Global Chitin Glucosamine in Animal Feed Market Size (2024 - 2030)

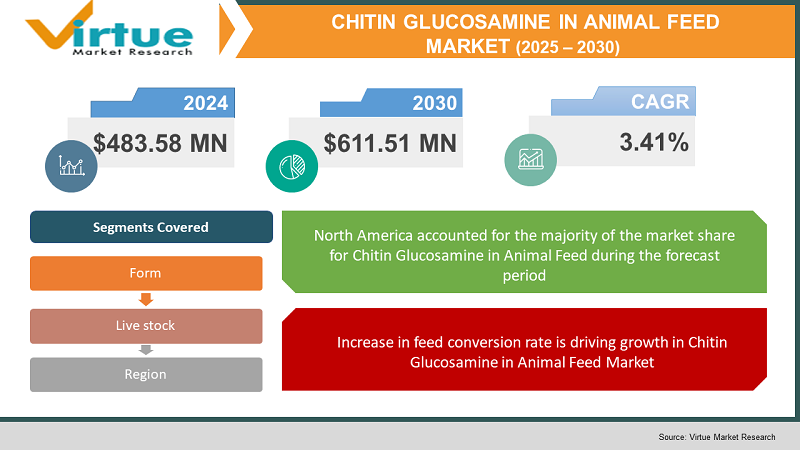

The Global Chitin Glucosamine in Animal Feed Market was valued at USD 483.58 Million in 2023 and is projected to reach a market size of USD 611.51 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.41%.

Industry Overview:

Products like animal feeds are in charge of enhancing animals' health. Different feed dosages are given depending on the animal. During the projection period, chances for expansion in the animal feed market will be fuelled by rapid urbanisation, increased consumption of meat, and other end products like milk and eggs in various areas. By supplying increased nutrients together with the feed, promoting rapid growth and weight gain, and fostering immunity, the feed enhances the animal's capabilities.

COVID-19 Impact:

In terms of confirmed cases and reported deaths as of July 2021, the US, India, Brazil, Russia, Spain, France, the UK, Turkey, and Italy were among the nations that had been most severely impacted. Due to lockdowns, travel restrictions, and business closures, the COVID-19 is having an impact on the economies and many businesses in various nations. The closing of numerous production facilities and factories has had a severe influence on the production, delivery schedules, and sales of items on the international market. Additionally, the additional international travel restrictions imposed by nations in Europe, Asia-Pacific, and North America are having an impact on commercial partnerships and cooperation. The food and beverage industry is suffering tremendous losses as a result of the Covid-19 outbreak, which is further harming the global economy. The transportation network and the raw material supply have both been significantly hampered. The availability of raw materials has been adversely affected by the disrupted value chain, which is having an effect on the expansion of the animal feed market. However, as people are purchasing goods from online retailers, the need for animal feed is anticipated to increase as businesses plan to resume their operations. Additionally, the businesses that produce animal feed are taking safety precautions to combat the coronavirus. These include limiting direct contact with delivery people and visitors, enforcing and communicating good hygiene practises, conducting thorough sanitations, and preventing employee contact during shift changes. With all of these reasons, it can be assumed that the demand for these products will increase in the post-pandemic period.

MARKET DRIVERS

Increase in commercial livestock production is driving growth in Chitin Glucosamine in Animal Feed Market

The key drivers of market expansion are an increase in commercial livestock production and increased demand for meat and other animal-based goods. A growing demand for dairy and meat products as a source of different nutrients is being driven by expanding consumer health consciousness, which is favourably affecting the demand for animal feed. The market is expanding significantly in part due to rising consumer awareness of the health advantages of animal feed additives derived from algae. In order to supplement animal feed with nutrients during the infancy of livestock development, microalgae are crucial. It also encourages physical development while insuring the production of meat, milk, and eggs of the highest calibre.

Increase in feed conversion rate is driving growth in Chitin Glucosamine in Animal Feed Market

The feed conversion rate has grown as a result of the modernization of animal farming, which has principally boosted demand for ingredients in animal feed that are high in protein. To aid in weight gain and the production of meat high in protein, industrially farmed livestock are typically fed concentrates produced from cereal and vegetable protein, including soybean meals. Animals raised for food rely substantially on proteins and other nutrients as the basis for healthy growth. Animal feeds contain a lot of energy-dense proteins that also contain vital amino acids like lysine and methionine as well as minerals like calcium and phosphorus.

MARKET RESTRAINTS

Supply chain issues are restraining growth in Chitin Glucosamine in Animal Feed Market

Protein feeds including animal protein meals, fish meals, bone meals, feather meals, blood meals, and other protein meals and feeds are in high demand as a result of expanding knowledge of the health advantages of proteins for animal health. The demand for nutrient-rich and protein-rich animal feeds is anticipated to increase during the forecast period since agricultural and livestock animals play a significant part in the global food supply chain. The entire animal feed industry is anticipated to develop even further as a result of the rising need for animal feeds high in protein to support livestock growth at all life stages. However, market growth is anticipated during the forecast period despite the significant volatility of raw material costs.

CHITIN GLUCOSAMINE IN ANIMAL FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.41% |

|

Segments Covered |

By Form, Live stock, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alltech, Cargill Incorporated, Kemin Industries, Inc., Nutreco N.V., Charoen Pokphand Foods PCL, BRF S.A., Purina Animal Nutrition LLC, New Hope Group, ADM Animal Nutrition, Kent Nutrition Group, Archer Daniels Midlands, Chr. Holdings A/S, Danisco, DSM, Evonik Industries AG, and Novozymes |

This research report on the global Chitin Glucosamine in Animal Feed Market has been segmented and sub-segmented based on form, livestock and region.

Chitin Glucosamine in Animal Feed market segmentation – By Form

- Pellets

- Crumbles

- Mash

- Others

The market is divided into Pellets, Crumbles, Mash, and Others based on form. Feed pellets offer a better nutritional density, more substantial cost advantages, and a more complete nutritional profile. In addition to being simpler to store and carry than other forms, these pellets are easier for animals to digest, absorb, and conserve when fed, which will help the animal feed market flourish on a global scale.

Chitin Glucosamine in Animal Feed market segmentation – By Live Stock

- Poultry

- Ruminants

- Swine

- Aquaculture

- Others

The market is divided into categories for poultry, ruminants, swine, aquaculture, and other livestock. Farm hens, ducks, geese, and other domestic birds eat food called poultry feed. Common ingredients in poultry feed include whole maize, cottonseed cake, maize germ, soy beans, sunflower seeds, and fish meal (omen). Modern chicken feeds contain grains, protein supplements, including soybean oil meal, minerals, and vitamins, which is fuelling market expansion and expanding the global chitin glucosamine animal feed business.

Chitin Glucosamine in Animal Feed market segmentation – By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

The Global Chitin Glucosamine in Animal Feed Market is divided into four regions based on geography: North America, Europe, Asia Pacific, and the Rest of the World. The North American area is anticipated to experience the most growth during the projection period. The primary factor driving the expansion of the Chitin Glucosamine in Animal Feed market in this region is the enormous and simple accessibility of the raw materials needed to create Chitin Glucosamine in Animal Feed. The North American Chitin Glucosamine in Animal Feed market has been significantly impacted by consumer lifestyle changes and a rise in knowledge of issues affecting animal health.

The demand for Chitin Glucosamine in Animal Feed in the area has greatly increased due to a greater focus on animal health. Some of the factors causing an increase in demand for Chitin Glucosamine in Animal Feed in North American nations include the rising concern for animal health, the rapid expansion of animal husbandry, and product improvements. These variables collectively are accelerating market expansion in this area, which is anticipated to boost the Chitin Glucosamine in Animal Feed industry and therefore raise demand for the Chitin Glucosamine in Animal Feed market.

Chitin Glucosamine in Animal Feed market segmentation – By Company

With a focus on the global market, the "Global Chitin Glucosamine in Animal Feed Market" study report will offer insightful information.

- Alltech

- Cargill Incorporated

- Kemin Industries, Inc.

- Nutreco N.V.

- Charoen Pokphand Foods PCL

- BRF S.A.

- Purina Animal Nutrition LLC

- New Hope Group

- ADM Animal Nutrition

- Kent Nutrition Group

- Archer Daniels Midlands

- Chr. Holdings A/S

- Danisco

- DSM

- Evonik Industries A

- Novozymes

NOTABLE HAPPENINGS IN THE CHITIN GLUCOSAMINE IN ANIMAL FEED MARKET IN THE RECENT PAST:

- In July 2020, to improve its innovation and research capabilities, Kemin Industries unveiled architectural renderings of a new quality control lab that would be constructed at its Des Moines, Iowa, headquarters.

- In July 2020, a US patent application for a technique to identify the African swine fever virus in feed was combined by Kemin Industries.

- In March 2020, Alltech announced a cooperation with the aqua feed nutrition business Corey Nutrition in an effort to broaden its line of feed products for fish growers in North America.

Chapter 1.CHITIN GLUCOSAMINE IN ANIMAL FEED MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Chitin Glucosamine in Animal Feed marketMARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3 Chitin Glucosamine in Animal Feed market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Chitin Glucosamine in Animal Feed market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. CHITIN GLUCOSAMINE IN ANIMAL FEED MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Chitin Glucosamine in Animal Feed market– By Application

6.1. Pellets

6.2. Crumbles

6.3. Mash

6.4. Others

Chapter 7.Chitin Glucosamine in Animal Feed market– By Application

7.1. Poultry

7.2. Ruminants

7.3. Swine

7.4. Aquaculture

7.5. Others

Chapter 8. Chitin Glucosamine in Animal Feed marketShare- By Regional

8.1. North America

8.2. Europe

8.3. Asia Pacific

8.4. Latin America

8.5. Middle East & Africa

Chapter 9. Co2 Indicator Labels marketShare- by Company

9.1. Alltech

9.2. Cargill Incorporated

9.3. Kemin Industries

9.4. Inc

9.5. Nutreco N.V

9.6. Charoen Pokphand Foods PCL

9.7. , BRF S.A.,

9.8. Purina Animal Nutrition LLC

9.9. New Hope Group

9.10. , ADM Animal Nutrition

9.11. Kent Nutrition Group

9.12. Archer Daniels Midlands, Chr

9.13. Holdings A/S, Danisco

9.14. ADM Animal Nutrition,

9.15. Kent Nutrition Group

9.16. Archer Daniels Midlands

9.17. Chr

9.18. DSM, Evonik Industries AG

9.19. Novozymes

Download Sample

Choose License Type

2500

4250

5250

6900