Closed Cell Metal Foam Market Size (2024 – 2030)

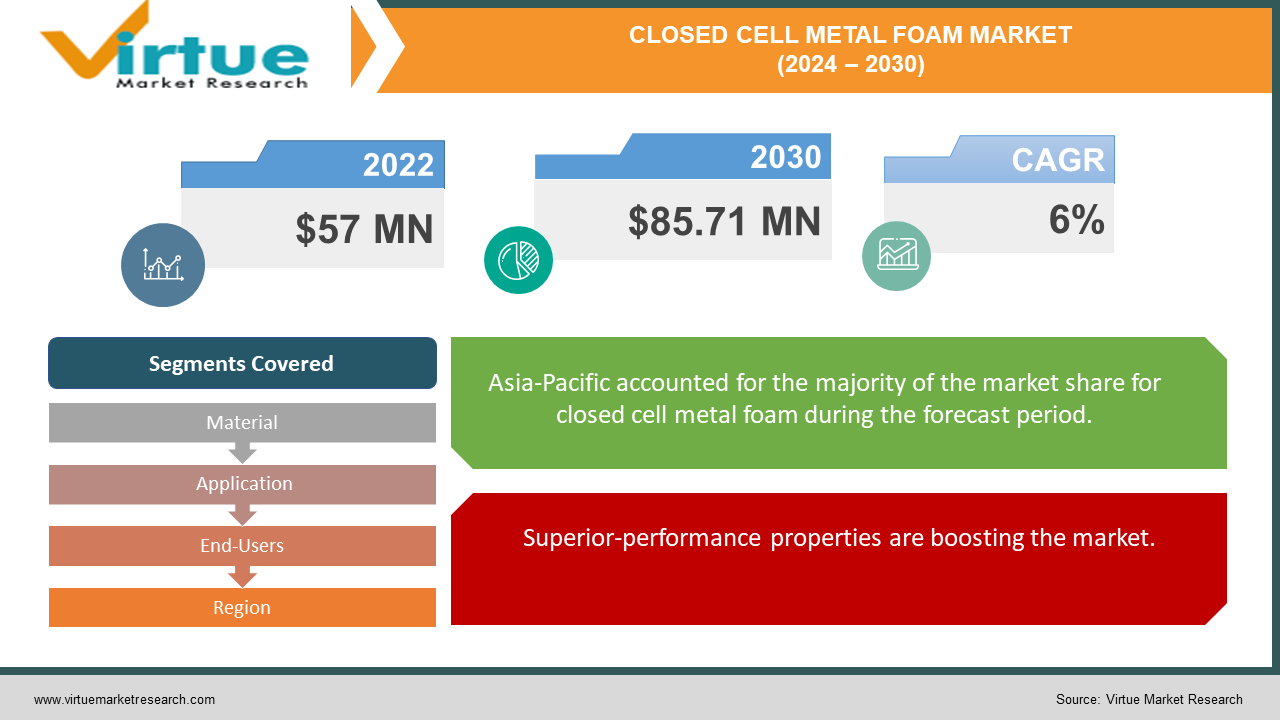

The global closed-cell metal foam market was valued at USD 57 million in 2023 and will grow at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 85.71 million by 2030.

To stabilize the bubbles in molten metal, a foaming agent or gas injection is used to create closed-cell metal foams. Usually, the pores, or cells, range in size from 1 to 8 mm. Like the polymer foams in a bicycle helmet, closed-cell metal foams are utilized as impact-absorbing materials for higher impact loads. Metal foams, in contrast to many polymer foams, can only be distorted once and retain their shape after impact. The special qualities of closed-cell metal foams include buoyancy, stress absorption, high specific strength and stiffness, and crashworthiness. Automobiles, energy absorbers, silencers, bearings, and other industrial fields all use closed-cell metal foams.

Key Market Insights:

The exceptional characteristics of closed-cell metal foam, including its high strength-to-weight ratio, impact absorption, vibration damping, thermal management, and fire resistance, lead to its adoption in numerous industries and enhance sustainability, safety, and fuel efficiency.The largest and fastest-growing material in this market is aluminum, which is valued for its adaptability to many industries and lightweight characteristics. Anti-intrusion bars are the most popular and rapidly expanding use, thanks to strict safety laws in the building and automotive industries.While there is much potential to increase applications, find sustainable solutions, and enhance manufacturing technology, there are also many hurdles to be overcome, such as high manufacturing costs and limited production scale.

Global Closed Cell Metal Foam Market Drivers:

Superior-performance properties are boosting the market.

The exceptional properties of closed-cell metal foam are propelling its use across various industries. Their high strength-to-weight ratio makes them superstars in weight reduction. This translates to lighter vehicles in automotive and aerospace, leading to better fuel efficiency and performance. But their talent goes beyond lightness. They excel at absorbing impact and vibrations, making them ideal for protective packaging, sports equipment, and even earthquake-resistant building materials. Their closed-cell structure functions as a heat shield, facilitating effective heat dissipation, which is advantageous for thermal management and battery technology. To top it off, many closed-cell foams boast impressive fire resistance, adding a layer of safety in construction and other fire-prone environments. These unique properties combined are making closed-cell metal foam a game-changer across various sectors.

Expanding applications are accelerating the growth rate.

Closed-cell metal foam is revolutionizing industries beyond just its material properties. The automotive industry is a prime example, where these foams are replacing heavier components in vehicles. This translates to a lighter car without sacrificing structural integrity, leading to significant improvements in fuel efficiency and overall performance. In construction, closed-cell foams are finding diverse applications, from soundproofing noisy environments to reinforcing structures for enhanced stability. They even hold promise for creating energy-efficient building materials. The energy sector is also embracing this innovation. Here, closed-cell foams contribute to the development of safer and more efficient batteries by aiding in thermal management and impact protection. Wind turbines can also benefit from lightweight components made from these foams. The unique properties extend to consumer goods as well, with applications ranging from high-performance sporting equipment that offers better protection and maneuverability to advanced protective gear. This versatility across various sectors highlights the immense potential of closed-cell metal foam in shaping the future of manufacturing and product design.

Sustainable solutions are aiding development.

The closed-cell metal foam market is fueled not only by its impressive properties but also by its alignment with growing environmental concerns. As the world strives for sustainability, the lightweight nature of these foams presents a significant advantage. By replacing heavier materials in various applications, closed-cell foams contribute to lighter vehicles and more fuel-efficient transportation, leading to a reduced carbon footprint. This resonates with the rising demand for eco-friendly solutions across industries. Additionally, advancements in manufacturing processes hold immense potential for the future of closed-cell metal foam. By bringing down production costs, these advancements can open doors for wider adoption. This could unlock a new era of lightweight, high-performance products across various sectors, further accelerating the market growth of closed-cell metal foam.

Global Closed-Cell Metal Foam Market Challenges and Restraints:

High manufacturing costs can be a barrier.

The Achilles' heel of closed-cell metal foam lies in its production complexity. Unlike traditional materials with well-established, cost-effective processes, crafting closed-cell foams involves intricate steps that translate to a hefty price tag. This presents a major hurdle for industries where cost is a top priority. This challenge is particularly acute for price-sensitive sectors like construction or consumer goods. Bridging this cost gap is crucial for wider adoption. Advancements in manufacturing technology and economies of scale hold the key to bringing down production costs and making closed-cell foams a more attractive option across various industries.

Limited production scales can cause hindrances.

Closed-cell metal foam's potential is currently bottlenecked by its limited production volume. Unlike readily available materials churned out in massive quantities, closed-cell foams are still produced on a relatively small scale. This scarcity creates a double whammy. First, it restricts their overall availability. This can significantly hinder project timelines and adoption. Secondly, the limited scale can inflate costs further. Economies of scale play a crucial role in manufacturing. With low production volume, closed-cell foams miss out on this cost advantage, making them even more expensive compared to mass-produced materials. To unlock the full potential of closed-cell foams, ramping up production volume is essential. This can not only make them more readily available but also pave the way for cost reductions, ultimately leading to wider market adoption.

Technical complexities can create challenges.

Integrating closed-cell metal foams into existing manufacturing workflows isn't as seamless as it might seem. Their unique structure, characterized by the presence of numerous closed cells, throws a wrench into conventional joining and machining techniques. Traditional methods often used for metals can crush or tear the delicate cell walls, compromising the very properties that make these foams valuable. This is a similar challenge faced when machining closed-cell foams. Special techniques like laser welding or chemical bonding are needed, but these can be complex and require additional expertise. This incompatibility with established processes creates a hurdle for manufacturers, as they need to adapt their production lines or invest in new skill sets for successful integration. Addressing these joining and machining challenges is crucial for ensuring the smooth implementation of closed-cell foams into existing manufacturing paradigms.

Global Closed Cell Metal Foam Market Opportunities:

The closed-cell metal foam market is brimming with exciting opportunities, driven by its unique material properties and growing environmental concerns. The automotive industry stands as a prime example, where replacing heavier components with these lightweight foams can significantly improve fuel efficiency and vehicle performance. This translates to a reduced carbon footprint, aligning perfectly with the global push for sustainability. Beyond transportation, the construction sector offers vast potential. Closed-cell foams can be instrumental in soundproofing noisy environments, reinforcing structures for better earthquake resistance, and even creating energy-efficient building materials. The energy sector is another key player, with applications in battery technology (thermal management and impact protection) and lightweight components for wind turbines. Furthermore, the unique properties of closed-cell foams extend to consumer goods, fostering the development of high-performance sporting equipment that offers superior protection and maneuverability alongside advanced protective gear. However, unlocking the full potential of this market requires addressing some challenges. High production costs due to complex manufacturing processes can be a barrier for cost-sensitive industries. Limited production volume currently restricts wider availability and can further inflate costs. Additionally, joining and machining these foams can be difficult due to their structure, posing challenges when integrating them into existing manufacturing lines. Fortunately, advancements in manufacturing technology and a growing focus on sustainable solutions present significant opportunities. By bringing down production costs and raising awareness about the benefits of closed-cell metal foams, the market can witness wider adoption across various sectors. Ultimately, closed-cell metal foam has the potential to revolutionize industries by offering a unique combination of lightweight strength, exceptional energy absorption, and enhanced thermal management. As these foams become more cost-effective and easier to integrate into existing processes, we can expect to see them play a transformative role in the future of manufacturing and product design.

CLOSED CELL METAL FOAM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Material, Application, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ERG Aerospace Corporation (US), Cymat Technologies Ltd. (Canada), Alantum (South Korea), Ultramet (US), Mott Corporation (US), American Elements (US), Shanxi Putai Aluminum Foam Manufacturing Co. Ltd. (China), Nanoshel (US), Reade International Corp (US), SELEE Corporation (US) |

Closed Cell Metal Foam Market Segmentation: By Material

-

Aluminum

-

Copper

-

Zinc

-

Titanium

In the closed-cell metal foam market, aluminum is the largest and fastest-growing material. Its remarkable light weight, combined with its adaptability to many different industries, fuels its dominance. Aluminum's function as a lightweight substitute for heavy materials grows more and more important as businesses place a greater emphasis on efficiency and sustainability. The market is experiencing considerable expansion due to the increasing demand for closed-cell metal foam made of aluminum, which finds applications in various industries such as electronics, construction, and automotive.

Closed Cell Metal Foam Market Segmentation: By Application

-

Heat Exchangers

-

Anti-Intrusion Bars

-

Sound Absorbers

-

Others

Anti-intrusion bars are the largest and fastest-growing application. Robust anti-intrusion systems are becoming more and more necessary as safety rules in the automobile and construction sectors get stricter. The outstanding energy absorption capabilities of closed-cell metal foam, when paired with its lightweight nature, make it a perfect material for improving building and automobile safety. Furthermore, closed-cell metal foam has grown significantly in anti-intrusion bar applications due to ongoing improvements in material design and production techniques, which guarantee better crashworthiness and occupant safety.

Closed Cell Metal Foam Market Segmentation: By End-Users

-

Automotive

-

Aerospace

-

Building & Construction

-

Healthcare

-

Energy

-

Others

The largest and fastest-growing sector is the automotive industry. The introduction of closed-cell metal foam in the automotive production process is driven by the need for lightweight materials that can improve fuel efficiency and reduce emissions. The category is growing due in part to strict rules that attempt to reduce vehicle weight to fulfill environmental standards. The automobile sector continues to be at the forefront of utilizing closed-cell metal foam for improved performance and sustainability because of ongoing breakthroughs and advancements in materials technology.

Closed Cell Metal Foam Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The region that is expanding the largest and fastest is Asia-Pacific. Closed-cell metal foam is in high demand across a variety of industries, including electronics, construction, automotive, and aerospace. This need is being driven by rapid industrialization, urbanization, and infrastructure improvements in nations like China, India, and Japan. Moreover, rising R&D expenditures and the existence of significant market participants in the area support the industry's expansion. Moreover, the Asia-Pacific closed-cell metal foam market has grown significantly as a result of the increased emphasis on sustainability and the use of lightweight materials in production processes.

COVID-19 Impact Analysis on the Global Closed-Cell Metal Foam Market

The COVID-19 pandemic threw a curveball at the closed-cell metal foam market. Initial disruptions were evident as lockdowns hampered raw material availability and caused manufacturing delays. This resulted in shortages and production slowdowns, impacting the entire supply chain. Additionally, the decline in global industrial activity and a slump in car sales dampened demand for these foams in the automotive sector. However, there's a silver lining. As restrictions eased and economic activity rebounded, the demand for lightweight vehicles for improved fuel efficiency picked up again. This bodes well for the closed-cell metal foam market in the long run. Furthermore, the growing focus on sustainable solutions in various industries, along with advancements in manufacturing technology, is expected to accelerate market growth despite the temporary setbacks caused by the pandemic. Overall, while COVID-19 caused a temporary hiccup, the long-term outlook for the closed-cell metal foam market remains positive.

Latest trends/Developments

The closed-cell metal foam market is bubbling with exciting developments. Research is delving into creating metal foams with even higher strength-to-weight ratios, pushing the boundaries of lightweight performance. This is particularly interesting for the aerospace industry, where every gram saved translates to increased fuel efficiency and payload capacity. Additionally, advancements in 3D printing technology are opening doors for the creation of complex, customized closed-cell metal foam structures. This paves the way for lighter and more efficient components in various industries, from intricate heat sinks in electronics to bespoke soundproofing solutions in construction. Furthermore, sustainability is taking center stage. Researchers are exploring the use of recycled metals in foam production, reducing the environmental impact and aligning with the growing demand for eco-friendly solutions. These trends, coupled with ongoing efforts to bring down production costs and raise industry awareness, are poised to propel the closed-cell metal foam market toward a future filled with innovative applications and wider adoption across various sectors.

Key Players:

-

ERG Aerospace Corporation (US)

-

Cymat Technologies Ltd. (Canada)

-

Alantum (South Korea)

-

Ultramet (US)

-

Mott Corporation (US)

-

American Elements (US)

-

Shanxi Putai Aluminum Foam Manufacturing Co. Ltd. (China)

-

Nanoshel (US)

-

Reade International Corp (US)

-

SELEE Corporation (US)

Chapter 1. Closed Cell Metal Foam Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Closed Cell Metal Foam Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Closed Cell Metal Foam Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Closed Cell Metal Foam Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Closed Cell Metal Foam Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Closed Cell Metal Foam Market – By Material

6.1 Introduction/Key Findings

6.2 Aluminum

6.3 Copper

6.4 Zinc

6.5 Titanium

6.6 Y-O-Y Growth trend Analysis By Material

6.7 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. Closed Cell Metal Foam Market – By Application

7.1 Introduction/Key Findings

7.2 Heat Exchangers

7.3 Anti-Intrusion Bars

7.4 Sound Absorbers

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Closed Cell Metal Foam Market – By End-User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Aerospace

8.4 Building & Construction

8.5 Healthcare

8.6 Energy

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-User

8.9 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Closed Cell Metal Foam Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Closed Cell Metal Foam Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ERG Aerospace Corporation (US)

10.2 Cymat Technologies Ltd. (Canada)

10.3 Alantum (South Korea)

10.4 Ultramet (US)

10.5 Mott Corporation (US)

10.6 American Elements (US)

10.7 Shanxi Putai Aluminum Foam Manufacturing Co. Ltd. (China)

10.8 Nanoshel (US)

10.9 Reade International Corp (US)

10.10 SELEE Corporation (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global closed-cell metal foam market was valued at USD 57 million in 2023 and will grow at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 85.71 million by 2030.

Superior performance properties, expanding applications, and an emphasis on sustainability are the reasons that are driving the market.

Based on material type, the market is divided into aluminum, copper, zinc, and titanium.

Asia-Pacific is the most dominant region for the global closed-cell metal foam market.

ERG Aerospace Corporation, Cymat Technologies Ltd., Alantum, Ultramet, and Mott Corporation are the major players in the global closed-cell metal foam market.