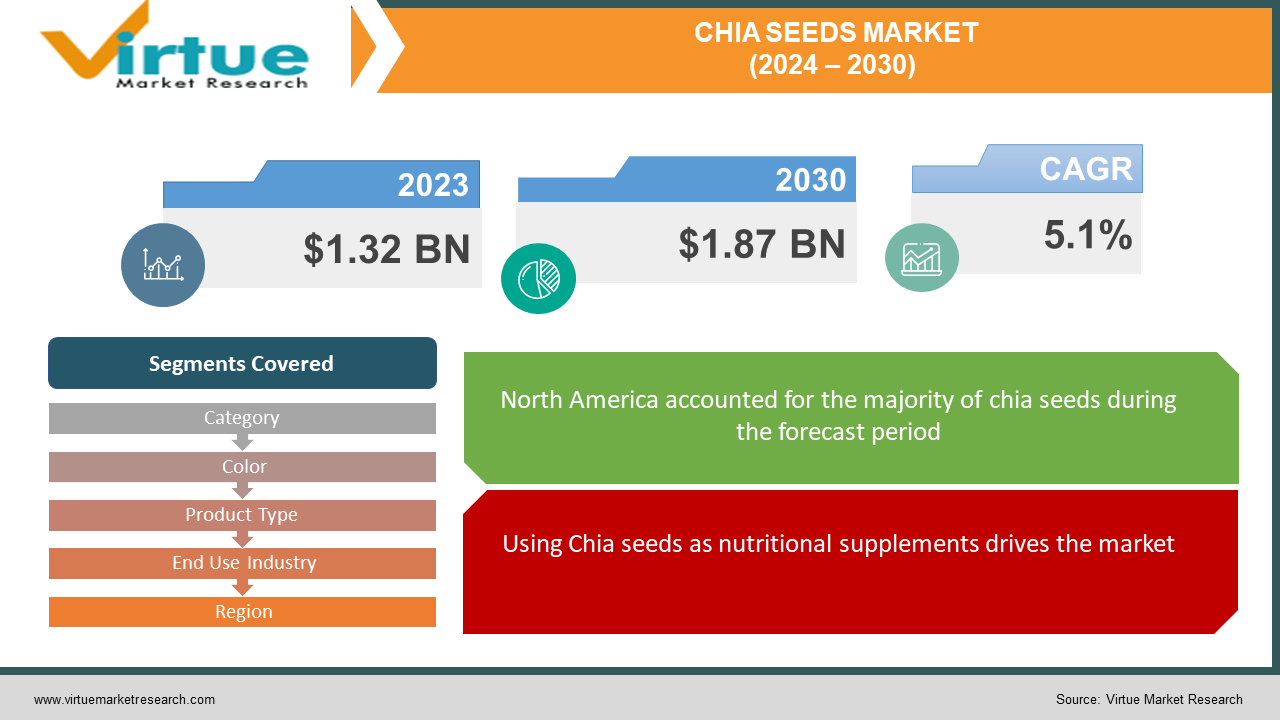

Chia Seeds Market Size (2024 – 2030)

The Chia Seeds Market was valued at USD 1.32 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.87 billion by 2030, growing at a CAGR of 5.1%.

The edible seeds of Salvia hispanica, a flowering plant belonging to the mint family (Lamiaceae) and indigenous to central and southern Mexico, are known as chia seeds. Characterized by their oval shape and gray color adorned with black and white spots, these seeds measure approximately 2 millimeters (0.08 in) in diameter. Demonstrating hygroscopic properties, they can absorb liquid up to 12 times their weight when soaked. This absorption results in the development of a mucilaginous coating, imparting a unique gel texture to food and beverages derived from chia.

Key Market Insights:

The market is experiencing substantial growth driven by several key factors, including an increasing demand for gluten-free products, heightened awareness regarding the health advantages associated with chia seeds, and the utilization of omega-3 in animal feed. Chia seeds, derived from the plant Salvia hispanica, are small black/white seeds that thrive in a dry Mediterranean climate with marine influences. Despite the favorable conditions, the limited growth of the plant and subsequent seed production may pose a constraint on market expansion.

Notwithstanding the challenges, chia seeds boast an array of nutritional benefits, being rich in fibers and containing essential elements. They serve as an exceptional source of omega-3 fatty acids, in addition to providing protein and minerals such as iron, calcium, magnesium, and zinc. Consequently, the high nutritional value of chia seeds has propelled their demand in various food and beverage applications, and they are also widely utilized as a food supplement.

Chia Seeds Market Drivers:

Using Chia seeds as nutritional supplements drives the market.

The market is witnessing increased momentum due to the expanding incorporation of chia seeds in the production of protein bars, energy drinks, and various nutritional supplements. This surge in demand is closely aligned with the global trend toward veganism and a heightened emphasis on adopting a healthier lifestyle. Consumers worldwide are actively seeking products crafted from natural components that offer high nutritional value, with chia seeds being a preferred choice in this regard.

Increasing chia seeds as personal care boosts the market growth.

The increasing utilization of chia seeds as a key component in the personal care industry, attributed to benefits such as skin repair and improved complexion, is anticipated to drive market demand and expand product portfolios. Additionally, the rising adoption of chia seeds as a firming agent in cake mixes and smoothies contributes to the overall advancement of the market. Nevertheless, the upward trend in the cost of organic chia seeds relative to conventional ones poses a constraint on sales within the organic sector.

Chia Seeds Market Restraints and Challenges:

The absence of standardized directives governing the applications of chia seeds is projected to impede market growth throughout the forecast period. Varied regulations concerning the use and applications of chia seeds exist in different countries, posing a challenge for key industry players in adhering to diverse regulatory frameworks. This complexity in managing country-specific regulations is proving to be a deterrent for significant investments in the chia seeds industry, consequently limiting overall market growth.

Chia Seeds Market Opportunities:

The healthy properties of Chia seeds create opportunities in the market.

The growing appetite for ancient nutritional grains and multi-cereal-based products, such as functional foods, is propelling the demand for chia seeds. Renowned for being gluten-free and rich in protein, chia seeds are garnering heightened interest. The gluten-free attribute of chia seeds is poised to generate robust demand, particularly among consumers afflicted by gluten intolerance (celiac disease) or those who consciously abstain from gluten due to lifestyle preferences.

CHIA SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Category, Color, Product Type, End Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Glanbia Nutritionals , Garden of Life, Navitas Organics, Nutiva Inc., Benexia, Salba Smart Natural Products, The Chia Co, Mamma Chia, Spectrum Organics Products LLC, Chia Bia |

Chia Seeds Market Segmentation: By Category

-

Organic

-

Conventional

The majority of the market share is currently dominated by the Organic segment. This is attributed to the elevated nutritional content, and there is a growing preference for organic chia seeds among manufacturers of nutritional and dietary supplements. However, the Conventional category is experiencing the fastest growth during the forecasted period, primarily due to its higher content of omega-3 fatty acids.

Chia Seeds Market Segmentation: By Color

-

White

-

Black

-

Brown

The largest segment within the market is currently the black seed type, attributed to its higher production volume compared to other types and a slightly elevated protein content. This segment is expected to sustain its dominance in the future and exhibit the fastest Compound Annual Growth Rate (CAGR). On the other hand, white seeds, characterized by slightly higher Omega-3 fatty acid content, are anticipated to secure the second-largest market share.

Chia Seeds Market Segmentation: By Product Type

-

Whole Chia Seeds

-

Grounded Chia Seeds

-

Chia Seed Oil

The whole chia segment currently holds the largest market share, primarily driven by high demand. These whole seeds are readily accessible in the industry and can be incorporated into a variety of foods and beverages. Furthermore, the increasing utilization i animal feed, attributed to the high omega-3 content, is expected to further stimulate the demand for these seeds.

The chia oil segment is projected to be the fastest-growing form over the forecast period, fueled by rising demand. Additionally, the oil form demonstrates a broad scope of application in various foods, given its composition of fatty acids, dietary fibers, and antioxidant elements.

Chia Seeds Market Segmentation: By End Use Industry

-

Food & Beverages Industry

-

Nutraceuticals

-

Personal Care

-

Others

The market is currently dominated by the Food & Beverage industry, with chia seeds standing out as highly exported commodities within the food sector, given their limited production in specific countries. Within the food & beverage sector, chia seeds find preference in the formulation of breakfast cereals, protein bars, ready-to-eat meals, snacks, energy drinks, bakery items, and various other products.

The Personal Care segment is anticipated to witness growth in the forecasted period. The expanding applications of chia seeds in personal care products and cosmetics are expected to contribute to the overall growth of the chia seeds market. This trend is likely to persist, driven primarily by a shift in consumer preferences towards organic and natural ingredients in skincare products. Chia seeds are recognized as functional ingredients in personal care and skin care products, attributed to their ability to enhance skin texture, repair skin barriers, and provide optimal hydration.

Chia Seeds Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

During the study period, North America emerged as the largest consumer of chia seeds, driven by various factors. The demand in the North American market is propelled by considerations such as vegan dietary preferences, community lifestyle choices, heightened health awareness, and a shift from unhealthy snacks to healthier alternatives. The American Heart Association's recommendation for incorporating omega-3-rich foods and oils in daily diets to prevent heart disease further contributes to the demand. Over time, plant sources of omega-3 essential fatty acids, such as chia seeds, have gained popularity due to their seamless integration into convenience and functional foods, along with their neutral taste.

Chia seeds hold the designation of 'superfoods' in the United States, leading many merchants to prominently display vitamin, mineral, and antioxidant contents on packaging to attract customers. The region has witnessed a surge in chia seed consumption owing to its high protein, omega-3 fatty acid, and fiber content. In the United States, chia seeds are increasingly being incorporated into health and food trends, including snacks, energy drinks, and cereal combinations. Chia seed merchants in the country actively engage in educational marketing programs, featuring in-store demonstrations nationwide. Investments in point-of-sale displays and the provision of a certificate of analysis for every batch of chia aim to enhance market shares, contributing to overall market growth.

Europe is poised for significant growth in the global chia seeds market throughout the forecast period. Germany and the Netherlands stand out as particularly lucrative markets for chia seeds, with Germany accounting for over 40% of total chia seed imports in Europe. The increasing popularity of chia seeds as a superfood, driven by their nutritional contents, plays a pivotal role in fostering market growth across Europe.

COVID-19 Pandemic: Impact Analysis

The initial lockdown imposed due to the COVID-19 pandemic resulted in disruptions in the logistics system, impacting the global supply of commodities, including chia seeds. Consequently, there was a decline in the market during the first half of 2020. However, the pandemic has had a silver lining by increasing health consciousness among consumers. This heightened awareness has created an opportunity for the growth of superfoods, including chia seeds. As a result, this factor is expected to drive the market during the forecast period.

Latest Trends/ Developments:

In April 2022, Mamma Chia made an announcement stating that its Chia Energy Beverages and Chia Vitality Beverages would be keto-friendly, offering only 6 grams of net carbs per serving from that point onward.

Key Players:

These are the top 10 players in the Chia Seeds Market: -

-

Glanbia Nutritionals

-

Garden of Life

-

Navitas Organics

-

Nutiva Inc.

-

Benexia

-

Salba Smart Natural Products

-

The Chia Co

-

Mamma Chia

-

Spectrum Organics Products LLC

-

Chia Bia

Chapter 1. Chia Seeds Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Chia Seeds Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Chia Seeds Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Chia Seeds Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Chia Seeds Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Chia Seeds Market – By Category

6.1 Introduction/Key Findings

6.2 Organic

6.3 Conventional

6.4 Y-O-Y Growth trend Analysis By Category

6.5 Absolute $ Opportunity Analysis By Category, 2024 – 2030

Chapter 7. Chia Seeds Market – By Color

7.1 Introduction/Key Findings

7.2 White

7.3 Black

7.4 Brown

7.5 Y-O-Y Growth trend Analysis By Color

7.6 Absolute $ Opportunity Analysis By Color, 2024 – 2030

Chapter 8. Chia Seeds Market – By Product Type

8.1 Introduction/Key Findings

8.2 Whole Chia Seeds

8.3 Grounded Chia Seeds

8.4 Chia Seed Oil

8.5 Y-O-Y Growth trend Analysis End-Use Industry

8.6 Absolute $ Opportunity Analysis End-Use Industry, 2024 – 2030

Chapter 9. Chia Seeds Market – By End-User

9.1 Introduction/Key Findings

9.2 Food & Beverages Industry

9.3 Nutraceuticals

9.4 Personal Care

9.5 Others

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2023-2030

Chapter 10. Chia Seeds Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Category

10.1.2.1 By Color

10.1.3 By Product Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Category

10.2.3 By Color

10.2.4 By Product Type

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Category

10.3.3 By Color

10.3.4 By Product Type

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Category

10.4.3 By Color

10.4.4 By Product Type

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Category

10.5.3 By Color

10.5.4 By Product Type

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Chia Seeds Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Glanbia Nutritionals

11.2 Garden of Life

11.3 Navitas Organics

11.4 Nutiva Inc.

11.5 Benexia

11.6 Salba Smart Natural Products

11.7 The Chia Co

11.8 Mamma Chia

11.9 Spectrum Organics Products LLC

11.10 Chia Bia

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is witnessing increased momentum due to the expanding incorporation of chia seeds in the production of protein bars, energy drinks, and various nutritional supplements.

Top Players operating in the Chia Seeds Market are - Glanbia Nutritionals, Garden of Life, Navitas Organics, Nutiva Inc., Benexia, Salba Smart Natural Products, The Chia Co, Mamma Chia, Spectrum Organics Products LLC, and Chia Bia.

The initial lockdown imposed due to the COVID-19 pandemic resulted in disruptions in the logistics system, impacting the global supply of commodities, including chia seeds.

The gluten-free attribute of chia seeds is poised to generate robust demand, particularly among consumers afflicted by gluten intolerance (celiac disease) or those who consciously abstain from gluten due to lifestyle preferences.

Europe is poised for significant growth in the global chia seeds market throughout the forecast period.