Clean Label Emulsifier Market Size (2024-2030)

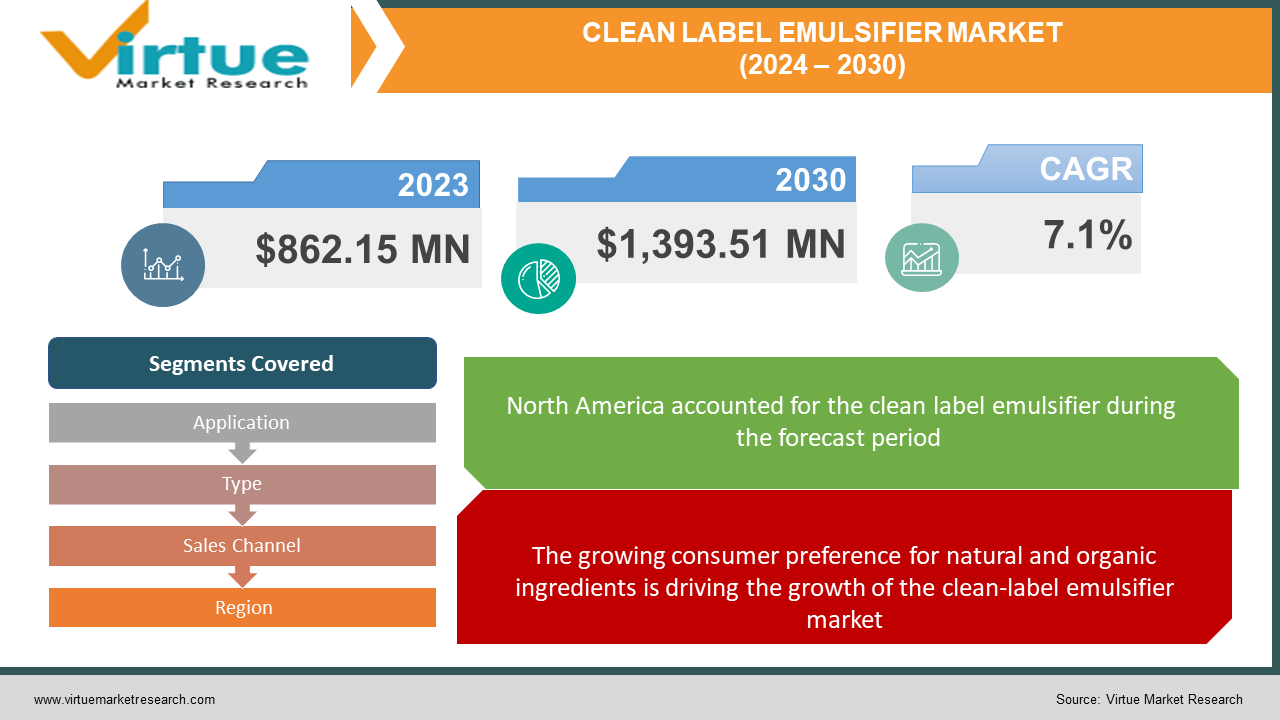

The Global Clean Label Emulsifier Market was valued at USD 862.15 Million and is projected to reach a market size of USD 1,393.51 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.1%.

A clean-label emulsifier is a food ingredient that stabilizes food products by combining oil and water. Clean-label emulsifiers are different from regular emulsifiers in that they are made without artificial additives from natural sources like dairy, eggs, and plant oils. They enhance the shelf life, texture, and nutritional value of foods like dressings and sauces. Clean-label emulsifiers are preferred by those who prefer natural ingredients in their food. They might not be as safe or easily accessible as synthetic alternatives, though, and there may be health risks associated with them, such as toxicity, antinutrients, and a possible link between saponins and cancer.

Key Market Insights:

Clean-label emulsifiers have been gaining traction in the global market as consumers show a preference for products free of artificial additives and preservatives. Numerous industries, including the dairy and baking sectors, use these emulsifiers.

To keep up with the growing demand, manufacturers are releasing new goods. For instance, InnovoPro introduced CP-Pro 70 concentrate, a clean-label chickpea protein, in February 2024. It's nutrient-dense, easily absorbed, and dissolves in both hot and cold foods. It can also bind fat and water efficiently, keeping it stable on the shelf.

Global Clean Label Emulsifier Market Drivers:

The growing consumer preference for natural and organic ingredients is driving the growth of the clean-label emulsifier market.

Manufacturers of organic food additives are modifying their production procedures in order to produce goods with a clean label. These ingredients can be found in a variety of food products, including vegan meals and sauces. Businesses are changing their recipes to accommodate customers' inclinations toward natural and organic components. For instance, clean-label emulsifier EvanesseCB6194, derived from vegan chickpea broth, was introduced by Ingredion Inc. This is a vegan-friendly choice that satisfies the growing demand for clean labeling. In a similar vein, in response to the growing demand for bright organic food colorants, Diana Food is introducing a new line of organic colors for food and drink in Europe.

A perfect replacement for synthetic emulsifiers to boost the clean-label emulsifier market

In the food industry, clean-label emulsifiers are becoming more and more popular as a result of the clean-label movement. These natural emulsifiers are thought to be healthier than their synthetic counterparts and have several health benefits. Benefits of clean-label emulsifiers include decreased risk of gastrointestinal disorders and increased stability of the product. Because of these emulsifiers' beneficial effects on health, consumers are becoming more and more interested in them. In response to the demand for natural and chemical-free ingredients from the clean-label movement, manufacturers are creating new, natural emulsifiers to replace popular synthetic ones.

Clean Label Emulsifier Market Challenges and Restraints:

Even though clean-label emulsifiers are in high demand, many customers are not aware of what they entail. A mere 34% of individuals possess a comprehensive comprehension of clean-label emulsifiers, which are linked to natural, pesticide-free, and additive-free attributes. The market's potential is hampered by this lack of knowledge. It is challenging for manufacturers to introduce natural alternatives to chemical emulsifiers and phase them out completely. Furthermore, using natural emulsifiers excessively can have negative effects that prevent market growth. Even though efforts are made to adhere to clean label regulations, some innovations—like those based on the complex of whey protein and pectin—may have drawbacks that compromise the stability of emulsions.

Clean Label Emulsifier Market Opportunities:

Meeting the growing demand for clean-label enzymes, as consumers prefer natural and transparent ingredients, is one of the market's opportunities. Producing products with components that are simple to understand will draw in more customers. Ongoing research and development can lead to novel enzyme solutions with enhanced capabilities. Enzymes can be made more effective by investing in cutting-edge technologies and opening up new applications for them.

CLEAN LABEL EMULSIFIER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.1% |

|

Segments Covered |

By Application, Type, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kerry, Evonic Industries, BASF Nutrition, Musim Mas, CP Kelco, Nexira, Kewpie, Rousselot, Gelita, Palsgaard |

Global Clean Label Emulsifier Market Segmentation: By Application

-

Baking

-

Dairy processing

-

Oils and Fats derivative processing

-

Others

The clean-label emulsifier market is heavily influenced by the baking sector, which also contributes significantly to its revenue. This is a result of the growing demand for clean-label baked goods such as bread, cakes, pastries, and cookies from consumers who prefer natural and uncomplicated ingredients in their food. Over the course of the forecast period, the dairy processing segment is expected to grow at a high Compound Annual Growth Rate (CAGR). The need to enhance the texture, stability, and shelf life of dairy products like cheese, yogurt, butter, and ice cream has led to a rise in the use of clean-label emulsifiers.

Global Clean Label Emulsifier Market Segmentation: By Type

-

Plant-based

-

Animal-based

In the clean-label emulsifier market, plant-based emulsifiers are predicted to grow at the fastest rate in the upcoming years. The rising demand for clean-label products and the growing appeal of vegetarianism and veganism are the main drivers of this growth. Since plant-based emulsifiers come from sources like soy, sunflower, and rapeseed, they are a popular option for customers looking for natural and sustainable ingredients. Animal-based emulsifiers currently rule the market because of their superior functional attributes, which give food products texture and stability. Because they are affordable and readily available, they are also extensively utilized in the food industry. On the other hand, the growing demand for clean-label products is anticipated to propel the market for plant-based emulsifiers in the coming years.

Global Clean Label Emulsifier Market Segmentation: By Sales Channel

-

B2B

-

B2C

-

Online

-

Offline

Due to strong demand from food producers and processors, the clean-label emulsifier market is anticipated to be dominated by the B2B (business-to-business) segment. Suppliers, manufacturers, and processors of food products that use clean-label emulsifiers fall into this category. Demand in the B2B market is being driven by the growing inclination of consumers towards clean-label food items, which has resulted in greater use of clean-label emulsifiers in food processing. However, the growing consumer demand for clean-label food products is expected to propel the B2C (business-to-consumer) category's rapid growth. With the increasing popularity of e-commerce platforms, it is anticipated that the online channel in the B2C market will expand at a faster rate than the physical channel. Online channels make it simple for consumers to purchase a variety of clean-label food products, including those that contain clean-label emulsifiers.

Global Clean Label Emulsifier Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With a sizable share of the global clean-label emulsifier market's revenue, North America is the market leader. This is a result of the region's strict laws governing food safety and labeling, the presence of important players, and consumers' strong awareness of and preference for natural and organic products. With a high Compound Annual Growth Rate (CAGR) over the projected period, the clean-label emulsifiers market is growing at the fastest rate in the Asia-Pacific region. A number of factors, including rising disposable income, urbanization, the demand for convenience foods, rising health consciousness among local consumers, and the uptake of clean-label products, are blamed for this growth.

COVID-19 Impact on the Global Clean Label Emulsifier Market:

The clean-label emulsifier market has been greatly affected globally by the COVID-19 pandemic. The pandemic's effects on the supply chain have made it difficult to get the parts needed to produce clean-label emulsifiers. Due to this scarcity, clean-label emulsifiers are now more expensive. Furthermore, the market for natural clean-label emulsifiers has decreased as a result of restrictions on the hotel and food service industries. As a result, fewer of these emulsifiers are being sold. There has been a decrease in the production of natural clean-label emulsifiers as a result of the pandemic's effects on labor and resource availability. Notwithstanding these obstacles, the market for clean-label emulsifiers is predicted to rise in the near future due to consumers' growing inclination for natural and clean-label products.

Latest Trend/Development:

A significant manufacturer of food ingredients, Ingredion, unveiled its newest production facility in September 2023. This move indicated efforts to expand manufacturing capacity, which may lead to a rise in the production of clean-label emulsifiers.

In response to the increasing demand from consumers for clean-label emulsifiers, DuPont Nutrition and Bioscience launched new natural emulsifiers in February 2022. The goal of this action is to give consumers more options when it comes to natural and clean-label ingredients.

Key Players:

-

Kerry

-

Evonic Industries

-

BASF Nutrition

-

Musim Mas

-

CP Kelco

-

Nexira

-

Kewpie

-

Rousselot

-

Gelita

-

Palsgaard

Market News:

In the fiercely competitive clean-label enzymes market, businesses are concentrating on cutting-edge technologies. Major players are dedicated to satisfying the needs of contemporary consumers by providing premium goods with clean label certifications. To meet these demands, they make large investments in research and development. Introducing novel enzymes created especially for the dairy and baking industries is a crucial tactic. As a result, their market presence is strengthened and their position as industry leaders is cemented.

Chapter 1. Clean Label Emulsifier Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Clean Label Emulsifier Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Clean Label Emulsifier Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Clean Label Emulsifier Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Clean Label Emulsifier Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Clean Label Emulsifier Market – By Application

6.1 Introduction/Key Findings

6.2 Baking

6.3 Dairy processing

6.4 Oils and Fats derivative processing

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Clean Label Emulsifier Market – By Type

7.1 Introduction/Key Findings

7.2 Plant-based

7.3 Animal-based

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Clean Label Emulsifier Market – By Sales Channel

8.1 Introduction/Key Findings

8.2 B2B

8.3 B2C

8.4 Online

8.5 Offline

8.6 Y-O-Y Growth trend Analysis By Sales Channel

8.7 Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 9. Clean Label Emulsifier Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By By Sales Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By Sales Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By Sales Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By Sales Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By Sales Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Clean Label Emulsifier Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Kerry

10.2 Evonic Industries

10.3 BASF Nutrition

10.4 Musim Mas

10.5 CP Kelco

10.6 Nexira

10.7 Kewpie

10.8 Rousselot

10.9 Gelita

10.10 Palsgaard

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

A food ingredient called a clean-label emulsifier is used to bind water and oil together in a stable state. It generally contains no artificial additives, preservatives, or other synthetic compounds and is sourced from natural sources such as plant oils, eggs, and dairy products.

The Global Clean Label Emulsifier Market was valued at USD 862.15 Million and is projected to reach a market size of USD 1,393.51 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.1%.

The market for clean-label emulsifiers is expanding due to consumers' increasing the g preference for natural and organic ingredients and an ideal substitute for artificial emulsifiers to stimulate the market for clean-label emulsifiers

Even though clean-label emulsifiers are in high demand, many customers are not aware of what they entail. A mere 34% of individuals possess a comprehensive comprehension of clean-label emulsifiers, which are linked to natural, pesticide-free, and additive-free attributes. It is challenging for manufacturers to introduce natural alternatives to chemical emulsifiers and phase them out completely.

Asia-Pacific is the fastest-growing region of the global Clean Label Emulsifier.