Ceramic Matrix Composites Market Size (2024 – 2030)

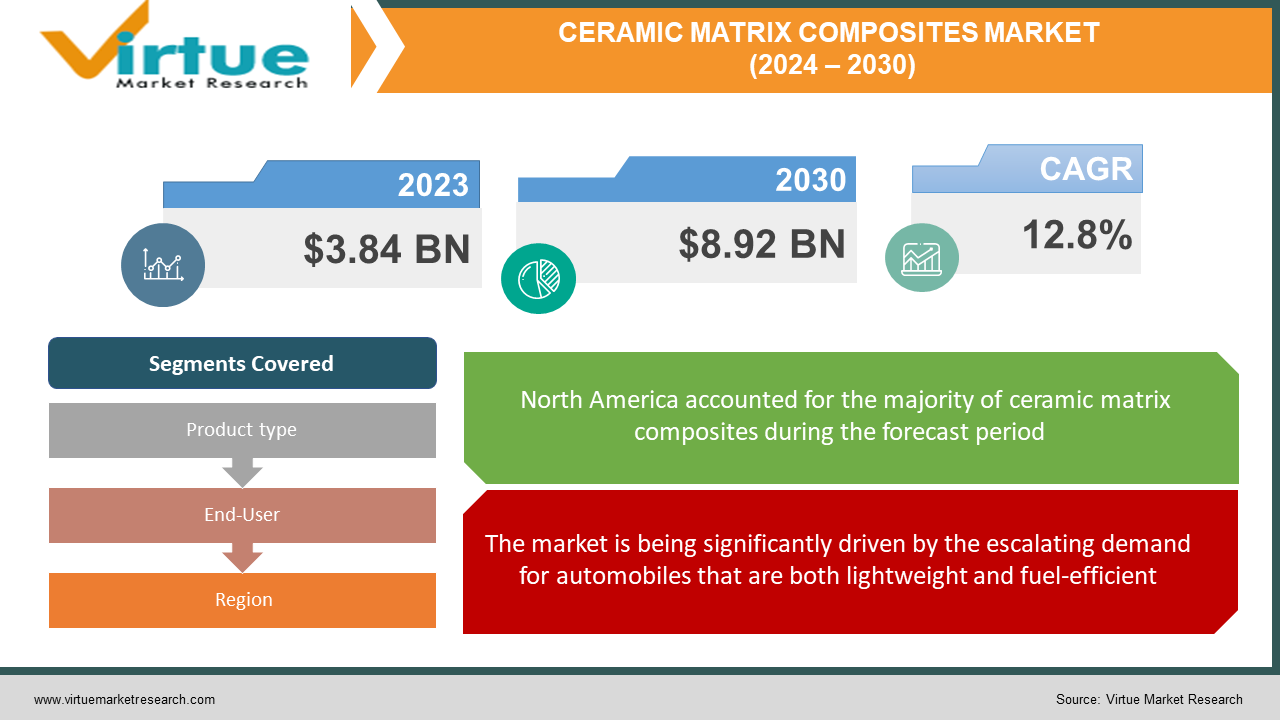

The Global Ceramic Matrix Composites Market are expected to grow from USD 3.84 billion in 2023 to reach a valuation of USD 8.92 billion by 2030 at a compound annual growth rate (CAGR) of 12.8% between 2024-2030.

Ceramic Matrix Composites (CMCs) typically comprise ceramic fibers or whiskers embedded within a ceramic matrix. These composites utilize a variety of fibers such as carbon, alumina, zirconia, aluminum nitride, and silicon carbide in their construction. The incorporation of ceramic reinforcement in these materials imparts superior resistance to cracking, ensuring they withstand heavy loads without failure. The growth in the aerospace and automotive industries globally is poised to drive the expansion of the ceramic matrix composites market in the forthcoming period.

SiC/SiC ceramic matrix composites are prevalently used in gas turbine applications. Presently, South Africa is home to approximately 33 wind farms at various stages of development. The country boasts over 1,365 wind turbine generators, representing an installed capacity of 3.672 MW, with 2.020 MW fully operational. Consequently, the increasing number of wind farms is fuelling the growth of the ceramic matrix composites market. However, the market's progression may be hindered by the higher costs of high-temperature ceramic composites compared to metals and alloys, particularly throughout the forecast period.

Key Market Insights:

In the realm of automotive applications, the latest trend observed in the ceramic matrix composites market is the deployment of CMCs. These composites are instrumental in reducing vehicle weight, thereby enhancing fuel efficiency and diminishing pollution levels. Given the stringent environmental regulations being implemented worldwide, the demand for CMCs in the automotive sector is expected to surge in the upcoming years.

The aerospace industry is witnessing a growing demand for CMCs, attributed to their exceptional mechanical properties and impressive strength-to-weight ratio, leading to a tightening in their supply. These composites are increasingly utilized in high-speed mechanical parts, power transmission components, rotor blade sleeves for helicopters, ventral fins for fighter jets, and jet engine fans. A significant escalation in airplane production, especially in European countries, is observed to meet the demands of global trade operations. This surge in airplane manufacturing is projected to bolster the ceramic matrix composites market in the forthcoming years.

Global Ceramic Matrix Composites Market Drivers:

The market is being significantly driven by the escalating demand for automobiles that are both lightweight and fuel-efficient.

There's a pressing global necessity to mitigate pollution and reduce the planet's carbon footprint. In response, governments globally are advocating for the adoption of fuel-efficient vehicles with lower emission levels. This shift necessitates that car manufacturers focus on reducing vehicle weight to enhance overall efficiency. Consequently, this leads to less concern over rising fuel costs and a notable reduction in carbon emissions, triggering a surge in scientific and technological innovations. This dynamic has heightened the demand for ceramic matrix composites, underlined by the need for increased efficiency, reduced fuel expenditures, diminished pollution, and the production of lighter vehicles.

Advancements in research and development have yielded new technologies for fabricating ceramic matrix composites. These composites exhibit enhanced features and greater structural efficiency at lower weights than current technologies. These innovations are expected to lead to reductions in both the costs and cycle times of composite production. This advancement is set to fulfill the rising demand for lightweight products based on ceramic matrix composites, contributing to market growth.

The burgeoning automobile sector in emerging economies also serves as a key driver for the market.

Ceramic matrix composites, recognized for their high tensile strength and ability to withstand elevated temperatures, are increasingly being adopted in automotive applications, especially for engine components. This preference has catalyzed growth in the ceramic matrix composites market. These composites, being lighter and more robust than conventional composites, can also endure extremely high temperatures. Their thermal resistance and ability to operate with minimal cooling reduce the cooling air requirement for engines, enhancing their operational efficiency.

Due to their lightweight and high-efficiency attributes, ceramic matrix composites are poised to replace traditional alloys and metal components in vehicle engines. The demand for automobiles is rising in developing nations such as China, India, and Japan. According to the International Organization of Automobile Manufacturers, China continues to be the world's largest car market, with its annual vehicle production rising by 3.2%. As the production of both personal and commercial vehicles increases, influenced by factors like reduced tariffs on imported cars and auto parts and an uptick in vehicle manufacturing, the demand for ceramic matrix composites is anticipated to increase correspondingly.

Global Ceramic Matrix Composites Market Restraints and Challenges:

The substantial expense associated with ceramic matrix composites (CMCs) serves as a major impediment to the growth of the ceramic matrix composites market.

The intricate and specialized procedures required for the production of CMCs, encompassing the creation of fibers, preparation of the matrix, and the fabrication of the composite, result in higher production costs compared to conventional materials. This increased cost significantly hinders the broader adoption of CMCs, especially in sectors where cost-efficiency is paramount. The elevated cost also presents obstacles for smaller enterprises or those with constrained resources, as they may struggle to afford the requisite equipment and expertise for producing CMCs. Additionally, the limited scalability of CMC production processes further hampers their widespread availability in substantial volumes, thereby reducing their accessibility and affordability for many potential users. Consequently, the substantial cost of CMCs constitutes a significant barrier to the expansion of the ceramic matrix composites market.

Costlier than alternative metals and alloys, hindering market growth.

In comparison to traditional metals and alloys used in similar applications, ceramic matrix composites are notably more expensive. The cost of these composites is largely influenced by the price of ceramic fibers. Carbon/carbon ceramic matrix composites are relatively less expensive than silicon carbide/silicon carbide and oxide/oxide composites, primarily due to the mass production of carbon fibers to meet the growing global demand for carbon fiber and CFRP products. In contrast, the production of alumina and silicon carbide fibers remains relatively limited on a global scale.

The production of ceramic matrix composites also demands significant energy consumption, which substantially increases the cost of the final product. The necessity for high processing temperatures leads to more complex manufacturing procedures, further escalating costs. Moreover, the use of expensive raw materials coupled with extended production durations contribute to higher costs. Such factors are anticipated to pose considerable obstacles to the market's expansion.

Global Ceramic Matrix Composites Market Opportunities:

Enhanced Efficiency through Standardized Mass Production of Ceramic Matrix Composites

A significant portion of major ceramic matrix composites manufacturers are required to adhere to the specific demands of diverse end-use industries and OEMs. This customization process entails elevated expenses, extended timelines, and increased labor input. The manufacturing and inspection procedures are also prolonged due to the elevated temperatures inherent in the production process. These supplementary costs escalate the overall expenses of ceramic matrix composites, placing them at a cost-related disadvantage compared to traditional components. Therefore, the implementation of standardization in terms of shape, size, and specifications, coupled with mass production, could streamline processes, reduce time consumption, and enhance cost-efficiency by significantly minimizing the efforts involved in manufacturing and fabrication.

Advancements in Ceramic Matrix Composites for Exceptional High-Temperature Applications

Recent studies focusing on ultra-high temperature ceramics (UHTCs) have substantiated their exceptional resistance to erosion at temperatures reaching or surpassing 2000 degrees Celsius. However, these materials face challenges in withstanding thermal shocks and potential damage. The objective of the C3HARME project is to develop ultra-high temperature ceramic matrix composites (UHTCMCs) endowed with self-healing capabilities, effectively overcoming these technological constraints. This will be achieved through the amalgamation of the favorable characteristics of ceramic matrix composites (CMCs) and ultra-high temperature ceramics (UHTCs). Consequently, the anticipation is that the production of innovative products utilizing CMCs with superior qualities will present lucrative prospects in the market.

CERAMIC MATRIX COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.8% |

|

Segments Covered |

By Product type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, COI Ceramics, Inc., Coorstek, Inc., General Electric Company, Kyocera Corporation, Lancer Systems LP, SGL Carbon Company, Ultramet, Inc., Ube Industries, Ltd. |

Global Ceramic Matrix Composites Market Segmentation: Product Type

-

C/C C.M.C

-

C/SIC C.M.C

-

Oxide/Oxide C.M.C

-

SIC/SIC C.M.C

The SiC/SiC CMC category dominated the market, holding a significant 39% share in 2023. This segment's growth is attributed to the extensive use of carbon fiber in wind turbine production for high-temperature operations, capitalizing on its high-temperature and oxidation resistance properties. The increasing use of carbon fiber in the energy and power sector, particularly in wind turbine manufacturing due to its excellent resistance to oxidation and radiation, has spurred growth. For example, in South Africa, construction is underway for 33 wind farms, including two large-scale projects, utilizing carbon fiber. These projects collectively house 1,365 turbine generators with a total capacity of 3,672 Megawatts, of which 2,020 MW are fully operational across various locations in the country. Despite a brief suspension due to the COVID-19 lockdown, the project resumed in May 2022 after beginning in March. Moreover, the rising export of aerospace and defense equipment, such as fighter jets from Germany, the USA, France, and the UK to developing nations, has bolstered the demand for SiC/SiC materials.

Global Ceramic Matrix Composites Market Segmentation: End-User

-

Automotive

-

Aerospace

-

Defense

-

Energy & Power

-

Electrical & Electronics

-

Others

The aerospace industry emerged as the largest market segment, holding a 35% share in 2023. Factors such as increasing demand for manufacturing aircraft components like fins, rudders, body flaps, leading edges, tiles, hot structures, and panels are expected to surge the demand, contributing to the segment's growth. According to SMR, the global aircraft fleet, which stood at 27,884 units in 2022, is projected to increase to 38,189 units by 2030.

Global Ceramic Matrix Composites Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is projected to lead the Ceramic Matrix Composites Market from 2024 to 2030. The region's robust aircraft industry significantly contributes to the demand for CMCs, as these materials offer advantages in creating lighter, more fuel-efficient aircraft capable of enduring harsh environments. Additionally, the defense sector plays a crucial role in the demand for CMCs in North America, particularly for lightweight yet strong materials in military applications, including aircraft parts and ballistic defense systems. The region's diverse energy sector, encompassing both traditional and renewable resources, also recognizes the benefits of CMCs.

The Asia-Pacific region is expected to experience the fastest market growth from 2024 to 2030. The region is undergoing a significant industrial transformation, with industries from manufacturing to energy realizing the potential of these advanced materials for enhancing performance and durability. The burgeoning air travel and emerging regional aerospace industries further drive the demand for lightweight, high-performance materials, making CMCs increasingly sought-after in Asia's expanding aerospace sector.

COVID-19 Impact Analysis on the Global Ceramic Matrix Composites Market:

The global ceramic matrix composites (CMCs) market has encountered significant disruptions and challenges as a result of the COVID-19 pandemic. The widespread economic uncertainty, disruptions in the supply chain, and decreased industrial activities across various sectors have collectively impeded the growth of the CMCs market. Industries that are major end-users of CMCs, including aerospace, automotive, and energy, experienced notable setbacks, including production stoppages, project delays, and diminished investments. The restrictions on travel and trade further contributed to a decline in the demand for CMCs in international markets. Additionally, businesses, constrained by financial challenges, adopted a cautious approach and implemented cost-cutting measures, leading to reduced capital expenditure and a hesitancy in embracing advanced materials like CMCs. While the market is anticipated to recover gradually with the reopening of economies and resumption of industrial activities, the short-term growth trajectory of the CMCs market has undeniably been impacted by the COVID-19 pandemic.

Recent Trends and Developments in the Global Ceramic Matrix Composites Market:

-

In April 2023, SGL Carbon embarked on a collaborative venture with Lancer Systems to innovate in the field of ceramic matrix composites, specifically targeting thermal protection systems. This collaboration aims to leverage the unique properties of ceramic matrix composites, such as their high-temperature resistance and lightweight nature, for use in safeguarding aircraft and spacecraft during atmospheric re-entry, where extreme temperatures are encountered.

-

Earlier, in January 2023, Rolls-Royce entered into a Memorandum of Understanding with the University of Sheffield in the United Kingdom. This agreement signifies a joint effort towards researching and developing novel ceramic composite materials, marking a significant step in material innovation.

Key Players:

-

3M Company

-

COI Ceramics, Inc.

-

Coorstek, Inc.

-

General Electric Company

-

Kyocera Corporation

-

Lancer Systems LP

-

SGL Carbon Company

-

Ultramet, Inc.

-

Ube Industries, Ltd.

Chapter 1. Ceramic Matrix Composites Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ceramic Matrix Composites Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ceramic Matrix Composites Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ceramic Matrix Composites Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ceramic Matrix Composites Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ceramic Matrix Composites Market – Product Type

6.1 Introduction/Key Findings

6.2 C/C C.M.C

6.3 C/SIC C.M.C

6.4 Oxide/Oxide C.M.C

6.5 SIC/SIC C.M.C

6.6 Y-O-Y Growth trend Analysis Product Type

6.7 Absolute $ Opportunity Analysis Product Type, 2024-2030

Chapter 7. Ceramic Matrix Composites Market – End-User

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Defense

7.5 Energy & Power

7.6 Electrical & Electronics

7.7 Others

7.8 Y-O-Y Growth trend Analysis End-User

7.9 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 8. Ceramic Matrix Composites Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product type

8.1.3 End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product type

8.2.3 End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product type

8.3.3 End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product type

8.4.3 End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product type

8.5.3 End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Ceramic Matrix Composites Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M Company

9.2 COI Ceramics, Inc.

9.3 Coorstek, Inc.

9.4 General Electric Company

9.5 Kyocera Corporation

9.6 Lancer Systems LP

9.7 SGL Carbon Company

9.8 Ultramet, Inc.

9.9 Ube Industries, Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ceramic Matrix Composites Market size is valued at USD 3.84 billion in 2023.

The worldwide Global Ceramic Matrix Composites Market growth is estimated to be 12.8% from 2024 to 2030.

The Global Ceramic Matrix Composites Market is segmented By Product Type (C/C C.M.C, C/SIC C.M.C, Oxide/Oxide C.M.C, SIC/SIC C.M.C), By End-User (Automotive, Aerospace, Defense, Energy & Power, Electrical & Electronics, Others).

The growing demand in the aerospace, automotive, and energy industries is expected to propel expansion in the global market for ceramic matrix composites. Promising trends and prospects for market expansion are presented by growing emphasis on lightweight materials, applications in hostile environments, and manufacturing process advancements.

The COVID-19 pandemic has had an impact on the global market for ceramic matrix composites, delaying projects in the automotive and aerospace industries and upsetting supply chains. Nonetheless, once industries heal and start up again, the market is anticipated to recover.