Circulating Tumor Cells Market Size (2025 – 2030)

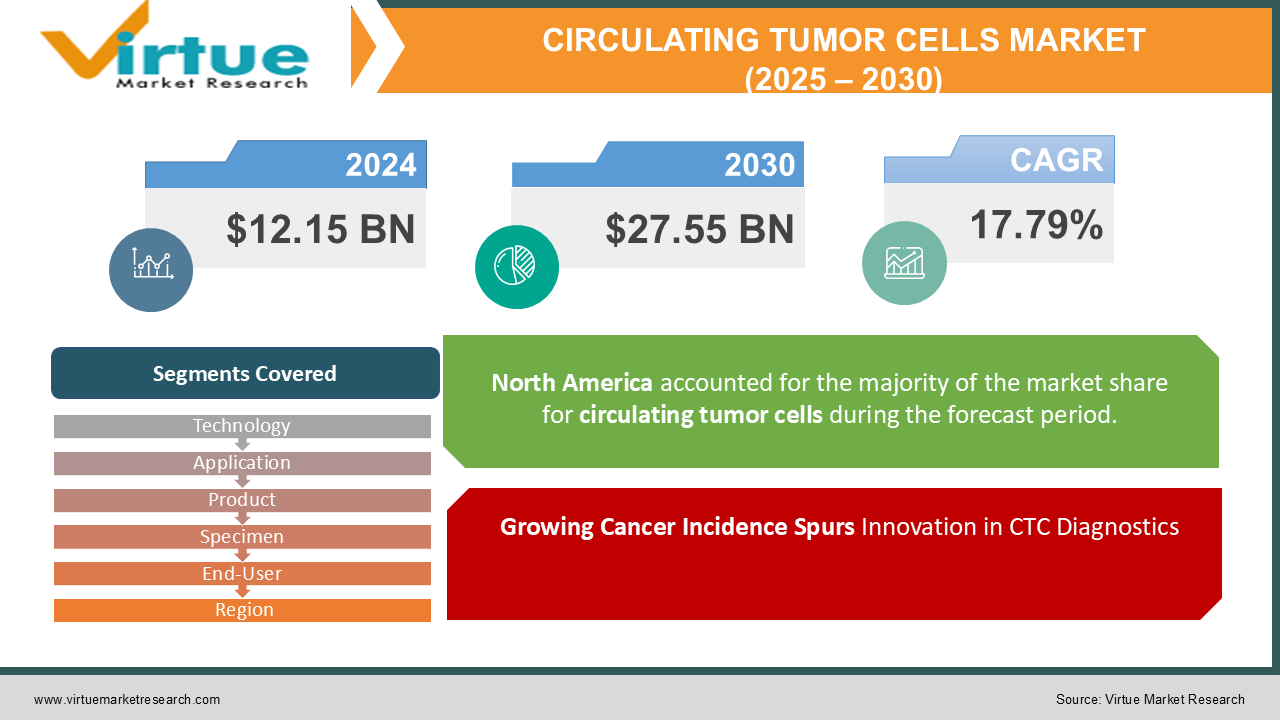

The Global Circulating Tumor Cells Market was valued at USD 12.15 billion in 2024 and is projected to reach a market size of USD 27.55 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 17.79%.

The Circulating Tumor Cells (CTCs) market is a rapidly enhancing segment in the field of liquid biopsy and cancer diagnostics. CTCs are cancer cells that detach from primary tumors and enter the bloodstream, serving as critical biomarkers for early cancer detection, disease monitoring, and treatment decision-making. Advances in microfluidics, molecular analysis, and immunoassay technologies have significantly improved the detection and isolation of CTCs, enhancing their clinical applications. The rising prevalence of cancer, increasing focus on personalized medicine, and growing investments in liquid biopsy research are key factors propelling the expansion of the Circulating Tumor Cells market.

Key Market Insights:

-

The Circulating Tumor Cells (CTCs) market is witnessing significant growth due to advancements in liquid biopsy technologies. Studies show that CTC detection can predict cancer progression with up to 90% accuracy, making it a crucial tool for oncologists. The increasing incidence of cancer worldwide, coupled with a shift toward non-invasive diagnostic methods, has fueled the demand for CTC-based testing. Research indicates that CTCs can be found in approximately 70% of metastatic cancer patients, reinforcing their potential in real-time cancer monitoring.

-

Technological innovations in microfluidics and molecular characterization have enhanced CTC isolation efficiency by over 80%, enabling precise identification and classification of cancer cells. The development of next-generation sequencing (NGS) and artificial intelligence (AI)-driven analysis has further enhanced the accuracy of CTC profiling, aiding in targeted therapies. Clinical trials have demonstrated that liquid biopsy methods, including CTC analysis, can detect cancer recurrence months before conventional imaging techniques, offering a critical advantage in early intervention.

-

The integration of CTC testing in personalized medicine is gaining traction, with research revealing that patients receiving treatment adjustments based on CTC count experience a 30% higher survival rate. Additionally, pharmaceutical companies are leveraging CTCs for drug development and therapy response monitoring, reducing clinical trial timelines by up to 25%. The demand for non-invasive diagnostics, along with regulatory approvals for CTC-based tests, is expected to further accelerate market growth in the coming years.

Circulating Tumor Cells Market Drivers:

Growing Cancer Incidence Spurs Innovation in CTC Diagnostics

The rising incidence of cancer across the globe is a key driver for the circulating tumor cells (CTC) market, as early detection significantly improves patient outcomes. With millions of new cases diagnosed annually, the demand for advanced diagnostic tools like CTC analysis is surging. The ability of CTC detection to offer a non-invasive method for cancer monitoring further accelerates its adoption in clinical settings.

Advancements in Liquid Biopsy Technologies Enhancing CTC Detection Accuracy

Innovations in liquid biopsy and molecular diagnostics are revolutionizing the detection and characterization of circulating tumor cells. Better sensitivity and specificity in CTC detection technologies are enabling better cancer prognosis, treatment monitoring, and personalized therapies. Continuous R&D efforts in the field are making CTC-based diagnostics more reliable and accessible, contributing to market expansion.

Growing Demand for Personalized Medicine Fueling CTC-Based Diagnostics

The shift towards precision medicine is influencing the demand for CTC analysis as it provides real-time insights into tumor biology. By enabling oncologists to tailor treatments based on individual patient profiles, CTC technologies are playing a crucial role in improving therapy effectiveness. As pharmaceutical companies focus on developing targeted cancer therapies, the need for CTC-based monitoring tools is expected to rise.

Increasing Clinical Trials and Research Investments Supporting Market Growth

Pharmaceutical and biotech companies, along with research institutions, are seriously investing in clinical trials to explore the full potential of circulating tumor cell analysis. The growing focus on integrating CTC detection in cancer drug development and treatment response assessment is boosting its adoption. As regulatory approvals for CTC-based diagnostic tests increase, the market is expected to witness steady growth in the coming years.

Circulating Tumor Cells Market Restraints and Challenges:

High Costs and Technical Complexities Hindering Widespread Adoption

Despite its potential in cancer diagnostics and treatment monitoring, the circulating tumor cells (CTC) market faces various challenges, primarily due to the high costs associated with CTC detection technologies. Advanced liquid biopsy techniques require sophisticated equipment and specialized expertise, making them expensive and limiting their accessibility, especially in developing regions. Additionally, the isolation and characterization of CTCs remain technically complex because of their rarity in the bloodstream, leading to inconsistent detection rates and potential inaccuracies. Regulatory hurdles and the need for extensive clinical validation further slowdown the commercialization of CTC-based diagnostic tests, posing challenges to widespread adoption.

Circulating Tumor Cells Market Opportunities:

The circulating tumor cells (CTC) market shows significant opportunities driven by advancements in liquid biopsy technologies and the rising demand for non-invasive cancer diagnostics. The increasing focus on early cancer detection, prognosis, and treatment monitoring has positioned CTC analysis as a critical tool in precision oncology. Additionally, ongoing research in CTC characterization and molecular profiling is paving the way for targeted therapies, enhancing personalized treatment approaches. The integration of artificial intelligence (AI) and machine learning (ML) in CTC detection and analysis further enhances accuracy and efficiency, opening new avenues for innovation. Growing investments in biotechnology and expanding clinical applications are expected to accelerate the market's growth, particularly in regions with strong healthcare infrastructure

CIRCULATING TUMOR CELLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

17.79% |

|

Segments Covered |

By Technology, Application, Product, Specimen,End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Menarini Silicon Biosystems, Qiagen N.V., Bio-Techne Corporation, BioFluidica, Thermo Fisher Scientific Inc., Miltenyi Biotec GmbH, Creatv MicroTech, Inc., Precision for Medicine, Greiner Bio-One International GmbH, Advanced Cell Diagnostics, Inc. (A Bio-Techne Brand) |

Circulating Tumor Cells Market Segmentation: By Technology

-

CTC Detection & Enrichment Methods

-

CTC Direct Detection Methods

-

CTC Analysis

CTC Detection & Enrichment Methods dominate the circulating tumor cells (CTC) market because of their widespread clinical applications, high sensitivity, and ability to isolate rare CTCs from blood samples, making them essential for early cancer detection and monitoring. These methods, including immunomagnetic separation and microfluidics-based techniques, provide higher purity and yield, ensuring accurate downstream analysis. Additionally, continuous advancements in isolation techniques are improving efficiency, reducing processing time, and increasing their adoption in both research and clinical settings.

CTC Analysis is the fastest-growing sub-segment, influenced by advancements in genomic and proteomic profiling, which enable personalized treatment plans and targeted therapy selection. The increasing adoption of next-generation sequencing (NGS) and AI-driven analytics in CTC characterization is accelerating its growth, further strengthening its role in precision oncology. Furthermore, the rising interest in liquid biopsy as a non-invasive cancer diagnostic tool is propelling demand for CTC analysis, making it a crucial component of modern cancer research and treatment strategies.

Circulating Tumor Cells Market Segmentation: By Application

-

Clinical/Liquid Biopsy

-

Research

Clinical/Liquid Biopsy dominates the circulating tumor cells (CTC) market as it plays a crucial role in non-invasive cancer diagnostics, treatment monitoring, and personalized medicine. The increasing preference for liquid biopsies over traditional tissue biopsies is driving its adoption, as they offer real-time insights into tumor progression and therapeutic response. With increasing FDA approvals and advancements in biomarker-based CTC detection, liquid biopsy is becoming an essential tool in oncology, reducing patient discomfort while improving diagnostic accuracy.

Research is the fastest-growing sub-segment, driven by the rising focus on cancer biology, drug development, and precision medicine. The raising funding for cancer research, coupled with technological advancements in single-cell analysis and next-generation sequencing (NGS), is fueling the demand for CTCs in research applications. Additionally, collaborations between academic institutions and biotech companies are accelerating innovation in CTC-based studies, further expanding its scope in understanding metastasis and discovering new therapeutic targets.

Circulating Tumor Cells Market Segmentation: By Product

-

Kits & Reagents

-

Blood Collection Tubes

-

Devices or System

Kits & Reagents dominate the circulating tumor cells (CTC) market fueled by their essential role in sample preparation, isolation, and analysis. These products are widely used in both clinical and research settings, enabling efficient detection and characterization of CTCs. The increasing adoption of liquid biopsy and advancements in molecular diagnostics are further boosting demand for high-quality kits and reagents. Additionally, ongoing innovations in assay sensitivity and specificity are enhancing the reliability of CTC detection, making them indispensable in oncology applications.

Devices or Systems are the fastest-growing, driven by the continuous advancements in automated CTC detection and enrichment technologies. The growing demand for high-throughput, user-friendly platforms for real-time CTC analysis is propelling market expansion. Emerging microfluidic-based and AI-integrated systems are further improving accuracy and efficiency, enabling better clinical decision-making. With increasing investments in cancer diagnostics and personalized medicine, this segment is poised for significant growth in the coming years.

Circulating Tumor Cells Market Segmentation: By Specimen

-

Blood

-

Bone Marrow

-

Other Body Fluids

Blood is the dominant specimen contributing in the circulating tumor cells (CTC) market, as it is the most commonly used and minimally invasive sample for liquid biopsy. Blood-based CTC detection enables real-time cancer monitoring, early diagnosis, and treatment response evaluation, making it a preferred choice for clinicians and researchers. The ease of sample collection, high patient compliance, and continuous advancements in blood-based CTC enrichment and detection technologies contribute to its widespread adoption. Additionally, blood samples provide valuable molecular insights that help in guiding personalized treatment strategies.

Bone Marrow is the fastest-growing because of its critical role in detecting metastatic and hematological cancers. As a rich source of tumor cells, bone marrow samples offer highly specific and sensitive detection of CTCs, particularly in leukemia and other blood-related malignancies. Advancements in bone marrow aspiration techniques, along with increasing research on CTC characterization from this specimen, are fueling its growth. Moreover, its potential in monitoring disease progression and treatment efficacy in high-risk cancer patients is driving its increasing utilization.

Circulating Tumor Cells Market Segmentation: By End-User

-

Research & Academic Institutes

-

Hospitals and Clinics

-

Diagnostic Centers

Research & Academic Institutes dominate the circulating tumor cells (CTC) market as they perform at the forefront of cancer research, biomarker discovery, and drug development. These institutions conduct extensive studies on CTC detection, enrichment, and analysis, contributing to advancements in liquid biopsy technologies. Government and private funding for cancer research, along with collaborations with biotech firms, further strengthen their dominance

Hospitals and Clinics are the fastest-growing end-user segment because of the increasing adoption of liquid biopsy for cancer diagnosis, prognosis, and treatment monitoring. With a rising number of cancer cases worldwide, hospitals and clinics are integrating CTC-based tests into routine clinical practice, enhancing early cancer detection and personalized therapy. The demand for non-invasive diagnostic solutions, coupled with advancements in automated CTC detection technologies, is accelerating the segment’s growth.

Circulating Tumor Cells Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the dominant position in the circulating tumor cells (CTC) market, contributing for the largest share of approximately 37%. The region's dominance is driven by advanced healthcare infrastructure, high adoption of liquid biopsy techniques, significant R&D investments, and a strong presence of key industry players. The increasing prevalence of cancer, coupled with favorable government initiatives and reimbursement policies, further strengthens North America's leadership in the market.

Asia-Pacific is the fastest-growing region, projected to expand at the highest CAGR in the coming years. This rapid growth is driven by rising cancer cases, improving healthcare facilities, increasing awareness about liquid biopsy technologies, and growing investments in precision medicine. Countries such as China, Japan, and India are experiencing significant developments in cancer diagnostics and treatment, with a surge in research activities and collaborations between healthcare organizations and biotech firms.

COVID-19 Impact Analysis on the Global Circulating Tumor Cells Market:

The COVID-19 pandemic had a mixed impact on the circulating tumor cells (CTC) market, affecting both demand and supply dynamics. Initially, the market witnessed disruptions in clinical trials and research activities, as hospitals and healthcare institutions prioritized COVID-19 patients, leading to delays in cancer diagnostics and treatment procedures. This significantly impacted liquid biopsy-based cancer detection, slowing down the adoption of CTC technologies. Additionally, supply chain disruptions affected the production and distribution of essential diagnostic products, including blood collection tubes, reagents, and detection kits.

However, as the pandemic progressed, the demand for minimally invasive diagnostic techniques increased, with an increased preference for liquid biopsy over traditional tissue biopsies. Telemedicine and remote patient monitoring also gained momentum, encouraging further research in non-invasive cancer diagnostics, including CTC detection.

Latest Trends/ Developments:

The integration of artificial intelligence (AI) and machine learning (ML) in CTC analysis is revolutionizing cancer diagnostics by enhancing accuracy, detection speed, and predictive capabilities. AI-powered image recognition and data analysis are enabling researchers to identify rare CTCs more effectively, leading to early-stage cancer detection and personalized treatment planning. This trend is expected to enhance precision oncology, allowing for tailored therapies based on real-time patient data.

Another major development is the advancement in microfluidic technologies for CTC isolation and enrichment. Microfluidics-based platforms offer higher sensitivity and specificity in capturing CTCs from blood samples, reducing the reliance on traditional, time-consuming methods. These advancements are making liquid biopsy more accessible and cost-effective, driving its adoption in both research and clinical settings. The market is also experiencing a shift toward single-cell analysis for deeper tumor profiling. Researchers are focusing on studying CTCs at a single-cell level to uncover genetic mutations, drug resistance mechanisms, and tumor heterogeneity. This is opening new avenues for targeted therapies and precision medicine, particularly for aggressive cancers such as breast, lung, and prostate cancer.

Key Players:

-

Menarini Silicon Biosystems

-

Qiagen N.V.

-

Bio-Techne Corporation

-

BioFluidica

-

Thermo Fisher Scientific Inc.

-

Miltenyi Biotec GmbH

-

Creatv MicroTech, Inc.

-

Precision for Medicine

-

Greiner Bio-One International GmbH

-

Advanced Cell Diagnostics, Inc. (A Bio-Techne Brand)

Chapter 1. Circulating Tumor Cells Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Circulating Tumor Cells Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Circulating Tumor Cells Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Circulating Tumor Cells Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Circulating Tumor Cells Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Circulating Tumor Cells Market – By Technology

6.1 Introduction/Key Findings

6.2 CTC Detection & Enrichment Methods

6.3 CTC Direct Detection Methods

6.4 CTC Analysis

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2025-2030

Chapter 7. Circulating Tumor Cells Market – By Product

7.1 Introduction/Key Findings

7.2 Kits & Reagents

7.3 Blood Collection Tubes

7.4 Devices or System

7.5 Y-O-Y Growth trend Analysis By Product

7.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 8. Circulating Tumor Cells Market – By Application

8.1 Introduction/Key Findings

8.2 Clinical/Liquid Biopsy

8.3 Research

8.4 Y-O-Y Growth trend Analysis By Application

8.5 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Circulating Tumor Cells Market – By Specimen

9.1 Introduction/Key Findings

9.2 Wired Sensors

9.3 Wireless Sensors

9.4 Y-O-Y Growth trend Analysis By Specimen

9.5 Absolute $ Opportunity Analysis By Specimen, 2025-2030

Chapter 10. Circulating Tumor Cells Market – By End Use

10.1 Introduction/Key Findings

10.2 Research & Academic Institutes

10.3 Hospitals and Clinics

10.4 Diagnostic Centers

10.5 Y-O-Y Growth trend Analysis Construction

10.6 Absolute $ Opportunity Analysis Construction, 2025-2030

Chapter 11. Circulating Tumor Cells Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Technology

11.1.2.1 By Product

11.1.3 By By Application

11.1.4 By End Use

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Technology

11.2.3 By Product

11.2.4 By By Application

11.2.5 By Specimen

11.2.6 By End Use

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Technology

11.3.3 By Product

11.3.4 By By Application

11.3.5 By Specimen

11.3.6 By End Use

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Technology

11.4.3 By Product

11.4.4 By By Application

11.4.5 By Specimen

11.4.6 By End Use

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Technology

11.5.3 By Product

11.5.4 By By Application

11.5.5 By Specimen

11.5.6 By End Use

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Circulating Tumor Cells Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Menarini Silicon Biosystems

12.2 Qiagen N.V.

12.3 Bio-Techne Corporation

12.4 BioFluidica

12.5 Thermo Fisher Scientific Inc.

12.6 Miltenyi Biotec GmbH

12.7 Creatv MicroTech, Inc.

12.8 Precision for Medicine

12.9 Greiner Bio-One International GmbH

12.10 Advanced Cell Diagnostics, Inc. (A Bio-Techne Brand)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Circulating Tumor Cells Market was valued at USD 12.15 billion in 2024 and is projected to reach a market size of USD 27.55 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 17.79%.

Advancements in liquid biopsy and rising cancer prevalence drive the market.

Based on Application, the Global Circulating Tumor Cells Market is segmented into Clinical/Liquid Biopsy and Research.

North America is the most dominant region for the Global Circulating Tumor Cells Market.

Menarini Silicon Biosystems, Qiagen N.V., Bio-Techne Corporation, BioFluidica are the leading players in the Global Circulating Tumor Cells Market.