Clinical Research Tools Market Size (2023 – 2030)

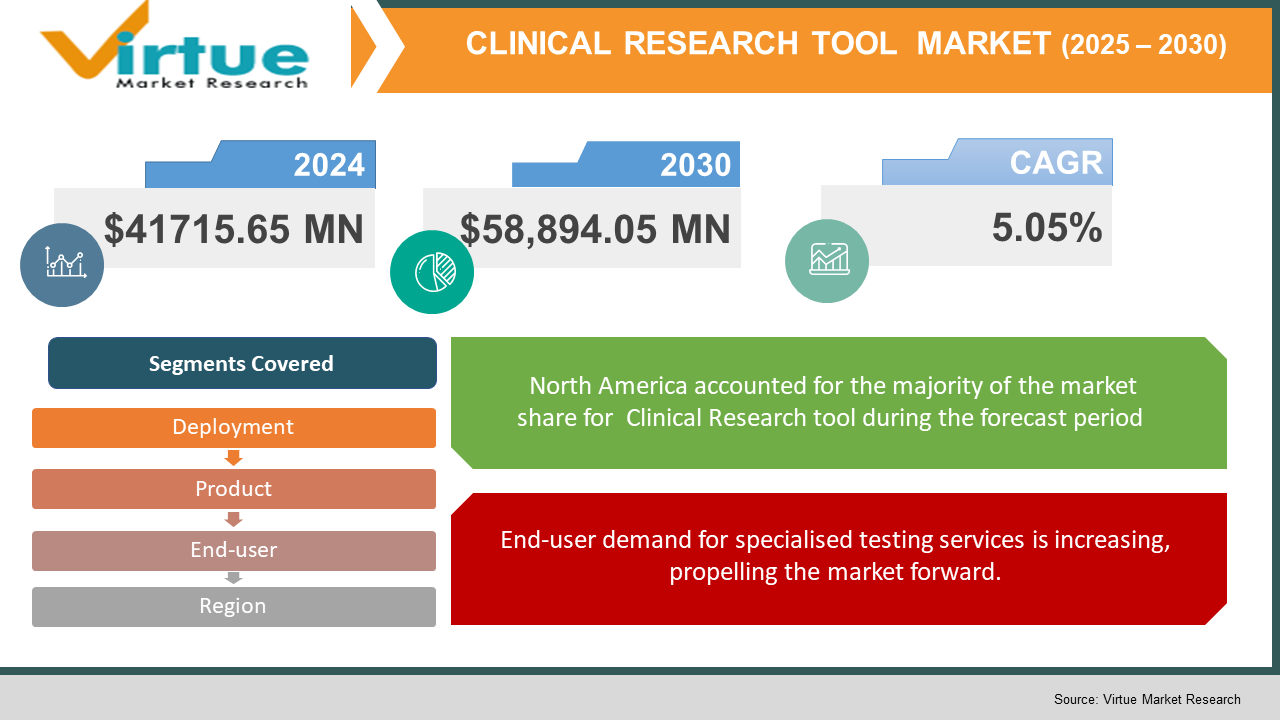

According to the report published by Virtue Market Research in Global Clinical Research Tool Market was valued at USD 41715.65 million and is projected to reach a market size of USD 58,894.05 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.05%.

Market Overview

A clinical research tool is a software system used to handle clinical trials in the biotechnology and pharmaceutical industries. The system's goal is to track and manage patient data. Clinical trial administration systems are made up of many software, hardware, and service components. The clinical trial management system feeds data to the business intelligence system, which works as a data hub, lowering the number of trials that are postponed.

More industry-academic cooperation, an increase in the number of clinical trials, technological advancements in the healthcare sector, and increased government backing for research studies are all driving the worldwide clinical trial management market forward. Furthermore, variables such as the increased prevalence of clinical trial management systems (CTMS) are ascribed to the increase in the number of CTMS.

Furthermore, clinical research tool system products are effective, simple to use, ensure patient safety and regulatory compliance, and improve financial management. For example, Environmental US Canada Response Team (ERT), a global clinical services organisation, announced the debut of data insight in December 2020 to improve research effectiveness and efficiency. Veeva, a cloud computing startup, also announced the debut of Reeva vault payment software, which is a programme utilised for Reeva vault, in January 2020. CTMS The market is expected to rise due to an increase in the number of clinical trials and the number of key companies developing innovative clinical trial management systems. (CTMS).

COVID-19 Impact on clinical research tool market

The global clinical research tool market has suffered as a result of the COVID-19 epidemic. The focus on finding a new COVID-19 vaccination and treatment has thrown off upcoming and ongoing clinical studies for various diseases all across the world. According to the International Nepal Epidemiological Association's journal, 69 per cent of responders were unable to perform ongoing clinical studies during the COVID-19 pandemic in 2020. The COVID-19 pandemic has had a significant impact on the clinical trial market, with a growing focus on generating novel treatments or vaccinations to prevent or treat the disease. COVID-19 has also resulted in a minor alteration in the way clinical trials are conducted. In recent years, there has been a surge in interest in virtual/decentralized trials.

MARKET DRIVERS

The market is growing because of an increase in clinical studies and the availability of improved CTMS technologies.

The number of clinical trials in the life sciences business grows every year around the world. The increased prevalence of chronic diseases, the expiration of blockbuster pharmaceuticals, the availability of government money for clinical trials, and severe competition in the pharmaceutical sector are all contributing to the increase in the number of clinical trials. Leading firms have introduced various CTMS solutions to the market in recent years that outperform their traditional counterparts. These devices are affordable, simple to use, and provide effective patient safety and regulatory compliance while also improving users' financial management capabilities.

End-user demand for specialised testing services is increasing, propelling the market forward.

In recent years, cooperating sooner in the medication development process to save time and money has become more popular. Companies are increasingly outsourcing specialised testing services early in the API process development cycle, such as Liquid Chromatography-Mass Spectrometry (LC/MS), RNA sequencing, gene expression analysis, wet chemistry analysis of compendia raw materials, trace metal analysis with Inductively Coupled Mass Spectrometry (ICP-MS), and various others. These specialist services are mostly utilised for structural elucidation of critical impurities, removal of class I and II solvents, risk analysis, column chromatography removal, and efforts to reduce overall cost and process efficiency.

MARKET RESTRAINTS

Budget constraints are impeding market expansion.

Due to limited private funding, stringent regulatory demands, and a bleak financial future, small and mid-sized client facilities frequently encounter financial limits for clinical trials. Ineffective site selection, poor study design & trial execution, safety concerns, and dropouts due to practical or budgetary constraints are all examples of this. Furthermore, the amount of time and money needed to finish a study grows with each phase. A Phase III failure's overall cost includes all previous stages' costs as well as time that could have been spent testing an alternative medicine. Each unsuccessful study adds to the escalating expenses of biopharmaceutical research and development. Although R&D spending in the life sciences business is increasing, start-ups and SMEs still confront financial constraints that influence their decision-making.

The market's expansion is being hampered by a scarcity of qualified personnel.

The lack of experienced individuals in research teams to handle complex digital solutions is limiting the market's growth. CROs and pharmaceutical corporations are hesitant to spend on training their research personnel due to severe time limitations and rising costs. As a result, there is a significant gap in the clinical research sector between available and required experienced labour, limiting the acceptance and use of complicated software solutions in clinical trials. For software manufacturers in this sector, developing user-friendly software solutions could be a crucial growth potential.

CLINICAL RESEARCH TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.05% |

|

Segments Covered |

By Product, Deployment, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IQVIA (US), LabCorp (US), Charles River Laboratories (US), WuXi AppTec (China), Syneos Health (US), and PPD (US), and ICON Plc (US). |

Clinical Research tool Market - by Product

-

Software

-

Services

In 2021, the software sector held more than 76.9% of the clinical research instrument market share, with a predicted 11.7 per cent growth rate through 2030. Among other things, the programme provides key duties like thorough trial planning, nation & site progress, and monitoring operations. In addition, the growing number of clinical studies around the world will raise the acceptance rate, boosting industry value over the forecast period. Furthermore, advances in CTMS software will hasten the launch of new products by ensuring better management of clinical trial data supplied by biotech and pharmaceutical companies, thereby meeting industry demand.

Clinical Research tool Market - by deployment

-

Web-hosted

-

On-premise

-

Cloud-based

In 2021, the web-based segment market was worth USD 514.7 million. The most popular clinical research tools are web-based solutions. The high growth rate can be ascribed to several benefits associated with web-based solutions, including remote data access and low technical concerns. CTMS stores, updates, and backs up data in secure enterprise-class data centres daily. Web-based software also enables data centralization, making data accessible from any place. They also help to reduce the costs of system security, backups, updates, and uptime consistency.

Clinical Research tool Market - by end-user

-

Pharma

-

Medical Device Manufacturers

-

CROs

By 2030, pharmaceuticals will be valued at roughly USD 1.1 billion. Pharma and biotech businesses will drive the market forward by increasing their use of clinical trial management system software in various clinical studies for new drug development. Furthermore, the increased prevalence of chronic diseases such as cancer, heart disease, neurological disease, and infectious disease would necessitate the development of more new medications to treat them. As a result, the demand for clinical research tools will rise as pharma and biopharma businesses invest more in the discovery of new medications.

Clinical Research tool Market - by region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

The total clinical trial management systems market was dominated by North America, with the United States emerging as the leading contributor. Increased research and development spending, as well as an increase in demand for medication development, are assisting the country's market's expansion. According to ClinicalTrials.gov, there are now 358,156 clinical trials in 2020, with locations in all 50 states and 218 countries, compared to roughly 285,679 clinical trials in 2018. Increased financing for clinical research, combined with an increase in the number of studies and clinical trials, is expected to boost corporate growth.

Pharmaceutical companies research and development budgets have also increased in recent years, owing to a greater focus on regulating markets, complicated compounds, and therapy segments. Pharmaceutical companies in the United States spend more money, time, and energy on research and development than other industries. The overall amount spent on research and development (R&D) by member companies is predicted to reach USD 91 billion by 2020, according to the PhRMA Annual Membership Survey for 2021.

As a result, the increase in research and development activities, as well as clinical trials in the area, is likely to raise demand for clinical trial management systems, which would help the market growth over the forecast period.

The clinical trial management system market is predicted to grow rapidly in the Asia Pacific region. The presence of less stringent regulatory guidelines in comparison to developed nations, a large patient base, a faster rate of patient recruitment for clinical trials than mature nations, low operating costs for conducting clinical trials, a shortage of trial volunteers in Europe and North America, and the growing number of pharmaceutical companies are among the major factors driving the Asia Pacific market's growth.

Clinical Research tool Market by company

Since the market is so competitive, large pharmaceutical companies are investing heavily in research and development, particularly in emerging markets, to obtain market share in the major regions. Strategic alliances between pharmaceutical corporations and contract research organisations are projected to have a substantial impact on market growth. In the following years, only a few new firms are projected to enter the industry.

The rapid adoption of modern technologies for enhanced healthcare is also a crucial factor determining the competitive nature. Major players are also frequently active in mergers, acquisitions, and new product launches to retain shares and extend their product line. The major companies in the market include

-

IQVIA (US)

-

LabCorp (US)

-

Charles River Laboratories (US)

-

WuXi AppTec (China)

-

Syneos Health (US)

-

PPD (US)

-

ICON Plc (US)

RECENT HAPPENING IN THE CLINICAL RESEARCH TOOL MARKET IN THE RECENT PAST.

-

PRODUCT LAUNCH: In January 2022, Clarify Health announced the launch of Clarify Trials, cloud software. As they negotiate the Food and Drug Administration's (FDA) 2020 recommendation to promote diversity in clinical trials, this solution enables life sciences companies and clinical research organisations (CROs) to proactively minimise health inequalities without excessive trial delays, budget overruns, or protocol revisions.

-

RESEARCH AND DEVELOPMENT: In December 2021, Pfizer Inc. revealed the full results of its Phase 2/3 EPIC-HR (Evaluation of Protease Inhibition for COVID-19 in High-Risk Patients) trial of its innovative COVID-19 oral antiviral candidate PAXLOVID.

-

PARTNERSHIPS: In March 2022, THREAD established a partnership with Amazon Web Services. AWS will help with the development of new THREAD platform capabilities, such as scalable automation and built-in AI, to enable faster and more efficient trials by allowing for higher-quality data collection throughout the clinical study's lifespan.

Chapter 1.CLINICAL RESEARCH TOOL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.CLINICAL RESEARCH TOOL MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.CLINICAL RESEARCH TOOL MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.CLINICAL RESEARCH TOOL MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. CLINICAL RESEARCH TOOL MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.CLINICAL RESEARCH TOOL MARKET – By Product

6.1. Software

6.2. Services

Chapter 7.CLINICAL RESEARCH TOOL MARKET – By Deployment

7.1. Web-hosted

7.2. On-premise

7.3. Cloud-based

Chapter 8.CLINICAL RESEARCH TOOL MARKET – By End-User

8.1. Pharma

8.2. Medical Device Manufacturers

8.3. CROs

Chapter 9.CLINICAL RESEARCH TOOL MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.CLINICAL RESEARCH TOOL MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10. 1. IQVIA (US)

10.2. LabCorp (US)

10.3. Charles River Laboratories (US)

10.4. WuXi AppTec (China)

10.5. Syneos Health (US)

10.6. PPD (US)

10.7. ICON Plc (US)

Download Sample

Choose License Type

2500

4250

5250

6900