Charcoal Market Size (2024 – 2030)

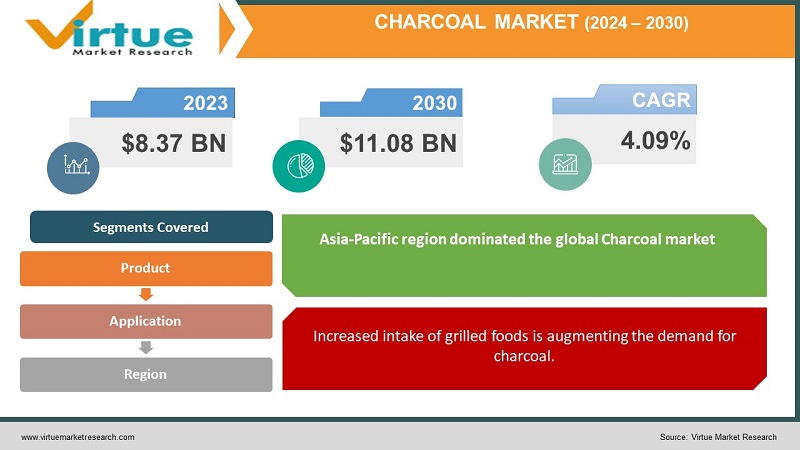

The Global Charcoal Market was valued at USD 8.37 billion and is projected to reach a market size of USD 11.08 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.09%.

Charcoal is a substance made by humans that comes from plant material, like wood. This process happens when there is oxygen present. It helps to get rid of things like substances and water. The global charcoal market is expected to grow in the future due to the rising demand for charcoal in industries such as recreational cooking, metal manufacturing, construction, healthcare, industrial filtration, and pharmaceutical applications. Charcoal can be used as an alternative to coal in cooking and its popularity in barbeque restaurants is also contributing to the increased demand, for charcoal.

Key Market Insights:

By the end of 2022, it is expected that wood charcoal sales, in the United States will make up a portion 95%, of the total revenue generated from wood charcoal sales, in North America.

According to the World Steel Association, China, the producer of steel globally saw a production increase, from 97.9 million tons in April 2021 to 99.5 million tons in May 2021 marking a growth of 1.63%. As a result, there will be a demand for charcoal as a fuel, within the steel industry.

The healthcare industry, in India is set to experience growth due to factors such as rising income levels improved accessibility, insurance, and a growing awareness of health and lifestyle diseases. According to the Indian Brand Equity Foundation (IBEF), it is projected that the healthcare sector will reach a value of USD 372 billion by 2022.

According to the Food and Agriculture Organization of the United Nations (FAO), the main culprits responsible, for Zambia's deforestation are charcoal producers and small-scale farmers, in the country.

According to the United Nations Environment Programme (UNEP), 40% of the energy generated in Africa comes from fuelwood and charcoal. Additionally, charcoal is being utilized as a filtering agent to remove oils, pesticides, salts, and harmful substances from the air and water in the area.

Charcoal Market Drivers:

The growing industrialization and urbanization had created a significant demand for charcoal.

The rising demand, for charcoal is primarily driven by the growing population in developing nations. With over half of the world's population now residing in cities city dwellers rely on charcoal due to its ease of production, accessibility, transportation, and rooted tradition. Urbanization has not influenced the choice of fuels. Also increased the overall energy consumption for various purposes thereby further boosting the demand, for charcoal production throughout the region.

Increased intake of grilled foods is augmenting the demand for charcoal.

Barbecuing is an activity, in many parts of the world, especially during the summer. While some people use gas or electric grills many prefer the flavor that comes from grilling with charcoal. Charcoal is commonly used for barbecuing in North America and Europe. It serves as the primary cooking fuel in most African countries. The market for grilled food is driven by its growing popularity among millennials. Additionally, due to the COVID-19 lockdown restrictions, more people are staying at home. Engaging in cooking at home and hosting small social events. As a result, there is an increasing demand, for home cooking equipment and materials.

Charcoal Market Restraints and Challenges:

Government regulations for charcoal production are strict restricting market growth.

Several policies and regulations have been implemented to ensure the quality and safe handling of charcoal production. The Canada Consumer Product Safety Act (CCPSA) (S.C. 2010 c. 21) focuses on preventing any risks to health or safety that may be associated with consumer products, in Canada both manufactured and imported ones.

Inadequate baseline data for policy design about charcoal hampering market growth.

The growth of the charcoal market is primarily driven by population growth and the transition, from firewood to charcoal. However, it is important to note that the ongoing deforestation on a level cannot be solely attributed to wood fuel exploitation. The issues related to wood fuel have been exacerbated by a lack of information regarding policies governing charcoal production. This has resulted in a gap between supply and demand for charcoal in the region. To address this it is crucial to obtain data on the entire value chain of charcoal which will serve as a foundation, for developing effective policy frameworks. This will also provide a chance for stakeholders to contribute their knowledge, innovation, capital, and technology at every stage of the charcoal production process. As a result, the lack of information, for policy development poses a significant obstacle to the expansion of the market.

Charcoal Market Opportunities:

Traditional household stoves that are commonly used for heating and cooking tend to be inefficient and produce an amount of air pollution, which can negatively impact human health. To improve the efficiency of cooking and heating while reducing pollution better cook stoves have been introduced in countries. Additionally, when charcoal is prepared and used correctly in appliances it can be burned cleanly and safely. These improved cook stoves have a shape. Are insulated on all sides. Due, to their insulation properties they require charcoal to produce the amount of heat as traditional stoves while also retaining heat for longer periods. Furthermore, there have been advancements in cook stove technology that aim to reduce greenhouse gas emissions by improving fuel efficiency thereby decreasing the demand, for charcoal needed for cooking energy.

CHARCOAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.09% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal and Firewood Depot, Subur Tiasa Holdings Berhad, Etosha , The Clorox Company, Fire & Flavor, Timber Charcoal Company LLC, FogoCharcoal.com, NamCo Charcoal and Timber Products, Namchar |

Charcoal Market Segmentation: By Product

-

Lump Charcoal

-

Charcoal Briquettes

-

Japanese Charcoal

-

Sugar Charcoal

-

Others

In 2022, based on the product, the Lump Charcoal segment accounted for the largest revenue share by almost 50% and has led the market. Lump charcoal is created by charring hardwood logs in a kiln. It provides a heat output. Has a long burning time making it perfect, for grilling and barbecuing. Charcoal briquettes have become increasingly popular in the charcoal market with a Compound Annual Growth Rate (CAGR) of over 5%. These briquettes are made from a combination of charcoal powder, binder, and water. They are more affordable compared to lump charcoal. They ignite and burn easily. Additionally, charcoal briquettes have a size and shape which makes them convenient for use, in cookers and grills.

Charcoal Market Segmentation: By Application

-

Outdoor Activities

-

Restaurant Business

-

Metallurgical Fuel

-

Industrial Fuel

-

Filtration

-

Others

In 2022, based on the application, the Outdoor Activities segment accounted for the largest revenue share by almost 60% and has led the market. The filtration sector is experiencing the fastest growth, in the charcoal market with a compound annual growth rate (CAGR) exceeding 5%. Charcoal serves as an adsorbent and finds extensive use, in various filtration applications, including water treatment, air purification, and industrial effluent treatment.

Charcoal Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the Asia-Pacific region dominated the global Charcoal market with a revenue of 40%. The Asia Pacific region currently holds the market share, in the charcoal industry. South America is experiencing the most rapid growth. Over the years we can expect a steady increase in the charcoal market due to the rising demand for charcoal for barbecues and grilling along with its expanding use, in various industrial applications.

COVID-19 Impact Analysis on the Global Charcoal Market:

The charcoal market has been significantly affected by the COVID-19 pandemic as every country has chosen to shut down production facilities except, for those involved in manufacturing goods.

The charcoal market has been negatively impacted by the COVID 19 resulting in an estimated year-on-year growth rate compared to 2019 due to reduced activity in sectors associated with charcoal. However, since the reopening of the market after COVID-19, there has been growth. It is projected that there will be substantial growth in the sector due to increased demand, for barbecued food.

Manufacturing companies are implementing strategies to recover from the impact of COVID-19. These players are engaging in research and development efforts to enhance the technology used in charcoal production. As a result, they aim to introduce technologies, into the market. Additionally, government initiatives promoting the use of vehicles have contributed to the growth of this industry.

Latest Trends/ Developments:

In some countries, efforts have been made to improve cooking and heating efficiency while also reducing pollution in households. One solution that has been introduced is the use of advanced cookstoves. These stoves are designed with insulation, on all sides, which helps them retain heat for periods. As a result, they require charcoal to generate the amount of useful heat. This does not increase fuel efficiency. Also lowers greenhouse gas emissions. Additionally, there is a growth opportunity for operators in the charcoal industry as there are plans to replace

Key Players:

-

Plantar

-

Rancher Charcoal

-

E & C Charcoal

-

Jumbo Charcoal (Pty) Ltd.

-

Sagar Charcoal and Firewood Depot

-

Subur Tiasa Holdings Berhad, Etosha

-

The Clorox Company, Fire & Flavor

-

Timber Charcoal Company LLC

-

FogoCharcoal.com

-

NamCo Charcoal and Timber Products

-

Namchar

-

In March 2022 Kingsford Products Company, a subsidiary of The Clorox Company introduced a range of charcoals and hardwood pellets with flavors. The primary goal, behind this product launch is to enhance the grilling experience by offering a range of flavors and aromas. This initiative aims to expand and enrich the company's product portfolio.

-

In September 2020 Fire and Flavor a company formed a partnership, with Englewood Marketing Group (EMG). This collaboration will enable Fire and Flavor to expand its presence in the charcoal industry.

Chapter 1. Charcoal Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Charcoal Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Charcoal Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysi

Chapter 4. Charcoal Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Charcoal Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Charcoal Market – By Product

6.1 Introduction/Key Findings

6.2 Lump Charcoal

6.3 Charcoal Briquettes

6.4 Japanese Charcoal

6.5 Sugar Charcoal

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Charcoal Market – By Application

7.1 Introduction/Key Findings

7.2 Outdoor Activities

7.3 Restaurant Business

7.4 Metallurgical Fuel

7.5 Industrial Fuel

7.6 Filtration

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Charcoal Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Charcoal Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Plantar, Rancher Charcoal,

9.2 E & C Charcoal,

9.3 Jumbo Charcoal (Pty) Ltd.,

9.4 Sagar Charcoal and Firewood Depot,

9.5 Subur Tiasa Holdings Berhad, Etosha ,

9.6 The Clorox Company, Fire & Flavor,

9.7 Timber Charcoal Company LLC,

9.8 FogoCharcoal.com,

9.9 NamCo Charcoal and Timber Products,

9.10 Namchar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Charcoal Market was valued at USD 8.37 billion and is projected to reach a market size of USD 11.08 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.09%.

The growing industrialization and urbanization had created a significant demand for charcoal and increased intake of grilled foods.

Based on Product, the Global Charcoal Market is segmented by Lump Charcoal, Charcoal Briquettes, Japanese Charcoal, Sugar Charcoal, and Others.

Asia-Pacific is the most dominant region for the Global Charcoal Market.

Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal and Firewood Depot, Subur Tiasa Holdings Berhad, Etosha, The Clorox Company, Fire & Flavor, are the key players operating in the Global Charcoal Market.