliment Component Test

7.4 Other Tests

Chapter 8. Coinage Metals Market - By End-User

8.1 Hospitals

8.2 Clinics

8.3 Home Care

8.4 Other

Chapter 9. Coinage Metals Market – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. Coinage Metals Market – Key players

10.1 Perfern RF

10.2 Rapid Labs

10.3 Arlington Scientific

10.4 Avantor

10.5 Atlas Medical

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2022, the Global Coinage Metals Market was valued at 101.25 billion, and is projected to reach a market size of $267.84 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 12.93%.

Increasing demand for coins for investment purposes and the rising demand for coins collections by numismatists and collectors are the market drivers for Global Coinage Metals Market.

Investment, Numismatics, and Others are the segments under Global Coinage Metals Market by application.

North America dominates the market for Global Coinage Metals Market.

Asia-Pacific is the fastest-growing region in the Global Coinage Metals Market.