Clean Label Ingredients Market Size (2024 – 2030)

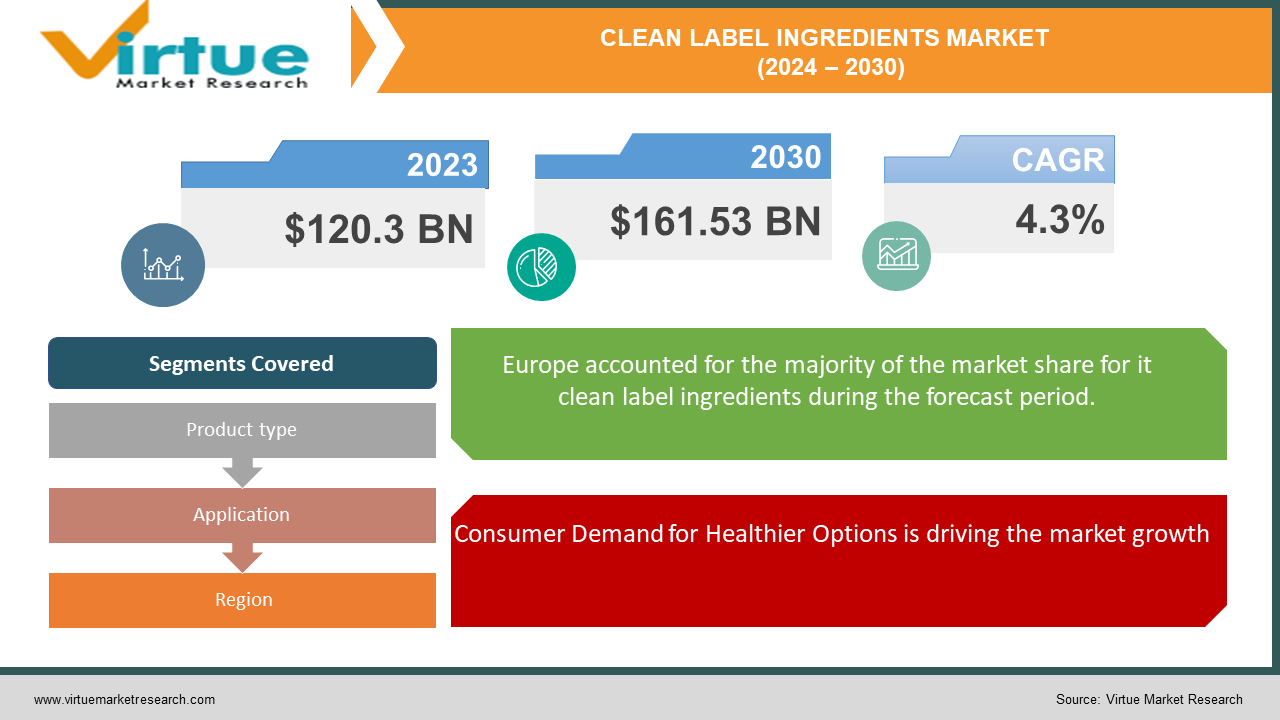

The Global Clean Label Ingredients Market was valued at USD 120.3 billion in 2023 and will grow at a CAGR of 4.3% from 2024 to 2030. The market is expected to reach USD 161.53 billion by 2030.

The Clean Label Ingredients Market caters to the growing consumer demand for transparency and natural food options. This market focuses on ingredients derived from natural sources with minimal processing and free from artificial additives or preservatives. Driven by health-conscious consumers, the market is experiencing significant growth with increasing demand for clean label ingredients across all regions, particularly North America. However, challenges like higher costs, limited ingredient availability, and potential performance limitations require innovative solutions from manufacturers.

Key Market Insights:

There is a rising consumer demand for healthier and more transparent food options, with a preference for recognizable and natural ingredients. Increased health consciousness and concerns about artificial additives and preservatives.

Clean label product launches are surging due to the aforementioned consumer demand.

Specific ingredients gaining traction include clean label fruit & vegetable ingredients, natural colors and flavors, and plant-based alternatives for sugar, dairy, and meat.

Europe with a market share of 31.5% is the most dominant region for the Clean Label Ingredients Market.

Global Clean Label Ingredients Market Drivers:

Consumer Demand for Healthier Options is driving the market growth

The tide is turning towards health-conscious consumers who prioritize what goes on their plates. This shift is driven by a desire for transparency and a belief that simpler translates to healthier. Clean labels, featuring recognizable ingredients free from artificial additives and chemicals, resonate with this movement. Consumers want to understand what they're putting in their bodies, and clear labels empower them to make informed choices. This focus on natural ingredients goes beyond just avoiding the unfamiliar; it's linked to a perception of increased health benefits. By opting for clean label products, consumers feel confident they're nourishing themselves with better-for-you ingredients, fueling a growing demand that's shaping the future of the food industry.

Shifting Preferences Away from Artificial Ingredients is driving market growth

Public trust in the long list of artificial ingredients found in processed foods is eroding. Consumers are wary of unfamiliar chemical names and potential health risks associated with artificial additives, preservatives, and colorings. This skepticism fuels a growing preference for clean label products that boast recognizable, natural ingredients. The perception is that if you can understand what's on the label, it must be better for you. This focus on whole foods and minimal processing goes beyond just avoiding the unpronounceable; it taps into a desire for a more natural approach to eating. Clean label ingredients are seen as a return to simpler times, where food came from recognizable sources and didn't require a chemistry degree to decipher the ingredients list. This shift in preference presents a significant challenge to food manufacturers, who must adapt by developing innovative and functional clean label ingredients that can compete with their artificial counterparts.

Advancements in Food Technology are driving the market growth

Fueled by consumer demand for clean label products, food science is experiencing a renaissance in innovation. Researchers are constantly developing new ingredients that meet clean label criteria, meaning they are derived from natural sources and minimally processed. This focus goes beyond simply avoiding artificial additives and preservatives. Food scientists are also working on creating clean label ingredients that can replicate the functionality of their artificial counterparts. Texture, mouthfeel, and shelf life are all crucial aspects of food product development, and clean label ingredients must be able to deliver on these fronts as well. Advances in areas like fermentation, enzyme technology, and extraction techniques are opening doors to a new generation of functional clean label ingredients. This ongoing innovation is essential for the future of the clean label movement, allowing manufacturers to create delicious, healthy, and transparent food products that meet the evolving demands of today's consumers.

Global Clean Label Ingredients Market challenges and restraints:

Supply Chain Constraints are restricting the market growth

Sourcing clean label ingredients throws a curveball at manufacturers aiming to meet the rising consumer demand for transparency and natural ingredients. Unlike conventional ingredients with established, large-scale production, clean label options often face limitations in availability. This can be due to several factors. Certain clean label ingredients may come from specific regions with limited growing areas or require specific growing conditions, making them more susceptible to disruptions from weather or disease. Additionally, the organic or minimally processed nature of clean label ingredients sometimes means lower yields compared to conventionally grown crops. These limitations translate to challenges in securing consistent supply throughout the year, potentially leading to price hikes as manufacturers compete for available resources. Ultimately, these supply chain constraints can disrupt production schedules and make it difficult for manufacturers to consistently deliver clean label products, potentially frustrating both themselves and the consumers they're trying to reach.

Deceptive Labeling is restricting the market growth

Deceptive labeling practices by some manufacturers threaten the entire clean label movement, posing a significant challenge. Consumers seeking transparency and natural ingredients can be misled by vague terms or outright falsehoods on product packaging. This "cleanwashing" involves using terms like "all-natural" or "free-from" when the product may still contain artificial ingredients or have undergone significant processing. These deceptive tactics erode consumer trust, leaving them unsure which products are genuinely clean labels and hindering their ability to make informed choices. The consequences are far-reaching. Consumers who are misled may feel betrayed and abandon clean label products altogether. Additionally, responsible manufacturers who prioritize clean ingredients face an unfair disadvantage in the marketplace. Stronger regulations and clear labeling standards are crucial to combat deceptive practices and rebuild consumer trust in the clean label movement.

Market Opportunities:

The clean-label ingredients market is brimming with exciting opportunities for companies that can capitalize on the surging consumer demand for healthier, more transparent food options. This shift presents a goldmine for producers of natural, minimally processed ingredients. Functional ingredients that deliver health benefits like added fiber, protein, or probiotics are particularly hot, as they cater to the trend of holistic wellness. Innovation in areas like plant-based alternatives, particularly for meat and dairy, holds immense potential as consumers seek natural substitutes without sacrificing taste or texture. Furthermore, the growing demand for sustainable and ethically sourced ingredients presents an opportunity for companies that can demonstrate responsible practices throughout their supply chain. Emerging markets, particularly in Asia, offer fertile ground for clean label products as a growing middle class prioritizes health and transparency. By staying ahead of the curve in ingredient development, catering to specific dietary needs, and demonstrating a commitment to sustainability, companies can position themselves to win big in the thriving clean label ingredients market.

CLEAN LABEL INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Cargill Incorporated, Ingredion Incorporated, E. I. du Pont de Nemours and Company, Kerry Group plc, Tate & Lyle PLC, Roquette Frères, DowDuPont Inc., Naturex S.A |

Clean Label Ingredients Market Segmentation - by Application

-

Beverages

-

Bakery and Confectionery

-

Sauces and Condiments

-

Dairy and Frozen Desserts

-

Meat and Meat Products

The beverage industry holds the dominant position in the clean label ingredients market. This is driven by several factors: firstly, the sheer volume of beverages consumed globally. Secondly, the rise of functional and health-oriented beverages like organic juices, kombucha, and protein shakes creates a strong demand for clean label ingredients. Consumers are particularly interested in clear labeling for these products, as they often associate them with specific health benefits. Finally, innovation in clean label sweeteners and natural flavors is making it easier for beverage manufacturers to develop healthier and more transparent beverage options, further solidifying the beverage segment's leadership in the clean label ingredients market.

Clean Label Ingredients Market Segmentation - By Product Type

-

Food Colorants

-

Food Flavors and Enhancers

-

Food Sweeteners

-

Food Preservatives

-

Food Hydrocolloids

The most dominant one is currently Food Hydrocolloids. These ingredients play a multifunctional role, thickening, gelling, stabilizing, and texturizing food products without resorting to artificial additives. This aligns perfectly with the clean label philosophy of using minimally processed, natural ingredients to achieve desired textures and functionalities.

Clean Label Ingredients Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe boasts the largest market share due to a long-standing focus on unprocessed foods and stricter regulations that promote clear labeling. Consumers in Europe are highly informed and willing to pay a premium for clean label products. However, Asia-Pacific is the fastest-growing market, fueled by a rising middle class with increasing disposable income and a growing desire for healthier options. This region presents a massive opportunity for clean label ingredient manufacturers, particularly in China and India.

COVID-19 Impact Analysis on the Global Clean Label Ingredients Market

The COVID-19 pandemic acted as a double-edged sword for the clean label ingredients market. Initially, supply chains were disrupted due to lockdowns and restrictions, making it difficult to source certain clean label ingredients. This posed a challenge for manufacturers and could have potentially hampered growth. However, the overall impact of COVID-19 was largely positive for the market. Heightened health consciousness during the pandemic led consumers to prioritize healthier food options. Transparency in labeling became even more important, as people wanted to understand the ingredients in the food they were consuming to boost their immunity. This shift in consumer behavior fueled a surge in demand for clean label products, which in turn, increased the demand for clean label ingredients. Additionally, the pandemic accelerated the growth of e-commerce and online grocery shopping. Clean label manufacturers were quick to adapt by expanding their online presence and distribution channels, making it easier for consumers to access these sought-after products. Overall, the COVID-19 pandemic, despite initial challenges, ultimately served as a catalyst for the clean label ingredients market, accelerating its growth trajectory.

Latest trends/Developments

The clean label ingredients market is a dynamic space constantly evolving to meet consumer preferences. One key trend is the rise of functional clean label ingredients. These go beyond simply being natural; they deliver specific health benefits like added protein, fiber, or probiotics. This taps into the growing interest in holistic wellness and empowers consumers to make targeted dietary choices. Another exciting development is in the realm of plant-based alternatives. With consumers seeking natural substitutes for meat and dairy, innovation in plant-based ingredients is flourishing. Manufacturers are developing clean label solutions that mimic the taste, texture, and functionality of animal products, making plant-based options even more appealing. Sustainability is also at the forefront, with a growing demand for clean label ingredients sourced responsibly and ethically. Companies that prioritize sustainable practices throughout their supply chain are well-positioned to capitalize on this trend. Finally, the market is witnessing a surge in clean label ingredient options for specific dietary needs. This caters to the rise of food allergies, intolerances, and preferences like gluten-free, keto, or paleo. By providing solutions that cater to these diverse needs, clean label ingredient manufacturers can ensure they stay relevant in a constantly evolving market.

Key Players:

-

Archer Daniels Midland Company

-

Cargill Incorporated

-

Ingredion Incorporated

-

E. I. du Pont de Nemours and Company

-

Kerry Group plc

-

Tate & Lyle PLC

-

Roquette Frères

-

DowDuPont Inc.

-

Naturex S.A

Chapter 1. Clean Label Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Clean Label Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Clean Label Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Clean Label Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Clean Label Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Clean Label Ingredients Market – By Application

6.1 Introduction/Key Findings

6.2 Beverages

6.3 Bakery and Confectionery

6.4 Sauces and Condiments

6.5 Dairy and Frozen Desserts

6.6 Meat and Meat Products

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Clean Label Ingredients Market – By Product Type

7.1 Introduction/Key Findings

7.2 Food Colorants

7.3 Food Flavors and Enhancers

7.4 Food Sweeteners

7.5 Food Preservatives

7.6 Food Hydrocolloids

7.7 Y-O-Y Growth trend Analysis By Product Type

7.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Clean Label Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Product Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Product Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Product Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Product Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Product Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Clean Label Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Cargill Incorporated

9.3 Ingredion Incorporated

9.4 E. I. du Pont de Nemours and Company

9.5 Kerry Group plc

9.6 Tate & Lyle PLC

9.7 Roquette Frères

9.8 DowDuPont Inc.

9.9 Naturex S.A

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Clean Label Ingredients Market was valued at USD 120.3 billion in 2023 and will grow at a CAGR of 4.3% from 2024 to 2030. The market is expected to reach USD 161.53 billion by 2030.

Advancements in Food Technology and Consumer Demand for Healthier Options are the reasons that are driving the market.

Based on product type it is divided into five segments – Food Colorants, Food Flavors and Enhancers, Food Sweeteners, Food Preservatives, Food Hydrocolloids

Europe is the most dominant region for the Clean Label Ingredients Market.

Tate & Lyle PLC, Roquette Frères, DowDuPont Inc., Naturex S.A