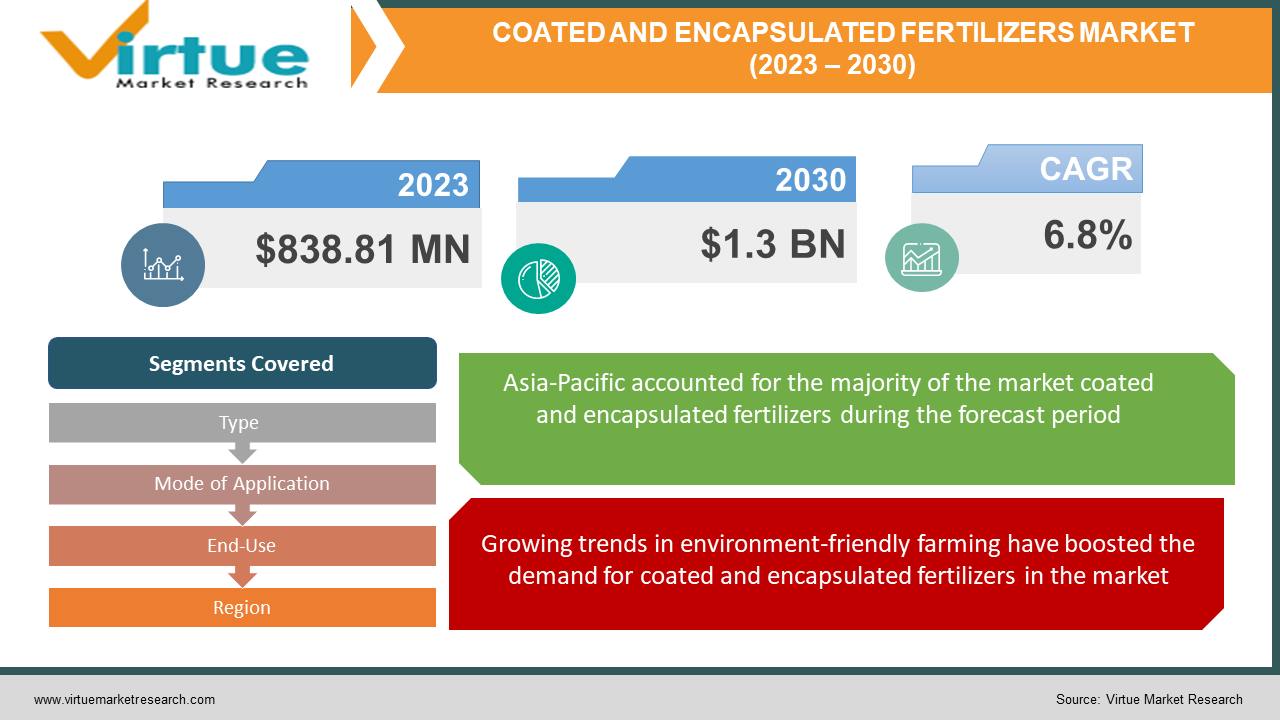

Coated and Encapsulated Fertilizers Market Size (2023 – 2030)

The Global Coated and Encapsulated Fertilizers Market was valued at USD 838.81million and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.8%.

Earlier fertilizers involved harsh chemicalized formulations that aimed to increase crop yield at a faster rate but with increased environmental impact. Moreover, it led to nutrient wastage in groundwater and surface water bodies. However, with rapid technological advancements in agriculture and coating technology, advanced coated and encapsulated fertilizers gained momentum in the market. The growth is attributed to enhanced crop yield and improved nutritional efficiency in plants, which further raised consumer demand for fresh, quality, and natural food products in the market. Moreover, coated and encapsulated fertilizers reduced the risk of nutrient wastage, as it emphasizes on gradual and slow release of nutrients to plants over a longer period, which was a major disadvantage of traditional fertilizers. Furthermore, the future holds positive for the coated and encapsulated fertilizers market with growing trends in smart farming, that allow integration with mobile apps, smart devices, or sensors for monitoring real-time crop growth.

Key Market Insights:

A study conducted by the US National Science Foundation found that nutrient pollution is threatening 40% of the contiguous US.

Neem Coating in India for fertilizers showed a 100% efficiency rate in crop growth. (Ministry of Information and Broadcasting)

As per FAO estimates, globally, between 691 million and 783 million people were hungry in the year 2022.

Coated and Encapsulated Fertilizers Market Drivers:

Growing trends in environment-friendly farming have boosted the demand for coated and encapsulated fertilizers in the market.

With increased awareness among farmers and consumers regarding the ill effects of intensive farming practices, there is an increased demand for eco-friendly farming methods that help minimize the negative impact of agricultural waste on the environment. With the help of coated and encapsulated fertilizers, farmers can control agricultural runoff such as chemical runoff, nitrogen runoff into the soil, eutrophication of plants in water bodies, and others. Moreover, coated and encapsulated fertilizers ensure precise release of nutrients to crops, that minimize the risk of leaching, wherein excess nutrients wipe away with water and contaminate water bodies. Additionally, it helps in reducing GHG (greenhouse gas emissions), which are caused due to ill-treated chemical release from farmlands in groundwater. Furthermore, with these fertilizers, plants get natural nutrients, as coated and encapsulated fertilizers depend on the activity of microorganisms inside the soil. For instance, sulfur-coated fertilizers depend on microbial activity for optimal plant growth.

The increase in global food demand has boosted the demand for coated and encapsulated fertilizers in the market.

Rapidly growing population, especially in developing countries is amongst the key factors in fueling the demand for coated and encapsulated fertilizers in the market, as these fertilizers help in increasing the efficiency and productivity of crops. Moreover, in areas with large-scale farm settings, where diverse crops are cultivated and water is scarce, these fertilizers help in the controlled release of nutrients to crops through methods such as fertigation. Conversely, areas with limited arable land benefit from these fertilizers, as they enable farmers to maximize food production on the same piece of land by enhancing the nutritional efficiency of crops. In addition, growing consumer demand for natural and organic food products, particularly naturally grown vegetables and exotic fruits, is further boosting the demand for coated and encapsulated fertilizers in the market.

Coated and Encapsulated Fertilizers Market Restraints and Challenges:

Expensive costs to farmers can reduce the demand for coated and encapsulated fertilizers in the market. Coated and encapsulated fertilizers are produced using advanced materials and intensive technological processes, which increases the production costs of companies leading to increased final prices to consumers.

Furthermore, excessive use of these fertilizers can pose similar environmental concerns to traditional fertilizers, leading to soil degradation and stunted plant growth. This can decrease the demand for coated and encapsulated fertilizers in the market.

Moreover, a lack of knowledge and proper training for farmers regarding the usage and effects of coated and encapsulated fertilizers can result in reduced yield of crops. This further can affect the market demand for coated and encapsulated fertilizers.

Coated and Encapsulated Fertilizers Market Opportunities:

The Coated and Encapsulated Fertilizers Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing trends in sustainable agricultural practices due to increased consumer demand for natural and quality food products are predicted to develop the market for coated and encapsulated fertilizers and enhance its future growth opportunities.

COATED AND ENCAPSULATED FERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Type, Mode of Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Helena Agri Enterprise, Koch Industries, Nutrien Ltd, Yara, Mosaic, DOW, ICL Group, Sollio Agriculture, Compo Export |

Coated and Encapsulated Fertilizers Market Segmentation: By Type

-

Nitrogen Stabilizers

-

Slow-Release

In 2022, based on market segmentation by type, slow release occupied the highest share of about 29% in the market. Slow-released fertilizers are widely used in agriculture for the controlled release of nutrients to crops over a longer period. Further, the major advantage of slow-release fertilizers is that they minimize the wastage of resources, provide enhanced nutrient content to crops, and ensure increased productivity.

Nitrogen stabilizers are the fastest-growing segment during the forecast period. Nitrogen stabilizers are added to the fertilizers to slow the conversion of ammonium nitrogen to nitrate nitrogen, that is, to reduce nitrogen loss and its effect on the environment; and increase its efficiency for crop growth. Moreover, it is usually utilized for corn production in North America, where the soil is highly reactive to the atmosphere.

Coated and Encapsulated Fertilizers Market Segmentation: By Mode of Application

-

Foliar

-

Soil

-

Fertigation

-

Others

In 2022, based on market segmentation by mode of application, the soil segment occupied the highest share of about 32% in the market. Coated and encapsulated fertilizers are widely used in soil, where nutrients directly reach the plant roots and increase their productivity. One of the most common applications of incorporating fertilizers is pre-planting, wherein fertilizers are added into the soil before the growth of the plant, which allows increased absorption of nutrients once the crop starts growing. Another application method is done for seasonal varieties of crops, wherein coated and encapsulated fertilizer is added into the soil for the changing nutrient requirement of crops.

Fertigation is the fastest-growing segment during the forecast period. Fertigation involves applying fertilizers to crops through irrigation. That is, coated and encapsulated fertilizers are mixed with water for the gradual and controlled release of fertilizers to crops. Moreover, fertilizing through this method ensures precise and efficient delivery of nutrients to crops, reduces manual labor, reduces wastage, and minimization of agricultural waste. Furthermore, China and India are the major countries that rely on fertigation for crop growth.

Coated and Encapsulated Fertilizers Market Segmentation: By End-Use

-

Non-Agricultural

-

Agricultural

In 2022, based on market segmentation by end-use, agriculture occupied the highest share of about 63% in the market. Agricultural settings such as large-scale farms, small-scale farms, commercial agriculture spaces, and others utilize coated and encapsulated fertilizers for enhanced crop growth. These fertilizers provide a controlled release of nutrients to plants, improve the efficiency of fertilizers, reduce labor costs, and offer customization to farmers, wherein they can formulate the fertilizers as per the need of crops or for specialized crops that require extra precision such as cotton, sugarcane, oilseeds, maize, and others.

Non-agricultural is the fastest-growing segment during the forecast period. Non-agricultural applications of coated and encapsulated fertilizers involve the use of fertilizers for home gardening, horticulture, turf management, and others. Home gardeners increasingly use coated and encapsulated fertilizers for growing flowerbed and potted plants, as this helps in improving the nutrient efficiency of plants. Additionally, slow-release fertilizers are popularly used for outdoor containers and houseplant care. Moreover, horticulturists use it for landscaping purposes, where precise release of fertilizers is essential for the optimal growth of ornamental plants.

Coated and Encapsulated Fertilizers Market Segmentation: Regional Analysis:

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2022, Asia-Pacific occupied the highest share of about 42% in the market. The abundance of natural fauna, increased agricultural practices in countries such as India and China, and increased support of the government in the form of grants, subsidies, program launches, and others have contributed to the demand for coated and encapsulated fertilizers in the region.

North America is the fastest-growing region during the forecast period. Growing trends in sustainable agriculture and home gardening, along with technologically advanced farming practices have contributed to the demand for coated and encapsulated fertilizers in the region.

COVID-19 Impact Analysis on the Coated and Encapsulated Fertilizers Market:

The pandemic hurt the coated and encapsulated fertilizers market. Due to the lockdown across nations, the transfer of agricultural items witnessed a delay, which led to a decline in the production and manufacturing process of fertilizers. Furthermore, restrictions in the movement led to a labor shortage in the agricultural sector, declining the demand for coated and encapsulated fertilizers in the market. In addition to that, the shift in the government budget towards the healthcare sector reduced the market growth of agricultural items such as fertilizers. Furthermore, consumer demand for organic and naturally sourced food increased as a result of increased health awareness during the pandemic, which further raised the demand for organic farming methods involving the use of organic fertilizers, leading to a reduction in demand for coated and encapsulated fertilizers in the market.

Latest Developments:

The market for coated and encapsulated fertilizers is witnessing significant growth in the market due to trends in sustainable and precision agriculture. Moreover, technological advancements in coating technology such as polymer coating technology, microbial coating technology, biodegradable coating technology, and others are shaping the market landscape for these fertilizers and helping to achieve increased crop yield without nutrient loss. For example, ICL, a leading global company dealing with specialty minerals launched a biodegradable coated fertilizer technology in September 2022, in Tel Aviv, Israel. The launch aimed to maximize crop yield and performance. Moreover, it aimed to provide a controlled release of nutrients to crops with reduced nitrogen applications.

- In September 2023, Sollio Agriculture opened a fertilizer coating plant (CRF Agritech) in St. Thomas, Ontario. The aim is to manufacture controlled-release fertilizer for farmers across Eastern Canada and Northeastern US. Moreover, the plant will manufacture more than 100,000 tonnes of fertilizers annually.

Key Players:

-

Helena Agri Enterprise

-

Koch Industries

-

Nutrien Ltd

-

Yara

-

Mosaic

-

DOW

-

ICL Group

-

Sollio Agriculture

-

Compo Export

Chapter 1. Coated and Encapsulated Fertilizers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Coated and Encapsulated Fertilizers Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Coated and Encapsulated Fertilizers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Coated and Encapsulated Fertilizers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Coated and Encapsulated Fertilizers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Coated and Encapsulated Fertilizers Market – By Type

6.1 Introduction/Key Findings

6.2 Nitrogen Stabilizers

6.3 Slow-Release

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Coated and Encapsulated Fertilizers Market – By Mode of Application

7.1 Introduction/Key Findings

7.2 Foliar

7.3 Soil

7.4 Fertigation

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Mode of Application

7.7 Absolute $ Opportunity Analysis By Mode of Application, 2023-2030

Chapter 8. Coated and Encapsulated Fertilizers Market – By End User

8.1 Introduction/Key Findings

8.2 Non-Agricultural

8.3 Agricultural

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User, 2023-2030

Chapter 9. Coated and Encapsulated Fertilizers Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Mode of Application

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Mode of Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Mode of Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Mode of Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Mode of Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Coated and Encapsulated Fertilizers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Helena Agri Enterprise

10.2 Koch Industries

10.3 Nutrien Ltd

10.4 Yara

10.5 Mosaic

10.6 DOW

10.7 ICL Group

10.8 Sollio Agriculture

10.9 Compo Export

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Coated and Encapsulated Fertilizers Market was valued at USD 785.4 million and is projected to reach a market size of USD 1.3 billion by the end of 2030.

Growing trends in environment-friendly farming and an increase in global food demand are the market drivers of the Coated and Encapsulated Fertilizers market.

Foliar, Soil, Fertigation, and Others, are the segments under the Coated and Encapsulated Fertilizers Market by mode of application.

AnAsia-Pacific is the most dominant region for the Coated and Encapsulated Fertilizers Market.

North America is the fastest-growing region in the Coated and Encapsulated Fertilizers Market.