Cocamidopropyl Betaine Market Size (2023-2030)

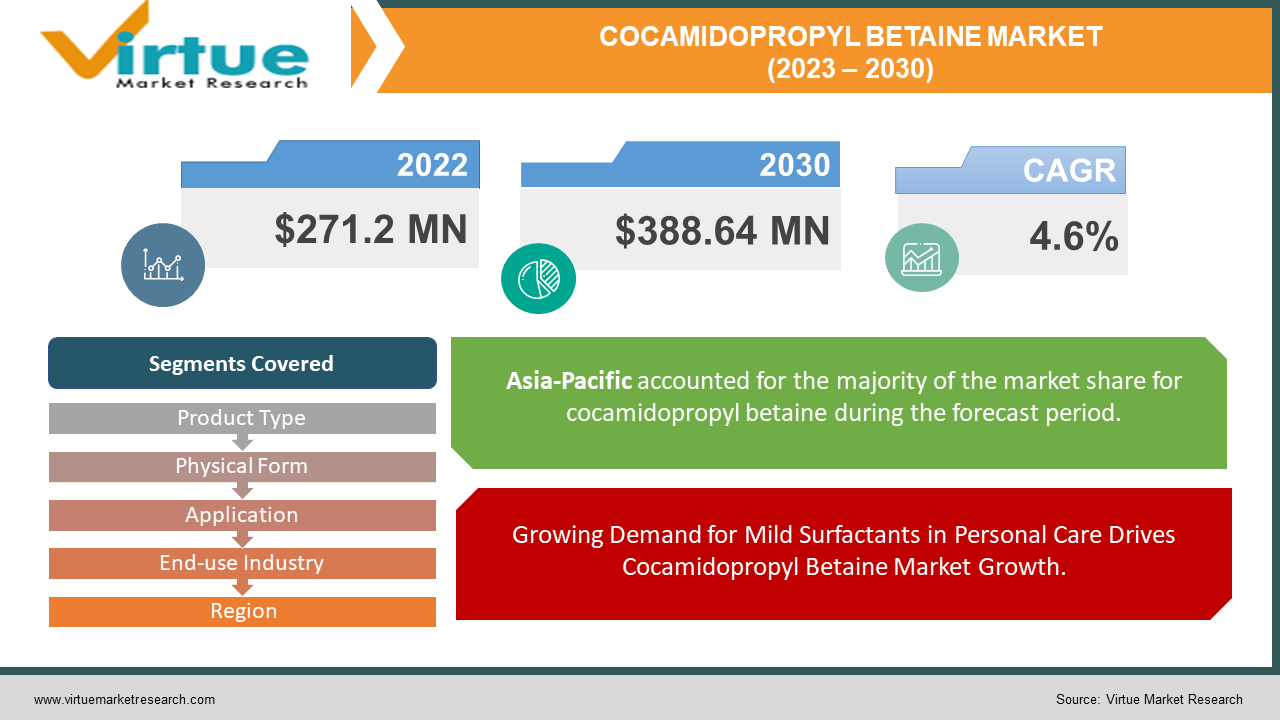

The Global Cocamidopropyl Betaine Market, valued at USD 271.2 million in 2022, is projected to reach USD 388.64 million by 2030, exhibiting a robust CAGR of 4.6% during the forecast period 2023-2030.

Cocamidopropyl betaine, recognized as a prominent surfactant, holds widespread use in personal care items due to its gentle properties and compatibility across diverse formulations. Its prevalence in this sector stems from its capacity to facilitate mild cleansing, its minimal potential for irritation, and its efficacy in generating rich lather in products such as shampoos, body washes, and liquid soaps. This has fuelled a consistent growth trajectory within the Cocamidopropyl betaine market, propelled by its reputation for providing a non-harsh cleaning experience. Beyond personal care, its versatility comes to the forefront, permeating into household cleaning goods and industrial concoctions. The adaptable nature of Cocamidopropyl betaine positions it as a sought-after solution for addressing the demand for both efficacy and gentleness in cleaning solutions. This inherent balance it offers sustains its pivotal role as a fundamental ingredient in formulating a diverse range of cleansing products that cater to evolving consumer preferences for effective and mild cleansing experiences, solidifying its position within the market.

Cocamidopropyl Betaine Market Drivers:

Growing Demand for Mild Surfactants in Personal Care Drives Cocamidopropyl Betaine Market Growth.

The trend towards milder and skin-friendly personal care products has propelled the demand for Cocamidopropyl betaine. Its excellent compatibility with sensitive skin, along with its ability to create a rich and luxurious lather, positions it as a preferred choice for formulators in the cosmetics and personal care industry. As consumers become more conscious of the ingredients in their skincare and haircare products, Cocamidopropyl betaine's gentle cleansing attributes make it a sought-after ingredient in formulations targeting various skin types and hair conditions.

Rising Eco-conscious Consumer Preferences Boost Demand for Biodegradable Surfactants.

Cocamidopropyl betaine's biodegradability and eco-friendly characteristics align well with the growing consumer preference for sustainable and environmentally responsible products. As awareness about the environmental impact of personal care and cleaning products increases, manufacturers are incorporating Cocamidopropyl betaine to meet the demand for products that have a reduced ecological footprint. This trend is likely to drive the adoption of Cocamidopropyl betaine in various applications, especially in markets that emphasize eco-friendly products.

Increasing Focus on Natural and Organic Formulations Fuels Cocamidopropyl Betaine Usage.

The shift towards natural and organic formulations in the personal care and cleaning industries has led to an increased reliance on naturally derived ingredients. Cocamidopropyl betaine, derived from coconut oil, aligns perfectly with this trend. Its natural origin, combined with its excellent foaming and cleansing properties, makes it an ideal ingredient for formulating products catering to health-conscious and environmentally aware-consumers. As the demand for natural and organic products continues to rise, Cocamidopropyl betaine is anticipated to experience sustained growth in its usage.

Cocamidopropyl Betaine Market Challenges:

Sensitization Concerns and Allergenic Potential Pose Adoption Challenges for Cocamidopropyl Betaine.

While Cocamidopropyl betaine is known for its mildness, there have been reported cases of skin sensitization and allergic reactions associated with its use. Some individuals may develop contact dermatitis or experience irritation, which can impact their perception of the ingredient. To address this challenge, manufacturers need to ensure proper formulation and concentration to minimize the potential for adverse reactions, thereby maintaining consumer confidence in the safety of products containing Cocamidopropyl betaine.

Regulatory Scrutiny and Compliance Requirements Present Challenges to New Formulations of Cocamidopropyl Betaine.

Cocamidopropyl betaine's presence in cosmetic and cleaning products subjects it to regulatory scrutiny and compliance requirements. Adhering to regulations and ensuring that formulations meet safety standards can be complex and time-consuming. Manufacturers need to stay updated on evolving regulations and ensure proper labeling and documentation for their products. Striking a balance between innovation and regulatory compliance can pose challenges, particularly for companies looking to introduce new formulations containing Cocamidopropyl betaine.

Cocamidopropyl Betaine Market Opportunities:

Innovation in Formulations Expands Cocamidopropyl Betaine Application Horizons.

The versatility of Cocamidopropyl betaine opens up opportunities for its application in various formulations beyond personal care. With continuous innovation, manufacturers can explore its usage in industries such as textiles, agriculture, and even pharmaceuticals. By harnessing its mildness, foaming properties, and biodegradability, companies can tap into new markets and create unique products tailored to specific industry needs.

Rising Demand for Natural and Organic Home Care Products Spurs Cocamidopropyl Betaine Adoption.

The trend towards natural and organic cleaning products is not limited to personal care but extends to household cleaning as well. Cocamidopropyl betaine's natural origin, combined with its effective cleaning properties, positions it as a favorable ingredient for eco-friendly home care solutions. As consumers seek alternatives to traditional cleaning products with harsh chemicals, Cocamidopropyl betaine can find significant application in this segment.

COCAMIDOPROPYL BETAINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Product Type, Physical Form, Application, End-use Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Solvay, BASF SE, Kao Corporation, Miwon, The Lubrizol Corporation |

Cocamidopropyl Betaine Market Segmentation:

Cocamidopropyl Betaine Market Segmentation – By Product Type

-

CAB-30

-

CAB-35

-

Other

Based on market segmentation by Product Type, CAB-30 has the largest market share reflecting its alignment with consumer preferences, formulation requirements, and industry trends. Its leading position highlights its suitability for diverse applications in personal care and cleaning products, suggesting that its properties are well-suited for current market demands.

However, CAB-35 is the fastest growing due to its unique performance characteristics meeting current formulation demands, alignment with consumer preferences for milder and natural ingredients, potential eco-friendliness or regulatory compliance, adaptability to industry shifts and emerging markets, potential cost-effectiveness, and specialized suitability for specific applications within personal care and cleaning sectors.

Cocamidopropyl Betaine Market Segmentation – By Physical Form

-

Liquid

-

Powder

Based on market segmentation by Physical Form, the Liquid form of Cocamidopropyl Betaine holds the largest market share due to its easy incorporation into formulations that streamline the manufacturing process and contribute to its popularity. Other benefits that augment the increased demand are - versatility in creating various products, homogeneity within formulations ensuring consistent quality, user-friendly application, consumer perception of convenience, potential earlier market introduction, alignment with current formulation trends favoring sensory appeal and eco-friendliness, and suitability for both consumer and industrial applications.

However, the Solid form holds the second largest market share due to its formulation flexibility in products where powders are suitable, potential for higher concentrations and cost-effectiveness, enhanced stability and longer shelf life, reduced water content advantageous for specific formulations, alignment with sustainable packaging trends, suitability for applications requiring controlled water content or specific textures, potential consumer preferences for reduced plastic waste or tactile experiences, and the ability to cater to niche markets or emerging trends prioritizing solid formulations.

Cocamidopropyl Betaine Market Segmentation – By Application

-

Shampoos

-

Body Wash and Shower Gels

-

Facial Cleanser

-

Liquid Soaps

-

Other

Based on market segmentation by Application, Shampoos have often been observed to have the largest demand among the provided applications in the Cocamidopropyl Betaine market segmentation. Shampoos are an essential personal care product used by a wide range of consumers regularly, contributing to consistent and substantial demand. The need for effective cleansing and hair care products drives the popularity of shampoos, making them a key application area for ingredients like Cocamidopropyl Betaine.

However, "Body Wash and Shower Gels" have often shown strong growth potential. These products are widely used for daily hygiene routines, and there has been a rising demand for convenient and effective body cleansing solutions. The trend towards more luxurious and sensory-enhancing bathing experiences has also contributed to the growth of body wash and shower gel products, potentially making them one of the fastest-growing segments for ingredients like Cocamidopropyl Betaine.

Cocamidopropyl Betaine Market Segmentation – By End-use Industry

-

Personal Care and Cosmetics

-

Home Care

-

Industrial Applications

-

Textile

-

Agriculture

-

Oilfield Chemicals

-

Others

-

Based on market segmentation by End-use Industry, Personal Care and Cosmetics have the largest market share. Cocamidopropyl Betaine is widely used in personal care products such as shampoos, body washes, facial cleansers, and liquid soaps due to its gentle cleansing properties and compatibility with formulations.

However, the Home Care category is the fastest growing. The increased focus on cleanliness, hygiene, and environmentally friendly cleaning solutions has driven demand for Cocamidopropyl Betaine in household cleaning products. As consumers seek effective and safer alternatives for cleaning their living spaces, the Home Care category has the potential to experience rapid growth.

Cocamidopropyl Betaine Market Segmentation – By Region

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

South America

Based on market segmentation by Region, North America holds a significant market share in the Cocamidopropyl Betaine industry. The region is known for its well-established personal care, cosmetics, and home care industries, where Cocamidopropyl Betaine is commonly used.

However, Asia-Pacific has seen the fastest growth due to its rapid industrialization, urbanization, and growing population, leading to increased demand for personal care and home care products. The region's emerging markets, along with changing consumer preferences and rising disposable income, have contributed to the growth of the personal care and cosmetics industry, where Cocamidopropyl Betaine finds significant use.

Recent Industry Developments:

-

In March 2023, BASF Personal Care will kick off this year’s in-cosmetics with Re_think. This concept encompasses BASF’s commitment to the personal care market with a focus on health, sustainability, and transparency to reshape and reinvent personal care for a sustainable future.

Cocamidopropyl Betaine Market Key Players:

-

Solvay

-

BASF SE

-

Kao Corporation

-

Miwon

-

The Lubrizol Corporation

Chapter 1. Cocamidopropyl Betaine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cocamidopropyl Betaine Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Cocamidopropyl Betaine Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Cocamidopropyl Betaine Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Cocamidopropyl Betaine Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cocamidopropyl Betaine Market - By Product Type

6.1 CAB-30

6.2 CAB-35

6.3 Other

Chapter 7. Cocamidopropyl Betaine Market - By Physical Form

7.1 Liquid

7.2 Powder

Chapter 8. Cocamidopropyl Betaine Market - By Application

8.1 Shampoos

8.2 Body Wash and Shower Gels

8.3 Facial Cleanser

8.4 Liquid Soaps

8.5 Other

Chapter 9. Cocamidopropyl Betaine Market - By End-use Industry

9.1 Personal Care and Cosmetics

9.2 Home Care

9.3 Industrial Applications

9.3.1 Textile

9.3.2 Agriculture

9.3.3 Oilfield Chemicals

9.3.4 Others

Chapter 10. Cocamidopropyl Betaine Market – By Region

10.1 North America

10.2 Europe

10.3 Asia-Pacific

10.4 Latin America

10.5 The Middle East

10.6 Africa

Chapter 11. Cocamidopropyl Betaine Market – Key Players

11.1 Solvay

11.2 BASF SE

11.3 Kao Corporation

11.4 Miwon

11.5 The Lubrizol Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cocamidopropyl Betaine Market, valued at USD 271.2 million in 2022, is projected to reach USD 388.64 million by 2030, exhibiting a robust CAGR of 4.6% during the forecast period 2023-2030.

The growing demand for mild surfactants in personal care, rising eco-conscious consumer preferences, and increasing focus on natural and organic formulations are the key drivers for the Cocamidopropyl Betaine Market.

Shampoos, Body Wash and Shower Gels, Facial cleansers, Liquid soap, and others are the segments under the Cocamidopropyl Betaine Market by Application.

North America dominates the Cocamidopropyl Betaine Market due to its well-established personal care, cosmetics, and home care industries.

Asia-Pacific has seen the fastest growth due to its rapid industrialization, urbanization, and growing population, leading to increased demand for personal care and home care products.