Cloud GIS Market Size (2024 – 2030)

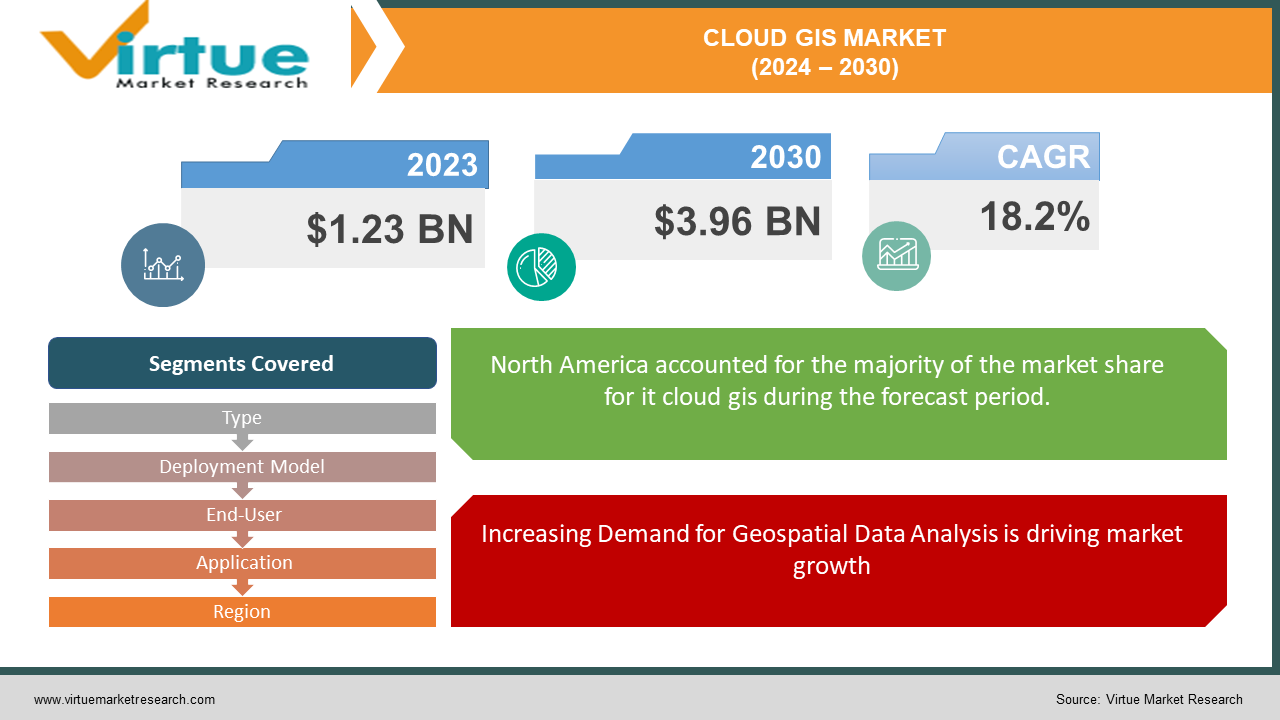

The Global Cloud GIS Market was valued at USD 1.23 billion in 2023 and will grow at a CAGR of 18.2% from 2024 to 2030. The market is expected to reach USD 3.96 billion by 2030.

The Cloud GIS market involves the provision and utilization of Geographic Information Systems (GIS) hosted on cloud platforms, enabling the storage, management, analysis, and visualization of geospatial data over the internet. This market is driven by the increasing need for real-time spatial data analysis, advancements in cloud computing technology, and the integration of AI, IoT, and big data with GIS applications. Cloud GIS offers significant benefits such as cost efficiency, scalability, and remote accessibility, making it a preferred choice for industries including urban planning, agriculture, transportation, and disaster management. The market is also bolstered by government initiatives promoting digital transformation and smart city projects, as well as the growing adoption of geospatial technologies across various sectors.

Key Market Insights:

The integration of advanced technologies such as AI, IoT, and big data analytics with GIS platforms is revolutionizing the Cloud GIS market. These technologies enhance the functionality and efficiency of GIS systems, enabling more precise data analysis and real-time decision-making.

Cloud GIS solutions are cost-effective as they eliminate the need for expensive on-premises hardware and software. Organizations can scale their GIS capabilities without significant upfront investments, leading to increased adoption, especially among small and medium-sized enterprises (SMEs).

Governments and regulatory bodies across various regions are promoting the use of Cloud GIS for urban development and environmental conservation projects. Policies supporting digital transformation and smart city initiatives are further propelling market growth.

Global Cloud GIS Market Drivers:

Increasing Demand for Geospatial Data Analysis is driving market growth:

The growing need for geospatial data analysis across various sectors is a primary driver for the Cloud GIS market. Businesses and governments require accurate geospatial data to make informed decisions in areas such as urban planning, disaster management, and infrastructure development. Cloud GIS provides a platform for storing, analyzing, and visualizing geospatial data, which helps organizations leverage this data effectively. For instance, urban planners use Cloud GIS to design smart cities by analyzing spatial data related to population density, land use, and infrastructure. This capability to handle and analyze vast amounts of geospatial data efficiently drives the adoption of Cloud GIS solutions.

Advancements in Cloud Computing Technology are driving market growth:

The rapid advancements in cloud computing technology have significantly impacted the growth of the Cloud GIS market. Cloud platforms now offer robust, scalable, and secure environments for GIS applications, making it easier for organizations to deploy and manage GIS solutions. Enhanced computational power, data storage capabilities, and advanced analytics tools available on cloud platforms enable more sophisticated geospatial analysis and modeling. For example, environmental monitoring organizations use cloud-based GIS to process and analyze large datasets from satellite imagery, providing real-time insights into environmental changes. These technological advancements make Cloud GIS solutions more attractive to organizations seeking to enhance their geospatial data capabilities.

Rise in Remote Sensing and IoT Applications are driving market growth:

The proliferation of remote sensing technologies and IoT devices has led to an exponential increase in the amount of geospatial data generated. Cloud GIS systems are essential for processing, storing, and analyzing this data. Remote sensing technologies, such as satellites and drones, collect vast amounts of spatial data that need to be processed and analyzed in real time. Cloud GIS platforms provide the necessary infrastructure to handle this data efficiently. Additionally, IoT devices embedded with sensors continuously generate location-based data, which can be integrated with Cloud GIS for various applications, such as asset tracking and environmental monitoring. The ability to integrate and analyze data from diverse sources makes Cloud GIS a critical tool for modern geospatial applications.

Global Cloud GIS Market challenges and restraints:

Data Privacy and Security Concerns is a significant hurdle for Cloud GIS:

One of the primary challenges facing the Cloud GIS market is data privacy and security. The storage and processing of sensitive geospatial data on cloud platforms raise concerns about unauthorized access and data breaches. Organizations are often hesitant to move their GIS operations to the cloud due to the risk of exposing critical location-based information to potential cyber threats. Ensuring data security involves implementing robust encryption, secure access controls, and compliance with data protection regulations. However, the complexity and cost associated with these security measures can be a significant restraint for organizations, particularly smaller enterprises, hindering the widespread adoption of Cloud GIS solutions.

High Initial Investment and Operational Costs are throwing a curveball at the Cloud GIS market:

Although Cloud GIS offers cost advantages in terms of scalability and reduced on-premises infrastructure, the initial investment required for migrating to cloud-based GIS solutions can be substantial. Organizations need to invest in cloud subscriptions, data migration, and staff training to effectively utilize Cloud GIS platforms. Additionally, ongoing operational costs, such as data storage fees and advanced analytics services, can add up over time. These financial barriers can deter organizations, especially those with limited budgets, from adopting Cloud GIS solutions. To address this challenge, service providers need to offer flexible pricing models and comprehensive support to help organizations manage their transition to cloud-based GIS.

Market Opportunities:

The Cloud GIS market presents significant opportunities driven by technological advancements, increasing demand for spatial data analysis, and the rise of smart city initiatives. One major opportunity lies in the integration of AI and machine learning with Cloud GIS platforms. AI-driven geospatial analytics can provide deeper insights and predictive capabilities, enabling organizations to make data-driven decisions with greater accuracy. For example, in agriculture, AI can analyze spatial data to predict crop yields, optimize irrigation, and detect pest infestations, leading to increased productivity and sustainability. Another opportunity is the expansion of Cloud GIS applications in emerging markets. As developing regions invest in digital infrastructure and smart city projects, there is a growing need for advanced geospatial solutions. Cloud GIS can support these initiatives by providing scalable and cost-effective tools for urban planning, transportation management, and environmental monitoring. Governments and private sector organizations in these regions are increasingly recognizing the value of geospatial data, creating a conducive environment for the growth of Cloud GIS solutions. The rise of 5G technology also offers new opportunities for Cloud GIS. With faster data transmission speeds and lower latency, 5G can enhance the performance of cloud-based GIS applications, enabling real-time data processing and visualization. This is particularly valuable for applications requiring immediate insights, such as disaster response and autonomous vehicle navigation. Service providers can leverage 5G networks to offer more responsive and reliable Cloud GIS solutions, further driving market growth. Moreover, the increasing focus on environmental sustainability presents an opportunity for Cloud GIS to play a crucial role in climate change mitigation and natural resource management. Organizations can use Cloud GIS to monitor environmental changes, manage natural resources more efficiently, and develop strategies for reducing carbon footprints. For instance, Cloud GIS can help track deforestation, analyze the impact of urbanization on ecosystems, and support renewable energy projects by identifying optimal locations for solar and wind farms.

CLOUD GIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.2% |

|

Segments Covered |

By Type, Deployment Model, End-User, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Esri, Hexagon AB, Google, Microsoft, Amazon Web Services (AWS), Oracle, IBM, Trimble Inc., Autodesk Inc., Bentley Systems, Pitney Bowes, GIS Cloud, Mapbox, SuperMap Software, CARTO |

Cloud GIS Market Segmentation - By Type

-

Software

-

Services

Among the two segments, Software is the most prominent sector in the Cloud GIS market. This dominance is driven by the high demand for advanced GIS software solutions that offer robust spatial analysis, data visualization, and decision-making capabilities. Continuous advancements in GIS technology, including the integration of AI and machine learning, further enhance the functionality of GIS software, making it indispensable for various applications such as urban planning, disaster management, and natural resource monitoring. The flexibility and scalability offered by cloud-based GIS software allow organizations to efficiently manage and analyze large volumes of geospatial data, leading to increased adoption across industries. As a result, the software segment remains at the forefront of the Cloud GIS market, contributing significantly to its growth and development.

Cloud GIS Market Segmentation - By Deployment Model

-

Public Cloud

-

Private Cloud

Among the two deployment models, the Public Cloud is the most prominent in the Cloud GIS market. Public cloud solutions offer unmatched scalability, flexibility, and cost-efficiency, making them the preferred choice for organizations of all sizes. They provide easy access to advanced GIS tools and services without the need for significant upfront investments in infrastructure. The public cloud's ability to handle large volumes of geospatial data and support real-time analysis is particularly beneficial for applications in urban planning, environmental monitoring, and disaster management. Additionally, major public cloud providers offer robust security measures and compliance certifications, addressing concerns about data privacy and security, and further driving their widespread adoption in the Cloud GIS market.

Cloud GIS Market Segmentation - By End-User

-

Government

-

Private Sector

Among the two sectors, the Government sector is the most prominent in the Cloud GIS market. Governments extensively use Cloud GIS for urban planning, infrastructure development, environmental monitoring, and disaster management. The ability to analyze and visualize geospatial data in real time is crucial for effective decision-making and policy implementation. Initiatives such as smart city projects, sustainable development goals, and national security efforts heavily rely on advanced GIS technologies. Additionally, governments are often the primary funders of large-scale GIS projects, ensuring continuous investment and adoption of the latest geospatial technologies, which further solidifies their dominance in the Cloud GIS market.

Cloud GIS Market Segmentation - By Application

-

Urban Planning

-

Agriculture

Among the two sectors, Urban Planning is the most prominent sector in the Cloud GIS market. Urban planning relies heavily on geospatial data for designing and managing urban infrastructure, zoning, transportation networks, and public services. Cloud GIS solutions provide urban planners with powerful tools for analyzing spatial data, visualizing city layouts, and making informed decisions to create sustainable and efficient urban environments. The integration of real-time data, such as traffic patterns and population density, enables dynamic and responsive urban planning, which is essential for addressing the challenges of modern cities. As cities around the world continue to grow and evolve, the demand for advanced GIS solutions in urban planning remains strong, driving significant adoption and investment in this sector.

Cloud GIS Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the Cloud GIS market, primarily due to the presence of major technology companies and the widespread adoption of advanced geospatial technologies. The region's strong digital infrastructure, high investment in research and development, and supportive government policies contribute to its leading position. Additionally, North America's emphasis on smart city initiatives and environmental monitoring further drives the demand for Cloud GIS solutions.

COVID-19 Impact Analysis on the Global Cloud GIS Market

The COVID-19 pandemic has had a profound impact on the Cloud GIS market, accelerating the adoption of cloud-based geospatial solutions across various sectors. During the pandemic, organizations and governments relied heavily on geospatial data to manage and respond to the crisis. Cloud GIS platforms provided crucial support for tracking the spread of the virus, planning vaccination campaigns, and monitoring the effectiveness of lockdown measures. For instance, public health authorities used Cloud GIS to visualize COVID-19 hotspots, analyze population movement patterns, and allocate medical resources efficiently. The pandemic also highlighted the need for real-time data and remote access to geospatial information. With many employees working remotely, cloud-based GIS solutions became essential for maintaining operational continuity. Organizations leveraged Cloud GIS to facilitate remote collaboration, allowing teams to access and share geospatial data from any location. This shift towards remote work and the increasing reliance on cloud technologies are expected to have a lasting impact on the Cloud GIS market, driving further adoption in the post-pandemic era. Furthermore, the pandemic underscored the importance of resilient infrastructure and disaster preparedness. Governments and organizations are now more focused on enhancing their capabilities to respond to future crises. Cloud GIS plays a critical role in disaster management by providing real-time situational awareness, supporting emergency response planning, and enabling efficient resource allocation. As a result, investments in Cloud GIS solutions for disaster management and public safety are expected to increase, contributing to the market's growth.

Latest trends/Developments

The Cloud GIS market is witnessing several key trends and developments that are shaping its future trajectory. One notable trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) with geospatial technologies. AI-driven analytics enhance the capabilities of Cloud GIS by providing more accurate predictions, automating data analysis, and uncovering hidden patterns in spatial data. For example, AI algorithms can analyze satellite imagery to detect changes in land use, monitor environmental conditions, and predict natural disasters. This integration is enabling organizations to derive deeper insights from their geospatial data and make more informed decisions. Another significant trend is the growing adoption of 3D GIS and augmented reality (AR) applications. 3D GIS technology allows for the visualization and analysis of spatial data in three dimensions, providing a more comprehensive understanding of geographic features and urban landscapes. This is particularly valuable for urban planning, infrastructure development, and environmental monitoring. Additionally, AR applications are being used to overlay geospatial information onto the real world, enhancing situational awareness and decision-making in various fields, such as navigation, maintenance, and field inspections. The rise of open-source GIS solutions is also influencing the market. Open-source platforms offer cost-effective and customizable alternatives to proprietary GIS software, making geospatial technologies more accessible to a broader range of users. These platforms are supported by active communities that contribute to continuous improvements and innovation. The adoption of open-source GIS solutions is growing, particularly among small and medium-sized enterprises (SMEs) and academic institutions, driving the overall expansion of the Cloud GIS market. Furthermore, the increasing focus on sustainability and environmental conservation is driving the demand for Cloud GIS solutions in natural resource management and climate change mitigation. Organizations are using Cloud GIS to monitor deforestation, track wildlife habitats, manage water resources, and develop renewable energy projects. The ability to analyze and visualize environmental data in real time helps in making strategic decisions that promote sustainability and reduce environmental impact.

Key Players:

-

Esri

-

Hexagon AB

-

Google

-

Microsoft

-

Amazon Web Services (AWS)

-

Oracle

-

IBM

-

Trimble Inc.

-

Autodesk Inc.

-

Bentley Systems

-

Pitney Bowes

-

GIS Cloud

-

Mapbox

-

SuperMap Software

-

CARTO

Chapter 1. Cloud GIS Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cloud GIS Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cloud GIS Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cloud GIS Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cloud GIS Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cloud GIS Market – By Application

6.1 Introduction/Key Findings

6.2 Urban Planning

6.3 Agriculture

6.4 Y-O-Y Growth trend Analysis By Application

6.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Cloud GIS Market – By Deployment Model

7.1 Introduction/Key Findings

7.2 Public Cloud

7.3 Private Cloud

7.4 Y-O-Y Growth trend Analysis By Deployment Model

7.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 8. Cloud GIS Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Government

8.3 Private Sector

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Cloud GIS Market – By Type

9.1 Introduction/Key Findings

9.2 Software

9.3 Services

9.4 Y-O-Y Growth trend Analysis By Type

9.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 10. Cloud GIS Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Application

10.1.2.1 By Deployment Model

10.1.3 By Distribution Channel

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Application

10.2.3 By Deployment Model

10.2.4 By Distribution Channel

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Application

10.3.3 By Deployment Model

10.3.4 By Distribution Channel

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Application

10.4.3 By Deployment Model

10.4.4 By Distribution Channel

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Application

10.5.3 By Deployment Model

10.5.4 By Distribution Channel

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Cloud GIS Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Esri

11.2 Hexagon AB

11.3 Google

11.4 Microsoft

11.5 Amazon Web Services (AWS)

11.6 Oracle

11.7 IBM

11.8 Trimble Inc.

11.9 Autodesk Inc.

11.10 Bentley Systems

11.11 Pitney Bowes

11.12 GIS Cloud

11.13 Mapbox

11.14 SuperMap Software

11.15 CARTO

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cloud GIS Market was valued at USD 1.23 billion in 2023 and will grow at a CAGR of 18.2% from 2024 to 2030. The market is expected to reach USD 3.96 billion by 2030.

The primary drivers of the Global Cloud GIS market include the increasing demand for geospatial data analysis, advancements in cloud computing technology, and the rise in remote sensing and IoT applications.

The Global Cloud GIS market is segmented by Component (Software, Services), Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), Application (Urban Planning, Agriculture, Transportation, Disaster Management, Natural Resource Management), and End-User (Government, Private Sector, Defense, Energy, and Utilities).

North America is the most dominant region for the luxury vehicle Market.

Leading players in the Global Cloud GIS market include Esri, Hexagon AB, Google, Microsoft, Amazon Web Services (AWS), Oracle, IBM, Trimble Inc., Autodesk Inc., Bentley Systems, Pitney Bowes, GIS Cloud, Mapbox, SuperMap Software, and CARTO.