Cloud Content Delivery Network Market Size (2025 – 2030)

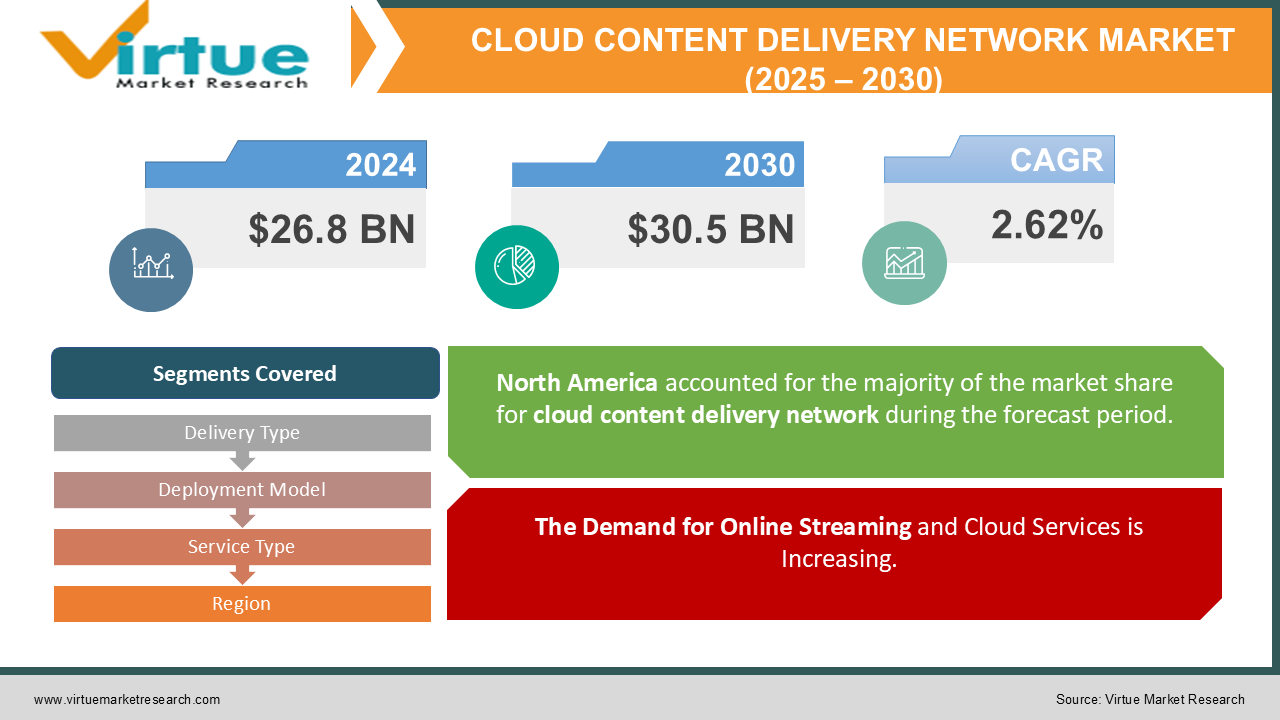

The Global Cloud Content Delivery Network Market was valued at USD 26.8 billion in 2024 and is projected to reach a market size of USD 30.5 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 2.62%.

A content delivery network or CDN consists of interconnected servers that securely distribute content. To improve speed and connectivity, CDNs provide input to the servers of the content exchange network. Content delivery is defined as the revenue generated from solutions and services used by endpoints around the world. Expansion of internet usage in emerging markets also increases demand for content delivery network services. CDNs should ensure optimal performance for this demand. Increasing interest in high-quality, low-latency digital experience further highlights the requirement for enhancement of website and application performance with CDNs. Media & entertainment industries make huge usage of CDNs to increase audio and video content delivery. This is due to the continuous evolution of content consumption and the necessity of high-quality, original content that has fulfilled the demand for effective CDN solutions capable of improving network performance and enhancing content delivery.

Key Market Insights:

Asia-pacific anticipated to witness significant growth, with a CAGR of 22.2% over the forecast period, driven by rapid digitization and expanding internet connectivity in countries like India and China.

As smartphones, tablets, and other smart handheld devices continue to proliferate, the subsequent rise in internet traffic shows no signs of abating. According to the GSMA report titled The State of Mobile Internet Connectivity 2023, more than 4.56 billion individuals used mobile internet services in FY2022, which marked an increase from FY2021's 4.35 billion.

In addition, approximately 54% of the total population equating to 4.3 billion individuals-owned a smartphone as of FY2022.

Cloud Content Delivery Network Market Drivers:

The Demand for Online Streaming and Cloud Services is Increasing.

With the ever-growing demand for high-quality video streaming, the Cloud Content Delivery Network Market Industry is experiencing significant growth. Online video consumption, popularized by services like video-sharing services, social media, and streaming applications, is surging and demands effective content delivery solutions. CDN services improve video quality and reduce buffering, allowing for a buffer-free viewing experience for the end user. The increasing use of video for entertainment and education among consumers makes reliable and scalable CDN services a prime necessity. With the increase in live streaming events, webinars, and virtual conferences, there is an increasing need for a robust CDN infrastructure. This trend mirrors a larger shift in consumer behavior, where on-demand and high-definition content are changing the face of how businesses approach content delivery. Due to these consumer requirements, enterprises will invest in CDs to optimize their bandwidth and be able to share content at global lightning speed, which will trigger the demand, and the evolution of the marketplace will allow a Cloud Content Delivery Network Market industry to take part in this upsurge accordingly. It is evident that with the increase in video streaming platforms, gaming services, and remote work tools, there is an added demand for simplified content delivery. The reduced latency, enhanced user experience, and guaranteed uninterrupted streaming brought about by CDNs increase their adoption across different industries.

The rapid expansion of the e-commerce and retail sector significantly drives growth in the cloud content delivery network market industry. .

The e-commerce and retail sector is rapidly expanding, and growth in the Cloud Content Delivery Network Market Industry is significantly driven by this sector. As more and more people are shopping online, businesses are trying to give their customers a better experience by making content delivery faster and more reliable. CDNs are critical for improving website performance, making transactions smooth, and reducing latency. Retailers are using CDNs to ensure that their websites load quickly and efficiently, even during peak traffic times like sales and holiday shopping seasons. This ensures that customers have a positive experience, leading to higher conversion rates and customer satisfaction.

As cyber threats and vulnerabilities continue to rise the focus on enhanced online security is increased.

As the threats and vulnerabilities on the web continue to grow, improving the network's security aspects has become one of the driving forces in the Cloud Content Delivery Network Market Industry. Most businesses are now turning to and adopting CDNs that provide protection within their services, such as DDoS protection and secure token authentication, to protect digital assets. This focus on security helps to maintain customer trust and adhere to regulatory standards. By improving performance and not compromising the integrity of applications and sensitive information, CDNs have become a uniquely critical component that organizations will always need to run online in the current threat environment.

Cloud Content Delivery Network Market Restraints and Challenges:

Costs of operations and deployment is high and the Integration is Complex.

Setting up a CDN infrastructure comes with high investments in servers, data centers, and network maintenance. For small businesses, the associated high costs with premium CDN services are likely to act as a barrier, limiting adoption to large enterprises or those with considerable budgets. Using CDN services alongside existing IT infrastructure, particularly in multi-cloud, might be quite complex. Additional requirements of easy performance, managing configurations, and compatibility with transformation technologies may be strong deterrents for organizations that do not have specific technical expertise.

Cloud Content Delivery Network Market Opportunities:

There are various key opportunities which have resulted in significant growth of the Cloud Content Delivery Network (CDN) market. Rising demand for fast streaming has led to a significant need for low-latency content delivery and efficient streaming with the rise in online video platforms and live broadcasts. Further, the advancement in cloud services has also helped boost the demands for scalable, reliable CDN, as they allow large traffic flows with no impact on user experiences. Emerging market expansion is new territory for the CDN providers where internet adoption, coupled with online content consumption increases in these territories. The increasing use of mobile internet has further accelerated the demand for CDNs that can optimize content delivery across various devices and networks. In addition, with the increasing cyber threats, the growing demand for enhanced security features, including DDoS protection and data encryption, has become a critical driver for CDN providers to offer robust security measures alongside performance improvements. These trends collectively position the CDN market for continued expansion and innovation.

CLOUD CONTENT DELIVERY NETWORK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

2.62% |

|

Segments Covered |

By Delivery Type, Deployment Model, Service Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fastly, Akamai Technologies, Amazon Web Services, Google Cloud, Verizon, CacheFly, Cloudflare, Alibaba Cloud, Microsoft, IBM, DigitalOcean, CDN77, Telstra, StackPath |

Cloud Content Delivery Network Market Segmentation: By Delivery Type

-

Streaming

-

Web Performance

-

Broadcasting

-

Software Distribution

The Cloud Content Delivery Network (CDN) market is segmented by delivery type, each addressing specific content distribution needs. Based on type, the market is categorized into Streaming, Web Performance, Broadcasting and Software Distribution.

The streaming category was the largest contributor to CDN growth, with value that in 2023 reached $3.5 billion and was projected to rise to $11.25 billion by 2032. The growing need for delivering high-quality, lag-free content with respect to video-on-demand services and real-time streams has increased the demand for a high-performance and low-latency CDN. Web performance focuses on optimizing website loading speed, aiming for enhanced user experience along with a reduction in bounce rates by efficiently distributing content across multiple locations. The Web Performance market will have increased to $9.5 billion by 2032. By way of CDNs for live television, radio, and sports broadcasting, this segment ensures minimal latency and high availability for global audiences. Broadcasting will reach the market size of $9.0 billion by 2032. Software Distribution is an important way in which the software updates, patches, and huge file delivery is done safely and rapidly to users everywhere over the globe, resulting in faster download times and eased server load. The Software Distribution segment is expected to reach $5.55 billion by 2032. All these delivery types are crucial in improving content accessibility, performance, and security in the rapidly growing digital landscape.

Cloud Content Delivery Network Market Segmentation: By Deployment Model

-

Public cloud

-

Private Cloud

-

Hybrid cloud

The Cloud Content Delivery Network is divided into segments based on deployment model, which offers different benefits based on the needs of an organization. In a public cloud model, the public internet provides CDN services from a third party. This mode is aptly utilized because it is quite scalable and cost-effective yet flexible for businesses with unpredictable traffic demands. It's particularly beneficial for companies with global reach that need to manage high volumes of content without investing heavily in infrastructure. Public cloud CDNs also have easy setup and are a popular choice for businesses looking for low-cost, high-performance content delivery solutions. On the other hand, the Private Cloud model is hosted on private infrastructure, where organizations can gain more control over their data and network. This model is generally adopted by those industries that have a higher requirement for security and compliance, including healthcare, finance, and government. Private cloud CDNs also offer better customization, so the business can maximize its content delivery strategy based on its needs. The flexibility in tailoring the security features and data management practice makes private cloud CDNs an attractive option for companies dealing with sensitive information or having stringent regulatory requirements.

In a Hybrid Cloud, there is the incorporation of the two types: public and private. This cloud offers the capability of distributing content in both clouds. This way, businesses are in a position to take advantages from both based on performance, security, and cost considerations. Hybrid cloud CDNs are more suitable for businesses that have varied workloads or wish to optimize content delivery in different platforms. The use of both public and private clouds allows hybrid cloud CDNs to be a highly versatile approach adaptable to dynamic needs. Each model serves different business requirements, from the scalability and low cost offered by public clouds to the security and customization options available in private clouds, as well as flexibility through hybrid models. The best deployment model to choose depends on the performance required, data sensitivity, security, compliance, and budget constraints.

Cloud Content Delivery Network Market Segmentation: By Service Type

-

Video Streaming

-

API Acceleration

-

Website Acceleration

-

Security Services

The digital landscape is constantly changing, with businesses increasingly depending on specialized services such as video streaming, API acceleration, website acceleration, and security services for performance, security, and better user experience. The global video analytics market size is expected to grow from USD 8.37 billion in 2023 to USD 39.28 billion by 2032 at a compound annual growth rate (CAGR) of 21.32%. This growth is driven by IP-based security camera demand and need to process video data in the unstructured variety. Video analytics software helps discover anomalies in the video content; it classifies trends, so video monitoring ability is improved. On the other hand, the API security market is expected to rise from USD 0.8 billion in 2022 to USD 10.6 billion by 2032. This growth will be fostered by the adoption of cloud computing and microservices, which expand the attack surface and require a robust security setup. APIs are necessary for communication between software systems, and security against unauthorized access and data breach is needed. Website acceleration, fueled by cloud content delivery networks (CDNs), is also gaining pace. The CDN market is expected to grow to USD 65.6 billion by 2030 at a CAGR of around 22.30%. CDNs enhance website performance by reducing latency and delivering content efficiently through a network of distributed proxy servers. Lastly, security services are more critical than ever, with studies showing that 84% of security professionals experienced an API security incident in the past year, emphasizing the need for comprehensive protection to safeguard digital assets. These growing service areas reflect the increasing importance of digital optimization and security in today's interconnected world.

The Cloud Content Delivery Network (CDN) market globally is categorized under various types based on service provider, including Traditional CDN Providers, Cloud CDN Providers, Peer-to-Peer (P2P) CDN Providers, and Telecom CDN Providers. Traditional CDN Providers are large-scale companies offering CDN services as a part of the general network infrastructure solutions they offer. While these cloud CDN Providers offer CDN service as part of their cloud computing platforms, drawing on their established cloud infrastructure. Peer-to-peer (P2P) CDN Providers rely upon a decentralized user network to propagate content, removing the dependency of centralized servers. Telecom CDN Providers are telecommunication companies that can offer CDN as an add-on feature to other network services provided. All of these segments play a critical role in offering efficient and reliable content delivery solutions to match the ever-growing demand for qualitative digital experiences across geographies. North America is the largest market shareholder, followed by Europe and Asia-Pacific, respectively. Steady growth in the adoption of CDN content delivery is seen in South America and the Middle East and Africa. The regional analysis focuses on the differences in adoption of CDN and growth factors, mainly through enhanced digital experiences and supporting the ever-growing number of online content consumers.

Cloud Content Delivery Network Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The cloud content delivery networks market is analyzed across Asia Pacific, North America, Europe, and the rest of the world. North America is expected to hold the highest share of the market, whereas Europe is expected to grow the fastest during the outlook period. The Technological advancement and greater adoption of mobile devices with NFC services in various verticals are said to be the cause of growth in the North American market.

COVID-19 Impact Analysis on the Global Cloud Content Delivery Network Market:

COVID-19 has been an unmatched global public health emergency that touches almost every aspect of the economy, and it is likely that the long-run effects will negatively impact the industry growth during the forecast period. Our continuous study expands our research framework to guarantee the incorporation of underlying COVID-19 issues as well as ways forward. This report provides insights into COVID-19 while considering changes in consumer behavior and demand, purchasing patterns, re-routing of the supply chain, dynamics of current market forces, and the significant interventions of governments. The updated study incorporates inputs on estimation and forecasting, considering the impact of COVID-19 on the market.

Latest Trends/ Developments:

The Cloud Content Delivery Network Market is also witnessing growth and rising with increasing internet penetration across the globe and expanding demand for better quality content delivery. Digital content is accessed through online platforms by businesses and individuals, thereby demanding improved performances as well as faster load times. The main driver thus is the need for better user experience, compelling enterprises to opt for CDN solutions that enable efficient and secure content delivery. In addition, video streaming services and the demand for cloud-based services have fueled demand for CDNs as companies continue to seek solutions that allow them to meet the expectations of instant access to content from consumers.

There are vast opportunities to explore in the market, especially since new technologies like edge computing and artificial intelligence are increasingly being used with CDN solutions. These innovations can improve the processing of real-time data and enhance the efficiency of content distribution. Another growth area is in better cybersecurity for content delivery systems as companies seek to protect user data and content from potential threats. Moreover, expansion worldwide by any businesses requires more from CDNs on multi-regional strategies so more providers could meet the market for localized solution guaranteeing a fast delivery in terms of the availability of any diverse content into numerous markets recently the market witnesses high cooperation levels by CDN vendors as well as other cloud computing infrastructure providers allowing streamlined content sharing resources and good resources management. In addition, personalization in content delivery is an emerging trend. Providers are looking to tailor services based on user behavior and preferences. Sustainability has also gained momentum as companies aim to reduce carbon footprints associated with data transfer.

Key Players:

-

Fastly

-

Akamai Technologies

-

Amazon Web Services

-

Google Cloud

-

Verizon

-

CacheFly

-

Cloudflare

-

Alibaba Cloud

-

Microsoft

-

IBM

-

DigitalOcean

-

CDN77

-

Telstra

-

StackPath

Chapter 1. Cloud Content Delivery Network Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cloud Content Delivery Network Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cloud Content Delivery Network Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cloud Content Delivery Network Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cloud Content Delivery Network Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cloud Content Delivery Network Market – By Delivery Type

6.1 Introduction/Key Findings

6.2 Streaming

6.3 Web Performance

6.4 Broadcasting

6.5 Software Distribution

6.6 Y-O-Y Growth trend Analysis By Delivery Type

6.7 Absolute $ Opportunity Analysis By Delivery Type, 2025-2030

Chapter 7. Cloud Content Delivery Network Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 Public cloud

7.3 Private Cloud

7.4 Hybrid cloud

7.5 Y-O-Y Growth trend Analysis By Deployment Mode

7.6 Absolute $ Opportunity Analysis By Deployment Mode, 2025-2030

Chapter 8. Cloud Content Delivery Network Market – By Service Type

8.1 Introduction/Key Findings

8.2 Video Streaming

8.3 API Acceleration

8.4 Website Acceleration

8.5 Security Services

8.6 Y-O-Y Growth trend Analysis By Service Type

8.7 Absolute $ Opportunity Analysis By Service Type, 2025-2030

Chapter 9. Cloud Content Delivery Network Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Delivery Type

9.1.3 By Deployment Mode

9.1.4 By Service Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Delivery Type

9.2.3 By Deployment Mode

9.2.4 By Service Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Delivery Type

9.3.3 By Deployment Mode

9.3.4 By Service Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Delivery Type

9.4.3 By Deployment Mode

9.4.4 By Service Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Delivery Type

9.5.3 By Deployment Mode

9.5.4 By Service Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cloud Content Delivery Network Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Fastly

10.2 Akamai Technologies

10.3 Amazon Web Services

10.4 Google Cloud

10.5 Verizon

10.6 CacheFly

10.7 Cloudflare

10.8 Alibaba Cloud

10.9 Microsoft

10.10 IBM

10.11 DigitalOcean

10.12 CDN77

10.13 Telstra

10.14 StackPath

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cloud Content Delivery Network Market was valued at USD 26.8 billion in 2024 and is projected to reach a market size of USD 30.5 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 2.62%.

The Demand for Online Streaming and Cloud Services is Increasing and As cyber threats and vulnerabilities continue to rise the focus on enhanced online security is increased.

Based on Service Provider, the Global Cloud Content Delivery Network Market is segmented into Traditional CDN Providers, Cloud CDN Providers, Peer-to-Peer (P2P) CDN Providers, and Telecom CDN Providers.

North America is the most dominant region for the Global Cloud Content Delivery Network Market.

Fastly, Akamai Technologies, Amazon Web Services, Google Cloud, Verizon, CacheFly, Cloudflare, Alibaba Cloud are the key players operating in the Global Cloud Content Delivery Network Market.