Chemical Tankers Market Size (2024-2030)

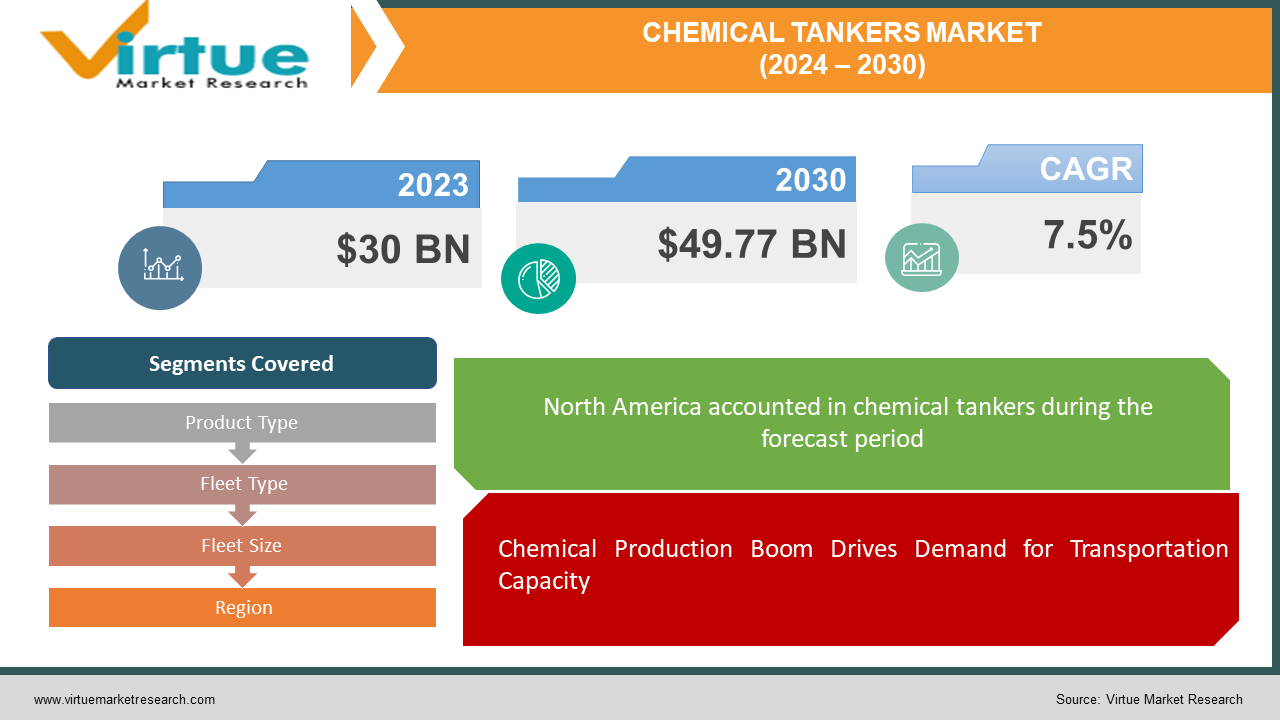

The Chemical Tankers Market was valued at USD 30 billion in 2023 and is projected to reach a market size of USD 49.77 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.5%.

The chemical tankers market plays a vital role in global maritime shipping, transporting a wide range of bulk liquid chemicals across international waters. These chemicals can be anything from organic compounds like alcohols to inorganic acids and bases, as well as vegetable oils and fats. The market is driven by several factors, including the expanding chemical industry worldwide, the growing popularity of bio-based products, and the increasing demand for chemicals in developing economies. Additionally, stricter safety and environmental regulations in the chemical industry are creating a need for specialized transportation, further propelling the growth of the chemical tanker market.

Key Market Insights:

The market itself is experiencing a positive upswing, driven by several factors. The global chemical industry is booming, demanding ever-greater capacity to move these materials. Additionally, the rise of biofuels and other bio-derived products is creating a need for specialized transportation that chemical tankers can uniquely provide. Finally, developing economies are witnessing a surge in their chemical needs, further fueling the growth of the chemical tankers market.

However, navigating the chemical tankers market isn't without its challenges. An overabundance of chemical tankers currently exists, which could lead to a decrease in freight rates for transporting chemicals. This could squeeze profit margins for shipping companies. Additionally, complying with increasingly stringent safety and environmental regulations can be a costly burden. These regulations, while necessary, require significant investment in upgrading ships and implementing stricter protocols.

Despite these challenges, the long-term outlook for the chemical tankers market remains promising. The thriving chemical industry and the growing emphasis on safety regulations are strong tailwinds propelling the market forward. By navigating the current obstacles and adapting to the evolving landscape, the chemical tankers market can ensure its continued success in the years to come.

The Chemical Tankers Market Drivers:

Chemical Production Boom Drives Demand for Transportation Capacity

The global chemical industry is experiencing significant expansion, creating a direct demand for increased chemical tanker capacity. As chemical production rises, the need for efficient and safe transportation of these materials across international waters grows proportionately.

Bio-revolution Creates Need for Specialized Chemical Tankers

The increasing popularity of biofuels and other bio-derived products is another major driver. These bio-based alternatives often require specialized transportation due to their unique properties. Chemical tankers, with their dedicated tanks and cleaning systems, are well-suited to handle this growing segment of the chemical market.

Developing Economies Fuel Growth with Rising Chemical Needs

Chemical demand in developing economies is surging. As these nations industrialize and their populations grow, the need for chemicals used in various sectors like manufacturing, construction, and agriculture increases. This translates to a growing need for chemical tankers to facilitate international trade and meet this rising demand.

Safety Regulations Push the Market Towards Advanced Chemical Tankers

Heightened focus on safety and environmental regulations within the chemical industry is a significant driver. Stringent regulations necessitate specialized tankers equipped with advanced safety features and capable of handling hazardous materials securely. This focus on safety creates a demand for modern and well-maintained chemical tankers, propelling the market growth.

The Chemical Tankers Market Restraints and Challenges:

The chemical tankers market, while crucial for transporting a vast array of chemicals across the globe, faces both positive drivers and pressing challenges. On the positive side, the market is propelled by the flourishing chemical industry. As chemical production continues to climb, the demand for efficient and safe transportation of these materials through international waters rises in tandem. Furthermore, bio-revolution, with its emphasis on biofuels and other bio-derived products, creates a need for specialized transportation that chemical tankers can uniquely provide. Additionally, developing economies are witnessing a surge in their chemical needs, further fuelling the growth of the market.

However, navigating the chemical tankers market isn't without its obstacles. An overabundance of chemical tankers currently exists, potentially leading to a decrease in freight rates for transporting chemicals. This could put a strain on shipping company profits. Keeping pace with ever-tightening safety and environmental regulations can also be a costly burden. These regulations, though necessary, require significant investments in upgrading ships and implementing stricter protocols. Finally, piracy in certain regions remains a concern, disrupting shipping routes, raising security issues, and impacting overall operational efficiency.

The Chemical Tankers Market Opportunities:

The chemical tankers market, while not without its hurdles, presents a dynamic landscape ripe with opportunities for innovative and forward-thinking companies. One strategy involves carving out a niche in the market by specializing in transporting high-value chemicals, delicate pharmaceuticals, or hazardous materials that require advanced safety features and specialized handling. Additionally, embracing technological advancements like automation, remote cargo monitoring systems, and data analytics can significantly optimize operations. These advancements can not only improve overall efficiency but also enhance safety standards by providing real-time insights into cargo conditions and potential issues. Furthermore, developing intermodal logistics solutions that seamlessly integrate chemical tanker transportation with other transport modes, such as pipelines or rail, can offer a significant advantage. By providing customers with a comprehensive and potentially more cost-effective service, companies can establish themselves as valuable partners within the global chemical supply chain. Finally, with a growing focus on sustainability, investing in eco-friendly technologies like wind propulsion systems or cleaner-burning fuels presents a strategic opportunity. By positioning themselves as sustainable leaders in the market, chemical tanker companies can not only attract environmentally conscious clients but also contribute to a greener and more responsible chemical transportation sector.

CHEMICAL TANKERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product Type, Fleet Type, Fleet Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bahri, Stolt-Nielsen, Odfjell, Navig8, MOL Chemical Tankers, Nordic Tankers, Wilmar International, MISC Berhad, Team Tankers International Ltd., Iino Kaiun Kaisha |

Chemical Tankers Market Segmentation: By Product Type

-

Organic Chemicals

-

Inorganic Chemicals

-

Vegetable Oils and Fats

The dominant segment in the chemical tankers market by product type is likely organic chemicals, driven by the vast production volume of these chemicals globally used in various industries. However, the vegetable oils and fats segment is expected to see the most significant growth due to the increasing awareness about health benefits and rising biofuel production.

Chemical Tankers Market Segmentation: By Fleet Type

-

IMO Type 1

-

IMO Type 2

-

IMO Type 3

Among IMO types, IMO Type 2 chemical tankers are likely the most dominant segment. This is because they can transport a wide range of moderately hazardous chemicals, catering to a larger portion of the chemical transportation market compared to the highly specialized IMO Type 1 (for the most hazardous chemicals). Data on the fastest-growing segments by IMO type is not readily available, but the overall growth of the chemical tanker market is likely driven by factors that benefit all IMO types, such as the expanding chemical industry and stricter safety regulations.

Chemical Tankers Market Segmentation: By Fleet Size

-

Inland Chemical Tankers (1,000-4,999 DWT)

-

Coastal Chemical Tankers (5,000-9,999 DWT)

-

Deep-Sea Chemical Tankers (10,000-50,000 DWT)

Currently, deep-sea chemical tankers (10,000-50,000 DWT) reign supreme in the fleet size sector thanks to their massive cargo capacity, perfectly suited for large-scale international chemical transportation. However, inland chemical tankers (1,000-4,999 DWT) are projected to be the fastest-growing segment. This surge is driven by the rising demand for efficient and cost-effective chemical transport within domestic markets and shorter coastal routes.

Chemical Tankers Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

An established market leader, North America boasts a well-developed shipbuilding industry and a strong presence of fleet owners. Growth in this region is expected to be steady, fueled by robust domestic chemical production and continued international trade. With a solid infrastructure and established regulations, North American chemical tanker companies are well-positioned to maintain their dominance in the market.

The Asia-Pacific region is the undisputed champion of growth in the chemical tanker market. This surge is primarily driven by the booming chemical industry in China and Southeast Asia, with increased intra-regional trade and rising chemical demand acting as further growth catalysts. As these economies continue to expand, the Asia-Pacific region offers immense potential for chemical tanker companies seeking to capitalize on new opportunities.

COVID-19 Impact Analysis on the Chemical Tankers Market:

The COVID-19 pandemic undeniably impacted the chemical tankers market, causing ripples of disruption across the global shipping industry. Lockdowns and restrictions initially hampered port operations, leading to delays, cancellations, and a temporary drop in demand for chemical transportation. Interestingly, there was a brief shift towards short-term solutions, with a surge in demand for offshore storage using chemical tankers, causing a temporary spike in freight rates.

As the pandemic progressed, the true impact unfolded. Supply chains faced disruptions due to labor shortages and port congestion, causing delays and uncertainty throughout the market. However, the chemical industry, deemed essential, continued operations, leading to a gradual recovery in demand for chemical transportation.

The long-term effects of COVID-19 are still being felt. This crisis highlighted the importance of resilient and adaptable supply chains. Chemical tanker companies are likely to invest in technologies that enhance operational efficiency and remote monitoring capabilities to navigate future disruptions. Additionally, the pandemic might lead to a renewed focus on regional production and transportation of chemicals, potentially impacting global trade patterns. On the positive side, the emphasis on hygiene and sanitation during the pandemic could lead to increased demand for specific chemicals, impacting the transportation needs of the chemical tanker market in unforeseen ways. Overall, the COVID-19 pandemic presented a complex set of challenges, but the chemical tanker market is expected to adapt and evolve, with a focus on resilience, efficiency, and potentially catering to a shift in chemical trade patterns.

Latest Trends/ Developments:

The chemical tankers market is constantly innovating to meet the demands of the global chemical industry. Digitalization is a major trend, with companies embracing AI and big data to optimize routes, manage cargo, and perform predictive maintenance, leading to increased efficiency and cost savings. Automation in tasks like loading and unloading is also gaining traction to enhance safety and reduce human error. Sustainability is another key focus. Environmental regulations and a growing green conscience are driving the development of eco-friendly technologies. Investments are being made in alternative fuels like LNG and wind propulsion systems to reduce emissions while optimizing vessel designs for better fuel efficiency is another area of active exploration.

Safety remains paramount, with stricter protocols and crew training programs being implemented to prevent accidents and environmental damage. Advancements in remote monitoring systems allow for real-time tracking of cargo conditions and potential issues, further enhancing safety during voyages.

Key Players:

-

Bahri

-

Stolt-Nielsen

-

Odfjell

-

Navig8

-

MOL Chemical Tankers

-

Nordic Tankers

-

Wilmar International

-

MISC Berhad

-

Team Tankers International Ltd.

-

Iino Kaiun Kaisha

Chapter 1. Chemical Tankers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Chemical Tankers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Chemical Tankers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Chemical Tankers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Chemical Tankers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Chemical Tankers Market – By Product Type

6.1 Introduction/Key Findings

6.2 Organic Chemicals

6.3 Inorganic Chemicals

6.4 Vegetable Oils and Fats

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Chemical Tankers Market – By Fleet Type

7.1 Introduction/Key Findings

7.2 IMO Type 1

7.3 IMO Type 2

7.4 IMO Type 3

7.5 Y-O-Y Growth trend Analysis By Fleet Type

7.6 Absolute $ Opportunity Analysis By Fleet Type, 2024-2030

Chapter 8. Chemical Tankers Market – By Fleet Size

8.1 Introduction/Key Findings

8.2 Inland Chemical Tankers (1,000-4,999 DWT)

8.3 Coastal Chemical Tankers (5,000-9,999 DWT)

8.4 Deep-Sea Chemical Tankers (10,000-50,000 DWT)

8.5 Y-O-Y Growth trend Analysis By Fleet Size

8.6 Absolute $ Opportunity Analysis By Fleet Size, 2024-2030

Chapter 9. Chemical Tankers Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Fleet Type

9.1.4 By Fleet Size

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Fleet Type

9.2.4 By Fleet Size

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Fleet Type

9.3.4 By Fleet Size

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Fleet Type

9.4.4 By Fleet Size

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Fleet Type

9.5.4 By Fleet Size

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Chemical Tankers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bahri

10.2 Stolt-Nielsen

10.3 Odfjell

10.4 Navig8

10.5 MOL Chemical Tankers

10.6 Nordic Tankers

10.7 Wilmar International

10.8 MISC Berhad

10.9 Team Tankers International Ltd.

10.10 Iino Kaiun Kaisha

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Chemical Tankers Market was valued at USD 30 billion in 2023 and is projected to reach a market size of USD 49.77 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.5%.

Soaring Demand for Self-Consumption and Energy Independence, Government Incentives and Supportive Policies, Growing Focus on Power Outage Resilience, and Advancements in Battery Technology.

Inland Chemical Tankers (1,000-4,999 DWT), Coastal Chemical Tankers (5,000-9,999 DWT), Deep-Sea Chemical Tankers (10,000-50,000 DWT).

The Asia-Pacific region reigns supreme in the Chemical Tankers Market, driven by the booming chemical industry in China and Southeast Asia.

Bahri, Stolt-Nielsen, Odfjell, Navig8, MOL Chemical Tankers, Nordic Tankers, Wilmar International, MISC Berhad, Team Tankers International Ltd., Iino Kaiun Kaisha.