Classical Photopolymers Market Size (2024 –2030)

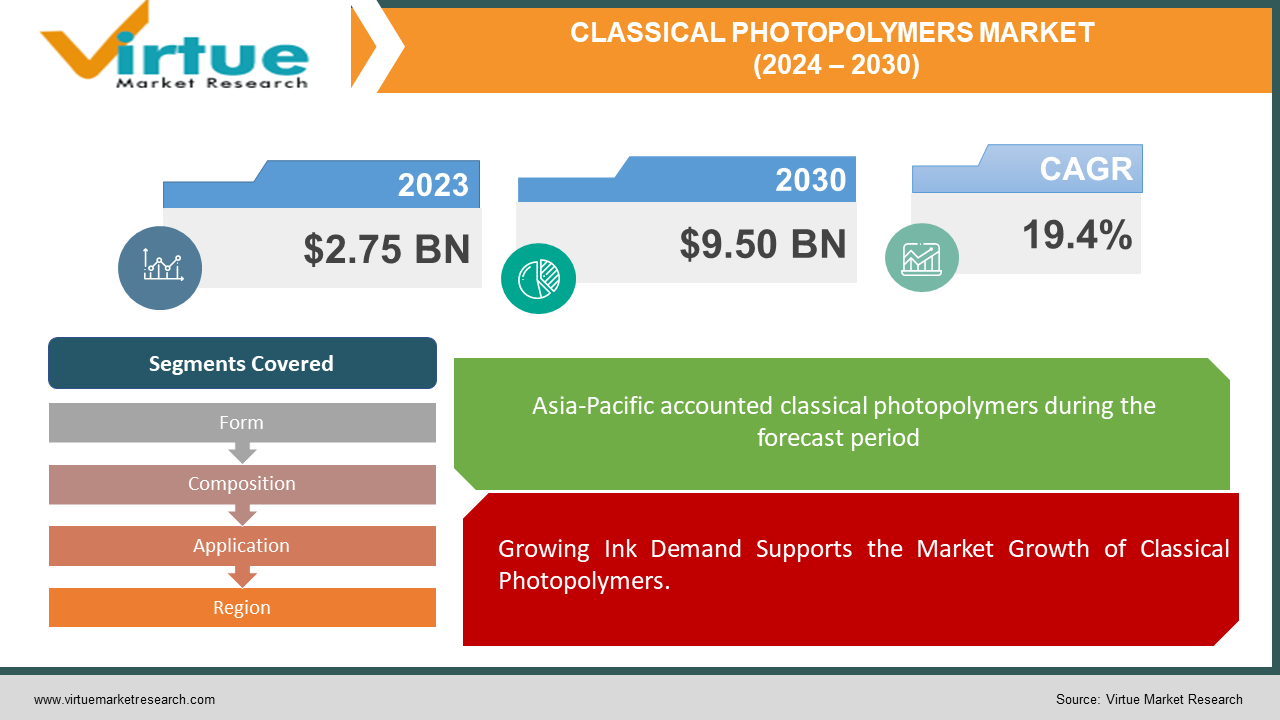

The Global Classical Photopolymers Market was estimated to be worth USD 2.75 billion in 2023 and is projected to reach a value of USD 9.50 billion by 2030, growing at a CAGR of 19.4% during the forecast period 2024-2030.

Particular types of plastics known as photopolymers change in response to light, particularly ultraviolet (UV) and visible light. UV light is applied to polymers, oligomers, or monomers to create them. Acrylics, polyamides, epoxies, and other materials that contribute to their physical characteristics are frequently the basis for photopolymers. The process of creating photopolymers begins with the addition of certain chemicals known as photo-initiators. When exposed to light, these substances are essential for starting the polymerization process. Photo-initiators come in various forms, such as cationic and free radical varieties.

Key Market Insights:

The market share of radical photopolymers is approximately 65%, while the market share of cationic photopolymers is around 35%. Photopolymers used in the electronics industry accounted for nearly 40% of the total market demand. The average price of classical photopolymers ranges between $3.5 and $6 per kilogram, depending on the type and application. There are numerous applications for photopolymers, including offset, flexography, and gravure printing technologies. The global consumption of classical photopolymers is estimated to be around 1.2 million metric tons per year. They are also utilized in the medical field to create adhesives, coatings, and photoresists.

Global Classical Photopolymers Market Drivers:

Growing Ink Demand Supports the Market Growth of Classical Photopolymers.

Photopolymers are excellent for printing because they produce crisp images and have good ink transfer. The need for printing inks is growing as more products require labels with specific information. For instance, food products in India are required by law to have particular information on digital labels, such as "best before" dates and manufacturing details. In a similar vein, the EU is developing new regulations for labeling medical equipment, which will also result in a greater demand for ink for printing. The market for photopolymers is expanding due to the rising demand for labels and printing inks.

Growing 3D printing demand in the medical field could boost the market for traditional photopolymers

Healthcare is using 3D printing more and more for a variety of purposes, including the creation of medical devices, tissues, organs, and customized medications. When compared to thermoplastics, photopolymers are preferred because of their enhanced flexibility, impact strength, and temperature resistance. The European Commission projects a notable increase in public healthcare spending by 2060, reflecting the growing investment in healthcare services. The photopolymer resin market will rise as a result of the healthcare sector's globalization.

Classical Photopolymers Market Challenges and Restraints:

Although photopolymer has numerous applications in a variety of industries, these uses are frequently specialized. Photopolymer resins are not as durable as strong injection molding materials, and they can distort over time when subjected to high loads. Moreover, photopolymer resins, such as liquid resin, can be highly costly—much more so than conventional plastic filaments. These elements might restrict the market for photopolymer resin's future expansion.

Classical Photopolymers Market Opportunities:

The market for traditional photopolymers is expanding significantly as a result of the rising need for 3D printing materials in sectors like aerospace, automotive, and healthcare. Photopolymers are indispensable for 3D printing techniques like digital light processing (DLP) and stereolithography (SL). They provide excellent resolution, robustness, and adaptability for producing intricate components and prototypes. Furthermore, photopolymers power sophisticated manufacturing techniques that facilitate quick iterations in product development and the manufacture of complex components with intricate designs. Photopolymers are widely used in film/sheet formats for holograms, photoresists, and printing plates to meet the needs of industries that need durable substrates and high-resolution printing. The market's potential is found in the applications' ongoing growth, which is being fueled by changing printing technologies and industrial demands. This development reflects the market's shift toward addressing particular industry demands and advancing manufacturing technology.

CLASSICAL PHOTOPOLYMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.4% |

|

Segments Covered |

By Form, Composition, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Anderson and Vreeland, Chemence, Dsm, Flint Group, Formlabs, Kivi Marking, Macdermid Inc, Nexa3D, Nitto Denko, Photocentric |

Global Classical Photopolymers Market Segmentation: By Form

-

Film

-

Liquid

-

Solution

Based on their physical state, traditional photopolymers are sold in three different forms on the market: film/sheet, liquid, and solution. Holograms, photoresists, and printing plates are among the common applications for film/sheet photopolymers. The two primary applications of liquid photopolymers in 3D printing are stereolithography (SL) and digital light processing (DLP). Coatings and adhesives are two applications for solution-form photopolymers. The market is expanding at the quickest rate for traditional photopolymers in liquid form because 3D printing is becoming more and more popular in sectors like healthcare, automotive, aerospace, and defense. Future growth is anticipated to continue at this rate. Film/sheet photopolymers presently have the biggest market share among the various forms. They are extensively employed in applications where durability, high-resolution printing, and ink transfer are necessary. It is anticipated that the market for traditional photopolymers in sheets and films will continue to grow.

Global Classical Photopolymers Market Segmentation: By Composition

-

Polymers

-

Acrylics

-

Polyvinyl Alcohol

-

Polyisoprene, Polyamides,

-

Epoxies

-

Polyimides

-

Nitrile Rubber

-

Others

-

Additives

-

Oligomers

-

Monomers

-

Photoinitiators

-

Others

In the global market for traditional photopolymers, oligomers play a significant role, particularly due to their high demand in 3D printing applications. Low molecular weight polymers called oligomers give photopolymers their strength, flexibility, and durability. They also have an impact on adhesion, shrinkage, and rate of curing. Oligomers come in a variety of forms, such as those from the styrene, olefin, glycerol, and methacrylate families. Polymers hold the largest market share and are the dominant sector in the traditional photopolymer market. The mechanical, thermal, and optical characteristics of photopolymers are determined by high molecular weight compounds called polymers. They are employed in many different processes and applications, including holography, offset, flexography, and gravure printing, as well as photoresists. Acrylics, polyvinyl alcohol, polyisoprene, polyamides, epoxies, polyimides, and nitrile rubber are common polymers used in traditional photopolymers.

Global Classical Photopolymers Market Segmentation: By Application

-

3D Imaging

-

Printing Inks

-

Photoresists

-

Rubber Stamps

-

Coatings and Adhesives

-

Others

The increased use of 3D printing in sectors such as healthcare, automotive, aerospace, and defense is driving rapid growth in the 3D imaging segment of the global market for traditional photopolymers. This section creates custom, detailed, high-resolution models and images using liquid photopolymers, such as poly jet photopolymers and stereolithography (SL). Printing inks hold the largest market share and are the dominant sector in the traditional photopolymer market. Printing inks create plates for offset, flexography, gravure, and other printing techniques using film/sheet photopolymers. Because photopolymers have superior resolution, durability, and ink transfer qualities, the market for printing ink is growing.

Global Classical Photopolymers Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The global market for traditional photopolymers is expanding at the quickest rate in the Asia-Pacific area as a result of rising economic development, urbanization, and industrialization in nations like South Korea, Japan, China, and India. The demand for conventional photopolymers is increased by these countries' use of 3D printing and imaging technologies in the healthcare, automotive, aerospace, and defense sectors. In terms of market share, North America dominates the global market for traditional photopolymers. The 3D printing industry in North America is experiencing rapid growth, fueled by the support of industry leaders such as Stratasys Inc. and 3D Systems Corporation. This growth in North America is further supported by government regulations and investments that support 3D printing technology in the healthcare, education, research, and defense sectors.

COVID-19 Impact on the Global Classical Photopolymers Market:

The COVID-19 pandemic has caused global instability, which has left the world in a crisis. Delays in the supply chain, problems with logistics, and opposition to globalization have resulted in shortages of necessities. Healthcare facilities are making a concerted effort to make the most of their beds, equipment, and knowledgeable personnel. Production facilities create the supplies and machinery required for basic services, particularly in the medical field. The extensive application of 3D printing holds promise for building a robust advanced manufacturing network. The 'art-to-part' factories are manufacturing facilities that can be situated in transit hubs and hospitals to fulfill the demands of the medical sector promptly. The need for photopolymer resins is still great despite the pandemic, and 3D printing has helped handle the COVID-19 emergency.

Latest Trend/Development:

The market for traditional photopolymers is expanding significantly due to the quick rise of 3D printing applications, especially in consumer goods, automotive, aerospace, and healthcare industries. Liquid photopolymers are widely used in 3D printing processes such as stereolithography (SL) and digital light processing (DLP) because they can be cured layer by layer with light, producing detailed and long-lasting 3D printed objects. The need for materials with superior resolution, a smooth surface finish, and mechanical qualities appropriate for end-use applications is driving this demand. Furthermore, film/sheet photopolymers are essential for holograms, photoresists, and printing plates, particularly in flexography, gravure, and offset printing. These photopolymers are preferred because they transfer ink onto substrates efficiently, resulting in prints with intricate designs that are durable and high-resolution. The focus on liquid photopolymers highlights the market's emphasis on advanced 3D printing materials that can satisfy the various demands of industries looking for high-quality, adaptable, and effective manufacturing solutions. The expanding utilization of classical photopolymers is indicative of their adaptability and efficacy in facilitating inventive applications within contemporary manufacturing technologies.

Key Players:

-

Anderson and Vreeland

-

Chemence

-

Dsm

-

Flint Group

-

Formlabs

-

Kivi Marking

-

Macdermid Inc

-

Nexa3D

-

Nitto Denko

-

Photocentric

Chapter 1. CLASSICAL PHOTOPOLYMERS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. CLASSICAL PHOTOPOLYMERS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. CLASSICAL PHOTOPOLYMERS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. CLASSICAL PHOTOPOLYMERS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. CLASSICAL PHOTOPOLYMERS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. CLASSICAL PHOTOPOLYMERS MARKET – By Form

6.1 Introduction/Key Findings

6.2 Film

6.3 Liquid

6.4 Solution

6.5 Y-O-Y Growth trend Analysis By Form

6.6 Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. CLASSICAL PHOTOPOLYMERS MARKET – By Composition

7.1 Introduction/Key Findings

7.2 Polymers

7.3 Acrylics

7.4 Polyvinyl Alcohol

7.5 Polyisoprene, Polyamides,

7.6 Epoxies

7.7 Polyimides

7.8 Nitrile Rubber

7.9 Others

7.10 Additives

7.11 Oligomers

7.12 Monomers

7.13 Photoinitiators

7.14 Others

7.15 Y-O-Y Growth trend Analysis By Composition

7.16 Absolute $ Opportunity Analysis By Composition , 2024-2030

Chapter 8. CLASSICAL PHOTOPOLYMERS MARKET – By Application

8.1 Introduction/Key Findings

8.2 3D Imaging

8.3 Printing Inks

8.4 Photoresists

8.5 Rubber Stamps

8.6 Coatings and Adhesives

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. CLASSICAL PHOTOPOLYMERS MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Form

9.1.3 By Composition

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Form

9.2.3 By Composition

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Form

9.3.3 By Composition

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Form

9.4.3 By Composition

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Form

9.5.3 By Composition

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. CLASSICAL PHOTOPOLYMERS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Anderson and Vreeland

10.2 Chemence

10.3 Dsm

10.4 Flint Group

10.5 Formlabs

10.6 Kivi Marking

10.7 Macdermid Inc

10.8 Nexa3D

10.9 Nitto Denko

10.10 Photocentric

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

When exposed to light, a photopolymer, a kind of polymer, changes in characteristics. Under the ultraviolet and visible portions of the electromagnetic spectrum, photopolymers change their characteristics.

The Global Classical Photopolymers Market was estimated to be worth USD 2.75 billion in 2023 and is projected to reach a value of USD 9.50 billion by 2030, growing at a CAGR of 19.4% during the forecast period 2024-2030.

Increasing Demand for Printing Inks and Increasing Demand for 3D printing in the Healthcare Industry are the drivers of the Global Classical Photopolymers Market.

Drawbacks Associated with Photopolymer may hamper the growth of the classical photopolymers market.

The liquid form is the fastest growing in the Global Classical Photopolymers Market.