Chilies Market Size (2025-2030)

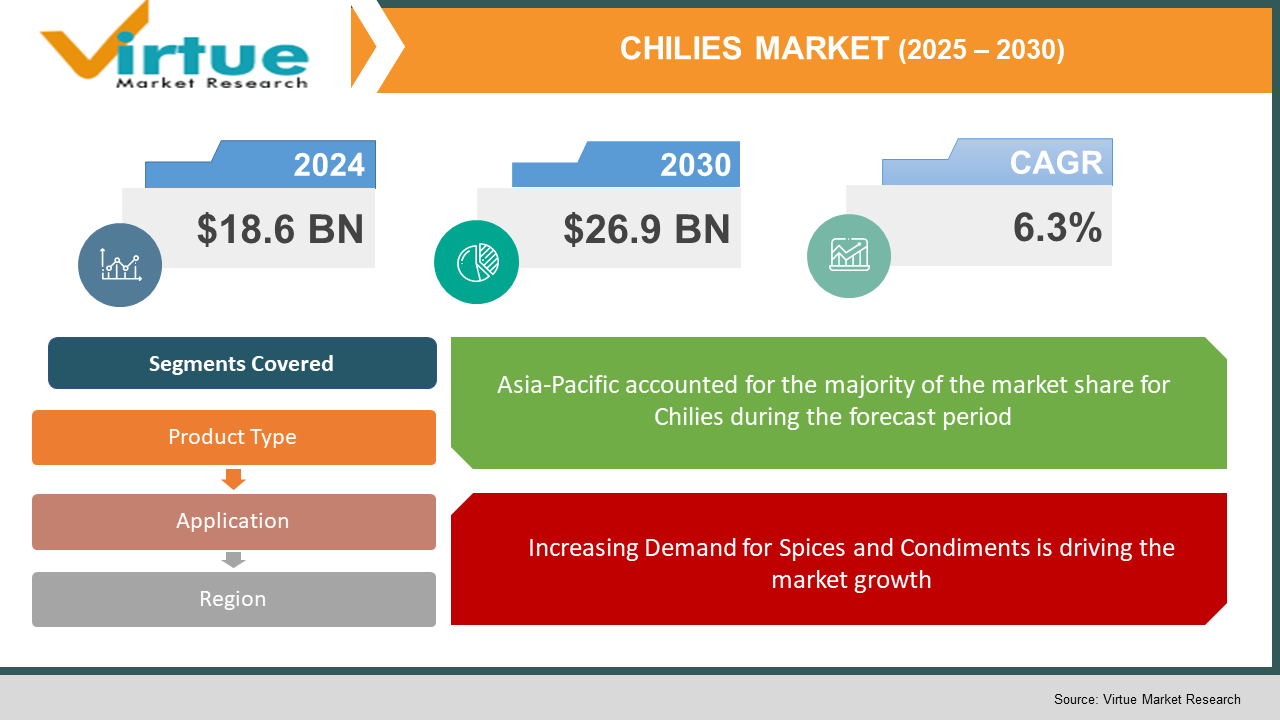

The Global Chilies Market was valued at USD 18.6 billion in 2024 and is projected to reach USD 26.9 billion by 2030, growing at a CAGR of 6.3% during the forecast period.

Chilies, widely used as a spice, vegetable, and preservative, are an integral part of global cuisine and have gained prominence in the pharmaceutical and cosmetics industries due to their health benefits.

With over 30 million tons of chilies produced annually, the market is driven by increasing consumption in emerging and developed economies. Rising demand for value-added chili products, such as chili powders, sauces, and extracts, is further boosting growth. The market is also benefiting from advancements in farming techniques and a focus on organic and sustainably sourced chilies.

Key Market Insights

- Dried chilies accounted for 42% of the total market revenue in 2024 due to their extended shelf life and widespread use in spice blends and processed foods.

- The food application segment dominated the market, contributing over 70% of total revenue in 2024, driven by the extensive use of chilies in global cuisines.

- Asia-Pacific remains the largest producer and consumer of chilies, accounting for more than 65% of global production. India leads in chili exports, followed by China and Thailand.

- Innovations in chili processing technologies, such as dehydration and freeze-drying, are improving product quality and shelf life.

- Growing popularity of hot and spicy flavors in processed foods and condiments is driving demand for chilies in developed markets like North America and Europe.

- The trend of organic chilies is gaining traction, driven by health-conscious consumers seeking pesticide-free products.

- Pharmaceutical applications of capsaicin, an active compound in chilies, are expanding due to its pain-relief and anti-inflammatory properties.

Global Chilies Market Drivers

1. Increasing Demand for Spices and Condiments is driving the market growth

Chilies are a staple in cuisines worldwide, valued for their flavor, color, and pungency. With the globalization of food cultures and the rising popularity of ethnic cuisines, the demand for chilies and chili-based products has surged.

In developed markets, the growing preference for hot and spicy flavors in snacks, sauces, and ready-to-eat meals is a significant driver. In emerging economies, chilies remain a kitchen essential, consumed fresh, dried, or processed into powders and pastes.

2. Health Benefits of Chilies is driving the market growth

Chilies are rich in vitamins A, C, and E, as well as capsaicin, which offers numerous health benefits. Capsaicin has been shown to boost metabolism, aid weight loss, reduce inflammation, and alleviate pain.

The increasing awareness of these health benefits is driving the adoption of chilies in dietary supplements, functional foods, and nutraceuticals. Moreover, chilies are being incorporated into cosmetic products for their skin-enhancing properties, such as improving circulation and reducing inflammation.

3. Rising Production and Export Activities is driving the market growth

The global chili market is supported by robust production and export activities in major producing countries such as India, China, and Mexico. These nations invest heavily in advanced farming techniques, including drip irrigation, hybrid seed varieties, and pest control measures, to enhance productivity and quality.

India, the largest exporter of dried chilies, accounts for over 40% of global exports, with major buyers including the U.S., Germany, and the UAE. The growing demand for Indian chilies, known for their flavor and pungency, continues to bolster the global market.

Global Chilies Market Challenges and Restraints

1. Vulnerability to Climate Change and Pests is restricting the market growth

Chilies are highly susceptible to climatic variations and pest infestations, which can lead to significant yield losses. Erratic rainfall, rising temperatures, and extreme weather events disrupt chili farming, particularly in major producing regions like Asia-Pacific and Latin America.

Pest attacks, such as thrips and aphids, not only reduce yields but also impact the quality of chilies, affecting their marketability. Addressing these challenges requires substantial investments in agricultural research, pest-resistant crop varieties, and sustainable farming practices.

2. Price Volatility and Trade Barriers is restricting the market growth

The chili market experiences significant price volatility due to a confluence of factors. Fluctuations in supply and demand are major drivers, with crop failures due to adverse weather conditions, increased production costs, and geopolitical tensions impacting global trade and pricing. Export restrictions, import tariffs, and stringent sanitary and phytosanitary (SPS) regulations imposed by importing countries further complicate international trade. For instance, stringent pesticide residue limits enforced by the EU and U.S. can restrict market access for exporters, requiring them to adhere to strict agricultural practices and quality control measures, increasing production costs. These factors collectively contribute to the inherent volatility and complexity of the global chili market, making it challenging for producers, exporters, and importers to navigate the market effectively.

Market Opportunities

The Global Chilies Market presents significant growth opportunities driven by a confluence of factors. The growing consumer preference for organic products is driving farmers and producers to adopt eco-friendly practices, with certifications such as USDA Organic and Fair Trade enhancing marketability and enabling premium pricing. The demand for processed and value-added chili products, including sauces, powders, and extracts, is on the rise, with innovations such as smoked chili powders, chili-infused oils, and gourmet chili sauces catering to premium and niche markets. The rising use of capsaicin, the active component in chilies, in pharmaceuticals, particularly in pain-relief creams and anti-inflammatory drugs, is a lucrative market segment. Similarly, capsaicin's metabolism-boosting properties are driving its inclusion in weight-loss supplements and functional foods. Investments in advanced processing techniques, such as freeze-drying and vacuum packaging, can improve the quality and shelf life of chilies, opening new market opportunities. The rising disposable incomes and urbanization in countries like Indonesia, Vietnam, and Nigeria present untapped potential for chili consumption and trade, further fueling market growth.

CHILIES MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

McCormick & Company, Inc., Everest Spices, Badia Spices Inc., Synthite Industries Ltd., Gajanand Foods, Organic Spices Inc., FRUTAROM Industries Ltd., Zhengzhou Hongle Machinery Equipment Co., Ltd., MTR Foods Pvt. Ltd., VLAM – Flanders' Agricultural Marketing Board |

Chilies Market Segmentation

Chilies Market Segmentation By Product Type:

- Fresh

- Dried

- Processed

- Chili Powders

- Chili Pastes

- Chili Sauces

The dried chilies segment led the market in 2024 due to its inherent advantages. Dried chilies offer significantly extended shelf life compared to fresh chilies, making them convenient for storage and transportation. This extended shelf life enhances their marketability and reduces spoilage, a significant concern for fresh produce. Furthermore, dried chilies exhibit remarkable versatility in culinary applications. They are widely used as a key ingredient in a diverse range of spice blends, curries, marinades, and sauces across various cuisines worldwide. This versatility makes them indispensable in both household kitchens and the food processing industry, driving consistent demand.

Chilies Market Segmentation By Application:

- Food

- Pharmaceutical

- Others

The food segment undeniably held the largest market share in 2024, a testament to the ubiquitous role of chilies in global cuisines. Chilies are far more than just a source of heat; they are culinary cornerstones that enhance flavor profiles in myriad ways. Their pungent aroma and vibrant color add depth and complexity to dishes, elevating them from ordinary to extraordinary. From fiery Mexican salsas and Indian curries to Southeast Asian stir-fries and South American stews, chilies play a pivotal role in imparting distinct regional flavors. Whether it's the smoky heat of chipotle, the fruity tang of jalapeño, or the fiery intensity of habanero, chilies provide a spectrum of flavor dimensions that tantalize taste buds and satisfy diverse palates. This indispensable role in global gastronomy firmly establishes the food segment as the dominant end-use market for chilies.

Chilies Market Regional Segmentation

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Asia-Pacific dominated the Chilies Market , accounting for over 65% of global production in 2024. India, China, and Thailand are the major producers, with India leading in dried chili exports. The region’s dominance is attributed to the widespread cultivation of chilies, favorable climatic conditions, and the cultural significance of chilies in regional cuisines. The growing trend of exporting high-quality, organic chilies further strengthens Asia-Pacific’s position in the global market.

COVID-19 Impact Analysis

The COVID-19 pandemic had a multifaceted impact on the global chili market. Lockdowns, labor shortages, and transportation restrictions initially disrupted production and distribution channels, leading to temporary supply chain disruptions. However, the pandemic also triggered a surge in home cooking as people spent more time at home, leading to increased demand for spices and condiments, including chilies. While exports faced initial challenges due to trade restrictions and logistical hurdles, the reopening of trade routes and the increasing reliance on e-commerce platforms for international trade mitigated these effects. The pandemic also served as a wake-up call, highlighting the importance of sustainable and resilient supply chains. This has prompted investments in advanced farming techniques, improved processing technologies, and the development of more robust and diversified supply chains to mitigate future disruptions.

Latest Trends/Developments

The global chilies market is witnessing several key trends. Farmers are increasingly adopting organic and sustainable farming practices to meet the rising demand for pesticide-free chilies, aligning with consumer preferences for healthier and more environmentally friendly products. Technological advancements, such as freeze-drying and vacuum sealing, are enhancing chili quality and extending shelf life, improving product stability and expanding market reach. The growing popularity of diverse global cuisines, from Mexican to Indian, is driving demand for specific regional chili varieties, such as Mexico's ancho and India's Kashmiri chilies. Ongoing research into the health benefits of capsaicin, the compound responsible for chilies' heat, is expanding its applications in pharmaceuticals and nutraceuticals, creating new market avenues. Finally, manufacturers are investing in eco-friendly packaging solutions, such as recyclable and biodegradable materials, to align with consumer preferences for sustainable products and reduce their environmental impact. These trends are collectively shaping the future of the global chilies market, driving innovation, and creating new opportunities for growth and sustainability.

Key Players

- McCormick & Company, Inc.

- Everest Spices

- Badia Spices Inc.

- Synthite Industries Ltd.

- Gajanand Foods

- Organic Spices Inc.

- FRUTAROM Industries Ltd.

- Zhengzhou Hongle Machinery Equipment Co., Ltd.

- MTR Foods Pvt. Ltd.

- VLAM – Flanders' Agricultural Marketing Board

Chapter 1. GLOBAL CHILIES MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL CHILIES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL CHILIES MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL CHILIES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL CHILIES MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL CHILIES MARKET– BY Product Type

6.1. Introduction/Key Findings

6.2. Fresh

6.3. Dried

6.4. Processed

6.4.1. Chili Powders

6.4.2. Chili Pastes

6.4.3. Chili Sauces

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. GLOBAL CHILIES MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Food

7.3. Pharmaceutical

7.4. Others

7.5. Y-O-Y Growth trend Analysis By APPLICATION

7.6. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL CHILIES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL CHILIES MARKET – Company Profiles – (Overview, Product Product TypeProduct Product Type s Portfolio, Financials, Strategies & Development

9.1. McCormick & Company, Inc.

9.2. Everest Spices

9.3. Badia Spices Inc.

9.4. Synthite Industries Ltd.

9.5. Gajanand Foods

9.6. Organic Spices Inc.

9.7. FRUTAROM Industries Ltd.

9.8. Zhengzhou Hongle Machinery Equipment Co., Ltd.

9.9. MTR Foods Pvt. Ltd.

9.10. VLAM – Flanders' Agricultural Marketing Board

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Chilies Market was valued at USD 18.6 billion in 2024 and is projected to reach USD 26.9 billion by 2030, growing at a CAGR of 6.3% during the forecast period.

Increasing demand for spices, rising awareness of chili health benefits, and robust production and export activities drive the Chilies Market.

The Chilies Market is segmented by Product Type (Fresh, Dried, Processed) and Application (Food, Pharmaceutical, Others).

Asia-Pacific dominates the market, with India, China, and Thailand leading in production and exports.

Major players include McCormick & Company, Everest Spices, Badia Spices Inc., and Synthite Industries Ltd.