Coating Additives Market Size (2024 – 2030)

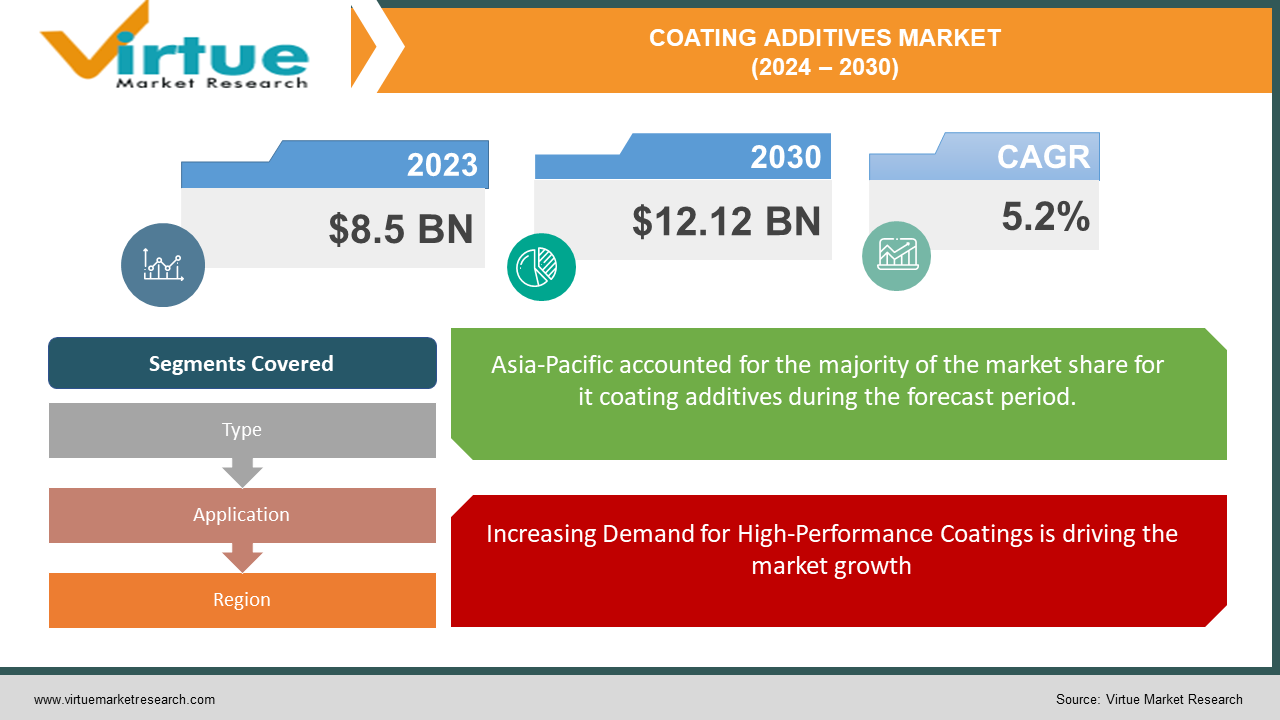

The Global Coating Additives Market was valued at USD 8.5 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The market is expected to reach USD 12.12 billion by 2030.

Coating additives are essential components in the formulation of coatings to enhance their performance, appearance, and durability. These additives are used in various industries, including automotive, construction, industrial, and marine, to improve coating properties such as dispersion, wettability, gloss, flow, and leveling.

Key Market Insights:

Technological advancements and innovations in coating formulations are boosting the adoption of advanced coating additives.

Rising environmental regulations and the need for sustainable coatings are propelling the demand for eco-friendly coating additives.

The growth of the construction and automotive industries, especially in emerging economies, fuels the market for coating additives.

The shift towards waterborne and solvent-free coatings is creating opportunities for the development of new and improved coating additives.

The increasing demand for high-performance coatings in various end-use industries is driving the growth of the coating additives market.

The Asia-Pacific region with a market share of 28.1% currently holds the dominant position in the coating additives market.

Global Coating Additives Market Drivers:

Increasing Demand for High-Performance Coatings is driving the market growth

The demand for high-performance coatings in various industries is a significant driver for the coating additives market. High-performance coatings offer superior properties such as corrosion resistance, UV protection, abrasion resistance, and chemical resistance, making them ideal for use in harsh environments and demanding applications. The automotive industry, for instance, relies heavily on high-performance coatings to protect vehicles from corrosion, enhance appearance, and improve durability. Similarly, the construction industry uses these coatings to protect buildings and infrastructure from environmental damage and extend their lifespan. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached 95.6 million units in 2023, indicating a robust demand for automotive coatings. Moreover, the increasing focus on infrastructure development and renovation projects worldwide is driving the need for high-performance coatings in the construction sector. As these industries continue to grow and seek advanced coating solutions, the demand for coating additives that enhance the performance of coatings is expected to rise significantly.

Technological Advancements and Innovations are driving market growth

Technological advancements and innovations in coating formulations are key drivers of the coating additives market. The development of new and advanced coating technologies has enabled the formulation of coatings with improved properties and functionalities. For example, nanotechnology has revolutionized the coatings industry by allowing the creation of nanocoatings with enhanced mechanical, thermal, and barrier properties. These coatings offer superior performance in terms of scratch resistance, UV protection, and antimicrobial properties, making them highly desirable in various applications. Furthermore, the introduction of smart coatings, which can respond to environmental stimuli such as temperature, light, and humidity, has opened new avenues for the coating additives market. Smart coatings find applications in self-healing, self-cleaning, and anti-corrosion coatings, among others. Additionally, advancements in polymer science and chemistry have led to the development of novel additives that improve the dispersion, flow, leveling, and adhesion properties of coatings. These innovations are driving the adoption of coating additives in diverse industries and contributing to market growth.

Rising Environmental Regulations and Sustainable Coatings are driving the market growth

The increasing stringency of environmental regulations and the growing demand for sustainable coatings are driving the coating additives market. Governments and regulatory bodies worldwide are imposing strict regulations on the use of volatile organic compounds (VOCs) and hazardous substances in coatings to reduce environmental pollution and protect human health. For example, the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation and the US Environmental Protection Agency's (EPA) regulations on VOC emissions have compelled manufacturers to adopt eco-friendly and low-VOC coating formulations. This shift towards sustainable coatings has created a demand for green additives that comply with environmental standards while maintaining or enhancing coating performance. Waterborne and solvent-free coatings, which have lower VOC content and reduced environmental impact, are gaining popularity as alternatives to conventional solvent-based coatings. Coating additives that facilitate the formulation of these environmentally friendly coatings are in high demand. For instance, dispersing agents, defoamers, and rheology modifiers that are compatible with waterborne systems are essential for achieving the desired properties in sustainable coatings. As environmental awareness and regulatory pressures continue to rise, the demand for sustainable coating additives is expected to drive market growth.

Global Coating Additives Market Challenges and Restraints:

High Costs of Advanced Coating Additives are restricting the market growth

One of the significant challenges faced by the coating additives market is the high costs associated with advanced additives. The development and production of innovative additives, such as nanomaterials, smart additives, and bio-based additives, involve substantial research and development (R&D) investments, specialized manufacturing processes, and stringent quality control measures. These factors contribute to the higher costs of advanced coating additives compared to conventional additives. For example, nanocoatings and smart coatings, which offer superior performance and functionalities, often come with a premium price tag due to the complexities involved in their formulation and production. The high costs of advanced additives can be a deterrent for small and medium-sized enterprises (SMEs) and cost-sensitive end-users, limiting their adoption. Moreover, the price volatility of raw materials used in the production of coating additives can impact the overall cost structure and profitability of manufacturers. To address this challenge, manufacturers are focusing on optimizing their production processes, developing cost-effective formulations, and exploring economies of scale to reduce costs. Additionally, educating end-users about the long-term benefits and return on investment (ROI) of advanced coating additives can help overcome the cost barrier and drive market adoption.

Technical Complexity and Compatibility Issues are restricting the market growth

The technical complexity and compatibility issues associated with coating additives pose challenges to market growth. The formulation of coatings requires a precise balance of various components, including resins, pigments, solvents, and additives, to achieve the desired properties and performance. The addition of coating additives must be carefully controlled to ensure compatibility with other components and to avoid negative interactions that could compromise the coating's quality. For instance, the incorporation of dispersing agents must be optimized to prevent pigment flocculation, while defoamers must be compatible with the coating system to avoid surface defects. Achieving the right balance and compatibility requires a deep understanding of coating chemistry and expertise in formulation science. Additionally, the performance of coating additives can be influenced by external factors such as temperature, humidity, and application methods, further adding to the technical complexity. Manufacturers must conduct extensive testing and validation to ensure the efficacy and stability of additives under various conditions. To address these challenges, collaboration between coating manufacturers and additive suppliers is essential to develop customized solutions and optimize formulations. Investing in R&D and technical support services can also help overcome compatibility issues and enhance the adoption of coating additives in the market.

Market Opportunities:

The Coating Additives Market presents numerous opportunities for growth and innovation. One significant opportunity lies in the development of multifunctional additives that offer a combination of benefits, such as improved durability, enhanced appearance, and environmental compliance. Manufacturers can leverage advancements in material science and nanotechnology to create additives with multifunctional properties, catering to the evolving needs of end-users. Additionally, the increasing focus on sustainability and green building practices presents opportunities for bio-based and eco-friendly additives. The demand for coatings with low environmental impact and reduced VOC emissions is driving the adoption of green additives that are derived from renewable sources and have minimal ecological footprint. Companies can capitalize on this trend by developing and promoting bio-based additives that meet regulatory requirements and consumer preferences for sustainable products. Furthermore, the growing trend of smart coatings and advanced surface technologies offers avenues for innovation. Additives that enable smart functionalities, such as self-cleaning, self-healing, and anti-corrosion properties, can gain traction in various industries, including automotive, aerospace, and construction. Manufacturers can explore partnerships with technology providers and research institutions to develop cutting-edge additives that enhance the performance and value of coatings. Expanding market presence in emerging economies, where rapid industrialization and urbanization are driving the demand for high-performance coatings, also presents significant growth opportunities. By focusing on product development, sustainability, and market expansion, companies can tap into the lucrative opportunities in the Coating Additives Market and achieve long-term growth.

COATING ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Inc., Evonik Industries AG, Arkema Group, Clariant AG, Ashland Global Holdings Inc., Eastman Chemical Company, Solvay S.A., BYK-Chemie GmbH, Elementis plc |

Coating Additives Market Segmentation - by Type

-

Dispersing Agents

-

Wetting Agents

-

Defoamers

-

Rheology Modifiers

-

Biocides

-

Others

In the world of coating additives, dispersing agents reign supreme. These workhorses ensure a smooth, even distribution of pigments and fillers throughout the coating. Their importance lies in preventing these particles from clumping together, which would lead to uneven color, poor hiding power, and application difficulties. Dispersing agents achieve this by attaching themselves to pigment particles, creating a repulsive force that keeps them separated. This translates to a stable, well-dispersed coating with optimal performance characteristics.

Coating Additives Market Segmentation by Application

-

Architectural Coatings

-

Automotive Coatings

-

Industrial Coatings

-

Wood & Furniture Coatings

-

Marine Coatings

-

Others

Architectural Coatings holds the strongest market dominance. This segment encompasses paints and coatings used for buildings and other structures. The vast number of residential and commercial construction projects, along with ongoing maintenance and renovation needs, fuels the demand for architectural coatings. Additionally, the focus on aesthetics, durability, and weather resistance in buildings translates to a constant need for high-performance architectural paints. This segment thrives on the growth of the construction industry and consumer spending on home improvement projects.

Coating Additives Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region currently holds the dominant position in the coating additives market. This dominance is driven by several factors. Firstly, the booming construction sector in this region, fueled by rapid urbanization and rising disposable income, translates to a significant demand for paints, coatings, and consequently, the additives that enhance them. Secondly, the flourishing automotive and furniture industries in this part of the world further contribute to the market growth. Finally, with a growing focus on eco-friendly solutions, the increasing adoption of waterborne coatings, which require specific additives for optimal performance, is another factor propelling the Asia-Pacific region's dominance in the coating additives market.

COVID-19 Impact Analysis on the Coating Additives Market:

The COVID-19 pandemic had a significant impact on the Coating Additives Market, causing disruptions and challenges across the value chain. The construction, automotive, and industrial sectors, which are major consumers of coating additives, experienced slowdowns and project delays due to lockdown measures, supply chain disruptions, and economic uncertainties. The temporary shutdown of manufacturing facilities and restrictions on workforce mobility led to reduced production and delayed project timelines. However, the pandemic also highlighted the importance of hygiene and safety, driving the demand for antimicrobial and self-cleaning coatings in healthcare, public spaces, and transportation. The shift towards remote work and increased focus on home improvement projects further boosted the demand for architectural coatings and related additives. As the global economy gradually recovers, the Coating Additives Market is expected to rebound, driven by the resumption of construction activities, increased automotive production, and ongoing investments in infrastructure development. Additionally, the pandemic underscored the need for resilient and sustainable coatings, creating opportunities for innovative and eco-friendly additives that address emerging consumer and regulatory demands.

Latest Trends/Developments:

The Coating Additives Market is witnessing several notable trends and developments that are shaping its growth and evolution. One significant trend is the increasing adoption of nanotechnology in coating formulations. Nanomaterials, such as nanoparticles and nanocomposites, are being incorporated into coatings to enhance their properties, including mechanical strength, UV resistance, scratch resistance, and antimicrobial activity. These nanocoatings find applications in various industries, including automotive, aerospace, healthcare, and electronics. Another trend is the growing focus on sustainability and green coatings. Manufacturers are developing bio-based and waterborne additives that reduce VOC emissions and environmental impact. The demand for eco-friendly coatings is driving innovations in green chemistry and the development of renewable additives derived from natural sources. Additionally, the trend towards smart coatings is gaining momentum, with additives enabling self-healing, self-cleaning, and anti-corrosion functionalities. These smart coatings offer enhanced performance and durability, making them suitable for critical applications in the aerospace, marine, and infrastructure sectors. Furthermore, advancements in digital technologies and data analytics are transforming the coatings industry. The integration of IoT, artificial intelligence, and machine learning in coating processes is improving efficiency, quality control, and predictive maintenance. Manufacturers are leveraging data-driven insights to optimize formulations, reduce waste, and enhance product performance. These trends and developments are expected to drive the growth and innovation in the Coating Additives Market, creating new opportunities for manufacturers and end-users.

Key Players:

-

BASF SE

-

Dow Inc.

-

Evonik Industries AG

-

Arkema Group

-

Clariant AG

-

Ashland Global Holdings Inc.

-

Eastman Chemical Company

-

Solvay S.A.

-

BYK-Chemie GmbH

-

Elementis plc

Chapter 1. Coating Additives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Coating Additives Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Coating Additives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Coating Additives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Coating Additives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Coating Additives Market – By Type

6.1 Introduction/Key Findings

6.2 Dispersing Agents

6.3 Wetting Agents

6.4 Defoamers

6.5 Rheology Modifiers

6.6 Biocides

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Coating Additives Market – By Application

7.1 Introduction/Key Findings

7.2 Architectural Coatings

7.3 Automotive Coatings

7.4 Industrial Coatings

7.5 Wood & Furniture Coatings

7.6 Marine Coatings

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Coating Additives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Coating Additives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Dow Inc.

9.3 Evonik Industries AG

9.4 Arkema Group

9.5 Clariant AG

9.6 Ashland Global Holdings Inc.

9.7 Eastman Chemical Company

9.8 Solvay S.A.

9.9 BYK-Chemie GmbH

9.10 Elementis plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Coating Additives Market was valued at USD 8.5 billion in 2023 and is projected to reach USD 12.12 billion by 2030, growing at a CAGR of 5.2% from 2024 to 2030.

Key drivers include increasing demand for high-performance coatings, technological advancements and innovations, rising environmental regulations, and the need for sustainable coatings.

The market is segmented by type (dispersing agents, wetting agents, defoamers, rheology modifiers, biocides, others) and application (architectural coatings, automotive coatings, industrial coatings, wood & furniture coatings, marine coatings, and others).

Asia-Pacific is the most dominant region, attributed to rapid industrialization, urbanization, and significant investments in the construction and automotive sectors, particularly in China and India.

The leading players include BASF SE, Dow Inc., Evonik Industries AG, Arkema Group, Clariant AG, Ashland Global Holdings Inc., Eastman Chemical Company, Solvay S.A., BYK-Chemie GmbH, and Elementis plc.