Cloud-Native Payment Platform Market Size (2024 - 2030)

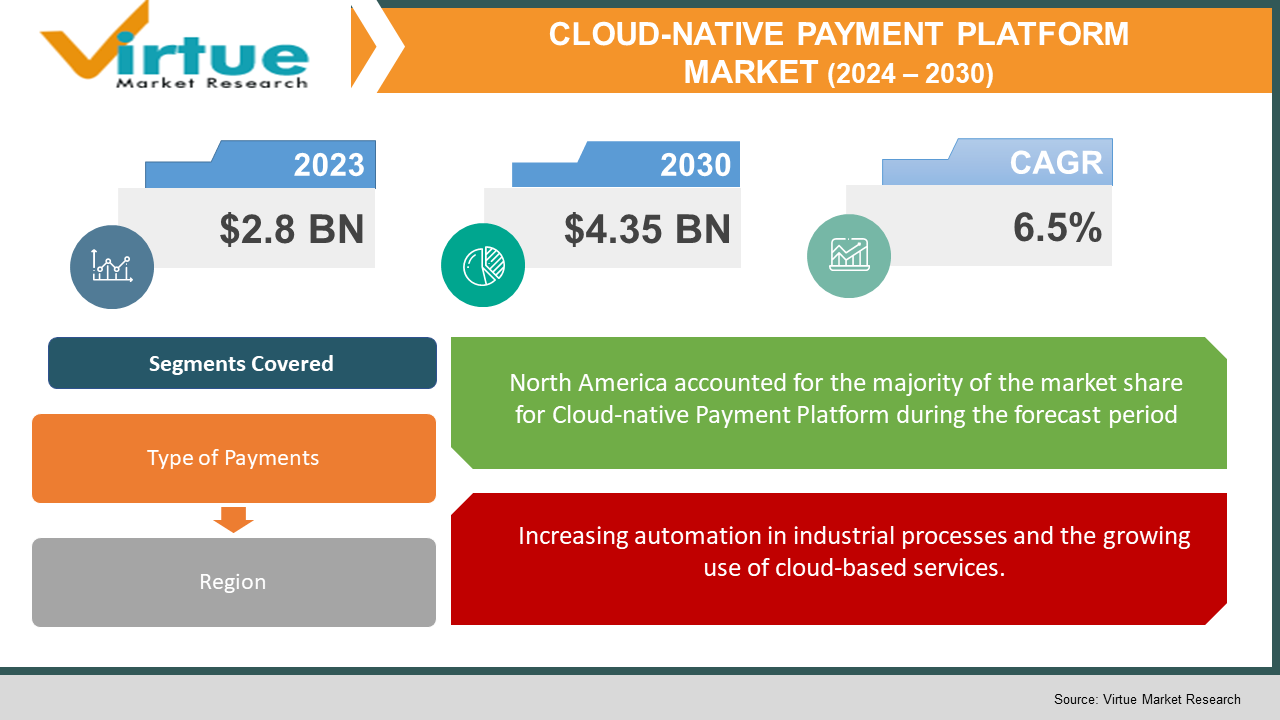

The global Cloud-native Payment Platform Market size is estimated to grow from USD 2.8 Billion in 2023 to USD 4.35 Billion by 2030. The market is witnessing a healthy CAGR of 6.5% from 2024 to 2030.

A contemporary system that leverages cutting-edge technology to manage real-time processing, ACH transactions, and direct debits via a single interface is known as a cloud-native payment platform. It is intended to be more cost-effective and scalable than conventional systems, with quicker updates and lower expenses. Because these platforms are constructed with contemporary architecture and tools, banks can provide a wide range of payment options in a timely and safe manner. In the upcoming years, it's anticipated that their increased popularity will stem from their ability to lower operating costs and improve data security. Several advantages such as lower infrastructure, maintenance, data safety, etc. provided by cloud payment platforms are the major factors driving the industry's growth.

Key Market Insights:

The market for cloud-native platforms offers services that make it simple for companies to develop, implement, and oversee apps in distributed, adaptable cloud environments. These solutions are provided by numerous businesses in response to the increasing demand for dependable, scalable, and adaptable application development and delivery techniques. As more businesses adopt cloud-native architectures, the global market for cloud-native platforms is expanding swiftly. These solutions are becoming more and more well-liked because of their affordability, scalability, and flexibility. Adopting a product-oriented operating model and defining new roles are necessary when switching to cloud-native platforms. The growing acceptance of low-code and no-code technologies, which streamline application development and make it easier and more effective, is another factor driving market expansion. This illustrates how cloud-native methods are becoming more and more significant in the evolving fields of application development and IT infrastructure.

Global Cloud-native Payment Platform Market Drivers:

The market is expanding due to several benefits offered by cloud-native payment platforms, including reduced infrastructure, maintenance, data security, etc.

Cloud-native payment solutions are made for the current payment era. They have advantages like faster updates, easier setup, less expensive infrastructure, flexibility to manage different workloads, and global scalability. Compared to conventional on-site storage, data kept in the cloud is frequently more secure. Private, public, and hybrid cloud solutions also enable financial institutions to select the location of their data storage by their requirements and legal obligations, which helps them reduce risk.

Increasing automation in industrial processes and the growing use of cloud-based services.

The market for cloud-native platforms is expanding as a result of an increase in cloud service usage among developers. They can quickly access a wide variety of tools and resources required for their projects thanks to these services. Because it enables businesses to operate more quickly and securely, cloud-native software is becoming more and more popular. Cloud-native platforms facilitate easier innovation generation and help businesses adjust to technological advancements. The fact that cloud-native software facilitates automation—the process of having computers perform tasks automatically in place of humans—is a major factor in the software's rise. Automation is becoming a critical component of business operations, particularly in the areas of cloud data security and seamless operations. Digitalization—the process by which things become more digital—is also driving up demand for cloud-native software. More devices in businesses are connected to the Internet, necessitating the use of software that can manage all the data and procedures involved. This implies that there are numerous chances for businesses that create cloud-native platforms to expand and provide fresh approaches to satisfy the demands of companies operating in this digital environment.

Cloud-native Payment Platform Market Challenges and Restraints:

Because they are concerned about the risks involved, including data leaks, hacking, and vulnerabilities in digital wallets, many customers are reluctant to switch to virtual payments. Furthermore, the advantages of virtual payments over cash or debit cards for online purchases—especially for pricey items—are not sufficiently emphasized. For the duration of the forecast, these factors will restrain market expansion.

Cloud-native Payment Platform Market Opportunities:

The rising popularity of microservices architecture presents an exciting opportunity in the market for cloud-native platforms. This approach to software development divides large applications into smaller, separate components. It greatly simplifies software development, scaling, and maintenance—just like when you build with Lego blocks. Companies are beginning to realize the advantages of utilizing microservices, such as increased flexibility and quicker development times. This trend indicates a significant opportunity for cloud-native platform providers to provide microservices-compatible solutions. This could make them stand out from the competition and draw in more clients who use the same methodology to develop software. Going forward, the market for cloud-native platforms will likely present more opportunities. One is edge computing, which involves processing data at the site of creation rather than transmitting it all to large data centers. There will be a great demand for cloud-native platforms that are compatible with edge computing. Developers can concentrate on writing code instead of worrying about overseeing the underlying technology thanks to serverless computing, which offers another opportunity. There could be significant growth in serverless computing platforms. Furthermore, cloud-native platforms will have the opportunity to employ artificial intelligence and machine learning to a greater extent as technology advances. These could be useful for improving decision-making and automating tasks. Ultimately, eco-friendly cloud-native platforms have the potential to become extremely popular due to the growing interest in environmentally friendly technology. This could entail reducing energy consumption or figuring out how to operate more sustainably.

CLOUD-NATIVE PAYMENT PLATFORM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type of Payments, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Apple, PayPal, Samsung, JP Morgan Chase, Amazon, Tencent, Google, Ant Financial, One97 Communications Limited, Vodafone |

Global Cloud-native Payment Platform Market - By Type of Payments

-

Remote Payments

-

Proximity Payments

In the market for cloud-native payment platforms, Proximity Payments are the most widely used of the two payment methods. This is because contactless payments are becoming the preferred option due to their increased popularity and safety features. However, it is anticipated that in the upcoming years, Remote Payments will expand at the fastest rate. This is a result of the growing trend of online shopping and the use of digital payment methods, which are made simple and safe by cloud-native payment platforms.

Global Cloud-native Payment Platform Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With more than 34.0% of the total revenue in 2023, North America dominated the global market. This was mostly brought about by technological advancements and the growing usage of smart parking meters. In Vancouver, for instance, a partnership introduced contactless parking payments. Demand for digital payment solutions is also being driven by the growth of unmanned stores in the United States. European banks are developing a single payment system for businesses and customers alike. It is anticipated that this initiative will open up new avenues for market expansion. Furthermore, the use of digital payments is increasing in Italy as a result of the country's digital payment campaign, which is accelerating regional market growth.

COVID-19 Impact on the Global Cloud-native Payment Platform Market:

The new virus that causes COVID-19 is contagious. After being discovered for the first time in China in December 2019, it rapidly spread around the world, sparking a pandemic. Global healthcare systems are under a great deal of strain as a result of the pandemic. Numerous businesses have stepped up their efforts to create vaccines and remedies for the virus. The pandemic has also altered consumer behavior in terms of shopping, with an increase in the number of people purchasing online rather than in physical stores. Online sales and the usage of online payment methods have significantly increased as a result of this. To prevent touching surfaces and spreading the virus, a lot of people and businesses have started making payments using mobile wallets rather than cash or credit cards. As a result, a growing number of people are utilizing mobile wallets for their regular purchases, making them extremely popular.

Latest Trend/Development:

Cloud-native platforms from CARTO are used in a variety of sectors, including communications and retail. It is based on cloud computing, which eliminates the need for conventional IT infrastructure and facilitates connectivity and scaling. Users can make decisions by analyzing spatial data with the help of CARTO's platform, including satellite imagery and climate datasets. It gives databases and data warehouses spatial capabilities through the use of a toolkit for spatial analytics, enabling users to carry out operations like geocoding, analyzing spatial data, and map-making. IBM introduced IBM Cloud for Education Applications Lab, a new service for educational establishments. It facilitates their easier utilization of IBM Cloud resources and services. With this bundle, educational institutions can use IBM Cloud services in a unified manner. Google Cloud and SAP SE extended their collaboration to assist companies in moving their vital systems to the cloud. Through this partnership, companies can also leverage the machine learning (ML) and artificial intelligence (AI) capabilities of Google Cloud to enhance their systems. Orange unveiled Wizitivi's Streamava cloud gaming platform in France. With Orange's 5G expansion, users can play over 300 games on their mobile devices without downloading them thanks to this gaming app.

Key Players:

-

Apple

-

PayPal

-

Samsung

-

JP Morgan Chase

-

Amazon

-

Tencent

-

Google

-

Ant Financial

-

One97 Communications Limited

-

Vodafone

Market News:

-

The Sisal Group and Wirecard decided to collaborate on contactless payment solutions for SisalPay in March 2022.

-

A new platform for banks and financial institutions called eMACH.ai was introduced by Intellect Design Arena on March 14, 2023. It assists them in developing cutting-edge technological solutions by utilizing Amazon Web Services (AWS) and artificial intelligence. Financial institutions may more easily innovate and create new solutions thanks to the platform's abundance of pre-built tools and features that are accessible in the cloud.

-

NVIDIA unveiled the NVIDIA Spectrum-X in May 2023 as a platform designed to boost AI clouds' effectiveness and performance. It combines the NVIDIA BlueField-3 DPU with the NVIDIA Spectrum-4 Ethernet switch to accelerate and reduce the power consumption of AI applications. NVIDIA offers tools and software that developers can use to create AI apps that run in the cloud.

Chapter 1. CLOUD-NATIVE PAYMENT PLATFORM MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. CLOUD-NATIVE PAYMENT PLATFORM MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. CLOUD-NATIVE PAYMENT PLATFORM MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. CLOUD-NATIVE PAYMENT PLATFORM MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. CLOUD-NATIVE PAYMENT PLATFORM MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. CLOUD-NATIVE PAYMENT PLATFORM MARKET – By Type of Payments

6.1 Introduction/Key Findings

6.2 Remote Payments

6.3 Proximity Payments

6.4 Y-O-Y Growth trend Analysis By Type of Payments

6.5 Absolute $ Opportunity Analysis By Type of Payments, 2024 - 2030

Chapter 7. CLOUD-NATIVE PAYMENT PLATFORM MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type of Payments

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type of Payments

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type of Payments

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type of Payments

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type of Payments

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. CLOUD-NATIVE PAYMENT PLATFORM MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Apple

8.2 PayPal

8.3 Samsung

8.4 JP Morgan Chase

8.5 Amazon

8.6 Tencent

8.7 Google

8.8 Ant Financial

8.9 One97 Communications Limited

8.10 Vodafone

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cloud-native Payment Platform Market was estimated at USD 2.8 Billion in 2023 and is estimated to have a value of USD 4.35 Billion by 2030, growing at a fast CAGR of 6.5 % during the forecast period 2024-2030

The Global Cloud-native Payment Platform Market driver has several advantages such as lower infrastructure, maintenance, data safety, etc provided by the cloud-native payment platform.

The US is the most dominating country in the North American region in the Global Cloud-native Payment Platform Market.

Apple, PayPal, and Samsung are the leading players in the Global Cloud-native Payment Platform Market.

The advantages of virtual payments over cash or debit cards for online purchases—especially for pricey items—are not sufficiently emphasized. For the duration of the forecast, these factors will restrain market expansion.