Child Presence Detection System Market Size (2024 –2030)

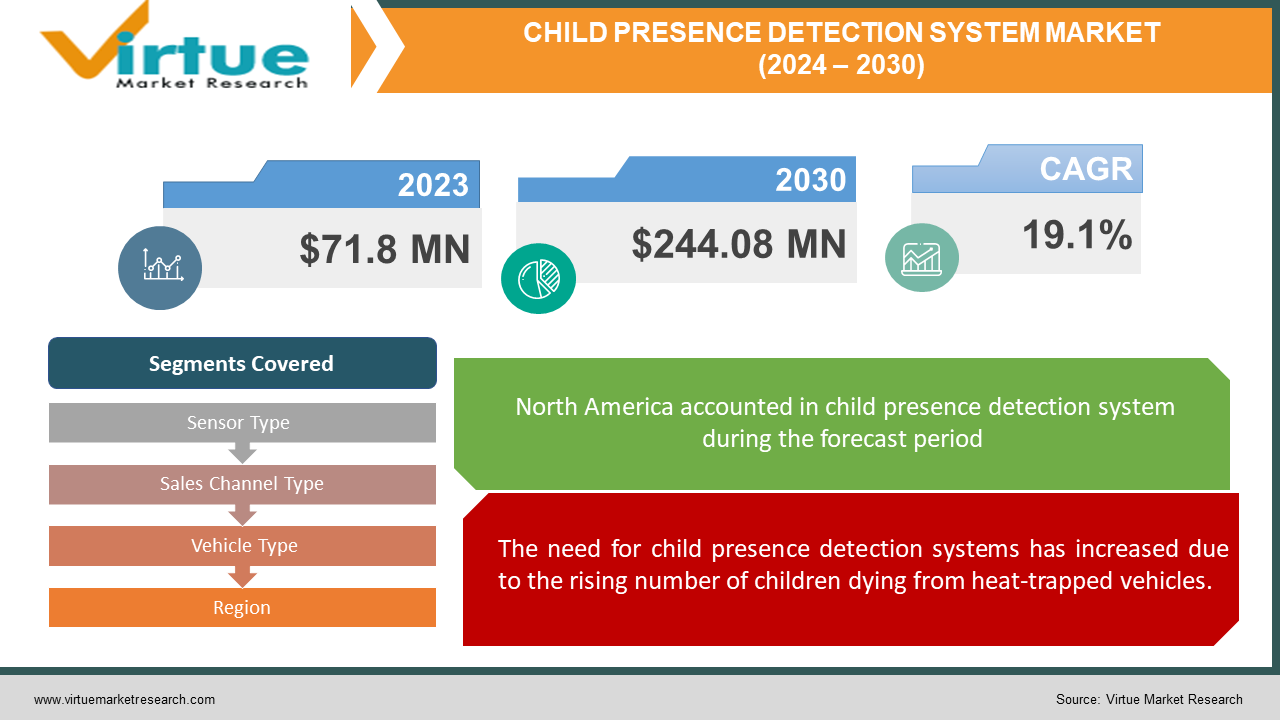

The Global Child Presence Detection System Market was estimated at USD 71.8 Million in 2023 and is anticipated to have a value of USD 244.08 Million by 2030, growing at a CAGR of 19.1% during the forecast period 2024-2030.

Child presence detection is a cutting-edge technology that notifies the driver if a child is left unsupervised in a car. To ascertain whether a child is present, it makes use of sensors such as cameras or weight sensors in car seats. The goal is to stop accidents involving children left alone in cars, which can be extremely risky, particularly during the summer. This technology is being developed to prevent the tragedies caused by heatstroke, which claims the lives of some children each year in cars. A few automakers are beginning to equip their cars with an extra safety feature called child presence detection. Older cars can also have comparable functionality added to them with aftermarket devices. Several child presence detection systems have been created to assist parents in preventing the tragic event of an unintentional child left in a car. One kind of system alerts parents or drivers when a car is turned off by gently reminding drivers with audio cues. If a child is left alone in a car, another kind of system sounds an alarm. To determine whether kids have entered the car on their own, some systems can also detect motion, temperature, sounds, and smells inside. To notify others when a child is in a car seat, another system uses a controller, an accelerometer, and a pressure sensor. The alert system sounds when the accelerometer registers movement but the pressure sensor detects weight.

Key Market Insights:

The accuracy rate of current child presence detection systems ranges from 90 to 98% when it comes to finding kids who get left behind in cars.An aftermarket child presence detection system typically costs between $150 and $300 at retail.Every year, an estimated 2 million new cars are sold worldwide that have integrated child presence detection systems installed.The market that could be reached by aftermarket child presence detection systems is estimated to be 100 million vehicles in the United States and Europe that are not equipped with this technology from the factory.

Global Child Presence Detection System Market Drivers:

The need for child presence detection systems has increased due to the rising number of children dying from heat-trapped vehicles.

Vehicular hyperthermia, which occurs when a child is left in a hot car, results in the tragic death of about 39 children annually. Car manufacturers and tech companies have been prompted to create systems that can identify whether a child is left alone in a vehicle by this worrying statistic. If a child is left alone, these systems are meant to notify parents or emergency services. Globally, governments and regulatory agencies are realizing how important these technologies are in averting these tragic events.

Global sales of luxury vehicles are driving the market for child presence detection systems to expand.

More people wish to purchase luxury vehicles as their incomes and standards of living rise. Luxury cars prioritize comfort and safety above all else, which is why a lot of automakers are investing in producing luxury sedans, hatchbacks, and superminis. Future sales of luxury vehicles are anticipated to significantly boost the market for child presence detection systems.

Child Presence Detection System Market Challenges and Restraints:

Because child presence detection systems in cars rely on sophisticated technology, such as sensors and cameras, to monitor the car and its occupants, they can be costly to install and maintain. The type of vehicle in which these systems are installed and the technology employed all affect how much these systems cost. Furthermore, the components and materials used in these systems have to adhere to international standards, which necessitates the use of premium, sometimes pricy, materials. In the future, these financial concerns may inhibit the growth of the worldwide market for child presence detection systems.

Child Presence Detection System Market Opportunities:

Radar and in-cabin sensing advancements are creating exciting opportunities in the global market for child presence detection systems. The technology used by radar sensors outside of cars has been improved by automakers, increasing the dependability of safety features like the ability to identify people inside the car. Sensors are used by advanced driver assistance systems (ADAS) to detect objects, pedestrians, and other vehicles in the environment. To ensure high levels of accuracy and dependability, these same technologies are now being used inside cars to improve safety features like airbag activation, seatbelt reminders, and child presence alarms. Because leaving children in cars carries significant risks, automakers and customers are increasingly focusing on child presence detection using radar sensors, which are simple and affordable for in-cabin sensing. These developments in in-cabin sensing and radar present encouraging market growth prospects.

CHILD PRESENCE DETECTION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.1% |

|

Segments Covered |

By Sensor Type, Sales Channel Type, Vehicle Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DENSO Corporation (Japan), Verra Mobility Corp (United States), Bosch Sensortec (Germany), ZF Friedrichshafen AG (Germany), Elepho (United States), Continental AG (Germany), Faurecia SE (France), Valeo (France), BorgWarner (United States), Magna International Inc. (Canada) |

Global Child Presence Detection System Market Segmentation: By Sensor Type

-

Ultrasonic Sensors

-

Radar Sensors

-

Pressure Sensors

-

Others

The ultrasonic, radar, pressure, and other sensor types were the segments of the global market for child presence detection systems in 2023. The segment with the biggest market share was radar sensors. Radar sensors are a popular option for vehicle applications because of their high accuracy, dependability, affordability, and capacity to function well in a variety of weather conditions.

Global Child Presence Detection System Market Segmentation: By Sales Channel Type

-

OEM

-

Aftermarket

By type of sales channel, the global market for child presence detection systems was divided into OEM (Original Equipment Manufacturer) and aftermarket segments in 2023. The biggest market share was the OEM channel. Government-mandated safety regulations are met by OEMs working with automakers to directly integrate child presence detection systems into vehicles.

Global Child Presence Detection System Market Segmentation: By Vehicle Type

-

Hatchback

-

Sedan

-

SUV

-

MUV

Vehicle types that comprised the global market for child presence detection systems in 2023 were hatchbacks, sedans, SUVs, and MUVs (Multi Utility Vehicles). MUVs had the biggest portion of the market. MUVs are common in populous nations where there is a demand for high-capacity passenger vehicles for transportation. For safety reasons, some nations have made it mandatory for MUVs to have child presence detection systems installed.

Global Child Presence Detection System Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

The Middle East & Africa

-

South America

The global market for child presence detection systems was dominated by North America. The media's extensive coverage of tragic events involving children left unaccompanied in cars has led to a strong awareness and concern for child safety in this region. To protect passengers left in unattended cars from heatstroke-related injuries and deaths as well as other hazards, the United States passed the Hot Cars Act in 2021. Consequently, to comply with this law and improve safety, big automakers like Ford, General Motors, and Chrysler are now equipping their cars with child presence detection systems.

COVID-19 Impact on the Global Child Presence Detection System Market:

The global market for child presence detection systems was significantly impacted by the COVID-19 pandemic. It complicated the production and delivery of these systems to automakers and customers, upsetting supply chains. During the pandemic, fewer people purchased cars, which reduced the need for these detection systems. But when lockdowns became less frequent, big businesses like Bosch and Elektrobit created updated versions of their child presence detection systems that made use of cutting-edge sensors and machine learning. The Hot Cars Act of 2021 is a new law in the US that mandates child presence detection systems for upcoming cars. Thus, although the pandemic presented difficulties, it also created new chances for market expansion and innovation.

Latest Trend/Development:

Growing awareness of child safety and technological advancements are driving notable trends and developments in the child presence detection system market. A noteworthy development in automotive technology is the incorporation of sophisticated sensors and artificial intelligence (AI) algorithms to identify and notify drivers when children are present. This includes employing computer vision systems, infrared sensors, and radar technology to precisely detect the presence of kids in cars. The cooperation of automakers and tech firms to create novel solutions—like adding child presence detection systems to already-existing safety features like automated braking and rear-seat reminder systems—is another trend. The market is also growing as a result of legislative initiatives requiring child presence detection systems in new cars. For instance, automakers are being compelled to incorporate these systems in their vehicles by laws such as the Hot Cars Act in the United States. All things considered, the market is changing quickly in response to the pressing need to stop the terrible incidents of kids being left alone in cars.

Key Players:

-

DENSO Corporation (Japan)

-

Verra Mobility Corp (United States)

-

Bosch Sensortec (Germany)

-

ZF Friedrichshafen AG (Germany)

-

Elepho (United States)

-

Continental AG (Germany)

-

Faurecia SE (France)

-

Valeo (France)

-

BorgWarner (United States)

-

Magna International Inc. (Canada)

Market News:

-

VinFast and Vayyar Imaging partnered in January 2023 to incorporate in-cabin radar technology into their most recent VF 6 and VF 7 models. This technology warns other passengers of safer travels and assists in detecting if children are left in the car.

-

A division of Samsung Electronics Co., HARMAN International purchased CAARESYS, an Israeli business that specializes in contactless radar-based car passenger monitoring systems, in September 2022. Vital sign monitoring, passenger localization, and Child Presence Detection (CPD), which has proven effective with major automakers, are just a few of the cabin monitoring solutions provided by CAARESYS.

-

An advanced "in-cabin radar module" was created by LG Innotek in June 2022. It uses radio waves to identify the presence or movement of living things. This technology can guarantee that kids aren't left alone in cars and can stop car theft.

Chapter 1. Child Presence Detection System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Child Presence Detection System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Child Presence Detection System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Child Presence Detection System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Child Presence Detection System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Child Presence Detection System Market – By Sensor Type

6.1 Introduction/Key Findings

6.2 Ultrasonic Sensors

6.3 Radar Sensors

6.4 Pressure Sensors

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Sensor Type

6.7 Absolute $ Opportunity Analysis By Sensor Type, 2024-2030

Chapter 7. Child Presence Detection System Market – By Sales Channel Type

7.1 Introduction/Key Findings

7.2 OEM

7.3 Aftermarket

7.4 Y-O-Y Growth trend Analysis By Sales Channel Type

7.5 Absolute $ Opportunity Analysis By Sales Channel Type, 2024-2030

Chapter 8. Child Presence Detection System Market – By Vehicle Type

8.1 Introduction/Key Findings

8.2 Hatchback

8.3 Sedan

8.4 SUV

8.5 MUV

8.6 Y-O-Y Growth trend Analysis By Vehicle Type

8.7 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 9. Child Presence Detection System Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Sensor Type

9.1.3 By Sales Channel Type

9.1.4 By Vehicle Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Sensor Type

9.2.3 By Sales Channel Type

9.2.4 By Vehicle Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Sensor Type

9.3.3 By Sales Channel Type

9.3.4 By Vehicle Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Sensor Type

9.4.3 By Sales Channel Type

9.4.4 By Vehicle Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Sensor Type

9.5.3 By Sales Channel Type

9.5.4 By Vehicle Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Child Presence Detection System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 DENSO Corporation (Japan)

10.2 Verra Mobility Corp (United States)

10.3 Bosch Sensortec (Germany)

10.4 ZF Friedrichshafen AG (Germany)

10.5 Elepho (United States)

10.6 Continental AG (Germany)

10.7 Faurecia SE (France)

10.8 Valeo (France)

10.9 BorgWarner (United States)

10.10 Magna International Inc. (Canada)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Child Presence Detection System Market was estimated at USD 71.8 Million in 2023 and is anticipated to have a value of USD 244.08 Million by 2030.

The Global Child Presence Detection System Market Drivers are the growing number of children deaths in hot vehicles and the increasing sale of luxury vehicles.

Based on the sensor type, the global child presence detection system market is segmented into ultrasonic sensors, radar sensors, pressure sensors, and others

The North American region held the largest share of the Global Child Presence Detection System Market in 2023.

DENSO Corporation, Bosch Sensortec, and BorgWarner are the leading players in the Global Child Presence Detection System Market