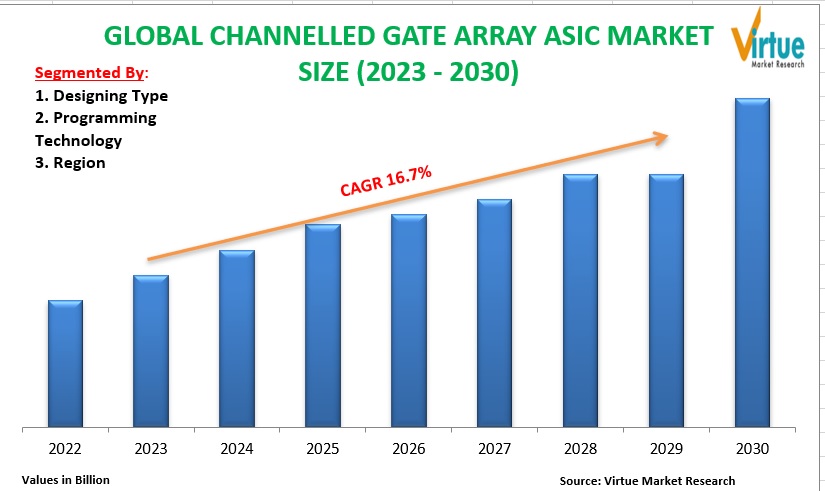

CHANNELLED GATE ARRAY ASIC MARKET SIZE (2023 - 2030)

According to estimates, the Channelled Gate Array ASIC market would be worth USD 300 bn in 2023 and USD 650 bn in 2030, growing at a 16.7% CAGR.

Industry Overview:

An integrated circuit that has been specifically designed for a certain application or end-use as opposed to being used for broader purposes is known as an application specific integrated circuit, or simply an ASIC. The IC in a DVD player that decodes the data on an optical disc and the IC created as a charge controller for lithium-ion batteries are two simple examples of ASICs. As opposed to other common ICs like microprocessors or memories, which are made to be utilised in a variety of applications, ASICs are quite distinct from these. An ASIC, on the other hand, can only be utilised in the programme for which it was created. ASICs frequently pack more capability while being smaller, using less power, and producing less heat than a normal IC solution since they are application-specific bespoke devices. The fundamental distinction between ASICs and conventional ICs, such as memories, is that the client, who may have a better understanding of the application, can directly build an ASIC. ASICs have had a significant impact on the integrated circuit industry since the early 1980s. They are in charge of the growth of the semiconductor industry, modification of the integrated circuits' economic structure, and sharp rise in the number of IC designs and design engineers. The entire ecosystem of semiconductor design and manufacturing, including system design, fabrication and manufacturing processes, testing and packaging, and CAD tools, were also impacted by ASICs.

COVID-19 Impact:

The COVID-19 pandemic has significantly impacted the global economy and supply chain, which has presented difficulties for Channelled Gate Array ASIC market and its supplier factories. In order to help suppliers, deal with the exceptional circumstances and protect the factory workers' health and safety, we are collaborating with them. Asics will keep an eye on how the COVID-19 pandemic is affecting our supply chain and will keep working with the appropriate agencies and business associations to take the required precautions to lessen any adverse effects. Since many businesses are now required to urge their workers to work from home (remotely) due to worries about public health, the economy's decline is to blame for the substantial problems the IT industry is currently experiencing. This results in a significant loss of opportunity for many businesses with foreign dealers. For instance, it is predicted that Apple Inc.'s shares will decline by at least 10% as a result of the market's dearth of iPhones. China, which is currently experiencing a significant crackdown, is meant to supply the components needed to make the iPhones.

MARKET DRIVERS

Increasing demand for customizable ICs is driving growth in Channelled Gate Array ASIC Market

The market is expanding as a result of the rising demand for customisable ICs. Custom ICs enable designers to alter products. In the industrial, automotive, healthcare, and other sectors, their demand is rising. For instance, customised ICs are used in a range of medical equipment, including computer tomography (CT) scanners, digital X-ray machines, ultrasound machines, and electrocardiography (ECG) machines.

Demand for aerospace industry is driving growth in Channelled Gate Array ASIC Market

The considerable expansion of the aerospace sector, which uses FPGAs for waveform creation, image processing, partial reconfiguration, and aircraft navigation, is the main factor driving the field programmable gate array market. Additionally, because of their high compute density and low power consumption, FPGAs are used in security, network processing, and deep packet inspection. In addition, the need for FPGAs is increasing due to the growing desire for autonomous driving experiences that rely on sophisticated sensors and domain controllers that include AI.

MARKET RESTRAINTS

Low awareness about Channelled Gate Array ASIC is restraining growth in Channelled Gate Array ASIC Market

The growth of the Channelled Gate Array ASIC is being constrained by low awareness of the technology.

High cost of capital is restraining growth in Channelled Gate Array ASIC Market

Because FPGAs provide advantages including the capacity to be upgraded and reprogrammed, which lowers the cost of purchasing a new machine when the process changes, high capital costs are limiting the industry's expansion. Additionally, it enables users to personalise chips with programmable logic components set up in various ways.

CHANNELLED GATE ARRAY ASIC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

16.7% |

|

Segments Covered |

By Design Type, Programming Technology and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AchronixSemiconductor,CypressSemiconductor Corporation (Infineon Technologies AG), Efinix Inc., EnSilica Limited, Flex Logix Technologies Inc., Gidel Inc., Intel Corporation, Lattice Semiconductor Corporation, Microsemi Corporation(MicrochipTechnologyInc.), Quicklogic Corporation, Taiwan Semiconductor Manufacturing Company, Xilinx Inc. |

This research report on the global Channelled Gate Array ASIC Market has been segmented and sub-segmented based on design type, programming technology, and region.

Channelled Gate Array ASIC market segmentation – By Design Type

-

Semi-Custom

-

Programmable

-

Full Custom

In terms of design type, channelled gate array ASIC market can be segmented into Semi-Custom, Programmable, and Full Custom. Through the shrinking and integration of individual components and their functions into a single element, an Application Specific Integrated Circuit, ASIC design is a process for lowering the price and size of an electronic circuit, product, or system (ASIC). Many integrated circuits (ICs) that are coupled to each other to carry out a certain function often make up an electronic product. A smoke detector from the 1980s, for instance, was constructed entirely of general-purpose ICs, including amplifiers, comparators, regulators, and discrete components like resistors and capacitors. In comparison to a gate-array, a full-custom ASIC design is a little more challenging. However, because of the increased complexity, the chip is far more capable than its analogue. Due to the degree of customization and removal of unnecessary gates, the size of an ASIC can frequently be drastically reduced as compared to a gate-array architecture.

Channelled Gate Array ASIC market segmentation – By Programming Technology

-

Static RAM

-

Antifuse

-

EEPROM

-

EPROM

-

Others

In terms of programming technology, Channelled Gate Array ASIC market can be segmented into Static RAM, Antifuse, EEPROM, EPROM, and Others. ASICs are created expressly for one client in order to perform a task needed by the client's finished product. For instance, to reduce the size of the phone, a cell phone manufacturer might create an ASIC that combines the battery charging circuit and the display lighting controller into a single IC.

Channelled Gate Array ASIC market segmentation – By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The largest semiconductor market in the world is in China. Every year, China uses more than half of all semiconductors, both for domestic consumption and possible export. As a result, the FPGA market was helped by the rapid growth of Chinese demand. However, only around 30% of their needs can be met by domestic Chinese producers. In order to reduce China's dependence on foreign semiconductor demand, the Chinese government encouraged its national champions and top digital firms to expand their domestic semiconductor production capabilities. Additionally, both the network and device domains are gaining momentum with regard to 5G deployment. The number of 5G subscriptions is predicted to reach 1 billion by 2020, two years earlier than 4G, according to a report issued by Ericson Mobility. The early adoption of 5G in China compared to 4G and the timely availability of equipment from many suppliers are important reasons. The Chinese telecom industry has grown quickly in recent years, and it is estimated to do so through 2030. The growth of the industry is primarily driven by population growth, communication services, and smartphone use. The majority of the market development in China is being driven by premium connection and content offerings. In addition, China is paving the way for the FPGA market to grow as a result of rising demand brought on by its dominant position in the world's production of consumer electronics devices. China is the greatest producer of electronics in the world, generating 36% of all electronics, including computers, cellphones, cloud servers, and telecom equipment. This makes China the most significant node in the global electronics supply chain. The rise of artificial intelligence (AI) in China has given the Chinese consumer electronics market new development opportunities. In the coming ten years, makers of FPGA are projected to see tremendous growth potential in smart homes and IoT (Internet of Things). FPGA usage and application areas are expanding, which is driving up demand for FPGA in China's end-user industry. An illustration. The Chinese military UAV market is thriving and expanding quickly. The development of such UAV systems is altered by programmable gate arrays (FPGAs). FPGAs are employed in both safety-critical low-level tasks like system stability, state estimation, and peripheral interface as well as high-level navigation control techniques including path planning, simultaneous localization and mapping (SLAM), and stereo vision. Besides looking into the use of FPGAs for mission-critical tasks including target tracking, communication, and obstacle avoidance.

Channelled Gate Array ASIC market segmentation – By Company

-

Achronix Semiconductor

-

Cypress Semiconductor Corporation (Infineon Technologies AG)

-

Efinix Inc.

-

EnSilica Limited

-

Flex Logix Technologies Inc.

-

Gidel Inc.

-

Intel Corporation

-

Lattice Semiconductor Corporation

-

Microsemi Corporation (Microchip Technology Inc.)

-

Quicklogic Corporation

-

Taiwan Semiconductor Manufacturing Company

-

Xilinx Inc.

NOTABLE HAPPENINGS IN THE CHANNELLED GATE ARRAY ASIC MARKET IN THE RECENT PAST:

-

In February 2022, in order to address issues with semiconductor supply availability, QuickLogic Corporation introduced the PolarPro 3 line of low-power, SRAM-based FPGAs. This extremely adaptable family offers die alternatives, tiny footprints in small containers, and power consumption as low as 55uA.

-

In November 2021, Alveo U55C, Xilinx's most potent accelerator card designed specifically for HPC and large data workloads, was released. With the highest computing density and HBM capacity in the Alveo accelerator lineup, the new Alveo U55C card is the most potent Alveo accelerator card produced by the firm.

Chapter 1. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION – By Design Type

6.1. Semi Custom

6.2. Programmable

6.3. Full Custom

Chapter 7. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION – By Programme Technology

7.1. Static Ram

7.2. Antifuse

7.3. EEPROM

7.4. EPROM

7.5. Others

Chapter 8. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION – By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. CHANNELLED GATE ARRAY ASIC MARKET SEGMENTATION – By Companies

9.1. Achronix Semiconductor

9.2. Cypress Semiconductor Corporation (Infineon Technologies AG)

9.3. Efinix Inc.

9.4. EnSilica Limited

9.5. Flex Logix Technologies Inc.

9.6. Gidel Inc.

9.7. Intel Corporation

9.8. Lattice Semiconductor Corporation

9.9. Microsemi Corporation (Microchip Technology Inc.)

9.10. Quicklogic Corporation

9.11. Taiwan Semiconductor Manufacturing Company

9.12. Xilinx Inc.

Download Sample

Choose License Type

2500

4250

5250

6900