Cereals and Grains Food Safety Testing Market Size (2024-2030)

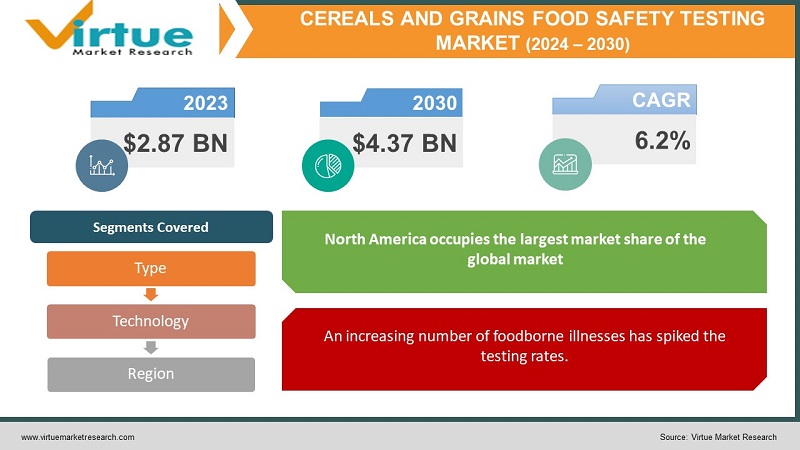

Global Cereals and Grains Food Safety Testing Market was valued at USD 2.87 Billion and is projected to reach a market size of USD 4.37 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.

The cereal and grain safety testing market plays a crucial role in the determination of harmful substances like pathogens, pesticides, contaminants, toxins, etc. Over the past few years owing to public health concerns and the emergence of new bacteria, viruses, contaminants, etc. this industry has seen a steady growth mainly because of the cost-effective and innovative technologies. Currently, most of the food industries have made it mandatory to follow all the testing procedures due to consumer awareness. With an increasing number of populations inclining towards health and fitness, this market is predicted to show notable growth during the forecast period.

Key Market Insights:

Demand for consumption of clean label food exceeded by 40% in many developed countries driving the demand for food safety testing.

Mycotoxin testing gained significant demand and has increased by 20% in the past few years.

Companies focussing on research and developmental activities saw a surge of 5-8% regarding testing techniques.

Quality assurance testing contributed up to 15-20% of the total market share.

Salmonella is estimated to cause an average of 1.35 million infections every year calling the need for stringent laws and regulations regarding food testing.

Around 60% of the food recalls were mainly from cereals and grains. This started affecting the food & and beverage industry. Therefore, Governmental schemes and public demand called for an increase in the frequency of food testing.

Global Cereals and Grains Food Safety Testing Market Drivers:

An increasing number of foodborne illnesses has spiked the testing rates.

According to WHO, an estimated 600 million people fall ill and 420000 fatalities occur every year after consuming contaminated food. The illness can range from diarrhea to vomiting to food poisoning to death. The primary cause is the contamination which can be due to microorganisms, fungi, parasites, chemicals, metals, mycotoxins, etc. Secondly, contamination can be through water, the environment, people, animals, etc. Additionally, while processing, the workforce might have incomplete knowledge about GMP (good manufacturing practices), modern technology, and quality control. According to a report, the Economic Research Service (ERS) estimates that the foodborne illness caused by pathogens such as Salmonella, Listeria monocytogenes, Toxoplasma gondii, Norovirus, and Campylobacter costs around USD 15.5 billion annually. All these factors play a significant role in paving the need for food testing thereby increasing the market revenue.

Rising food recalls have led to increased testing rates driving the growth of the market.

A food recall is a situation when the manufacturer of a food product removes the product because of issues like the presence of an allergen, pathogenic organism, metal, chemical, plastic, etc. According to a report, the US FDA reported 421 recalls in 2021, 495 in 2020, and 585 in 2019. The most common reason for food recalls and public health alerts in 2022 stemmed from Salmonella. This can cause serious health hazards for the public. This data calls for the need for more food testing, keeping in mind the welfare of the public.

Global Cereals and Grains Food Safety Testing Market Restraints and Challenges:

Technological challenges, associated costs, training, and mycotoxin contamination are the major barriers in the market.

Technological understanding and glitches can tremendously affect market expansion. Additionally, the costs of the technologies are pretty high. Moreover, additional costs for power supply, space, and training of the workforce are associated which can be challenging for start-ups and smaller firms. Moreover, certain complex technological equipment have advanced features that can increase the budget. Furthermore, Fusarium mycotoxins are a serious concern for the cereal industry across the world, owing to their frequent and sometimes excessive frequency, as well as the challenges in mitigating their presence in cereals and cereal products since they accumulate in grains during crop growth.

Global Cereals and Grains Food Safety Testing Market Opportunities:

There has been a lot of research and developmental progress in the microbiology field to prevent the contamination of crops during cultivation. Compute science through data analytics is projected to show promising growth. There is a rise in the number of funding and investments from investors. Governmental schemes and initiatives are playing a huge role as well. Technological innovations and creativity are equipped with accuracy which presents the market with an ample number of opportunities. Furthermore, collaborations and partnerships between companies are playing a significant role in paving the way for success.

CEREALS AND GRAINS FOOD SAFETY TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SGS SA , Eurofins Scientific , Intertek Group PLC , Bureau Veritas , ALS Limited , Thermo Fisher Scientific , Neogen Corporation , Mérieux NutriSciences , QIMA , PerkinElmer, Inc |

Global Cereals and Grains Food Safety Testing Market Segmentation:

Global Cereals and Grains Food Safety Testing Market Segmentation: By Type

- Pathogen

- Genetically Modified Organism (GMO)

- Chemicals and Toxins

- Heavy Metals

- Others

Based on type, the pathogen segment is the largest growing. According to a few reports, pathogen testing for foods in general is estimated to reach USD 1 billion by 2032. They hold a total share ranging between 30-35%. The popularity is due to the prevalence of bacteria like Salmonella and E. coli in cereals and grains. Additionally, wrong handling and unsuitable storage conditions add up. There have been a lot of advancements in sensors and assays that are used for pathogen testing further fuelling the progress. Genetic and nucleic acid-based amplification methods have caused a prominent upsurge. GMO testing is the fastest-growing type. PCR and ELISA are the most common techniques used for cereal and grain testing. Since a lot of regions, carry exports of these food products it becomes essential to test for GMOs. Adhering to country-specific standards, certifications, and regulations is a necessary step. Moreover, there is a lot of debate and ethical disputations regarding GMOs further increasing the need for testing. This is estimated to hold an approximate share ranging from 20-25% in the market.

Global Cereals and Grains Food Safety Testing Market Segmentation: By Technology

- Rapid Testing Methods

- Chromatography & Spectrometry

- Convenience-Based Testing

- Immunoassay

- Polymerase Chain Reaction (PCR)

- Traditional Testing Methods

- Microbiological Testing

- X-ray Testing

Based on technology, rapid testing methods are the largest and fastest-growing segment. As per a report, they are projected to grow at a CAGR of 7% by 2032. PCR and immunoassay techniques hold a significant market share. This is because the results are obtained in a time frame of 48 hours. They are suited for the identification of GMOs as well. Furthermore, they are cost-effective, efficient, accurate, and flexible, can test a wide range of contaminants, are highly sensitive, and can be used for low food concentration. They are known to hold a share exceeding 55%.

Global Cereals and Grains Food Safety Testing Market Segmentation: Regional Analysis

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Based on market segmentation by region, North America occupies the largest market share of the global market owing to the development in the agricultural sector, the number of grain production companies, the developed economy, technological advancements, and innovations. The USA, Canada, and Mexico are the leading countries. North America holds a share of around 32% in this market. Asia-Pacific region is the fastest growing during the forecast period holding a share of around 24%. According to a report, North America will reach a total of US 13,339.2 million for food testing in 2032. Factors like a rising economy, growing need, research activities, technology, and developing sectors are opening doors for a prominent market. Moreover, there have been a lot of initiatives from the Government to improve the existing and bring in advanced technologies for testing. China, India, and Japan are expected to see a vast amount of boost.

COVID-19 Impact on the Global Cereals and Grains Food Safety Testing Market:

The pandemic has impacted the industry significantly. Social isolation, movement restrictions, and lockdown was the new norm. There were supply chain disruptions and import-export trade was affected. Reports suggested that 85% of the company faced supply chain disruptions in general. This caused an economic slowdown. The shutdown of local stores and manufacturing companies took a toll on the growth. During the pandemic, a shift was observed where a majority of the population was biased towards consuming home-cooked meals. This caused a lot of loss to restaurants, packaging materials, and groceries supplied to food industries which indirectly affected the testing sector. Even though the Governmental organizations made sure to stick to all the codes of conduct mass fear was instilled in the public due to a lot of jargon, misinformation, and media. However, post-pandemic, with the upliftment of rules, regulations, and lockdowns the consumption of food products saw a gradual increase. As a result, the food testing sector picked up and showed a steady growth rate.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by various tactics such as acquisitions, partnerships, and investments. Companies are also paying more to upgrade existing technologies while keeping prices competitive. This has led to increasing government involvement and subsequent expansion.

Many industries like food & and beverage and agricultural industries have started implementing new techniques and strategies to obtain clean labelled food due to the rising demand. The need for sticking to regulatory standards and quality control has escalated the market. Moreover, prominence is being given to R&D activities to further widen human knowledge.

Key Players:

- SGS SA

- Eurofins Scientific

- Intertek Group PLC

- Bureau Veritas

- ALS Limited

- Thermo Fisher Scientific

- Neogen Corporation

- Mérieux NutriSciences

- QIMA

- PerkinElmer, Inc

- In March 2021, SGS, a global leader in inspection, verification, testing, and certification, purchased Vanguard Sciences, a food testing laboratory specializing in allergy and gluten testing. SGS's position in the food safety testing industry was strengthened as a result of this purchase.

- In January 2021, Mesa Biotech, a firm specializing in point-of-care molecular diagnostic assays, was acquired by Thermo Fisher Scientific. This acquisition aimed to broaden Thermo Fisher's capabilities in quick molecular testing, particularly food safety applications.

Chapter 1. Global Cereals and Grains Food Safety Testing Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Cereals and Grains Food Safety Testing Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Cereals and Grains Food Safety Testing Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Cereals and Grains Food Safety Testing Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Cereals and Grains Food Safety Testing Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Cereals and Grains Food Safety Testing Market – By Type

6.1. Introduction/Key Findings

6.2. Pathogen

6.3. Genetically Modified Organism (GMO)

6.4. Chemicals and Toxins

6.5. Heavy Metals

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Global Cereals and Grains Food Safety Testing Market – By Technology

7.1. Introduction/Key Findings

7.2. Rapid Testing Methods

7.2.1. Chromatography & Spectrometry

7.2.2. Convenience-Based Testing

7.2.3. Immunoassay

7.2.4. Polymerase Chain Reaction (PCR)

7.3. Traditional Testing Methods

7.3.1. Microbiological Testing

7.3.2. X-ray Testing

7.4. Y-O-Y Growth trend Analysis By Technology

7.5 . Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Global Cereals and Grains Food Safety Testing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By ResinType

8.1.3. By Technology

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By ResinType

8.2.3. By Technology

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Resin Type

8.3.3. By Technology

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Resin Type

8.4.3. By Technology

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Resin Type

8.5.3. By Technology

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Global Cereals and Grains Food Safety Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 SGS SA

9.2. Eurofins Scientific

9.3. Intertek Group PLC

9.4. Bureau Veritas

9.5. ALS Limited

9.6. Thermo Fisher Scientific

9.7. Neogen Corporation

9.8. Mérieux NutriSciences

9.9. QIMA

9.10. PerkinElmer, Inc

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Global Cereals and Grains Food Safety Testing Market was valued at USD 2.87 Billion and is projected to reach a market size of USD 4.37 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.