Ceramic Tiles Market Size (2024 – 2030)

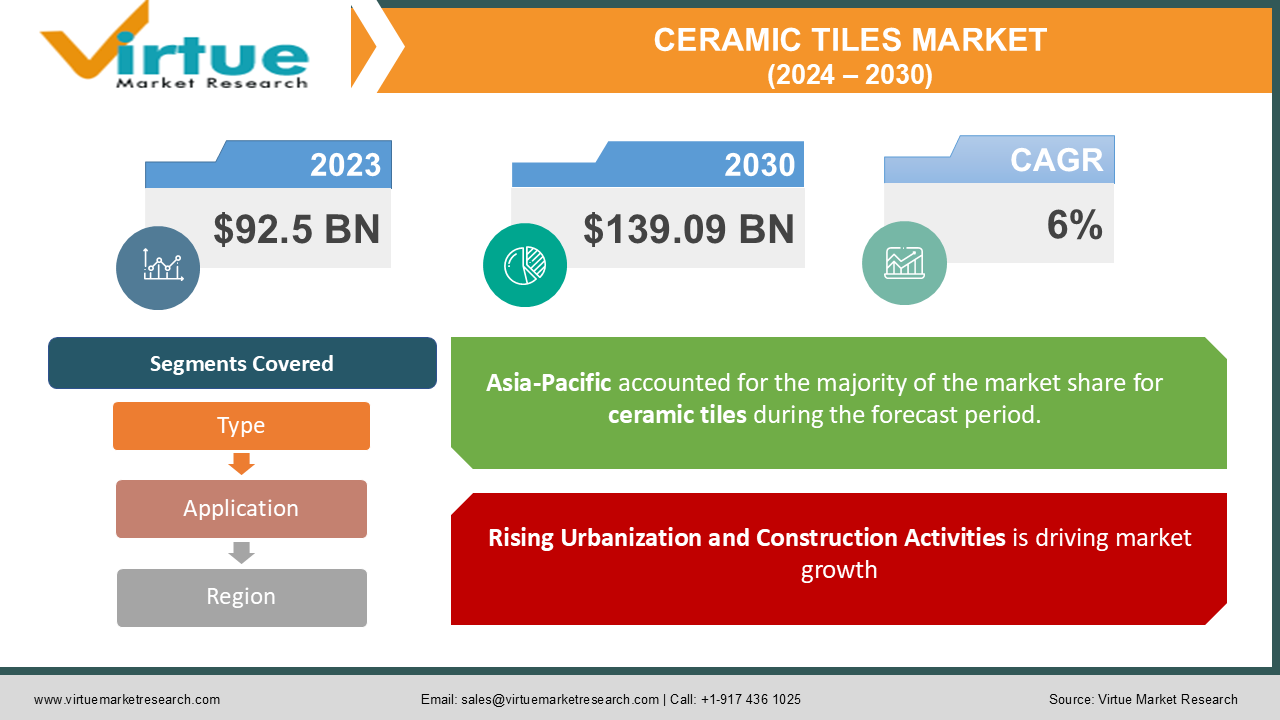

The Global Ceramic Tiles Market was valued at USD 92.5 billion in 2023 and is expected to grow at a CAGR of 6% from 2024 to 2030. The market is anticipated to reach USD 139.09 billion by 2030.

Ceramic tiles are durable, cost-effective, and versatile building materials that are extensively used in residential, commercial, and industrial construction projects. They are primarily used for flooring, walls, and exterior cladding due to their aesthetic appeal and functional properties such as durability, moisture resistance, and ease of maintenance. The growing demand for ceramic tiles is driven by increasing construction activities, urbanization, rising disposable incomes, and a preference for aesthetically pleasing interiors and exteriors. The market has been further boosted by the growing trend of home renovation and remodeling projects, particularly in developed economies.

Key Market Insights:

Ceramic tiles are increasingly being used in commercial and industrial construction projects due to their cost-effectiveness, durability, and availability in a variety of designs and finishes. These tiles are commonly used in shopping malls, airports, office buildings, and healthcare facilities, where there is a need for high-performance and aesthetically appealing building materials.

The introduction of digital printing technology in the production of ceramic tiles has revolutionized the market. This technology allows for the creation of high-definition, customizable tile designs that mimic the appearance of natural materials such as stone, wood, and marble, at a fraction of the cost.

The growing trend of DIY (do-it-yourself) home renovation and remodeling projects in developed regions has boosted the demand for ceramic tiles. Consumers are opting for ceramic tiles due to their easy installation, low maintenance requirements, and wide range of designs.

Global Ceramic Tiles Market Drivers:

Rising Urbanization and Construction Activities is driving market growth: The rapid urbanization in developing economies is one of the primary drivers of the global ceramic tiles market. As more people migrate to urban areas, there is a growing demand for residential and commercial spaces. This urban growth has led to a boom in construction activities, particularly in emerging economies such as China, India, and Brazil. For instance, in India, the government's "Housing for All" initiative aims to build millions of affordable homes for urban dwellers, significantly driving the demand for construction materials, including ceramic tiles. In addition to residential construction, the expansion of commercial real estate, such as office spaces, shopping malls, and healthcare facilities, has further boosted the need for ceramic tiles, which are widely used for flooring and wall coverings due to their durability and aesthetic appeal.

Technological Advancements in Tile Production is driving market growth: One of the most significant drivers of growth in the ceramic tiles market is the technological advancements in tile production, particularly digital printing technology. This technology allows manufacturers to produce high-quality, custom-designed tiles with intricate patterns, vibrant colors, and textures that mimic natural materials like marble, wood, and stone. The ability to create customized designs has made ceramic tiles more attractive to consumers who seek unique and personalized home décor solutions.

Growth of Home Renovation and Remodeling Activities is driving market growth: The growing trend of home renovation and remodeling activities, particularly in developed economies, is a significant driver of the ceramic tiles market. As homeowners seek to improve the aesthetic appeal and functionality of their living spaces, the demand for ceramic tiles has increased, particularly for use in kitchens, bathrooms, and outdoor areas. The rise of television shows, social media platforms, and online tutorials focused on DIY (do-it-yourself) home improvement projects has also contributed to the market's growth, as more consumers are willing to take on renovation tasks themselves. In developed countries such as the United States, Europe, and Japan, the demand for home renovations has surged due to aging housing stock and changing consumer preferences. Many homeowners are opting to modernize their homes with contemporary designs, where ceramic tiles are often chosen for their sleek appearance, durability, and low maintenance.

Global Ceramic Tiles Market Challenges and Restraints:

Fluctuating Raw Material Prices and Energy Costs is restricting market growth: One of the key challenges facing the ceramic tiles market is the volatility in the prices of raw materials, particularly clay, feldspar, sand, and natural gas. These materials are essential for the production of ceramic tiles, and fluctuations in their prices can significantly impact the overall production cost for manufacturers. For instance, natural gas is commonly used to fire kilns during the tile manufacturing process, and any increase in natural gas prices can lead to higher production costs. Similarly, shortages in the supply of clay, a primary raw material for ceramic tiles, can disrupt production schedules and lead to higher prices for finished tiles. In addition to raw material prices, energy costs represent a significant portion of the overall production expenses for ceramic tile manufacturers. The production process is energy-intensive, with kilns requiring high levels of heat for long durations. Any increase in electricity or fuel prices can reduce the profitability of manufacturers, especially in regions with unstable energy markets.

Environmental Concerns and Stringent Regulations is restricting market growth: The production of ceramic tiles has a significant environmental impact, particularly in terms of energy consumption, water usage, and carbon emissions. The manufacturing process involves the extraction of raw materials, which can lead to deforestation, soil degradation, and habitat destruction in mining areas. Additionally, the firing process used to produce ceramic tiles generates high levels of CO2 emissions, contributing to climate change. These environmental concerns have led to the implementation of stringent regulations aimed at reducing the environmental footprint of ceramic tile production. Governments and regulatory bodies worldwide are increasingly imposing environmental standards on the manufacturing sector, including the ceramic tiles industry. Manufacturers are required to comply with regulations related to waste management, water conservation, and emissions reduction.

Market Opportunities:

The global ceramic tiles market is ripe with opportunities, driven by technological advancements, evolving consumer preferences, and the expansion of the construction industry in emerging markets. One of the most significant opportunities lies in the growing demand for eco-friendly and sustainable building materials. As environmental concerns become more prominent, consumers and businesses are increasingly seeking products with minimal environmental impact. Ceramic tiles, especially those produced using sustainable methods, are well-positioned to capitalize on this trend. Manufacturers that adopt environmentally friendly production practices, such as recycling waste materials, reducing water usage, and lowering carbon emissions, will be able to attract environmentally conscious consumers and businesses. Another area of opportunity is the increasing popularity of luxury and designer ceramic tiles. As disposable incomes rise, particularly in emerging markets such as China, India, and Brazil, consumers are willing to invest more in high-end home décor products. The growing preference for aesthetically pleasing interiors has driven demand for ceramic tiles with intricate designs, high-definition patterns, and premium finishes. Manufacturers that offer a wide range of customizable designs, including tiles that mimic natural materials such as marble, wood, and stone, will be well-positioned to capture this growing segment of the market. In addition, the global shift towards urbanization and the expansion of infrastructure development projects in emerging economies present significant growth opportunities for the ceramic tiles market. Governments in countries like India, China, and Brazil are investing heavily in infrastructure projects, including housing developments, commercial buildings, airports, and public transportation systems. Ceramic tiles, known for their durability and cost-effectiveness, are increasingly being used in these projects. Manufacturers that establish a strong presence in these markets and cater to the specific needs of local consumers and businesses will be able to capitalize on the growing demand for construction materials.

CERAMIC TILES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mohawk Industries, RAK Ceramics, Kajaria Ceramics, SCG Ceramics, Lamosa Group, Crossville Inc., Pamesa Cerámica, Marazzi Group,Somany Ceramics, Ceramiche Atlas Concorde |

Ceramic Tiles Market Segmentation: By Type

-

Glazed ceramic tiles

-

Unglazed ceramic tiles

-

Porcelain tiles

-

Others

Porcelain tiles are the most dominant segment in the ceramic tiles market by product type. Porcelain tiles are favored for their strength, water resistance, and durability, making them suitable for both residential and commercial applications. They are increasingly used in high-traffic areas such as kitchens, bathrooms, and outdoor spaces, where durability and resistance to moisture are critical.

Ceramic Tiles Market Segmentation: By Application

-

Flooring

-

Wall covering

-

Exterior cladding

-

Others

Flooring is the dominant application segment in the ceramic tiles market. Ceramic tiles are widely used in flooring due to their durability, easy maintenance, and wide range of design options. They are popular in both residential and commercial spaces, and the trend towards using larger format tiles for seamless flooring is further boosting this segment's growth.

Ceramic Tiles Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the most dominant region in the global ceramic tiles market, accounting for a significant share of both production and consumption. The region's dominance is driven by rapid urbanization, booming construction activities, and increasing infrastructure development in countries like China and India. China, in particular, is the largest producer and exporter of ceramic tiles globally, owing to its vast manufacturing capacity and availability of raw materials. The growing middle-class population and rising disposable incomes in the region are also fueling the demand for ceramic tiles for residential and commercial projects. Additionally, government initiatives promoting affordable housing and infrastructure development are expected to further boost the market in the Asia-Pacific region.

COVID-19 Impact Analysis on the Ceramic Tiles Market:

The COVID-19 pandemic had a mixed impact on the global ceramic tiles market. During the initial stages of the pandemic, construction activities were halted due to lockdowns, supply chain disruptions, and labor shortages, leading to a temporary decline in the demand for ceramic tiles. The closure of manufacturing facilities and restrictions on international trade further exacerbated the situation, as raw material shortages and delays in shipments affected production schedules. However, as economies began to recover and restrictions were gradually lifted, the construction industry rebounded, leading to a resurgence in demand for ceramic tiles. The pandemic also accelerated the trend of home improvement and renovation projects, as people spent more time at home and sought to enhance their living spaces. This surge in home renovations, particularly in developed regions like North America and Europe, boosted the demand for ceramic tiles for use in kitchens, bathrooms, and outdoor areas. Moreover, the pandemic highlighted the importance of hygiene and cleanliness, leading to an increased preference for materials that are easy to clean and maintain. Ceramic tiles, known for their resistance to moisture, stains, and bacteria, became a preferred choice for both residential and commercial spaces. The demand for antibacterial and antimicrobial ceramic tiles, in particular, saw a notable increase, as consumers and businesses prioritized health and safety measures.

Latest Trends/Developments:

One of the latest trends in the ceramic tiles market is the growing demand for large-format tiles. These tiles are popular for creating seamless and modern interior designs, particularly in residential and commercial flooring applications. Large-format tiles reduce the number of grout lines, giving spaces a sleek and minimalist appearance. This trend is gaining traction in both developed and emerging markets, where consumers are increasingly opting for contemporary and luxurious home décor. Another significant trend is the rise of eco-friendly and sustainable ceramic tiles. Manufacturers are increasingly adopting environmentally friendly production practices, such as using recycled materials, reducing water consumption, and minimizing carbon emissions. The growing consumer awareness of environmental issues has led to a surge in demand for sustainable building materials, and ceramic tile manufacturers are responding by offering eco-friendly products. Digital printing technology continues to play a pivotal role in the ceramic tiles market. This technology enables manufacturers to produce high-definition tile designs that mimic natural materials like marble, wood, and stone. The ability to create intricate and customizable designs has expanded the appeal of ceramic tiles, particularly among consumers seeking unique and personalized home décor solutions. The ongoing advancements in digital printing technology are expected to drive innovation and enhance the aesthetic appeal of ceramic tiles in the coming years.

Key Players:

-

Mohawk Industries

-

RAK Ceramics

-

Kajaria Ceramics

-

SCG Ceramics

-

Lamosa Group

-

Crossville Inc.

-

Pamesa Cerámica

-

Marazzi Group

-

Somany Ceramics

-

Ceramiche Atlas Concorde

Chapter 1. Ceramic Tiles Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ceramic Tiles Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ceramic Tiles Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ceramic Tiles Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ceramic Tiles Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ceramic Tiles Market – By Type

6.1 Introduction/Key Findings

6.2 Glazed ceramic tiles

6.3 Unglazed ceramic tiles

6.4 Porcelain tiles

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Ceramic Tiles Market – By Application

7.1 Introduction/Key Findings

7.2 Flooring

7.3 Wall covering

7.4 Exterior cladding

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Ceramic Tiles Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Ceramic Tiles Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Mohawk Industries

9.2 RAK Ceramics

9.3 Kajaria Ceramics

9.4 SCG Ceramics

9.5 Lamosa Group

9.6 Crossville Inc.

9.7 Pamesa Cerámica

9.8 Marazzi Group

9.9 Somany Ceramics

9.10 Ceramiche Atlas Concorde

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ceramic Tiles Market was valued at USD 92 billion in 2023 and is expected to reach USD 139.09 billion by 2030, growing at a CAGR of 6 %.

Key drivers include rising urbanization and construction activities, technological advancements in tile production, and the growing trend of home renovation and remodeling projects.

The market is segmented by product (glazed ceramic tiles, unglazed ceramic tiles, porcelain tiles, and others), and by application (flooring, wall covering, exterior cladding, and others).

Asia-Pacific is the dominant region in the global ceramic tiles market, driven by rapid urbanization, construction growth, and infrastructure development, particularly in China and India.

Leading players include Mohawk Industries, RAK Ceramics, Kajaria Ceramics, SCG Ceramics, and Lamosa Group, among others.