Chemical Mixer Market Size (2024-2030)

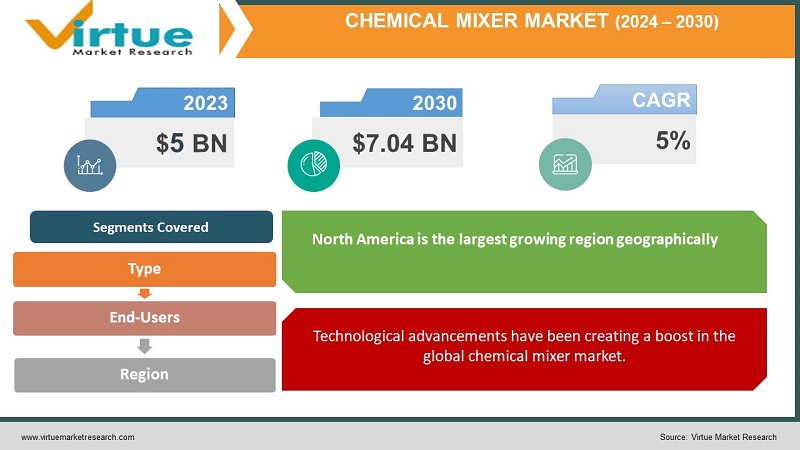

The global chemical mixer market was valued at USD 5 billion and is projected to reach a market size of USD 7.04 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5%.

To guarantee that the finished product satisfies requirements, a chemical mixer prepares, blends, and mixes chemicals. They could be employed in the food and beverage, cosmetic, or pharmaceutical industries, among other sectors. In the past, this market has had a limited presence. The mixing was mostly done by hand. Even though very few companies employed the mixers, they lacked advanced features. Presently, due to awareness, economic growth, and technological advancements, this market has seen notable growth. In the future, with an increasing emphasis on diverse applications and customization, this market is set to see good growth.

Key Market Insights:

By 2025, it is anticipated that Brazil's income from machines used for mixing or kneading solid mineral compounds will reach around 17.07 million US dollars.

The worldwide chemical sector generated 5.72 trillion dollars in sales in 2022, the most in fifteen years.

With about 9.88 billion euros invested in the chemical sector in 2022, Russia was the nation in Europe with the greatest level of investment.

By 2022, the chemical sector in the United States had invested around $26.1 billion in major projects.

The rate of technology adoption in the chemical mixer industry may indicate that between 30 and 40 percent of companies continue to use antiquated or conventional mixing technologies. To tackle this, organizations have been working towards awareness programs and improving marketing techniques

Chemical Mixer Market Drivers:

Technological advancements have been creating a boost in the global chemical mixer market.

Several innovations in the manufacturing of chemical mixers have been helping with the growth of the market. The capacity of the mixer has seen a drastic change. This means that it can take on more load, thereby saving a lot of time. Secondly, by employing low-frequency acoustic energy to generate hydraulic motion on both the bulk and microscales, low-frequency sonic mixing is accomplished. Thirdly, modern mixer and agitator designs prioritize energy efficiency above performance requirements. More energy-efficient mixing techniques are the result of the combined use of computational fluid dynamics (CFD) calculations, optimized impeller designs, and variable-speed motors. Moreover, integration with AI (artificial intelligence) and IoT (internet of things) has facilitated better quality and efficiency. Furthermore, countercurrent mixing, which involves the mixing pan and tools moving in opposing directions, is used in high-shear mixers. In a fluid, this mechanism aids in the dispersion of distinct phases.

The growth rate has been accelerated by industries' growing demand.

Chemical mixers find applications for many purposes. They are used for wastewater treatment as they improve efficiency by preventing hydraulic dead zones and encouraging thermal fluid circulation. Additionally, they regulate pH through appropriate mixing, which is necessary for flocculation, coagulation, and the production of sludge downstream. Moreover, as they mix chemicals into the process stream, they scatter the compounds. These substances can help with solid removal, neutralization, and color and odor management. Secondly, mixing produces heat, which can impact the final quality of the product. Chemical mixers may be used to regulate temperature. Thirdly, droplets are broken down and kept from recombining during the emulsification process using chemical mixers, such as high-shear mixers. Moreover, there are several uses for a chemical mixer in solid suspension. They are primarily used to facilitate the handling of the material. Furthermore, for gas dispersion, chemical mixers can be employed to guarantee complete dispersion and activation of the dispersing agent. By doing this, the dispersion's effectiveness and performance are maximized.

Chemical Mixer Market Restraints and Challenges:

Price, regulatory compliance, and operation limitations are the main issues that are currently being experienced by the market.

The related costs are one of the main obstacles in the industry. The initial investments are substantial. Furthermore, maintenance costs accumulate. Since vital reactions are carried out in these mixers, organizations must make sure they purchase high-quality equipment. Smaller businesses may face financial challenges due to this. Secondly, strict guidelines for testing, temperature control, and other similar safety measures that are established by the agencies and the government must be followed by different end-user sectors. This can make compliance more difficult. Apart from this, integration of the technology can be difficult, posing compatibility concerns with systems that are outdated. Additionally, operating the equipment requires skilled labor with proper knowledge about its performance and handling. This can create barriers for the market.

Chemical Mixer Market Opportunities:

Customizing designs to meet industry demands has opened up a lot of possibilities for the market. This can involve personalization concerning scalability, functionality, and size. Secondly, to create advanced features, research and development efforts are being given priority. Time-saving, cost-effective, and energy-efficient systems are in high demand. As such, most manufacturers are focusing on incorporating these factors into their equipment. Moreover, safety mechanisms are being enhanced as fewer toxic and dangerous chemicals might be used. This helps in the creation of a broader consumer base. Furthermore, to expand the market and, consequently, its profits, businesses are also focusing on expanding their worldwide operations. This results in greater revenue.

CHEMICAL MIXER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sulzer Ltd, EKATO Holding GmbH, SPX Flow, Inc., Philadelphia Mixing Solutions, Ltd., Mixer Direct, Inc., Mettler Toledo, Chemineer, Charles Ross & Son Company, Silverson Machines, Inc., Hayward Gordon Group |

Chemical Mixer Market Segmentation:

Chemical Mixer Market Segmentation: By Type:

- Static In-line Mixer

- Dynamic In-line Mixer

Dynamic in-line mixers are more commonly used by various end-user industries, making them the largest growth in the market. Direct mixing of chemicals into a pipeline flow is possible with dynamic in-line chemical mixers. They can lower the chance of obstruction and produce homogenous mixing results. In dynamic mixers, liquid components are blended using revolving mixers. When used with delicate liquids, they can produce homogenous results more quickly and consistently than alternative methods. Apart from this, they are affordable and easy to install, making them an attractive choice. Furthermore, by achieving effective mixing outcomes and streamlining the admixing process, dynamic in-line mixers can lower the danger of blockage. Static in-line mixers are the fastest-growing category. The inline continuous blending of fluids within a pipeline is made possible by the highly developed unmoving mixing machines known as static mixers. Static mixers use the energy of the flow stream to produce consistent, economical, and dependable mixing because they have no moving components. In water treatment, static mixers are frequently employed to establish an injection point into a water line for chemicals like soda ash and chlorine. They produce turbulence, which facilitates the chemical's quick mixing into the water stream.

Chemical Mixer Market Segmentation: By End-Users:

- Food and Beverage Industry

- Pharmaceutical Industry

- Chemical Industry

- Paper Industry

- Others

Based on end-users, the chemical industry is considered to be the largest segment in 2023. Chemical mixers are used for a variety of applications in this sector. They might be used for mixing and blending many chemicals and compounds for chemical reactions. Secondly, they can be used for particle size reduction. This decrease in size is necessary, as smaller particles tend to have better conductivity and surface quality. Apart from this, they are used for the customization of specific formulations as per the client's needs. The pharmaceutical sector is the fastest-growing end-user. They are mainly used for drug formulations. The development of these medications often requires the blending of various chemicals for which these mixers are used. This equipment ensures precise mixing, better yield, and increased efficiency. Pharmaceutical medications that come in powder, granular, or occasionally liquid form can all be mixed using mixers. Besides this, they can be used for similar applications as those in the chemical industry, like particle reduction and emulsification.

Chemical Mixer Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the largest growing region geographically. This area accounts for around 33% of the total in 2023. The US and Canada are the two leading countries. The economy is the main reason for this success. The infrastructure and other resources that are required for manufacturing are available in this area. Investments in the pharmaceutical and chemical sectors also contribute to its popularity. Secondly, there are a lot of important companies based in this area that are involved in production, large-scale manufacturing, and R&D activities. Prominent ones include Sulzer Ltd., Philadelphia Mixing Solutions Ltd., Mixer Direct, Inc., Chemineer, and Charles Ross & Son Company. These companies operate globally, thereby increasing sales and revenue. The Asia-Pacific region, which includes prominent nations like China, India, and Japan, is the fastest-growing. This region holds a rough share of 25%. The developing economy has been fueling this growth. There are many job prospects, particularly in the chemical industry. One of the largest markets for the chemical industry is Asia. The import-export of different chemicals contributes significantly to the region's economy. In addition, considerable progress has been made in wastewater management because of the innovative solutions that many emerging startups and companies have come up with. Furthermore, the rising funds from many business tycoons, multinational companies, and governmental bodies have been helping with the expansion.

COVID-19 Impact Analysis on the Global Chemical Mixer Market:

The pandemic caused damage to the market. The new normal included social isolation, movement limitations, and lockdowns. Transportation, logistics, and the supply chain were all affected by this. Activities related to import-export commerce were impacted by this. Businesses, manufacturing, and production facilities were temporarily closed to avoid the spread of viruses. Production facilities had a delay as a result of this. The majority of the ongoing procedures were rescheduled or delayed. An economic downfall was prevalent because of all these factors. Additionally, most of the financial resources and research efforts were being directed towards healthcare applications like vaccine development, increase in hospital beds, oxygen tanks, ventilators, PPE kits, etc. The pandemic significantly affected the chemical sector, resulting in a 35% decline in income, according to Statista. But post-pandemic, the market has been gradually recovering owing to the upliftment of rules and relaxation of guidelines.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing agricultural technologies while maintaining competitive pricing. This has further resulted in increased enlargement.

Recently, there has been a lot of awareness regarding sustainability. To keep up with this trend, companies have been giving prominence to green materials. Eco-friendly materials and designs are being emphasized to create a lower carbon footprint. Besides, energy-efficient mixers that require less power are being increasingly adopted by many industries.

Key Players:

- Sulzer Ltd

- EKATO Holding GmbH

- SPX Flow, Inc.

- Philadelphia Mixing Solutions, Ltd.

- Mixer Direct, Inc.

- Mettler Toledo

- Chemineer

- Charles Ross & Son Company

- Silverson Machines, Inc.

- Hayward Gordon Group

In August 2022, the Benchmix® 10 compact high-shear lab mixer was introduced by Admix, Inc., a multinational producer of sanitary and industrial mixing equipment servicing the food and beverage, chemical, cosmetic, and pharmaceutical sectors. The proprietary Admix Rotosolver® high shear mix head, which is included with the Benchmix 10, was designed to be extremely effective in dispersing and wetting out powders, getting rid of agglomerates, and producing homogeneous mixes and emulsions.

In January 2022, Zeppelin Systems introduced the patented CMQ container mixer. The essential parts of the mixer have been streamlined to make cleaning easier and potentially cut cleaning times by 80%. Zeppelin Systems further integrates a unique aspiration and filtration system with the mixers.

Chapter 1. GLOBAL CHEMICAL MIXER MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL CHEMICAL MIXER MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL CHEMICAL MIXER MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL CHEMICAL MIXER MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL CHEMICAL MIXER MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL CHEMICAL MIXER MARKET – By Type

6.1. Introduction/Key Findings

6.2. Static In-line Mixer

6.3. Dynamic In-line Mixer

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL CHEMICAL MIXER MARKET – By End-user Industry

7.1. Introduction/Key Findings

7.2. Food and Beverage Industry

7.3. Pharmaceutical Industry

7.4. Chemical Industry

7.5. Paper Industry

7.6. Others

7.7. Y-O-Y Growth trend Analysis By End-user Industry

7.8. Absolute $ Opportunity Analysis By End-user Industry , 2024-2030

Chapter 8. GLOBAL CHEMICAL MIXER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-user Industry

8.1.3. By Type

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By End-user Industry

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By End-user Industry

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By End-user Industry

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By End-user Industry

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL CHEMICAL MIXER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Sulzer Ltd

9.2. EKATO Holding GmbH

9.3. SPX Flow, Inc.

9.4. Philadelphia Mixing Solutions, Ltd.

9.5. Mixer Direct, Inc.

9.6. Mettler Toledo

9.7. Chemineer

9.8. Charles Ross & Son Company

9.9. Silverson Machines, Inc.

9.10. Hayward Gordon Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global chemical mixer market was valued at USD 5 billion and is projected to reach a market size of USD 7.04 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5%.

Technological advancements and a growing demand from industries are the main factors propelling the Global Chemical Mixer Market

Based on End-Users, the Global Chemical Mixer Market is segmented into the Food and Beverage Industry, Pharmaceutical Industry, Chemical Industry, Paper Industry, and Others.

North America is the most dominant region for the Global Chemical Mixer Market.

Sulzer Ltd, EKATO Holding GmbH, and SPX Flow, Inc. are the key players operating in the Global Chemical Mixer Market.