Coconut Coir Bubble Wrap Market Size (2025 – 2030)

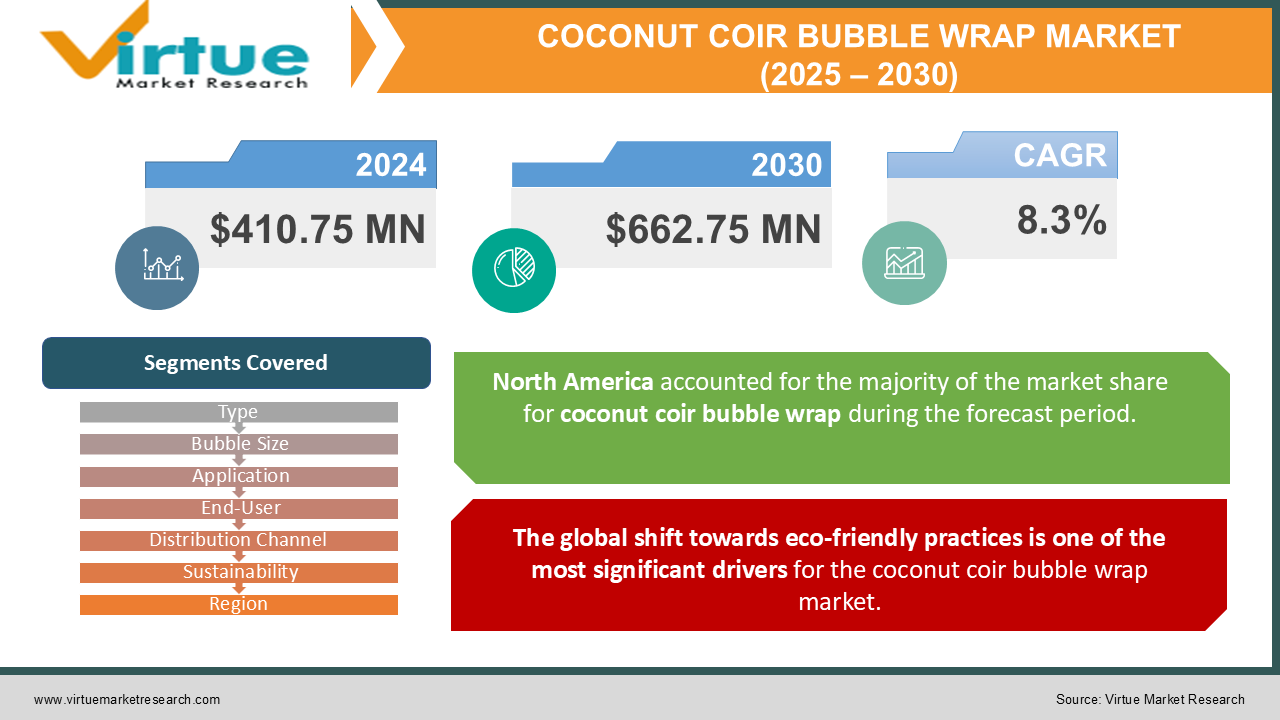

The Coconut Coir Bubble Wrap Market was valued at USD 410.75 Million in 2024 and is projected to reach a market size of USD 662.75 Million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.3%.

The coconut coir bubble wrap market is emerging as a transformative segment within the packaging industry, addressing the growing demand for sustainable and biodegradable packaging solutions. Coconut coir, a natural byproduct of coconut processing, is increasingly being used to develop innovative bubble wraps that provide excellent cushioning and protection while reducing environmental impact. This eco-friendly alternative is gaining traction across various industries such as electronics, glassware, pharmaceuticals, and automotive components, as organizations strive to align with global sustainability goals.

Key Market Insights:

In 2023, global demand for coconut coir bubble wrap reached approximately 45 million square meters.

Over 62% of the demand for coconut coir bubble wrap in 2023 came from the e-commerce sector.

Approximately 80,000 tons of coconut coir were utilized globally for bubble wrap production in 2023. Around 35% of coconut coir bubble wraps in 2023 were used for packaging electronics.

Thermal insulation applications of coconut coir bubble wrap accounted for 18% of the market share in 2023. The automotive sector contributed to 22% of the total demand for coconut coir bubble wrap in 2023. Approximately 28 million units of small bubble wraps made from coconut coir were sold in 2023.

Online retail contributed 34% of the total distribution channel market share in 2023. Specialty stores accounted for 21% of the sales in 2023.

The warehousing sector utilized 15% of coconut coir bubble wraps sold in 2023. Around 67% of the products in 2023 were classified as fully biodegradable.

Partially biodegradable bubble wraps accounted for 33% of the total production in 2023. The demand for natural coconut coir bubble wrap exceeded 70% of the total market in 2023.

Synthetic blend coir bubble wrap held a market share of 30% in 2023.

Large bubble wraps constituted 25% of the market in 2023. Medium bubble wraps held a 50% share, making it the most dominant bubble size in 2023.

Glassware and ceramics packaging made up 27% of the protective packaging applications. The horticulture sector used 19% of coconut coir bubble wraps in 2023. Seedling starters represented 11% of horticultural applications in 2023.

Market Drivers:

The global shift towards eco-friendly practices is one of the most significant drivers for the coconut coir bubble wrap market.

Governments worldwide are imposing stringent regulations to curb plastic pollution, such as bans on single-use plastics and incentives for adopting biodegradable packaging. Companies are also under pressure to reduce their carbon footprints and align with consumer expectations for environmentally responsible practices. Coconut coir bubble wrap offers a sustainable alternative, being fully biodegradable and produced from renewable resources. The demand for sustainable packaging has surged across industries, particularly in e-commerce, where companies are seeking eco-friendly options to ship goods. Major e-commerce platforms are implementing green initiatives, increasing the adoption of biodegradable materials like coconut coir bubble wrap. Additionally, sustainability certifications and eco-labels are becoming standard requirements, driving manufacturers to innovate and produce environmentally friendly packaging solutions.

The versatility of coconut coir bubble wrap extends its use across various sectors, including electronics, automotive, pharmaceuticals, and horticulture.

Its natural cushioning properties make it an excellent choice for fragile goods such as glassware and ceramics. Moreover, coconut coir bubble wrap offers thermal and acoustic insulation, making it suitable for specialized applications. The material's compatibility with seedling starters and weed control mats has made it a popular choice in horticulture, where organic and biodegradable materials are in high demand. Coconut coir's moisture-absorbing properties further enhance its utility in agricultural applications. These expanding use cases are driving its adoption in both traditional and emerging markets, positioning it as a versatile packaging solution.

Market Restraints and Challenges:

The production of coconut coir bubble wrap involves processes that are costlier than traditional plastic-based bubble wrap. Sourcing raw materials, ensuring quality, and employing advanced manufacturing techniques contribute to higher costs. While consumers and businesses are increasingly willing to pay a premium for sustainable products, cost remains a barrier, particularly in price-sensitive markets. Meeting the rising demand for coconut coir bubble wrap requires a reliable supply chain for raw materials. However, the availability of coconut coir is often dependent on the agricultural yield of coconuts, which can be affected by climatic conditions and other external factors. Additionally, the processing of coconut coir to make it suitable for bubble wrap production is labour-intensive, further limiting scalability.

Market Opportunities:

Developing advanced formulations that enhance the durability and performance of coconut coir bubble wrap could unlock new applications. For example, coatings that improve moisture resistance and thermal insulation could expand its use in sectors like food and beverage packaging and industrial insulation. Emerging economies represent significant opportunities for growth. As awareness of sustainability increases and governments introduce policies to reduce plastic waste, regions with high agricultural output, such as Southeast Asia and Latin America, could become hubs for coconut coir bubble wrap production and consumption.

COCONUT COIR BUBBLE WRAP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Product Type, Bubble Size, Application, End-User, Distribution Channel, Sustainability, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Eco Wrap Packaging, GreenShield Coir Products, Sustainable Packaging Solutions, Coir Bubble Tech, BioGuard Packaging, Natural Wrap Innovations, Coco Wrap Industries, EnviroPack Solutions, Bio Coir Materials, Earth Friendly Packaging Co. |

Coconut Coir Bubble Wrap Market Segmentation: By Product Type

-

Natural Coconut Coir Bubble Wrap

-

Synthetic Blend Coconut Coir Bubble Wrap

Natural coconut coir bubble wrap is the most widely adopted type, as it is fully biodegradable and aligns with environmental sustainability goals. Its non-toxic nature and compatibility with organic certifications make it the preferred choice across industries like horticulture and eco-conscious packaging.

Synthetic Blend Coconut Coir Bubble Wrap category is witnessing rapid growth due to its enhanced durability and improved performance, combining natural coir with synthetic additives. The blend appeals to sectors requiring robust packaging without compromising environmental benefits.

Coconut Coir Bubble Wrap Market Segmentation: By Bubble Size

-

Small Bubble Wrap

-

Medium Bubble Wrap

-

Large Bubble Wrap

Medium-sized bubbles offer a balance between cushioning and material efficiency, making them popular in e-commerce packaging and warehousing.

With increasing applications in automotive components and heavy-duty packaging, large bubble wrap is gaining traction for its superior cushioning properties.

Coconut Coir Bubble Wrap Market Segmentation: By Application

-

Protective Packaging

-

Electronics

-

Glassware and Ceramics

-

Pharmaceuticals

-

Automotive Components

-

Others

-

-

Insulation

-

Thermal Insulation

-

Acoustic Insulation

-

-

Horticulture

-

Seedling Starters

-

Weed Control Mats

-

Protective packaging for electronics leads this category, driven by the global surge in e-commerce and the need for eco-friendly solutions to ship fragile goods safely.

Horticultural uses are expanding rapidly as the agricultural sector embraces sustainable practices and biodegradable materials.

Protective packaging for electronics is the most dominant segment, while horticultural applications are witnessing the fastest growth.

Coconut Coir Bubble Wrap Market Segmentation: By End-User

-

Industrial

-

Manufacturing

-

Warehousing

-

Commercial

-

Retail

-

Offices

-

Residential

The residential sector is adopting coconut coir bubble wrap for personal packaging needs and DIY projects, reflecting rising awareness of eco-friendly options.

Industrial applications dominate due to high-volume demand from sectors like automotive and electronics manufacturing.

Coconut Coir Bubble Wrap Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributor Sales

-

Online Retail

-

Specialty Stores

-

Others

Online retail is surging as consumers and businesses increasingly opt for digital marketplaces for convenient access to sustainable packaging solutions. Specialty stores lead due to their focus on eco-conscious products and personalized customer experiences.

Coconut Coir Bubble Wrap Market Segmentation: By Sustainability

-

Fully Biodegradable

-

Partially Biodegradable

Fully biodegradable coconut coir bubble wrap is preferred for its environmental benefits and compliance with sustainability regulations.

Coconut Coir Bubble Wrap Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific is witnessing significant growth due to high agricultural activity and increased adoption of biodegradable materials. North America remains dominant due to stringent sustainability regulations and well-established industrial applications.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly influenced the coconut coir bubble wrap market, particularly in the areas of production and supply chain dynamics. Lockdowns disrupted the sourcing of raw materials and delayed manufacturing processes, leading to supply shortages. However, the surge in e-commerce and online retail during the pandemic created a heightened demand for protective packaging, driving adoption.

Latest Trends and Developments:

Innovations in coconut coir processing technology are enabling manufacturers to produce bubble wraps with enhanced properties, such as moisture resistance and biodegradability. Companies are also experimenting with blends that combine natural and synthetic materials to balance performance and sustainability. Additionally, the integration of branding and aesthetics into packaging design is emerging as a trend, enabling businesses to use coconut coir bubble wrap as a marketing tool.

Key Players in the Market:

-

Eco Wrap Packaging

-

GreenShield Coir Products

-

Sustainable Packaging Solutions

-

Coir Bubble Tech

-

BioGuard Packaging

-

Natural Wrap Innovations

-

Coco Wrap Industries

-

EnviroPack Solutions

-

Bio Coir Materials

-

Earth Friendly Packaging Co.

Chapter 1. Coconut Coir Bubble Wrap Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Coconut Coir Bubble Wrap Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Coconut Coir Bubble Wrap Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Coconut Coir Bubble Wrap Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Coconut Coir Bubble Wrap Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Coconut Coir Bubble Wrap Market – By Product Type

6.1 Introduction/Key Findings

6.2 Natural Coconut Coir Bubble Wrap

6.3 Synthetic Blend Coconut Coir Bubble Wrap

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Coconut Coir Bubble Wrap Market – By Bubble Size

7.1 Introduction/Key Findings

7.2 Small Bubble Wrap

7.3 Medium Bubble Wrap

7.4 Large Bubble Wrap

7.5 Y-O-Y Growth trend Analysis By Bubble Size

7.6 Absolute $ Opportunity Analysis By Bubble Size, 2024-2030

Chapter 8. Coconut Coir Bubble Wrap Market – By Application

8.1 Introduction/Key Findings

8.2 Protective Packaging

8.3 Electronics

8.4 Glassware and Ceramics

8.5 Pharmaceuticals

8.6 Automotive Components

8.7 Others

8.8 Insulation

8.9 Thermal Insulation

8.10 Acoustic Insulation

8.11 Horticulture

8.12 Seedling Starters

8.13 Weed Control Mats

8.14 Y-O-Y Growth trend Analysis By Application

8.15 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Coconut Coir Bubble Wrap Market – By End-User

9.1 Introduction/Key Findings

9.2 Industrial

9.3 Manufacturing

9.4 Warehousing

9.5 Commercial

9.6 Retail

9.7 Offices

9.8 Residential

9.9 Y-O-Y Growth trend Analysis End-User

9.10 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Coconut Coir Bubble Wrap Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Direct Sales

10.3 Distributor Sales

10.4 Online Retail

10.5 Specialty Stores

10.6 Others

10.7 Y-O-Y Growth trend Analysis By Distribution Channel

10.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. Coconut Coir Bubble Wrap Market – By Sustainability

11.1 Introduction/Key Findings

11.2 Fully Biodegradable

11.3 Partially Biodegradable

11.4 Y-O-Y Growth trend Analysis By Sustainability

11.5 Absolute $ Opportunity Analysis By Sustainability, 2024-2030

Chapter 12.Coconut Coir Bubble Wrap Market, By Geography – Market Size, Forecast, Trends & Insights

12.1 North America

12.1.1 By Country

12.1.1.1 U.S.A.

12.1.1.2 Canada

12.1.1.3 Mexico

12.1.2 By Product Type

12.1.2.1 By Bubble Size

12.1.3 By Application

12.1.4 By Distribution Channel

12.1.5 Countries & Segments - Market Attractiveness Analysis

12.2 Europe

12.2.1 By Country

12.2.1.1 U.K

12.2.1.2 Germany

12.2.1.3 France

12.2.1.4 Italy

12.2.1.5 Spain

12.2.1.6 Rest of Europe

12.2.2 By Product Type

12.2.3 By Bubble Size

12.2.4 By Application

12.2.5 By End-User

12.2.6 By Distribution Channel

12.2.7 Countries & Segments - Market Attractiveness Analysis

12.3 Asia Pacific

12.3.1 By Country

12.3.1.1 China

12.3.1.2 Japan

12.3.1.3 South Korea

12.3.1.4 India

12.3.1.5 Australia & New Zealand

12.3.1.6 Rest of Asia-Pacific

12.3.2 By Product Type

12.3.3 By Bubble Size

12.3.4 By Application

12.3.5 By End-User

12.3.6 By Distribution Channel

12.3.7 Countries & Segments - Market Attractiveness Analysis

12.4 South America

12.4.1 By Country

12.4.1.1 Brazil

12.4.1.2 Argentina

12.4.1.3 Colombia

12.4.1.4 Chile

12.4.1.5 Rest of South America

12.4.2 By Product Type

12.4.3 By Bubble Size

12.4.4 By Application

12.4.5 By End-User

12.4.6 By Distribution Channel

12.4.7 Countries & Segments - Market Attractiveness Analysis

12.5 Middle East & Africa

12.5.1 By Country

12.5.1.1 United Arab Emirates (UAE)

12.5.1.2 Saudi Arabia

12.5.1.3 Qatar

12.5.1.4 Israel

12.5.1.5 South Africa

12.5.1.6 Nigeria

12.5.1.7 Kenya

12.5.1.8 Egypt

12.5.1.9 Rest of MEA

12.5.2 By Product Type

12.5.3 By Bubble Size

12.5.4 By Application

12.5.5 By End-User

12.5.6 By Distribution Channel

12.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Coconut Coir Bubble Wrap Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1 Eco Wrap Packaging

13.2 GreenShield Coir Products

13.3 Sustainable Packaging Solutions

13.4 Coir Bubble Tech

13.5 BioGuard Packaging

13.6 Natural Wrap Innovations

13.7 Coco Wrap Industries

13.8 EnviroPack Solutions

13.9 Bio Coir Materials

13.10 Earth Friendly Packaging Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

One of the most significant drivers of the market is the growing awareness of environmental degradation caused by conventional plastic packaging materials. Governments, industries, and consumers are increasingly favoring biodegradable alternatives like coconut coir bubble wrap, which is made from renewable resources and decomposes naturally. This shift aligns with global sustainability goals, such as reducing carbon footprints and minimizing waste.

Coconut coir, the primary raw material for this bubble wrap, is derived from coconut husks. While coconuts are abundant in tropical regions, the supply of coir is dependent on efficient processing and availability. The uneven distribution of coconut-producing regions limits the raw material supply chain, leading to potential shortages.

Eco Wrap Packaging, GreenShield Coir Products, Sustainable Packaging Solutions, Coir Bubble Tech, BioGuard Packaging, Natural Wrap Innovations, Coco Wrap Industries.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.