GLOBAL CHICKPEA FLOUR MARKET SIZE (2024 - 2030)

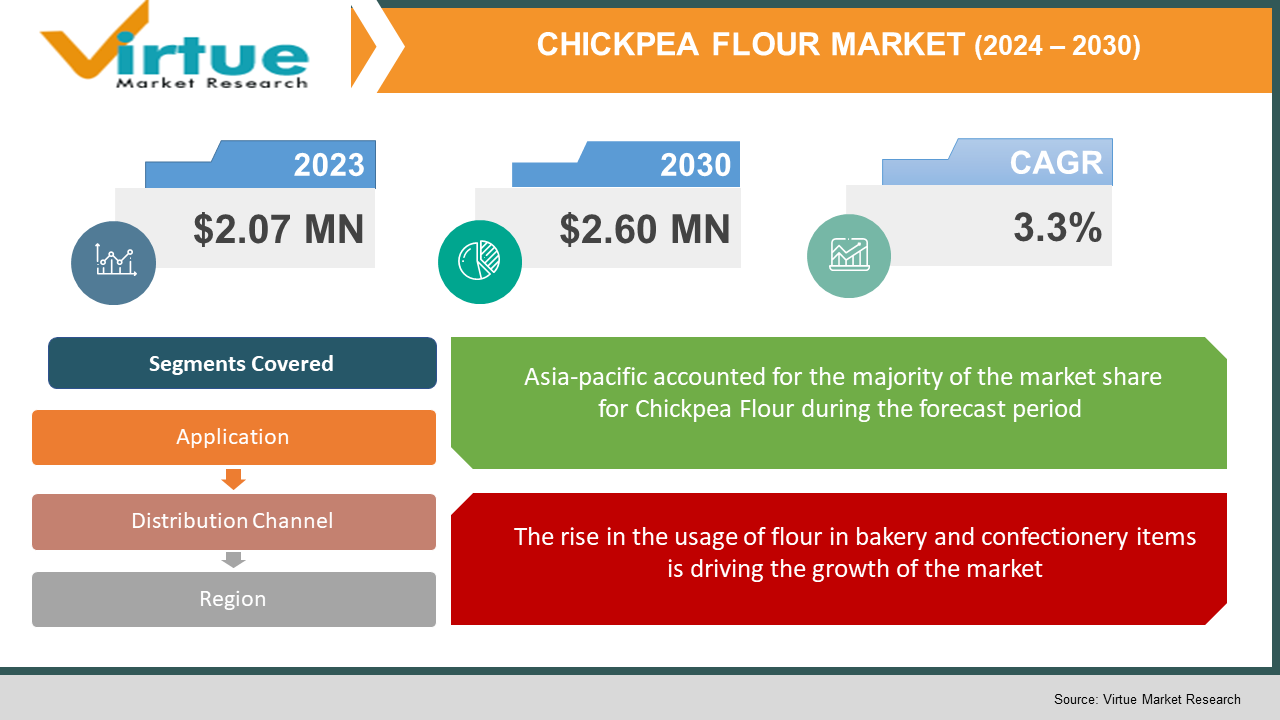

The Global Chickpea Flour Market was valued at USD 2.07 Million in 2023 and is projected to reach a market size of USD 2.60 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.3%.

Industry Overview:

Chickpea flour is a thin powder derived from finely grounding garbanzo beans. Just like lupin beans, garbanzo comes from a legume meal family. This pulse flour (chickpea) is incredibly famed in the Indian subcontinent as it is used as a crucial ingredient in cuisines of South Asian international locations such as Nepal, Pakistan, Myanmar, India, and others. The healthful stability of protein-forming molecules, amino acids, and sugar molecules (=complex carbohydrates) has unique chickpea flour as an available constituent for the meals industry. On the other hand, in contrast to lentils, chickpea flour is a higher and sound supply of oleic acid, linoleic, and polyunsaturated fatty acids. As a result, chickpea flour is deemed of utmost importance in lowering cholesterol levels and altering severe coronary heart problems.

Chickpea flour is additionally a wealthy supply of vitamins and minerals, and extensively boosts the consumption of manganese and folate. The increasing consumption of chickpeas can be attributed to their excessive dietary value amongst current plant protein sources. Owing to the healthful stability of amino acids, exceedingly low ranges of anti-nutritional factors, excessive ranges of complicated carbohydrates, and bioavailability of proteins, chickpea flour has emerged as a practical ingredient for the meals processing industry.

Chickpea flour additionally aids in curing quite many fitness issues like diabetes and cancer, coronary heart disease, and obesity, and is a pretty famous in-home remedy.

COVID-19 impact on the Chickpea Flour Market

The COVID-19 pandemic badly hit the world and it also affected the food and beverage market in a very large aspect. Especially the laminate market was badly hit by the pandemic. COVID-19 is an infectious sickness that originated in the Hubei province of Wuhan town in China in late December. The highly contagious disease, prompted by a virus, extreme acute respiratory syndrome coronavirus two (SARS-CoV-2), is transmitted from human to human. Since the outbreak in December 2019, the ailment has unfolded to nearly 213 international locations around the globe with the World Health Organization declaring it a public fitness emergency on March 11, 2020.

In the context of COVID-19, government agencies in various countries, lookup institutes, and many biotech and pharmaceutical companies are focusing on tremendous and fast technologies for the fast prognosis of COVID-19. Although food items were in great demand during the pandemic which initially increased the demand for food items but still there was a shortage of food because there is no proper facility for the transportation of items from one place to other which finally restrained the growth of the market.

MARKET DRIVERS:

The rise in the usage of flour in bakery and confectionery items is driving the growth of the market

Owing to the nutty taste and extra properties such as its low-glycemic and gluten-free nature, chickpea flour has emerged as a preeminent choice for different legume crops. It has carved its way into the regularly developing confectionery and bakery market. Germany and several different European countries are the main buyers of confectionery items as of now however the trend is predicted to shift with Asia being the most sizable customer in the foreseeable future, which will uplift the chickpea flour market.

The rise in the awareness about health benefits of flour is driving the growth of the market

Chickpeas are the powerhouse of vitamins as they keep an excessive quantity of diet C, iron, magnesium, calcium, and oleic acid. Therefore, they lengthen numerous health advantages such as coronary heart relief from continual nerve pain, anticancer behavior, higher skin, blood sugar, and LDL cholesterol control, etc. Therefore, rising fitness awareness amongst humans pushes them towards extra chickpea consumption. On the different hand, with mounting modernization and industrialization, the community of retail outlets' is strengthening day after day worldwide.

MARKET RESTRAINTS:

The rules and regulations imposed by the government on the food product market are restraining the growth of the market

In their relentless quest of constructing a greater modern and superior world, human beings have compromised the security of the environment. People speak fancy about climate change and air pollution but fail to take sincere steps to curtail it. Therefore, with the consistent rise in air pollution and local weather change problems, the natural period of the seasons is changing. Moreover, augmenting environmental temperature is ensuing in extreme floods and posing lowering the usual yield of crops. Additionally, the great of seeds has to be proven, specifically for germination, complete stay seeds per pound, and the presence of ascochyta blight. As per a case, almost 60-70% of the chickpea crop fields had been affected in the U.S. in 2019 owing to more than a few checks and deficits.

CHICKPEA FLOUR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.3 % |

|

Segments Covered |

By Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Scoular Company, AGT food and ingredients, Archer Daniels Midland Co., SunOpta, Anchor Ingredients, Parakh Agro Industries Ltd, EHL Limited, Batory Foods, Diefenbaker Spice & Pulse, Blue Ribbon, ADM, Great Western Grain, Best Cooking Pulses, Bean Growers Australia, CanMar Grain Products |

This research report on the global Chickpea Flour Market has been segmented and sub-segmented based on the Application, Distribution Channels, and regions.

Chickpea Flour Market - By Application:

-

Dairy products

-

Animal feeds

-

Food preparation (=confectionery and bakery)

-

Cosmetics

-

others.

By Application, the food industry phase held the biggest share in 2022. The increase is owing to the splendid use of chickpea flour in the instruction of foods, mainly confectioneries and bakery items. It has substituted numerous purposes of wheat flour in baking. This slight and nutty style flour has made its way into typical Indian dishes such as fritters, samosas, and many different special desserts.

Moreover, gram flour (=chickpea) is regarded as a natural thickening agent in curries. On the different hand, it is an imperative section of various splendor domestic redress which targets getting rid of darkish complexion, however, still, the beauty segment cannot outperform the food enterprise as gram flour utilization in beauty is trailing way at the back of its meals applications. Therefore, the meals enterprise phase is estimated to be the fastest-growing section with a CAGR of 4.8% over the forecast duration of 2023-2028.

Chickpea Flour Market - By Distribution Channels:

-

Supermarket and Hypermarket

-

Online store

-

Specialty store

-

Others

Based on the Distribution Channel, the offline platform section held the biggest share in 2022. The increase is owing to countless benefits of offline retail outlets, such as they construct non-public contact between shoppers and businesses. Therefore, shoppers continually love to save on offline platforms. Moreover, they provide customers the choice to contact and sense the products at the time of purchase. Therefore, buyers can locate out hid defects, if any. Additionally, immediate buy and sales assistance points of offline retail services gravitate buyers towards them.

Furthermore, in an strive to faucet the untouched potential, modern shops are discovering their way into some pastoral areas. However, the online phase is estimated to be the fastest-growing, with a CAGR of 5.0% over the forecast length of 2023-2028. This boom is owing to digitalization, a speedy swell in smartphone users, and effortless access to the net even in rural areas. Online structures do not maintain any time constraints and function 24*7. Besides being operationally cost-effective, online structures require comparatively decrease preliminary capital during the setup.

Chickpea Flour Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, Asia-pacific held the greatest share with 38% of the normal market in 2022. The increase in this section is owing to the elements such as the presence of countries like India, which is the largest producer and purchaser of chickpeas. According to a report, each year, India produces almost 8 million lots of garbanzo, which is around 68-70% of complete world production. Whereas, being the 2nd biggest producer, Australia has over 10% share in the world chickpea flour market. Moreover, chickpea has a one-of-a-kind location in the confectionery and bakery of South Asian international locations such as India, Pakistan, Nepal, Bangladesh, and others.

Moreover, Asia-Pacific is estimated to provide lucrative boom possibilities over the forecast duration of 2023-2028. This boom is owing to augmenting demand for confectionery and bakeries as the disposable profits of humans are budding gradually. On the different hand, with speedy modernization, the average living standards of humans are rising; therefore, they are turning into extra conscious of the health advantages of such ingredients.

Chickpea Flour Market Share by Company

1. The Scoular Company

2. AGT food and ingredients

3. Archer Daniels Midland Co.

4. SunOpta

5. Anchor Ingredients

6. Parakh Agro Industries Ltd

7. EHL Limited

8. Batory Foods

9. Diefenbaker Spice & Pulse

10. Blue Ribbon

11. ADM

12. Great Western Grain

13. Best Cooking Pulses

14. Bean Growers Australia

15. CanMar Grain Products

The market is highly fragmented. Prominent market players are pursuing several strategies, such as strategic joint ventures and partnership agreements, product innovations, lookup & development initiatives, geographical expansions, and mergers & acquisitions, to improve their foothold in the industry.

NOTABLE HAPPENINGS IN THE GLOBAL CHICKPEA FLOUR MARKET IN THE RECENT PAST:

- Product Launch - In May 2022, Tata and Lyle bought Chickpea ingredient company Nutriati. The company was actively producing protein and flour. Its Artesa Chickpea Protein and Artesa Chickpea Flour can be found in leading non-dairy, plant-based meat, and gluten-free brands, mainly in North America.

Chapter 1. CHICKPEA FLOUR MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. CHICKPEA FLOUR MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. CHICKPEA FLOUR MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. CHICKPEA FLOUR MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. CHICKPEA FLOUR MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CHicKPEA FLOUR MARKET – By application

6.1. Dairy Products

6.2. Animal Feeds

6.3. Food Preparation

6.4. Cosmetics

6.5. Others

Chapter 7. CHICKPEA FLOUR MARKET – By Distribution Channels

7.1. Hypermarkets and Supermarkets

7.2. Online STORE

7.3. Specially Store

7.4. Others

Chapter 8. CHICKPEA FLOUR MARKET – By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. CHICKPEA FLOUR MARKET – By Companies

9.1. The Scoular Company

9.2. AGT Food and Ingrediants

9.3. Archer Danieals Market

9.4. SunOpta

9.5. Anchor Ingrediants

9.6. Parakh Agro Industries Ltd

9.7. EHL Limited

9.8. Batery Foods

9.9. Difenbakery Spice & Pulse

9.10. Blue Ribbon

9.11.ADM

9.12. Western Grain

9.13.Best Cooking Pulses

Download Sample

Choose License Type

2500

4250

5250

6900