Chemical Logistics Market Size (2025 – 2030)

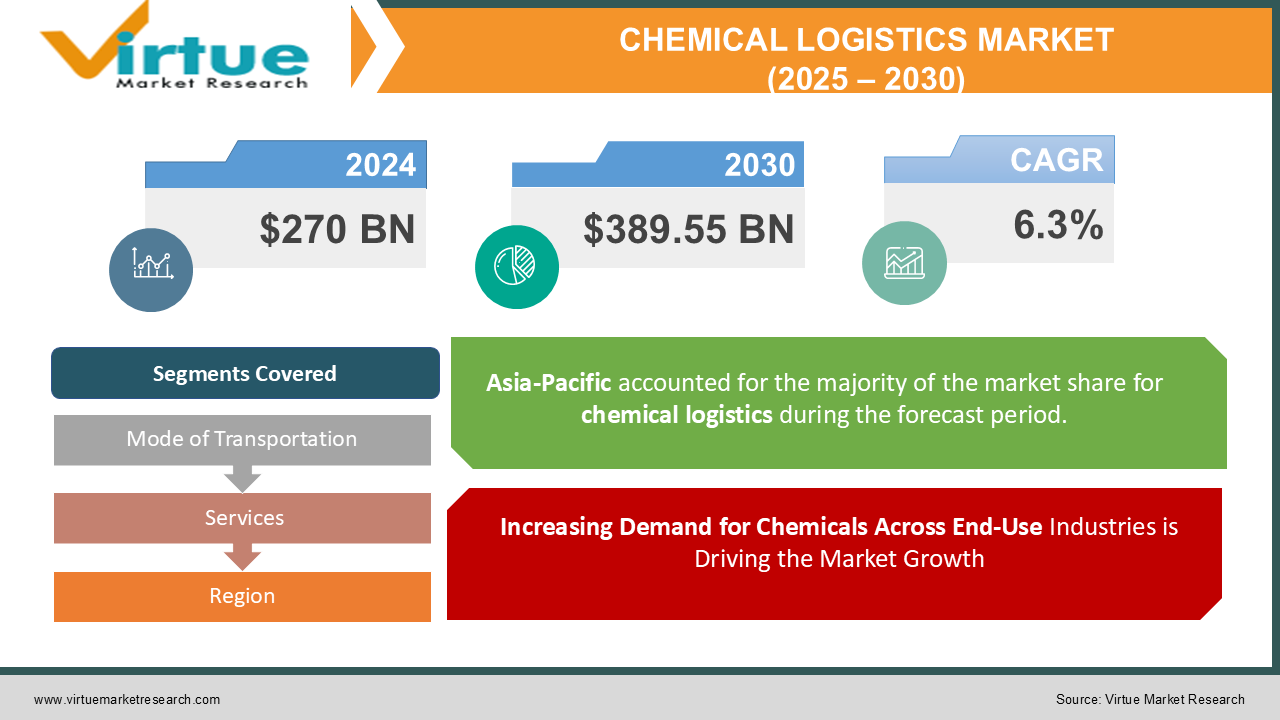

The Global Chemical Logistics Market was valued at USD 270 billion in 2024 and is expected to reach USD 389.55 billion by 2030, expanding at a CAGR of 6.3% during the forecast period.

The market focuses on transporting, storing, and distributing chemical products, which are often hazardous and require specialized handling and compliance with strict regulations.

Rapid industrialization, global trade expansion, and the increasing demand for chemicals across industries such as agriculture, manufacturing, and pharmaceuticals are driving the growth of the Chemical Logistics Market. The integration of advanced technologies like IoT and blockchain for enhanced safety, traceability, and operational efficiency is further propelling the market.

Key Market Insights

-

The roadways segment held the largest market share in 2024, accounting for 40% of the total revenue, driven by the flexibility and extensive reach of road transportation networks.

-

The transportation service segment leads the market, contributing over 50% of the global revenue, with growing demand for timely and safe delivery of chemicals.

-

Technological advancements, such as IoT-enabled tracking and predictive analytics, are enhancing the efficiency and safety of chemical logistics. Stringent environmental and safety regulations are shaping the operational strategies of logistics providers to ensure compliance.

Global Chemical Logistics Market Drivers

1. Increasing Demand for Chemicals Across End-Use Industries is Driving the Market Growth

The global demand for chemicals is rising due to their extensive application in industries such as agriculture, pharmaceuticals, food processing, and manufacturing. The agricultural sector, in particular, relies heavily on chemical fertilizers and pesticides to enhance crop yield.

Pharmaceutical companies require specialized logistics solutions to transport sensitive chemicals under controlled conditions. The growth of these industries directly influences the demand for efficient chemical logistics services, ensuring timely and secure delivery of products.

2. Advancements in Logistics Technologies are driving the market growth

The adoption of advanced technologies like IoT, AI, and blockchain is revolutionizing the chemical logistics market. IoT-enabled tracking systems provide real-time visibility of shipments, ensuring better control over transportation and storage conditions.

Blockchain technology enhances transparency and traceability in the supply chain, reducing risks associated with counterfeit products and non-compliance. These technological advancements not only improve operational efficiency but also strengthen customer trust, driving market growth.

3. Stringent Regulatory Frameworks is driving the market growth

Governments and regulatory bodies worldwide impose strict guidelines for the transportation and storage of chemicals due to their hazardous nature. Compliance with these regulations ensures safety, reduces environmental impact, and mitigates risks associated with chemical spills or accidents.

Logistics providers invest in specialized equipment, training, and certifications to meet regulatory standards. These measures, while challenging, create opportunities for established players with advanced capabilities to dominate the market.

Global Chemical Logistics Market Challenges and Restraints

1. High Costs of Specialized Logistics Solutions is restricting the market growth

The transportation and storage of chemicals require specialized equipment, including temperature-controlled containers, reinforced tanks, and advanced safety systems. These specialized solutions significantly increase operational costs for logistics providers.

Additionally, compliance with stringent regulations necessitates continuous investment in training, certifications, and safety protocols, further adding to the cost burden. These factors can deter small and medium-sized enterprises (SMEs) from entering the market or expanding their operations.

2. Environmental Concerns and Sustainability Challenges is restricting the market growth

The chemical logistics industry faces increasing scrutiny over its environmental impact. The use of fossil fuels for transportation and the generation of hazardous waste during storage and handling contribute to greenhouse gas emissions and pollution.

Logistics providers are under pressure to adopt sustainable practices, such as eco-friendly packaging, fuel-efficient vehicles, and renewable energy sources. While these initiatives align with global sustainability goals, their implementation involves significant capital investment, posing challenges for market participants.

Market Opportunities

The Global Chemical Logistics Market presents a landscape brimming with substantial growth opportunities, fueled by a confluence of evolving industry trends and rapid technological advancements. The burgeoning demand for specialty chemicals, such as adhesives, coatings, and sealants, across diverse sectors like automotive, construction, and electronics, necessitates customized logistics solutions, opening avenues for service providers to diversify their offerings. Concurrently, the rapid industrialization and urbanization sweeping across developing economies, particularly in Asia-Pacific, Latin America, and Africa, are driving a surge in chemical production and trade. This presents a fertile ground for logistics providers to establish a robust presence in these emerging markets. Furthermore, the escalating emphasis on sustainability is propelling the adoption of eco-friendly practices within the chemical logistics domain. Service providers who proactively invest in green technologies and sustainable processes can effectively differentiate themselves and gain a competitive edge in the market. The integration of cutting-edge digital technologies, including predictive analytics, artificial intelligence, and the Internet of Things, is revolutionizing supply chain efficiency and contributing to substantial reductions in operational costs. Companies adept at leveraging these technologies can effectively cater to the escalating demand for efficient, reliable, and cost-effective logistics solutions. Moreover, strategic collaborations and partnerships between logistics providers, chemical manufacturers, and technology companies can unlock significant synergies. These collaborative ventures facilitate the sharing of resources, drive down costs, and pave the way for the development of innovative solutions, ultimately expanding market reach and enhancing service offerings for all stakeholders

CHEMICAL LOGISTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Mode of Transportation, Services, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DHL Supply Chain, DB Schenker, Agility Logistics, Kuehne + Nagel International AG, FedEx Corporation, C.H. Robinson Worldwide, A.P. Moller – Maersk, CEVA Logistics, XPO Logistics, Yusen Logistics |

Chemical Logistics Market Segmentation - By Mode of Transportation

-

Roadways

-

Railways

-

Waterways

-

Airways

The roadways segment currently reigns supreme in the Chemical Logistics Market, primarily due to its unmatched flexibility and extensive reach. Road transport offers unparalleled accessibility, enabling door-to-door delivery to even the most remote locations, a crucial factor for the timely and efficient distribution of chemicals across diverse geographical landscapes. Its inherent flexibility allows for customized routes and schedules, ensuring swift and responsive delivery to meet the dynamic demands of the chemical industry. Furthermore, the widespread availability of road infrastructure and a vast network of carriers contribute to its dominance. However, the waterways segment is steadily gaining traction, particularly for the transportation of bulk chemicals. Water transport offers a compelling proposition due to its inherent cost-effectiveness, especially for transporting large volumes over long distances. Compared to road transport, waterways typically incur lower fuel costs and significantly reduced wear and tear on vehicles, translating into substantial savings for logistics operators. Moreover, the environmental footprint of water transport is generally lower, aligning with the growing emphasis on sustainable logistics practices within the industry. As a result, the waterways segment is poised for significant growth, driven by ongoing investments in infrastructure development, technological advancements in vessel design and navigation, and a renewed focus on sustainable transportation solutions.

Chemical Logistics Market Segmentation - By Services

-

Transportation

-

Storage & Warehousing

-

Distribution

The transportation segment undeniably holds the largest share within the Chemical Logistics Market, a position firmly cemented by the ever-increasing demand for timely and secure delivery of chemicals across a wide spectrum of industries. The intricate and often complex supply chains of the modern chemical industry necessitate efficient and reliable transportation solutions to ensure the uninterrupted flow of raw materials, intermediates, and finished products. From the procurement of raw materials from diverse global sources to the timely delivery of finished goods to end-users, transportation plays a pivotal role in every stage of the chemical manufacturing and distribution process. The growing emphasis on just-in-time manufacturing practices and lean supply chains further underscores the criticality of efficient transportation. Moreover, the stringent safety and regulatory requirements associated with the transportation of hazardous chemicals necessitate specialized expertise and robust infrastructure. This has led to a surge in demand for specialized transportation services, including temperature-controlled transportation, hazardous materials handling, and specialized packaging solutions. As the chemical industry continues to evolve, driven by factors such as globalization, technological advancements, and increasing regulatory scrutiny, the demand for efficient and reliable transportation services is poised to grow exponentially. This presents significant opportunities for logistics providers to innovate and expand their service offerings, leveraging cutting-edge technologies such as telematics, blockchain, and artificial intelligence to enhance visibility, optimize routes, and improve overall supply chain efficiency.

Chemical Logistics Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The Asia-Pacific region currently reigns supreme in the global Chemical Logistics Market, commanding a substantial share of over 45% in 2024. This dominance is primarily attributed to the region's rapid industrialization, a surge in chemical production across diverse sectors, and significant investments in modernizing transportation infrastructure. Key economies like China, India, and Japan serve as major contributors to this robust market growth. North America, while a mature market, remains a significant player, driven by the presence of well-established chemical manufacturers and a highly developed logistics infrastructure. The United States, in particular, dominates the regional market, bolstered by stringent regulatory frameworks and a strong demand for specialty chemicals. Europe, characterized by its mature market with a focus on stringent environmental and safety regulations, continues to demonstrate steady growth. The region's emphasis on sustainability and the adoption of green logistics practices further fuels market expansion. Germany, France, and the United Kingdom are key contributors to the European market. Latin America emerges as a dynamic market, with Brazil and Mexico spearheading growth, driven by increasing chemical production and a surge in trade activities. This region presents significant untapped potential for logistics providers to expand their operations and capitalize on emerging opportunities. The Middle East and Africa region is also witnessing steady growth, supported by investments in industrial development and the expansion of chemical manufacturing capacities. This region offers promising prospects for the future growth of the Chemical Logistics Market.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the Global Chemical Logistics Market. Supply chain disruptions, reduced industrial activities, and lockdown measures initially hindered market growth. However, the market rebounded as the demand for chemicals in pharmaceuticals, healthcare, and essential goods increased.

The pandemic accelerated the adoption of digital technologies and automation in logistics operations, enhancing resilience and efficiency. Post-pandemic recovery efforts and government initiatives to strengthen supply chain infrastructure are expected to sustain market growth in the coming years.

Latest Trends/Developments

The chemical logistics market is experiencing significant transformation driven by several key factors. The widespread adoption of IoT-enabled tracking systems and AI-powered analytics is revolutionizing operational efficiency, enhancing safety, and ensuring regulatory compliance throughout the supply chain. Logistics providers are increasingly prioritizing sustainability initiatives by embracing eco-friendly packaging, exploring alternative fuels, and implementing energy-efficient practices to minimize their environmental impact. The surging demand for specialty chemicals across various industries is driving the need for highly customized logistics solutions, prompting providers to expand their service offerings to cater to these specialized requirements. Furthermore, developing regions are emerging as key growth areas for the chemical logistics market, fueled by increasing chemical production and trade activities. Finally, collaborative supply chains, forged through strategic partnerships between logistics providers, manufacturers, and technology companies, are fostering innovation and enhancing market competitiveness by enabling the seamless flow of information, optimizing resources, and driving the development of cutting-edge solutions.

Key Players

-

DHL Supply Chain

-

DB Schenker

-

Agility Logistics

-

Kuehne + Nagel International AG

-

FedEx Corporation

-

C.H. Robinson Worldwide

-

A.P. Moller – Maersk

-

CEVA Logistics

-

XPO Logistics

-

Yusen Logistics

Chapter 1. Chemical Logistics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Chemical Logistics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Chemical Logistics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Chemical Logistics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Chemical Logistics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Chemical Logistics Market – By Mode of Transportation

6.1 Introduction/Key Findings

6.2 Roadways

6.3 Railways

6.4 Waterways

6.5 Airways

6.6 Y-O-Y Growth trend Analysis By Mode of Transportation

6.7 Absolute $ Opportunity Analysis By Mode of Transportation, 2025-2030

Chapter 7. Chemical Logistics Market – By Services

7.1 Introduction/Key Findings

7.2 Transportation

7.3 Storage & Warehousing

7.4 Distribution

7.5 Y-O-Y Growth trend Analysis By Services

7.6 Absolute $ Opportunity Analysis By Services, 2025-2030

Chapter 8. Chemical Logistics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Mode of Transportation

8.1.3 By Services

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Mode of Transportation

8.2.3 By Services

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Mode of Transportation

8.3.3 By Services

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Mode of Transportation

8.4.3 By Services

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Mode of Transportation

8.5.3 By Services

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Chemical Logistics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DHL Supply Chain

9.2 DB Schenker

9.3 Agility Logistics

9.4 Kuehne + Nagel International AG

9.5 FedEx Corporation

9.6 C.H. Robinson Worldwide

9.7 A.P. Moller – Maersk

9.8 CEVA Logistics

9.9 XPO Logistics

9.10 Yusen Logistics

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Chemical Logistics Market was valued at USD 270 billion in 2024 and is expected to reach USD 389.55 billion by 2030, expanding at a CAGR of 6.3% during the forecast period.

Key drivers include the increasing demand for chemicals across industries, advancements in logistics technologies, and stringent regulatory frameworks.

Segments include Mode of Transportation (Roadways, Railways, Waterways, Airways), Services (Transportation, Storage & Warehousing, Distribution), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa).

Asia-Pacific dominates the market, holding over 45% of the global share, driven by rapid industrialization and increasing chemical production.

Key players include DHL Supply Chain, DB Schenker, Agility Logistics, Kuehne + Nagel, and FedEx Corporation.