Ceramic Machinery Market Size (2024 – 2030)

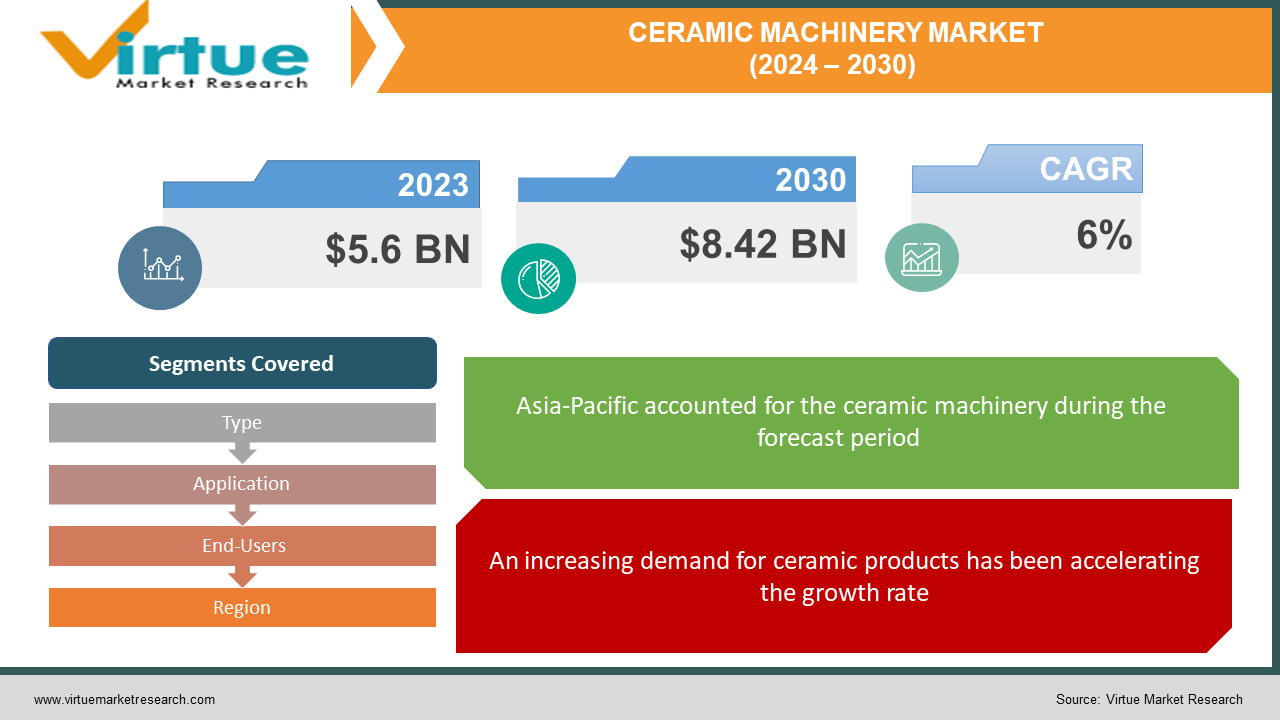

The global ceramic machinery market was valued at USD 5.6 billion and is projected to reach a market size of USD 8.42 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6%.

The machinery and tools used in the production and processing of ceramic materials, including porcelain, tiles, and pottery, are referred to as ceramic machinery. Ceramic machines can give pliancy for smooth work, eliminate air bubbles from the bulk, and prepare it. The process of removing material by ceramic machining calls for extreme control and supervision. It is employed to produce finer features for diameter measurements and surface finishes, as well as to achieve tighter tolerances. In the past, most of the ceramic products were done manually. The technology was limited. Presently, the market has seen a considerable expansion owing to economic development and innovations in machinery. In the future, with a focus on diverse applications and integration with emerging computer science fields, a notable upsurge is anticipated.

Key Market Insights:

The growing need for ceramic products in a variety of industries, including consumer goods, healthcare, electronics, automotive, aerospace, and energy, is the main factor propelling the global market for ceramic machinery. Technological developments in glazing, decoration, and ceramic shaping equipment are driving market expansion even further. Even though the industry confronts obstacles, including expensive installation costs and competition from substitute materials, there is potential to improve manufacturing efficiency and satisfy changing customer wants by using technology like robotics, automation, and 3D printing. SACMI, SITI B&T Group, and System Ceramics are some of the prominent competitors in the industry who are actively investing in innovations to keep a competitive advantage. The market is steadily rebounding despite the early effects of COVID-19, with North America and Asia-Pacific experiencing notable growth because of infrastructural expansion, urbanization, and technical developments in ceramic manufacturing.

Ceramic Machinery Market Drivers:

An increasing demand for ceramic products has been accelerating the growth rate.

The natural, ecological, and resilient qualities of ceramic items make them desirable. A growing number of industries, including the automotive, electronics, aerospace, healthcare, and energy sectors, are in increased need of advanced ceramic materials with remarkable properties, including high strength, thermal stability, resistance to wear, and electrical conductivity. Additionally, they are resistant to chemicals, high temperatures, and pressure. They have been used for millions of years and are safe for our health. Dust, pollen, and other allergens don't stick to the flat surface of ceramic tiles. Advanced ceramics are utilized in technologies such as electrical components, automotive engine parts, medical implants, and aerospace components due to their unique properties. The market for ceramic machinery is expected to rise as a result of the increased demand for sophisticated ceramic materials and the corresponding requirement for specialized machinery that can process and shape these materials precisely and effectively.

Rapid urbanization has been boosting the market.

The demand for ceramic items, including tiles, sanitaryware, and bricks for buildings, is being driven by economic progress, particularly in emerging nations. Growing infrastructure projects, such as public infrastructure, business complexes, and residential structures, need significant amounts of ceramic materials, which increases demand for ceramic machinery.

They are easy to maintain, long-lasting, and suitable for a range of uses in institutional, commercial, and residential structures. The growing need for manufacturing tools for shaping, glazing, burning, and finishing ceramic items helps the ceramic machinery industry. A further factor in the ongoing demand for equipment and ceramic materials is restoration and remodeling activity in both the business and residential sectors.

Ceramic Machinery Market Restraints and Challenges:

Associated costs, intense competition, and a shortage of skills are the main issues that the market is currently facing.

The installation expenses for ceramic machinery are very high. Additionally, maintenance and other upgrade charges add up. This can be a significant hurdle for small and medium-scale businesses. Secondly, consumer preferences can shift over time. Other materials like glass, porcelain, plastic, and other composites also have a huge demand in the market. Some of them might be cheaper than ceramic. As such, manufacturers can go for these alternatives, causing losses for this industry. Apart from this, the operation of the machinery requires skilled expertise. A lot of laborers might be unaware of the usage and applications. This can lead to defaults on the project and damage to the equipment.

Ceramic Machinery Market Opportunities:

Technological advancements have been providing the market with numerous possibilities. Recent developments in pressing technology have made ceramic machines more sustainable, flexible, and capable of producing goods faster. For instance, the Superfast press from System Ceramics is the first ceramic press in the world to operate without a mold, which helps speed up setup and boost output. With hydraulic circuit solutions, SACMI's Series Veloce achieves high-speed pressing without sacrificing quality or productivity. Emerging technologies like robotics, automation, and 3D printing have gained prominence. By implementing automation, manual labor, and human errors can be reduced. Robotics is used for material handling and inspection. Complex ceramic components with precise geometry and unique patterns are fabricated via 3D printing. Besides this, artificial intelligence (AI), machine learning (ML), data analytics, and big data are being used to predict future failures and improve decision-making by drawing data-driven insights.

CERAMIC MACHINERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Application, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SACMI, SITI B&T Group, System Ceramics, EGE Seramik, KEDA Industrial Group Co., Ltd., EFI Cretaprint, KERAjet, Beralmar, Manfredini & Schianchi, Itaca Group |

Ceramic Machinery Market Segmentation: By Type

-

Ceramic Shaping Machine

-

Glazing and Decorating Ceramic Machine

-

Raw Material Preparation Machine

-

Storage and Handling Machine

-

Others

Ceramic shaping machines are the largest shareholder by type. A device that shapes ceramic components using computer numerical control (CNC) technology is called a ceramic shaping machine. It manages the motion of a machine tool, such as a lathe or milling machine, to precisely cut the ceramic workpiece. In the process of producing ceramic goods, ceramic shaping machines are essential since they are responsible for molding raw materials into the correct shapes and sizes. These devices include a wide range of apparatus, including molding systems, extruders, and presses, all of which are customized to meet particular production needs. Technological advancements in shaping, including automation and digital controls, have optimized manufacturing processes to improve productivity and uniformity of output. The glazing and decorating category is the fastest-growing. Glazing and decoration are important steps in the production of ceramics because they improve the practicality and visual appeal of items like tiles, dinnerware, and sanitaryware. As a result, there is a large need for equipment that can apply glazes, colors, patterns, and decorations to ceramic surfaces quickly and effectively.

Ceramic Machinery Market Segmentation: By Application

-

Tile Manufacturers

-

Heavy Clay Manufacturers

-

Ceramic Sanitary Ware Manufacturers

Ceramic sanitary ware manufacturers have the largest market share by application. A wide range of bathroom fixtures and fittings composed of ceramic materials is referred to as ceramic sanitary ware. Sanitation is achieved by using ceramic sanitary equipment, which includes urinals, sinks, bathtubs, hoppers, closets, and washbasins. These goods are renowned for their strength, simplicity of upkeep, and visual attractiveness. Its qualities include excellent resistance to abrasion, mechanical strength, chemical erosion, durability, and weathering.

Additionally, they are cost-effective. It features an easily cleaned, shiny surface and can support weights over 400 kg. Ceramic tiles are the fastest-growing segment. Thin slabs of clay, water, or other inorganic elements are used to make ceramic tiles, which are then burned at high temperatures in a kiln and often covered in a glaze. They are simple to clean, non-absorbent, and waterproof. They are known for their affordability and longevity. Ceramic tiles are used to create wall and floor tiles and are quite adaptable.

Ceramic Machinery Market Segmentation: By End-Users

-

Building & Construction

-

Healthcare

-

Electronics

-

Automotive

-

Aerospace

-

Energy

-

Consumer Goods

-

Others

The building & construction industry is the largest and fastest-growing end-user in this market. Bricks, tiles, sanitaryware, and ornamental components are among the many ceramic items that are used by the building and construction sectors. These goods are widely utilized in infrastructural, commercial, and residential applications. The need for ceramic goods in building operations is driven by increases in urbanization, population expansion, and infrastructural development. The need for ceramic gear is supported by the building industry's fast growth, particularly in emerging nations. The market for construction ceramics is expanding due to technological advancements in ceramic manufacturing, such as digital printing, sophisticated materials, and sustainable production methods.

Ceramic Machinery Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific has the largest market. Countries like China, India, and Japan are in the lead. Growing consumer expenditure, advances in technology, extensive R&D, and widespread product use in buildings are the main reasons for the success. The market is expanding as a result of the building industry's rising need for ceramic tiles and bricks. As an environmentally beneficial and sustainable replacement for other materials, ceramic tiles, and bricks are growing in popularity. North America is the fastest-growing market. The United States and Canada are at the forefront. There are many building projects in the region, including residential, commercial, and infrastructure ones. These projects drive the need for ceramic items such as bricks, tiles, and sanitaryware. Furthermore, North American producers consistently invest in ceramic machinery to improve production quality, efficiency, and customization options. This puts the continent at the forefront of technical innovation. Apart from this, a varied customer base that favors fine, visually appealing ceramic goods drives the need for the ceramic machinery sector.

COVID-19 Impact Analysis on the Global Ceramic Machinery Market:

The market was impacted by the viral epidemic. Lockdowns, movement limitations, and social isolation were some of the new standards. Transportation, logistics, and supply chain management are all impacted by this. As a result, import-export operations deteriorated. All companies and industrial units were ordered to close to contain the sickness. Production and other operations were halted as a result. Construction activities were stopped. To stop the virus from spreading, remote work was given priority. Layoffs were commonplace due to the unpredictability of the economy. Many people lost their jobs. Initiatives about healthcare accounted for the majority of the money. Launches and partnerships were delayed as a result. As per a report by Ceramic World Web, there was a decline of 14.5% during the first half of the pandemic in the Italian ceramic and brick machinery. After the pandemic, the market has started to recover. Laws and limitations have been loosened, allowing for normal business.

Latest Trends/ Developments:

Manufacturers of ceramic machinery are putting more effort into creating tools and procedures that use less energy while producing their products. To increase energy efficiency and lower carbon emissions, kiln designs, optimum heating and cooling systems, and waste heat recovery technologies are being incorporated. Furthermore, the creation and application of environmentally friendly materials in the ceramics industry, such as natural clays, low-impact glazes, and recycled ceramics, is gaining popularity. They recycle waste from landfills and minimize the exploitation of resources, helping to lower the environmental impact of ceramic manufacturing.

Key Players:

-

SACMI

-

SITI B&T Group

-

System Ceramics

-

EGE Seramik

-

KEDA Industrial Group Co., Ltd.

-

EFI Cretaprint

-

KERAjet

-

Beralmar

-

Manfredini & Schianchi

-

Itaca Group

-

In December 2023, Rey Cera Creation, a producer and exporter in the ceramic sector, launched its largest 60x120 cm GVT factory in Morbi, Gujarat. The firm is the first to make unending 60x120 cm tiles with 5–8 random faces, and this factory is the largest 60x120 cm GVT in India. To create a carpet-like look with solid dots and linked veins, the tiles can be put in the same direction from the box to the desired surface.

-

In June 2023, at the international robotics and intelligent automation trade show Automatica 2023, the German bearing manufacturer Schaeffler Special Machinery, a division of the Schaeffler Group, showcased its multi-material 3D printing technology. The system will be able to support a wide range of items, such as consumer goods, medical technology, batteries, and e-mobility.

-

In June 2023, by arranging five linked exhibits concurrently, the 37th edition of Ceramics China 2023 at the Canton Fair Complex in Guangzhou, China, launched the Expo-Plus concept. The approach increases the scope of exhibitors and links the industrial chain from manufacturing to post-purchase servicing.

Chapter 1. Ceramic Machinery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ceramic Machinery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ceramic Machinery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ceramic Machinery Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ceramic Machinery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ceramic Machinery Market – By Type

6.1 Introduction/Key Findings

6.2 Ceramic Shaping Machine

6.3 Glazing and Decorating Ceramic Machine

6.4 Raw Material Preparation Machine

6.5 Storage and Handling Machine

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Ceramic Machinery Market – By Application

7.1 Introduction/Key Findings

7.2 Tile Manufacturers

7.3 Heavy Clay Manufacturers

7.4 Ceramic Sanitary Ware Manufacturers

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Ceramic Machinery Market – By End-Users

8.1 Introduction/Key Findings

8.2 Building & Construction

8.3 Healthcare

8.4 Electronics

8.5 Automotive

8.6 Aerospace

8.7 Energy

8.8 Consumer Goods

8.9 Others

8.10 Y-O-Y Growth trend Analysis By End-Users

8.11 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 9. Ceramic Machinery Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By End-Users

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By End-Users

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By End-Users

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By End-Users

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By End-Users

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ceramic Machinery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 SACMI

10.2 SITI B&T Group

10.3 System Ceramics

10.4 EGE Seramik

10.5 KEDA Industrial Group Co., Ltd.

10.6 EFI Cretaprint

10.7 KERAjet

10.8 Beralmar

10.9 Manfredini & Schianchi

10.10 Itaca Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global ceramic machinery market was valued at USD 5.6 billion and is projected to reach a market size of USD 8.42 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6%.

Increasing demand for ceramic products and rapid urbanization are the main factors propelling the global ceramic machinery market.

Based on application, the global ceramic machinery market is segmented into tile manufacturers, heavy clay manufacturers, and ceramic sanitary ware manufacturers.

Asia-Pacific is the most dominant region for the global ceramic machinery market.

SACMI, SITI B&T Group, and System Ceramics are the key players operating in the global ceramic machinery market.