Coated Fabrics Market Size (2024 – 2030)

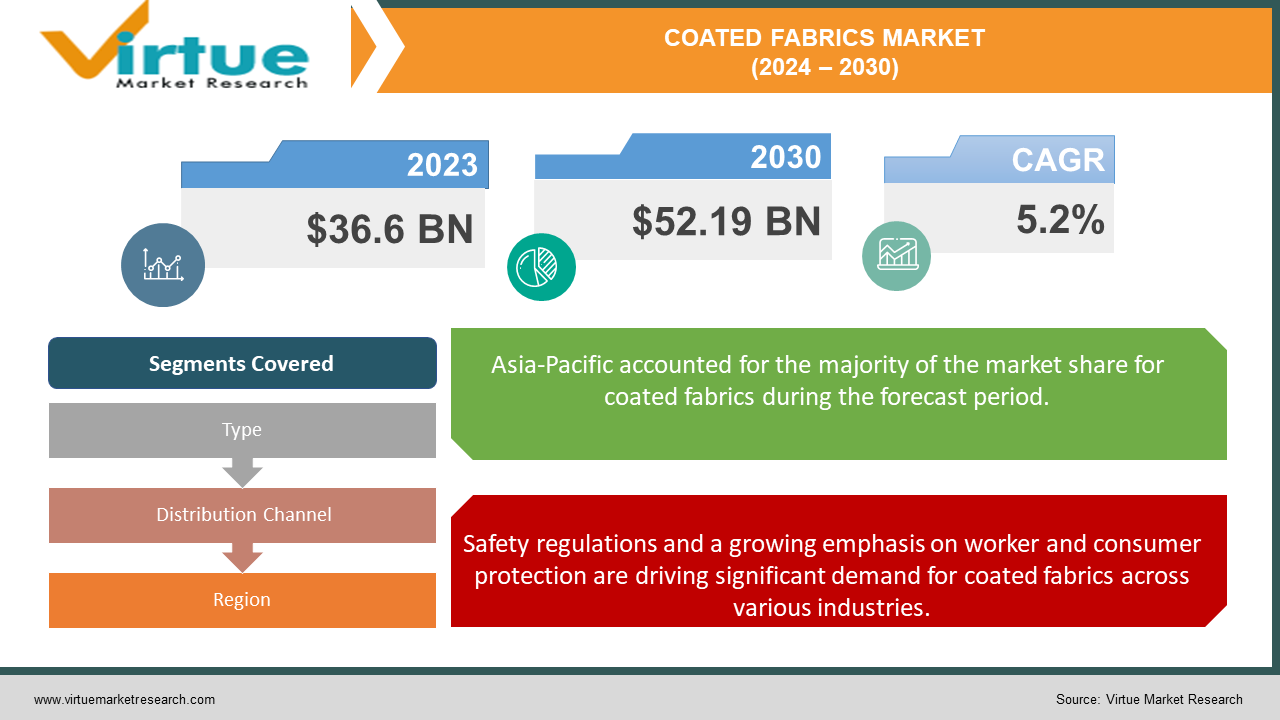

The Global Coated Fabrics Market was valued at USD 36.6 Billion in 2023 and is projected to reach a market size of USD 52.19 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

The coated fabrics market is a dynamic and diverse landscape, encompassing a wide range of textiles imbued with special properties through the application of coatings. These coatings transform base fabrics, often made from materials like nylon, polyester, or cotton, into functional materials with a vast array of applications. The automotive industry relies heavily on coated fabrics for car seats, dashboards, and interior components. These fabrics offer properties like durability, water resistance, and flame retardancy, ensuring passenger safety and comfort. Similarly, the aerospace industry uses coated fabrics for lightweight and high-strength applications in aircraft interiors. Coated fabrics are not limited to industrial applications. They are used in a variety of consumer products, including tents, backpacks, sporting goods, and inflatable structures. These fabrics offer weatherproofing, lightweight portability, and varying degrees of flexibility depending on the application.

Key Market Insights:

Because polymer-coated fabrics are so versatile and reasonably priced, they hold a dominant market share of over 65%.

With 22% of the market share, the automotive sector is the biggest user of coated fabrics, using them for dashboards, automobile seats, and other interior components.

The fastest-growing market is bio-based PU-coated fabrics, with a predicted CAGR of more than 8%. Environmental concerns and customer desire for sustainable products are the main drivers of this rise.

40% of the industry is made up of direct sales, where suppliers sell directly to big-ticket customers like furniture manufacturers and construction firms.

Because they are more convenient and available to a larger spectrum of consumers, e-commerce platforms are growing quickly and currently have 15% of the market share.

By 2025, it is anticipated that the building sector will require coated fabrics at a cost of USD 6.5 billion.

Aerospace applications for coated fabrics, such as lightweight and high-strength materials used in aircraft interiors, are expected to reach a market value of USD 1.8 billion by 2028.

Coated Fabrics Market Drivers:

Safety regulations and a growing emphasis on worker and consumer protection are driving significant demand for coated fabrics across various industries.

Stringent regulations in the automotive and aerospace industries mandate the use of fire-retardant, water-resistant, and high-durability coated fabrics for components such as airbags, seatbelts, aircraft interiors, and inflatable safety structures. These fabrics ensure passenger and crew safety in the event of accidents or emergencies. The construction, mining, and manufacturing sectors rely heavily on coated fabrics for protective gear like workwear, gloves, and boots. These fabrics are often coated with materials offering flame resistance, chemical resistance, and puncture protection, safeguarding workers from on-the-job hazards.

Sustainability is no longer a niche concern; it is a core driver influencing consumer behavior and industry practices. Coated fabric manufacturers are increasingly focusing on eco-friendly solutions to cater to this growing demand.

The development of bio-based coatings derived from renewable resources such as plant oils is a significant step towards sustainability. This reduces dependence on petroleum-based materials and minimizes the environmental footprint of production processes. Traditional coating processes often rely on solvents that can be harmful to the environment. Developing solvent-free coating technologies or utilizing water-based alternatives minimizes environmental impact and improves worker safety by reducing exposure to harmful VOCs. Developing and implementing sustainable solutions often comes at a higher initial cost. Striking the right balance between affordability and environmental responsibility is crucial for widespread adoption.

Coated Fabrics Market Restraints and Challenges:

Volatile organic compounds (VOCs) are generated during the evaporation of solvents in traditional coating techniques. In addition to endangering human health, these VOCs aggravate air pollution. Manufacturers must invest in cleaner technology and solvent-free alternatives as a result of strict restrictions being put in place to limit VOC emissions. Waste produced during production, such as unused coating ingredients and fabric remnants, must be disposed of properly. Waste disposal restrictions are tightening, and landfills are seeing a growing amount of overcrowding. Creating environmentally friendly waste management techniques is essential. Making trade-offs between performance and traditional alternatives may be necessary in the development of bio-based coatings or coatings with enhanced recyclability. For sustainable solutions to perform on par with current options, further study is required.

Coated Fabrics Market Opportunities:

Coatings that can repair minor tears or scratches would be highly desirable for applications like outdoor gear, inflatable structures, and automotive interiors. Integration of sensors and electronics into coated fabrics can create smart textiles with functionalities such as temperature regulation, energy harvesting, or health monitoring. This could have applications in wearable technology, medical textiles and even construction materials. Coatings with built-in antimicrobial properties can offer enhanced hygiene and protection against bacteria and viruses. This is particularly relevant for applications in healthcare, hospitality, and public transportation. Online platforms can offer interactive tools that allow customers to specify desired functionalities, colors, and finishes to create customized coated fabric solutions. Advanced-coated fabrics with lightweight, high-strength properties can be used in aircraft interiors and other aerospace applications.

COATED FABRICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Saint-Gobain (France), Serge Ferrari Group (France), Freudenberg Group (Germany), Continental AG (Germany), Trelleborg AB (Sweden), OMNOVA Solutions Inc.(United States), ContiTech AG (Germany), Graniteville (United States), Perstorp Specialty Chemicals AB (Sweden), Geo Specialty Chemicals, NC. (United States) |

Coated Fabrics Market Segmentation: By Type

-

Polymer-Coated Fabrics

-

Vinyl-Coated Fabrics

-

PU-Coated Fabrics

-

PE-Coated Fabrics

-

Rubber-Coated Fabrics

-

Fabric-Backed Wallcoverings

With a substantial 45% share, the polymer-coated fabrics (45%) sector dominates the coated fabrics market. Polymer coatings have many functions, which makes them appropriate for a wide range of uses. Polymer coatings are applicable in a multitude of industries due to their ability to be created with a wide range of qualities. This covers upholstery and airbags for automobiles, tarpaulins and roofing membranes for construction, upholstery and outdoor furnishings for furniture, and a variety of industrial uses (filtering fabrics, conveyor belts).

With a predicted CAGR of almost 7%, the PU-coated fabrics segment of the coated fabrics market is anticipated to grow at the quickest rate. A special mix of qualities, including flexibility, abrasion resistance, breathability, and weatherproofing, is provided by PU coatings. Because of this, they are perfect for a variety of demanding applications, such as medical textiles, sporting goods, shoes, and car interiors. The creation and use of bio-based PU coatings are being propelled by the increased focus on sustainability. Because these coatings are made from renewable resources like plant oils, there is less reliance on materials sourced from petroleum and the manufacturing process has less of an environmental impact.

Coated Fabrics Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

E-commerce platforms

-

Retail Stores

Direct sales hold the largest share of the coated fabrics market distribution landscape. Large-scale users of coated fabrics, like automotive or furniture manufacturers, often require customized solutions and negotiate bulk pricing directly with producers. Direct sales allow for close collaboration and ensure that specific application requirements are met. Direct interaction with manufacturers enables buyers to access technical expertise and product support. This ensures the selection of the most suitable coated fabric for their needs and facilitates troubleshooting or problem-solving.

E-commerce platforms are the fastest-growing distribution channel in the coated fabrics market, with a projected CAGR exceeding 8%. E-commerce platforms can cater to niche applications and offer some degree of customization through options like custom cuts or pre-configured kits. This caters to a growing segment of crafters, small businesses, and hobbyists. Many online platforms provide detailed product information, including specifications, technical data sheets, and user reviews. This transparency empowers buyers to make informed decisions about their coated fabric purchases.

Coated Fabrics Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

Asia-Pacific (50%) region reigns supreme in the coated fabrics market, holding a significant 50% share. The burgeoning economies of China, India, and Southeast Asian nations are experiencing rapid industrialization. This translates into a surge in demand for coated fabrics across various applications, including automotive components, furniture upholstery, and construction materials. The expanding middle class in the Asia Pacific region signs a rising consumer base with a growing disposable income. This fuels the demand for consumer goods like furniture, clothing, and sporting equipment many of which utilize coated fabrics.

The coated fabrics market in South America is expected to grow at the quickest rate, with a CAGR estimated at about 8%, notwithstanding Asia Pacific's existing dominance. In South America, people are becoming more conscious of environmental issues. This gives producers of environmentally friendly coated fabrics with sustainable production methods or created from recycled materials a chance to establish themselves in the area. Governments in several South American countries are investing more in renewable energy initiatives. The need for coated fabrics for solar panels, wind turbine blades, and other renewable energy infrastructure may result from this.

COVID-19 Impact Analysis on the Coated Fabrics Market:

Worldwide lockdowns resulted in the temporary closure of production facilities and interruptions to the supply chain. This halted the manufacturing of coated textiles and limited access to raw materials. The necessity for coated fabrics in the transportation and automotive sectors has decreased because the healthcare industry has taken center stage due to these industries' sluggish production. The pandemic demonstrated just how crucial personal protective equipment (PPE) is for halting the virus's spread. Coated materials have played a major role in making medical gowns, face masks, and other protective gear for important individuals and healthcare professionals. Specific types of coated textiles with properties like breathability, flame retardancy, and water repellency led to a brief industry boom. The heightened awareness of hygiene standards during the pandemic led to an increased demand for coated fabrics used in wipes, disinfectant dispensers, and other sanitation solutions. This presented a growth opportunity for manufacturers specializing in coated fabrics with antimicrobial properties. The pandemic forced manufacturers to adapt and innovate. Some companies repurposed existing production lines to create much-needed PPE, while others focused on developing new coated fabrics with antiviral or self-cleaning properties. This adaptability showcased the potential of the coated fabrics industry to respond to unforeseen challenges.

Latest Trends/ Developments:

Bio-based coatings made from plant oils and starches, which are renewable resources, are becoming increasingly popular. These green substitutes utilize less fossil fuel and emit fewer greenhouse gases while performing similarly to conventional petroleum-based coatings. Conventional coating techniques frequently use dangerous chemicals that worsen air pollution. Advances in solvent-free and water-based coating technologies provide a safer substitute that has less of an adverse effect on the environment. The integration of sensors and electronics into coated fabrics paves the way for the creation of smart textiles. These fabrics can have functionalities like temperature regulation, energy harvesting, or even health monitoring, opening doors for innovative applications in wearable technology, medical textiles, and even smart building materials. Nanotechnology offers exciting possibilities for coated fabrics. Nanocoatings can impart properties like superior water repellency, self-cleaning abilities, and improved abrasion resistance, enhancing the performance and durability of coated fabrics across various applications.

Key Players:

-

Saint-Gobain (France)

-

Serge Ferrari Group (France)

-

Freudenberg Group (Germany)

-

Continental AG (Germany)

-

Trelleborg AB (Sweden)

-

OMNOVA Solutions Inc.(United States)

-

ContiTech AG (Germany)

-

Graniteville (United States)

-

Perstorp Specialty Chemicals AB (Sweden)

-

Geo Specialty Chemicals, NC. (United States)

Chapter 1. Coated Fabrics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Coated Fabrics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Coated Fabrics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Coated Fabrics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Coated Fabrics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Coated Fabrics Market – By Type

6.1 Introduction/Key Findings

6.2 Polymer-Coated Fabrics

6.3 Vinyl-Coated Fabrics

6.4 PU-Coated Fabrics

6.5 PE-Coated Fabrics

6.6 Rubber-Coated Fabrics

6.7 Fabric-Backed Wallcoverings

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Coated Fabrics Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 E-commerce platforms

7.5 Retail Stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Coated Fabrics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Coated Fabrics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Saint-Gobain (France)

9.2 Serge Ferrari Group (France)

9.3 Freudenberg Group (Germany)

9.4 Continental AG (Germany)

9.5 Trelleborg AB (Sweden)

9.6 OMNOVA Solutions Inc.(United States)

9.7 ContiTech AG (Germany)

9.8 Graniteville (United States)

9.9 Perstorp Specialty Chemicals AB (Sweden)

9.10 Geo Specialty Chemicals, NC. (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Regulations in transport, construction, and healthcare industries mandate the use of coated fabrics with specific functionalities such as fire resistance, chemical resistance, and puncture protection, ensuring worker and consumer safety.

Reconciling the higher initial costs of sustainable solutions with affordability for both manufacturers and consumers remains a challenge. Finding this equilibrium is crucial for the widespread adoption of eco-friendly practices.

Saint-Gobain (France), Serge Ferrari Group (France), Freudenberg Group (Germany), Continental AG (Germany), Trelleborg AB (Sweden), OMNOVA Solutions Inc. (United States), ContiTech AG (Germany), Graniteville (United States), Perstorp Specialty Chemicals AB (Sweden), Geo Specialty Chemicals Inc. (United States).

Asia-Pacific emerged as the most dominant player in the market, commanding an impressive 50% share.

The coated fabrics market in South America is expected to grow at the quickest rate, with a CAGR estimated at 8%, notwithstanding Asia Pacific's existing dominance.