Cloud Native Application Protection Platform (CNAPP) Market Size (2024 – 2030)

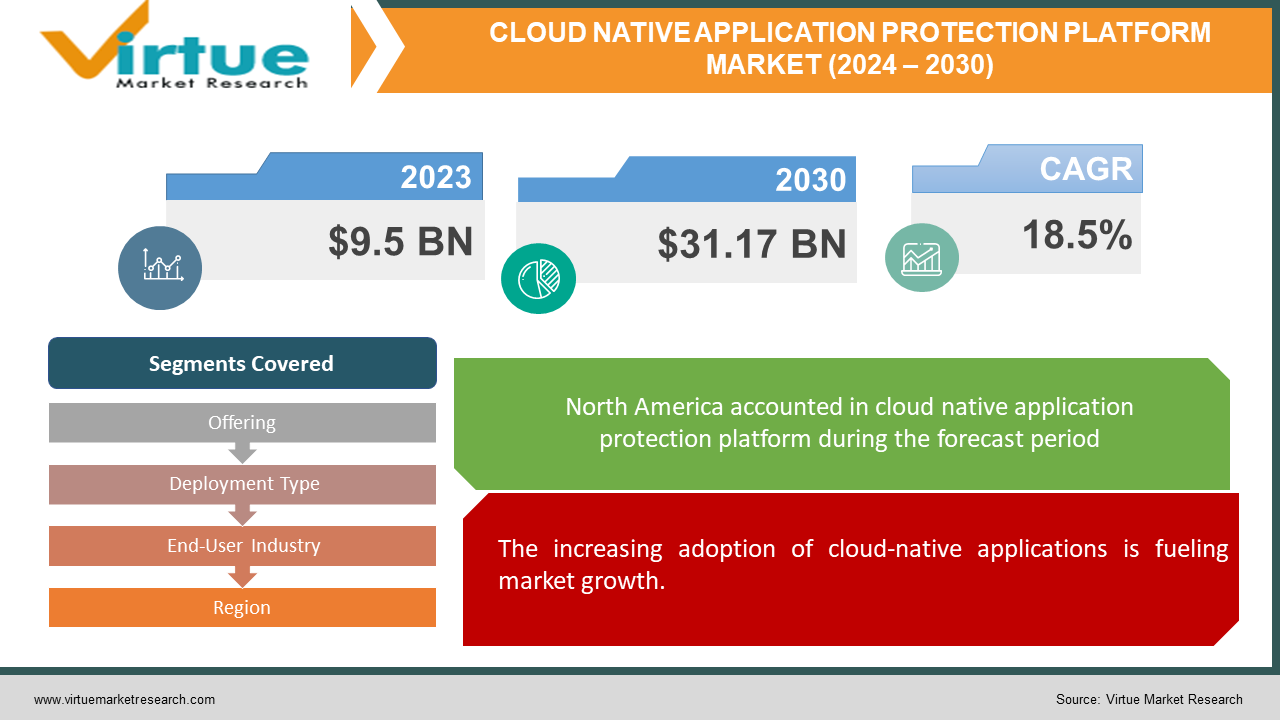

The global cloud-native application protection platform (CNAPP) market was valued at USD 9.5 billion in 2023 and is projected to reach a market size of USD 31.17 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 18.5%.

Cloud Native Application Protection Platform (CNAPP) is a solution designed to protect cloud-native applications from various threats. At its core, CNAPP seamlessly integrates with cloud infrastructure to provide a powerful layer of protection against cyber-attacks and vulnerabilities. CNAPP ensures timely and effective threat mitigation through the use of advanced technologies such as machine learning, behavioral analysis, and automation. The platform is designed to address the unique challenges presented by cloud environments that cannot be met with traditional security measures. CNAPP includes many security features, including identity and access control, access, volume security, and time protection. Additionally, CNAPP is designed to be fast and dynamic, allowing it to adapt to the advantages of cloud-based applications. With CNAPP, organizations can safely enjoy the benefits of cloud computing without compromising security and ensure their applications are protected against evolving cyber threats.

Key Market Insights:

The need for DevSecOps integration, rising cybersecurity concerns, and the growing usage of cloud-native applications are propelling the market's expansion. By providing security solutions designed specifically for cloud-native environments, CNAPP tackles these issues.Market expansion is hampered by the complexity of cloud-native settings, difficulties with compliance and regulations, and a lack of standardization. For their solutions to be deployed and adopted effectively, CNAPP suppliers must overcome these issues.There are opportunities to address multi-cloud and hybrid cloud strategies, promote DevSecOps and shift-left security practices, leverage zero-trust security principles, integrate security into DevOps pipelines, and provide comprehensive security solutions for rapid development and deployment.Because of its widespread use of superior cloud computing and technical advancements, North America has the biggest market share. The fastest-growing market, however, is in the Asia-Pacific area, driven by increased expenditures in technology infrastructure and activities aimed at bringing about the digital revolution in several industries.

Cloud Native Application Protection Platform (CNAPP) Market Drivers:

The increasing adoption of cloud-native applications is fueling market growth.

Cloud-native applications are designed to be scalable, flexible, and usable in cloud environments. With the rise of cloud computing, there has been an increase in cloud-based usage by organizations in many sectors. These applications are built using microservice architecture and containerization (like Docker) and are managed by platforms like Kubernetes. As more companies move their applications to the cloud, strong defenses against cyber threats become important. This creates a need for a cloud-native application protection platform (CNAPP) that can protect today's applications without compromising their speed and capacity.

Growing concerns about application security are accelerating market growth.

Cybersecurity threats continue to evolve, becoming smarter and more focused. Traditional security measures are often inadequate to protect against today's cyberattacks. Therefore, organizations are increasingly concerned about the security of applications and data in the cloud environment. CNAPP offers security solutions that provide features such as runtime protection, container security, API security, and negative management based on the specific needs of cloud applications. Increasing awareness of cyber threats and the need for secure application security led to the introduction of CNAPP.

Demand for DevSecOps integration is boosting the market.

DevOps practices, which emphasize collaboration between development and project teams to streamline the software delivery process, are widely used in the IT industry. However, integrating security into DevOps workflows (called DevSecOps) remains a challenge for many organizations. CNAPP addresses this challenge by providing security solutions that integrate into DevOps pipelines, enabling security audits, vulnerability assessments, and compliance checks throughout the software development lifecycle. The need for DevSecOps integration is driving the adoption of CNAPP as organizations seek to improve development processes while maintaining their security responsibilities.

Cloud Native Application Protection Platform (CNAPP) Market Restraints and Challenges:

The complexity of cloud-native environments restrains market growth.

Cloud-native environments are inherently complex, including distributed microservices, containers, serverless architectures, and dynamic orchestration platforms such as Kubernetes. This complexity poses a significant challenge for security teams tasked with protecting these environments. Traditional security tools often fall short of effectively dealing with cloud-native applications, resulting in gaps in security protection and the risk of cyber threats. CNAPPs must contend with the intricacies of cloud-native environments, requiring sophisticated capabilities for visibility, threat detection, and policy enforcement across the entire application stack.

Compliance and regulatory challenges are a concern.

Meeting regulatory requirements is a major challenge for organizations operating in the cloud. Regulations such as GDPR, HIPAA, PCI DSS, and others impose stringent data protection and privacy standards that must be adhered to, regardless of the deployment model. CNAPP should provide features that control compliance, such as access to information, access control, information analysis, and threats. However, ensuring compliance in dynamic, ephemeral cloud-native environments can be complex and resource-intensive, particularly for organizations operating in highly regulated industries such as finance, healthcare, and government.

Lack of standardization and interoperability hinders market growth.

The cloud-native landscape is characterized by a proliferation of tools, frameworks, and technologies, each with its standards and protocols. Lack of standardization and interoperability makes it difficult to integrate security solutions into cloud-based environments. CNAPP vendors face the challenge of maintaining compatibility with multiple platforms and technologies, which can disrupt deployment and management. Additionally, the absence of industry-wide standards for cloud-native security makes it difficult for organizations to evaluate and compare CNAPP products.

Cloud Native Application Protection Platform (CNAPP) Market Opportunities:

There are many opportunities for growth and innovation in the global Cloud Native Application Protection Platform (CNAPP) market. First, the growing need for security solutions that can keep up with rapid development and deployment presents a huge opportunity. CNAPP is available by providing a comprehensive platform that integrates with DevOps toolchains, a robust utility, a secure container, and compliance management.

Second, the emergence of the zero-trust security paradigm provides a positive approach. CNAPP can adapt solutions that follow Zero Trust principles to increase the security of cloud-based applications through measures such as minimal usage and regular recognition.

Additionally, as organizations increasingly adopt multi-cloud and hybrid cloud strategies, CNAPP will benefit from providing consistent security solutions across different cloud systems, ensuring uniform protection and enforcement. Finally, the growing importance of DevSecOps and shift-left security provides CNAPP with an opportunity to promote security integration throughout software development. CNAPP helps improve security and accelerate application delivery through the early detection and remediation of vulnerabilities.

CLOUD NATIVE APPLICATION PROTECTION PLATFORM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.5% |

|

Segments Covered |

By Offering, Deployment Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fortinet Inc. , Cequence Security Inc. Zscaler Inc., Sophos Ltd., Palo Alto Networks, Aqua Security Software Ltd. , Check Point Software Technologies Ltd. , Radware Ltd. , CrowdStrike, Trend Micro Incorporated |

Cloud Native Application Protection Platform (CNAPP) Market Segmentation - by Offering

-

Platform

-

Professional Services

The platform is the largest and fastest-growing segment. Platform offerings include a variety of security features specifically tailored to the needs of cloud environments. These platforms provide solutions to secure product suites, secure APIs, implement security controls, manage data encryption, and ensure compliance with regulatory standards. Platform offerings may also include development and security (DevSecOps) capabilities, Kubernetes native security capabilities, and support for multi-cloud deployments.

Cloud Native Application Protection Platform (CNAPP) Market Segmentation - by Deployment Type

-

Public

-

Private

-

Hybrid

Across all sectors, the hybrid model has been the most widely used implementation technique, making it the largest and fastest-growing deployment mode. To maximize the benefits and enhance company operations, resource consumption, cost efficiency, user experience, and application modernization, many companies are placing an increasing emphasis on developing hybrid cloud models and creative solutions.

Cloud Native Application Protection Platform (CNAPP) Market Segmentation by End-User Industry

-

Banking, Financial Services, and Insurance (BFSI)

-

Healthcare

-

Retail

-

IT and Telecommunications

-

Others

BFSI is the largest growing end-user and is anticipated to witness a CAGR of 21.50%. Organizations in the BFSI sector need security solutions to protect sensitive financial information and business processes from cloud applications. CNAPP BFSI solutions will include capabilities such as threat detection, intrusion detection, compliance management, and API gateway security. The BFSI industry is a prime target for cyber-attacks due to the potential for financial gain and disruption. CNAPP's solutions play an important role in reducing the risks posed by changing cyber threats, ensuring business continuity, and preventing financial losses. The healthcare industry is the fastest-growing segment. Personal health information (PHI), medical histories, and patient records are just a few of the extremely sensitive and regulated data that healthcare companies handle. Healthcare organizations and providers prioritize protecting this data from breaches, unauthorized access, and noncompliance. The healthcare sector has been adopting digital transformation programs more and more to boost productivity, optimize operations, and improve patient care. To implement scalable and cutting-edge solutions for telemedicine, electronic health records (EHR), medical imaging, and other areas, healthcare businesses need to use cloud-native apps.

Cloud Native Application Protection Platform (CNAPP) Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest market share, with over 35% of the of the market. The North American region, including the United States and Canada, is a significant market for CNAPP solutions due to its advanced cloud adoption, technological innovation, and stringent regulatory environment. North American CNAPP service providers serve a variety of industries, including finance, healthcare, technology, and government, offering solutions tailored to each industry's unique security requirements and standards implementation. Asia-Pacific is the fastest-growing market. A significant digital revolution is occurring throughout the Asia-Pacific region in several areas, including manufacturing, telecommunications, healthcare, retail, and finance. APAC businesses are using cloud-native technologies more frequently to update their IT infrastructure, increase flexibility, and boost competitiveness. The Asia-Pacific region's nations, including Australia, South Korea, Singapore, China, India, and Singapore, are seeing strong economic expansion and rising expenditures on technological infrastructure.

COVID-19 Impact Analysis on the Global Cloud Native Application Protection Platform (CNAPP) Market:

The COVID-19 pandemic has had a significant impact on the global cloud-native application protection platform (CNAPP) market and reshaped the landscape of cybersecurity and cloud-native technologies. With the sudden shift to remote working and increased reliance on digital services, organizations are accelerating their adoption of cloud-native solutions and increasing the need for CNAPP solutions to protect these spaces. The pandemic has highlighted the importance of taking effective security measures to protect sensitive data and ensure business continuity against cyber-attacks. Additionally, the proliferation has sparked digital transformation initiatives across industries, leading to increased investments in cloud-native technology and security solutions. However, the economic uncertainty caused by the pandemic is also affecting the budgets of some organizations, hindering their ability to invest in CNAPP projects. Overall, the COVID-19 pandemic has created challenges and opportunities for CNAPP businesses while underscoring the important role of climate change in ensuring strong and secure digital businesses in a post-globalization world.

Latest Trends/ Developments:

The global Cloud Native Application Protection Platform (CNAPP) market has witnessed several trends and innovations that have improved its trajectory. One of the notable trends is the increasing adoption of zero-trust security principles in cloud-based environments. Organizations are shifting from a traditional perimeter-based security model to a zero-trust approach that assumes users, devices, and networks are untrusted and require constant verification and tight control.

Additionally, there is a growing trend to integrate security into DevOps pipelines (known as DevSecOps). This trend underscores the importance of shifting security "left" into the software development lifecycle, enabling organizations to identify and remediate vulnerabilities early in the development process. Additionally, with the rise of serverless computing and microservices architectures, CNAPP solutions continue to improve visibility, protection, and compliance across these dynamic and distributed application domains. These trends reflect the industry's focus on innovation and adaptation to address the evolving cybersecurity challenges of cloud-native applications.

Key Players:

-

Fortinet Inc.

-

Cequence Security Inc.

-

Zscaler Inc.

-

Sophos Ltd.

-

Palo Alto Networks

-

Aqua Security Software Ltd.

-

Check Point Software Technologies Ltd.

-

Radware Ltd.

-

CrowdStrike

-

Trend Micro Incorporated

-

In September 2022, Zscaler announced the acquisition of ShiftRight, a leader in closed-loop security workflow automation. ShiftRight’s workflow automation technology is integrated into the Zscaler Zero Trust Exchange cloud security platform to automate security management for the growing influx of risks and incidents.

-

In March 2022, Radware announced that it was expanding its partnership with Presidio, a global digital services and solutions provider that accelerates business transformation through security technology modernization. To protect its customers in on-premises, cloud, or hybrid environments, Presidio is adding Radware's application and API security solutions, bot manager, DDoS protection, and Cloud Native Protector to its cybersecurity suite.

Chapter 1. Cloud Native Application Protection Platform (CNAPP) Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cloud Native Application Protection Platform (CNAPP) Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cloud Native Application Protection Platform (CNAPP) Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cloud Native Application Protection Platform (CNAPP) MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cloud Native Application Protection Platform (CNAPP) Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cloud Native Application Protection Platform (CNAPP) Market– By Offering

6.1 Introduction/Key Findings

6.2 Platform

6.3 Professional Services

6.4 Y-O-Y Growth trend Analysis By Offering

6.5 Absolute $ Opportunity Analysis By Offering, 2024-2030

Chapter 7. Cloud Native Application Protection Platform (CNAPP) Market– By Deployment Type

7.1 Introduction/Key Findings

7.2 Public

7.3 Private

7.4 Hybrid

7.5 Y-O-Y Growth trend Analysis By Deployment Type

7.6 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 8. Cloud Native Application Protection Platform (CNAPP) Market– By End-User

8.1 Introduction/Key Findings

8.2 Banking, Financial Services, and Insurance (BFSI)

8.3 Healthcare

8.4 Retail

8.5 IT and Telecommunications

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Cloud Native Application Protection Platform (CNAPP) Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Offering

9.1.3 By Deployment Type

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Offering

9.2.3 By Deployment Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Offering

9.3.3 By Deployment Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Offering

9.4.3 By Deployment Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Offering

9.5.3 By Deployment Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cloud Native Application Protection Platform (CNAPP) Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Fortinet Inc.

10.2 Cequence Security Inc.

10.3 Zscaler Inc.

10.4 Sophos Ltd.

10.5 Palo Alto Networks

10.6 Aqua Security Software Ltd.

10.7 Check Point Software Technologies Ltd.

10.8 Radware Ltd.

10.9 CrowdStrike

10.10 Trend Micro Incorporated

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global cloud-native application protection platform (CNAPP) market was valued at USD 9.5 billion in 2023 and is projected to reach a market size of USD 31.17 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 18.5%.

The segments under the global cloud-native application protection platform (CNAPP) market are based on offering platforms and professional services.

North America is the dominant region in the global cloud-native application protection platform (CNAPP) market.

Palo Alto Networks, CrowdStrike, Fortinet Inc., Radware Ltd., Zscaler Inc., and Sophos Ltd. are the major players in the global cloud-native application protection platform (CNAPP) market.

The COVID-19 pandemic has had a significant impact on the global cloud-native application protection platform (CNAPP) market and reshaped the landscape of cybersecurity and cloud-native technologies. With the sudden shift to remote working and increased reliance on digital services, organizations are accelerating their adoption of cloud-native solutions and increasing the need for CNAPP solutions to protect these spaces. The pandemic has highlighted the importance of taking effective security measures to protect sensitive data and ensure business continuity against cyber attacks.