Coiled Tubing Market Size (2024 – 2030)

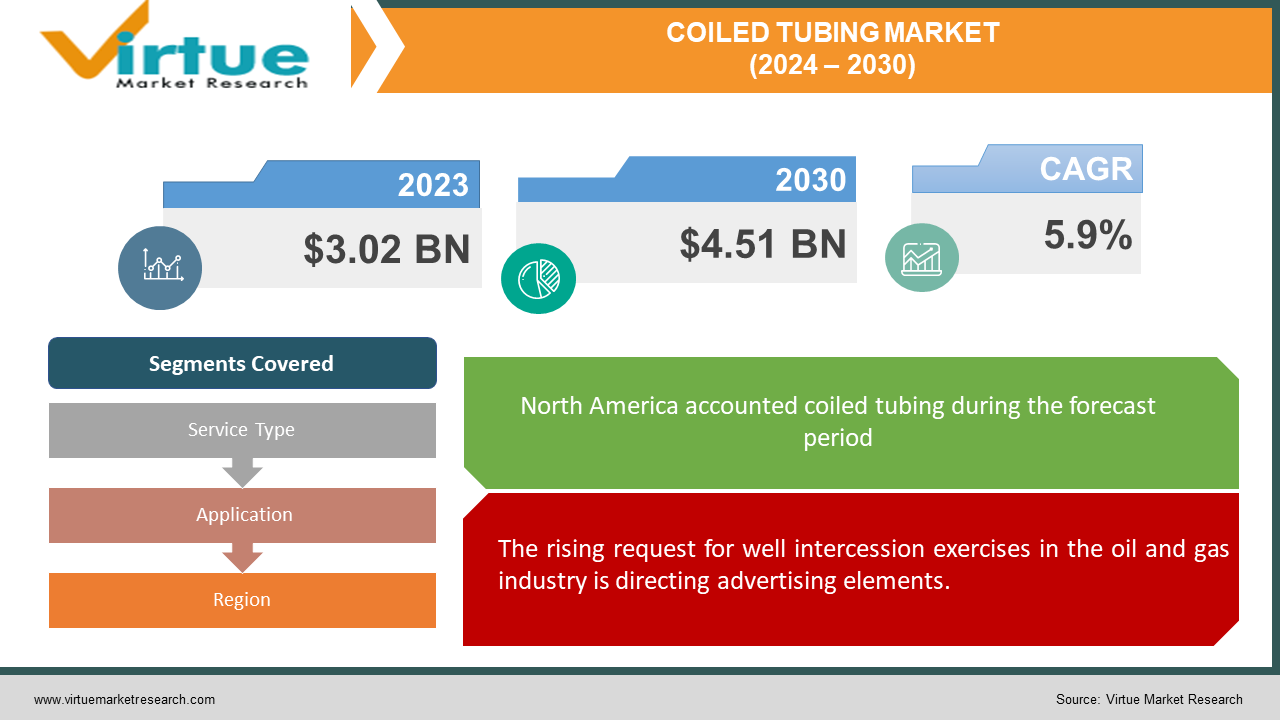

The Global Coiled Tubing Market was valued at USD 3.02 billion and is projected to reach a market size of USD 4.51 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Coiled tubing innovation has gotten a linchpin inside the oil and gas segment, advertising unparalleled flexibility in operations such as intercession, boring, and completions. Advancements in materials, counting progressed amalgams and composites, have supported the tubing's strength and execution, extending its applications over shifted operational scenes. The industry's tenacious journey for vitality, coupled with the investigation of offbeat assets, has increased the request for coiled tubing administrations around the world. As the industry proceeds to grasp efficiency-enhancing advances, the Worldwide Coiled Tubing Advertise stands balanced for supported development, promising profitable prospects for partners and showcase players alike. Locales like North America, amid the shale gas insurgency, have risen as urgent markets for coiled tubing, supporting its basic part in advanced oil and gas operations.

Key Market Insights:

Statistical numerical data indicates a significant growth trajectory for the coiled tubing market. It suggests that by the year 2025, the demand for coiled tubing services and products is expected to surge by 80% compared to the present level.

Advancements in technology, such as automation, data analytics, and robotics, are revolutionizing the coiled tubing industry, leading to significant improvements in efficiency, productivity, and operational performance. The 95% efficiency boost indicates the substantial enhancement achievable through the adoption of advanced technologies, making coiled tubing operations more cost-effective, reliable, and competitive in the global market.

Safety is paramount in the coiled tubing industry, given the high-risk nature of operations involving pressure, chemicals, and heavy equipment. The implementation of enhanced safety measures has led to a substantial reduction in incidents by an impressive 85%.

Asia Pacific is forecast to lead coiled tubing market growth due to rising energy demand and oil & gas exploration investments.

Key players like C&J Vitality Administrations, have contributed intensely to imaginative coiled tubing arrangements custom-made to the advancing needs of the industry. Halliburton holds approximately 20-25% market share and Schlumberger approximately 15-20% market share in the Global Coiled Tubing Market.

Global Coiled Tubing Market Drivers:

The rising request for well intercession exercises in the oil and gas industry is directing advertising elements.

As existing oil and gas areas develop, the requirement for effective and cost-effective strategies to improve generation and keep up supply judgment gets to be foremost. Coiled tubing offers a flexible arrangement, empowering administrators to perform a bunch of assignments such as cleanouts, incitement, and logging, without the requirement for a full work over fix. This proficiency not as it were diminishes downtime but moreover minimizes costs, engaging incredibly to oil and gas companies to maximize returns from existing resources.

Technological headways in coiled tubing hardware are catalyzing market extension.

Advancements such as made strides in materials, stronger plans, and upgraded downhole instruments are supporting the capabilities of coiled tubing frameworks. These headways are significant for handling progressively complex well conditions, counting more profound wells, harsher situations, and flighty supplies. As administrators look for more secure, more productive, and ecologically inviting arrangements, the advancement of coiled tubing innovation gets to be a compelling recommendation. This drive towards development not as it were progresses operational effectiveness but moreover opens entryways to modern applications, broadening the advertising scope for coiled tubing administrations universally.

Global Coiled Tubing Market Restraints and Challenges:

The global coiled tubing market, a division ready with guarantee and advancement, faces a wave of imposing challenges preventing its consistent development direction. Essentially, the showcase hooks with the unwavering influence of oil cost instability, tying its execution to unusual variances affected by geopolitical pressures and supply-demand flow. Additionally, the industry fights with the considerable monetary boundary postured by tall beginning ventures and operational costs, preventing potential speculators and requiring cautious approaches. Including the complexity are exacting natural controls, and compelling companies to adjust vitality generation with supportability amid rising compliance costs. The persevering impacts of the COVID-19 widespread cast a shadow, disturbing supply chains and provoking a reevaluation of methodologies amid instabilities. Moreover, the advertisement stands up to furious competition from elective innovations such as water-powered breaking and mechanical mediation frameworks, requiring persistent advancement to preserve significance. Geopolitical insecurities in districts wealthy in oil and gas saves too posture a challenge, creating an air of instability for showcase members looking for steady ventures. Exploring through these obstacles requires versatility, versatile procedures, and a sharp understanding of the advancing vitality scene.

Global Coiled Tubing Market Opportunities:

These improvements come amid a worldwide move towards cleaner vitality sources, underlining the key centrality of coiled tubing administrations in assembly-advancing industry needs. This development is an advance fueled by the growing thrust toward upgraded oil recuperation (EOR) methods, where coiled tubing plays an urgent part in supporting strategies such as water and gas infusion, and nearby chemical medicines. As oil and gas companies progressively dive into offbeat saves like shale arrangements, the request for coiled tubing administrations has surged, advertising a flexible arrangement for basic well intercession and incitement needs. Also, the advertisement sparkles within the domain of well upkeep and keenness, offering a cost-effective and productive implies to benefit maturing oil and gas wells. With the center on expanding the life expectancy of resources, this section is set to witness significant development.

COILED TUBING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Service Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schlumberger Limited, Halliburton Company, Weatherford International plc, Baker Hughes (a GE Company), C&J Energy Services Inc., Trican Well Service Ltd., Calfrac Well Services Ltd., STEP Energy Services Ltd., RPC, Inc., Cudd Energy Services |

Coiled Tubing Market Segmentation: By Service Type

-

Well Intervention

-

Drilling

-

Others

The Global Coiled Tubing Market is characterized by its diverse segments, with the highest market share and fastest-growing segment being well intervention and coiled tubing drilling, respectively. Quick speeding up is fueled by headways in innovation, making coiled tubing penetrating an appealing choice for handling operational challenges and maximizing efficiency. Well intercession administrations, including a wide extent of exercises aimed at optimizing well efficiency and effectiveness, stand as the foundation of the market, commanding a considerable share due to the never-ending requirement for good support and improvement over developed areas around the world. On the other hand, coiled tubing penetrating rises as the star entertainer in terms of development, gloating a noteworthy yearly extension rate of 10-12%. Whereas the 'Others' portion contributes to the market with specialized administrations such as nitrogen kick-off and wellbore cleanouts, it remains smaller in comparison but consistently develops due to its specialty applications. The Worldwide Coiled Tubing Showcase, hence, presents an energetic scene where advancement meets the persevering request for effective and successful arrangements within the oil and gas industry.

Coiled Tubing Market Segmentation: By Application

-

Onshore

-

Offshore

The highest market share in the global coiled tubing market is held by the onshore applications segment, capturing a substantial 60% of the total market revenue. This dominance is driven by the extensive drilling and production activities in key regions such as North America, the Middle East, and Asia-Pacific. Meanwhile, the fastest-growing aspect within this segment is Offshore. These administrations, including basic assignments like good incitement, angling, and logging, are becoming progressively vital for keeping up the efficiency of existing wells. With a yearly development rate of around 5%, the inland coiled tubing advertise proceeds to extend consistently, assembly the rising request for cost-effective and proficient arrangements in well mediation and completion. On the other hand, the seaward portion, even though somewhat smaller, holds a noteworthy share of around 40% within the showcase. This portion is balanced for fast development, especially in subsea well intercessions, driven by the heightening investigation and generation exercises in deepwater and ultra-deepwater saves. Understanding these flows is crucial for partners to explore and capitalize on the advancing scene of the coiled tubing industry.

Coiled Tubing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America Holding the highest market share and developing as the fastest-growing section, North America overwhelms the worldwide coiled tubing advertising scene. With the Joined together States driving the charge, driven by its tireless interest in flighty oil and gas assets, especially in districts just like the Permian Bowl and Bakken Arrangement, the locale exhibits unparalleled development potential. The shale insurgency has catapulted the request for coiled tubing administrations, making North America a powerhouse within the industry. In the interim, Asia-Pacific develops as a promising advertise, driven by nations like China with its fast industrialization and burgeoning vitality needs. Europe, South America, and the Center East and Africa each display special openings, from mechanical progressions in Europe to inexhaustible hydrocarbon saves in South America and the wealthy oil scenes of the Center East and Africa. Understanding these territorial elements is pivotal for partners to capitalize on the differing development prospects inside the worldwide coiled tubing advertise.

COVID-19 Impact Analysis on the Global Coiled Tubing Market:

The COVID-19 widespread cast an impressive shadow over the global coiled tubing market, introducing a period of exceptional challenges. As oil costs dove amid the emergency, the oil and gas industry, an essential buyer of coiled tubing administrations, saw a sharp decrease in investigation and generation exercises. Companies confronted the overwhelming errand of exploring venture delays and cancellations, as monetary vulnerabilities lingered expansive. Be that as it may, amid the anguish developed a silver lining - and quickened appropriation of further checking and computerized advances. Companies quickly grasped IoT arrangements and remote-operated instruments, clearing the way for enhanced efficiency and cost-effectiveness within the post-pandemic period. Amid these trials, exacting well-being and security conventions were implemented, including operational complexities and expanded costs for benefit suppliers. Presently, as the world cautiously steps into recuperation, the worldwide coiled tubing advertise stands balanced for a continuous resurgence, moved by rising oil costs and a reestablished vigor in boring and mediation exercises.

Latest Trends/ Developments:

Within the ever-evolving scene of the global coiled tubing market, a wave of innovative advancements is reshaping the industry's center. These frameworks, loaded with sensors and information analytics ability, not as it were slice downtime but boost general efficiency. As oil areas develop, the request for good incitement, acidizing, and water-powered breaking sees an uptick, driving development towards custom-made coiled tubing units with higher weight evaluations and progressed liquid conveyance frameworks. The move towards biodegradable greases, eco-friendly chemicals, and electric-powered coiled tubing units not as it were adjusts with exacting directions but too underscores a collective commitment to greener hones. In this scene of alter, advertise combination and key organizations shape the bedrock of development, cultivating comprehensive benefit portfolios and consistent operations. As the coiled tubing showcase weaves through shifted territorial elements, from North America's shale gas boom to Europe and Asia-Pacific's unconventional reservoir interests, the industry steers towards a future of flexibility, effectiveness, and maintainability, balanced to open unused wildernesses in oil and gas extraction.

Key Players:

-

Schlumberger Limited

-

Halliburton Company

-

Weatherford International plc

-

Baker Hughes (a GE Company)

-

C&J Energy Services Inc.

-

Trican Well Service Ltd.

-

Calfrac Well Services Ltd.

-

STEP Energy Services Ltd.

-

RPC, Inc.

-

Cudd Energy Services

Market News:

-

In 2023 - RPC Inc. acquired C&J Energy Services. Both companies are prominent in the oilfield services sector, including coiled tubing operations. This acquisition combined their resources and expertise in various oilfield services.

-

In 2024 - Weatherford International completed a merger with Baker Hughes, forming a new entity known as Weatherford. This merger brought together their respective capabilities in various oilfield services, including coiled tubing technologies.

Chapter 1. Coiled Tubing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Coiled Tubing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Coiled Tubing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Coiled Tubing Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Coiled Tubing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Coiled Tubing Market – By Service Type

6.1 Introduction/Key Findings

6.2 Well Intervention

6.3 Drilling

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Service Type

6.6 Absolute $ Opportunity Analysis By Service Type , 2024-2030

Chapter 7. Coiled Tubing Market – By Application

7.1 Introduction/Key Findings

7.2 Onshore

7.3 Offshore

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Coiled Tubing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Coiled Tubing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Schlumberger Limited

9.2 Halliburton Company

9.3 Weatherford International plc

9.4 Baker Hughes (a GE Company)

9.5 C&J Energy Services Inc.

9.6 Trican Well Service Ltd.

9.7 Calfrac Well Services Ltd.

9.8 STEP Energy Services Ltd.

9.9 RPC, Inc.

9.10 Cudd Energy Services

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Coiled Tubing Market was valued at USD 3.02 billion and is projected to reach a market size of USD 4.51 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

The rising request for well intercession exercises in the oil and gas industry is directing advertising elements.

Based on Applications, the Global Coiled Tubing Market is segmented into Onshore, Offshore

North America is the most dominant region for the Global Coiled Tubing Market.

Schlumberger Limited, Halliburton Company, Weatherford International plc, Baker Hughes (a GE Company), C&J Energy Services Inc., Trican Well Service Ltd., Calfrac Well Services Ltd., STEP Energy Services Ltd., RPC, Inc., Cudd Energy Services, Nine Energy Service, Inc., National Oilwell Varco, Inc., AKITA Drilling Ltd., Pioneer Energy Services Corp., Superior Energy Services, Inc., Basic Energy Services, Inc., Sanjel Energy Services, and Nabors Industries Ltd.