Ceramic Film Market Size (2025 – 2030)

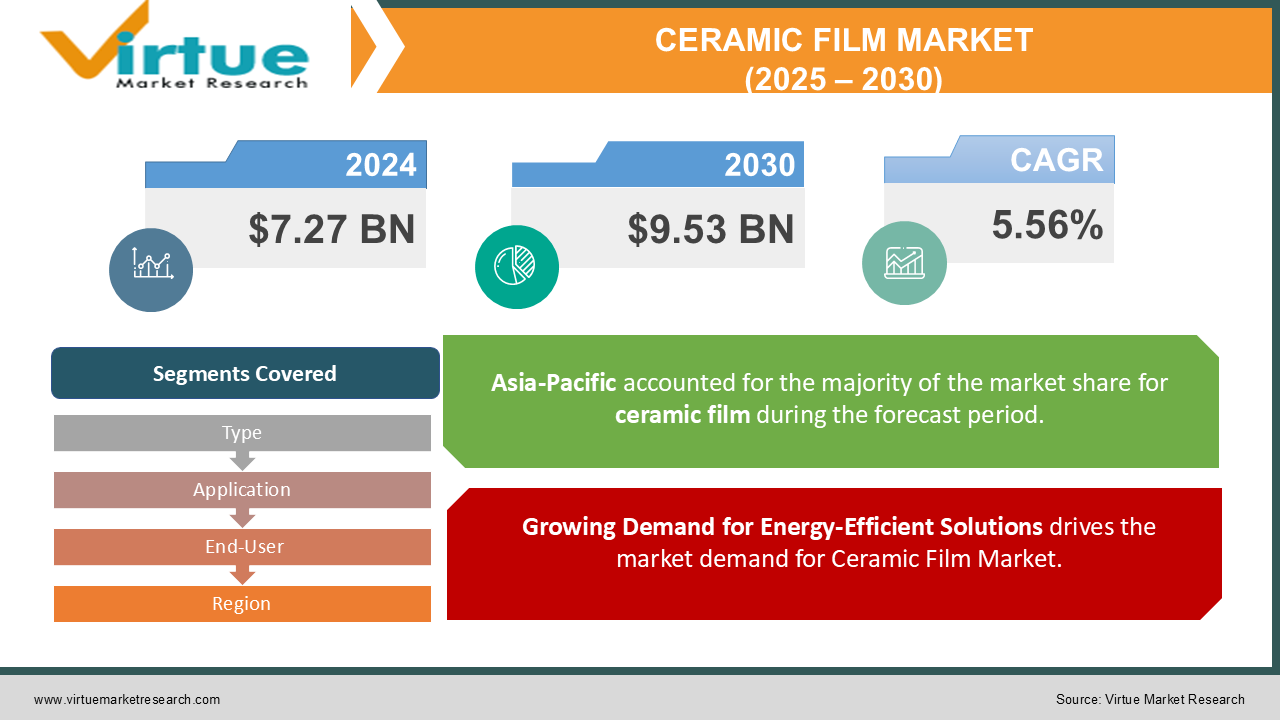

The Ceramic Film Market is valued at USD 7.27 Billion in 2024 and is projected to reach a market size of USD 9.53 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.56%.

The Global Ceramic Film Market is witnessing significant growth driven by the increasing demand for energy-efficient and high-performance materials. Ceramic films, with their excellent thermal insulation and UV protection properties, are gaining popularity across various industries such as automotive, electronics, and construction. The market is projected to expand due to the growing demand for energy-efficient solutions, government regulations promoting energy conservation, and advancements in material science.

Key Market Insights:

-

The Ceramic Film Market is projected to expand at a compound annual growth rate of over 5.56 % in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

-

3M Company, Eastman Chemical Company & Saint-Gobain S.A. are some key players of Ceramic Film Market.

-

Asia Pacific accounts for approximately 40-60 % of the Ceramic Film Market, driven by Growing Demand for Energy-Efficient Solutions, Technological Advancements in Ceramic Film Production, Rising Consumer Awareness for Health and Safety & Regulatory Support for Sustainable Materials.

Ceramic Film Market Drivers:

Growing Demand for Energy-Efficient Solutions drives the market demand for Ceramic Film Market.

The increasing need for energy-efficient solutions is driving the growth of the ceramic film market. Ceramic films are widely used for energy conservation in buildings, automotive applications, and electronics due to their exceptional heat resistance and insulating properties. Governments worldwide are focusing on energy conservation initiatives, encouraging the adoption of such technologies, which propels the demand for ceramic films across multiple industries, especially in regions with stringent energy regulations such as Europe and North America.

Technological Advancements in Ceramic Film Production drives the market demand for Ceramic Film Market.

Ongoing advancements in the production of ceramic films are another significant driver for market growth. Innovations in manufacturing techniques, such as advanced sputtering processes and multilayer coatings, have led to the production of films with improved performance characteristics such as enhanced durability, thermal insulation, and UV protection. These developments are broadening the application areas of ceramic films in industries like automotive, aerospace, and construction, further boosting the market demand.

Rising Consumer Awareness for Health and Safety drives the market demand for Ceramic Film Market.

Increased consumer awareness regarding health, safety, and environmental impact has contributed to the growing adoption of ceramic films. With their ability to block harmful UV rays, reduce glare, and improve indoor air quality, ceramic films are being used in residential and commercial buildings to enhance safety. In automotive applications, ceramic films offer greater protection against accidents and enhance comfort, making them a preferred choice for vehicle owners and manufacturers alike.

Regulatory Support for Sustainable Materials drives the market demand for Ceramic Film Market.

Governments and regulatory bodies are introducing policies to promote the use of sustainable and energy-efficient materials. In many regions, building codes and energy standards are pushing for the use of ceramic films in construction and automotive applications. This has resulted in increased investment in research and development for advanced ceramic film technologies, ensuring that the market continues to grow at a robust pace, driven by favorable regulatory frameworks.

Ceramic Film Market Restraints and Challenges:

One of the key challenges facing the ceramic film market is the high initial cost of materials and installation. Despite the long-term energy-saving benefits, the upfront cost of ceramic films can deter consumers and businesses from adopting them, especially in developing economies. Additionally, the availability of cheaper alternatives like traditional window tinting and films limits the market potential of ceramic films. Furthermore, the lack of awareness and technical expertise in some regions presents another barrier to widespread adoption.

Ceramic Film Market Opportunities:

The rising trend of sustainable and green building practices presents significant growth opportunities for the ceramic film market. As construction projects increasingly focus on reducing their environmental footprint, the demand for energy-efficient materials such as ceramic films will continue to rise. Additionally, expanding applications in the automotive industry, such as the growing demand for heat-resistant and UV-protective films for electric vehicles, opens up new avenues for growth in the ceramic film market.

CERAMIC FILM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.56% |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, Eastman Chemical Company, Saint-Gobain S.A., Solar Gard, Avery Dennison Corporation, XPEL Inc., Solar Control Films, Johnson Window Films, Bekaert, Hanita Coatings, Madico, Inc., Garware Polyester Ltd., CPFilms Inc., Global PET Films, TE Connectivity, Dow Chemical Company, Global Solar Film, Saint-Gobain Performance Plastics, SunTek Films, Rayno Window Film |

Ceramic Film Market Segmentation: By Type

-

Automotive Ceramic Films

-

Architectural Ceramic Films

-

Marine Ceramic Films

-

Aerospace Ceramic Films

The largest segment in the ceramic film market is the Automotive Ceramic Films. These films are primarily used for their heat rejection, UV protection, and glare reduction properties, making them ideal for improving comfort and safety in vehicles. Automotive films also help in preserving the car's interior by preventing fading and cracking due to UV exposure. As consumers become more aware of the benefits of ceramic films, their demand in the automotive industry continues to grow.

The fastest-growing segment in this category is expected to be the Aerospace Ceramic Films. As aerospace technologies advance, these films are increasingly used in aircraft to improve passenger comfort and reduce energy consumption. These films also provide UV protection, heat rejection, and glare reduction, making them a valuable asset for the aviation industry. With more focus on enhancing fuel efficiency and comfort, this sub-segment is set to experience rapid growth in the coming years.

Ceramic Film Market Segmentation: By Application

-

Heat Rejection

-

UV Protection

-

Glare Reduction

-

Decorative/Privacy Films

The largest application in the ceramic film market is Heat Rejection, driven by its effectiveness in reducing the absorption of infrared radiation. This application is particularly significant in automotive and architectural industries, where it directly improves energy efficiency, comfort, and protection from UV rays. Heat rejection films not only enhance user comfort but also lower cooling energy consumption, making them a sought-after solution in hot climates.

Glare Reduction is the fastest-growing application, with increasing demand from industries like automotive and commercial buildings. Glare reduction films are highly valued for improving driving visibility, reducing eye strain, and enhancing overall comfort. As consumer awareness of glare-related health concerns grows, this application is experiencing a surge in demand. Additionally, urbanization and the increasing use of glass buildings are contributing to the fast adoption of glare-reducing films.

Ceramic Film Market Segmentation: By End-User

-

Automotive

-

Construction

-

Marine

-

Aerospace

The largest sub-segment by end-user is Automotive, as the demand for ceramic films is highest in the vehicle sector. Ceramic films offer significant benefits, including heat rejection, UV protection, and glare reduction, making them essential for vehicle comfort and safety. The automotive industry's focus on enhancing fuel efficiency and passenger well-being drives the demand for ceramic window films. As electric vehicle adoption grows, the need for ceramic films in automotive applications is expected to expand even further.

Construction is the fastest-growing sub-segment due to the rise in commercial and residential projects focused on energy efficiency and sustainability. Ceramic films are increasingly used in buildings to improve insulation and reduce the reliance on HVAC systems, leading to lower energy consumption. As building codes and regulations continue to evolve with an emphasis on environmental sustainability, the demand for ceramic films in construction is expected to grow rapidly, making it a key area of expansion.

Ceramic Film Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific is the largest geographic segment in the ceramic film market, driven by rapid urbanization, growing automotive industries, and increasing construction activities. Countries like China, India, and Japan are leading the demand for ceramic films in both the automotive and construction sectors. The region's focus on improving energy efficiency and reducing carbon footprints has significantly increased the adoption of ceramic films. Furthermore, the rise of infrastructure projects in emerging economies continues to drive growth.

The fastest-growing region is also Asia-Pacific. With a burgeoning middle class, increased disposable income, and heightened awareness of environmental issues, demand for advanced products like ceramic films is surging. The rapid development of smart cities, along with rising automotive production, is fueling the growth of ceramic films in this region. As technology improves and manufacturing costs decrease, Asia-Pacific remains the most dynamic market for ceramic film innovations.

COVID-19 Impact Analysis on Ceramic Film Market:

The COVID-19 pandemic had a temporary negative impact on the ceramic film market, primarily due to disruptions in supply chains, manufacturing delays, and a slowdown in construction and automotive production. However, as the global economy recovers, demand for ceramic films is expected to rebound. The post-pandemic shift towards energy-efficient solutions, sustainable building designs, and the growing automotive sector presents opportunities for the market to recover and grow stronger in the coming years.

Latest Trends/ Developments:

Onyx Coating has launched its innovative Vunyx® Ceramic Window Films, designed to revolutionize heat rejection and UV protection for vehicles. These films offer up to 98% infrared heat rejection, ensuring a cooler car interior and enhanced fuel efficiency. The non-metallic, crystal-clear design ensures excellent visibility, providing a safe driving experience. Vunyx® is built for durability with scratch-resistant ceramic technology, maintaining superior performance and aesthetic for years. Additionally, it provides up to 99% UV protection, glare reduction, and is signal-friendly. With a lifetime warranty and installer support, Vunyx® is a game-changer in the window film industry.

Key Players:

-

3M Company

-

Eastman Chemical Company

-

Saint-Gobain S.A.

-

Solar Gard

-

Avery Dennison Corporation

-

XPEL Inc.

-

Solar Control Films

-

Johnson Window Films

-

Bekaert

-

Hanita Coatings

-

Madico, Inc.

-

Garware Polyester Ltd.

-

CPFilms Inc.

-

Global PET Films

-

TE Connectivity

-

Dow Chemical Company

-

Global Solar Film

-

Saint-Gobain Performance Plastics

-

SunTek Films

-

Rayno Window Film

Chapter 1. Ceramic Film Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ceramic Film Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ceramic Film Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ceramic Film Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ceramic Film Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ceramic Film Market – By Type

6.1 Introduction/Key Findings

6.2 Automotive Ceramic Films

6.3 Architectural Ceramic Films

6.4 Marine Ceramic Films

6.5 Aerospace Ceramic Films

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Ceramic Film Market – By End-User

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Construction

7.4 Marine

7.5 Aerospace

7.6 Y-O-Y Growth trend Analysis By End-User

7.7 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 8. Ceramic Film Market – By Application

8.1 Introduction/Key Findings

8.2 Heat Rejection

8.3 UV Protection

8.4 Glare Reduction

8.5 Decorative/Privacy Films

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Ceramic Film Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ceramic Film Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M Company

10.2 Eastman Chemical Company

10.3 Saint-Gobain S.A.

10.4 Solar Gard

10.5 Avery Dennison Corporation

10.6 XPEL Inc.

10.7 Solar Control Films

10.8 Johnson Window Films

10.9 Bekaert

10.10 Hanita Coatings

10.11 Madico, Inc.

10.12 Garware Polyester Ltd.

10.13 CPFilms Inc.

10.14 Global PET Films

10.15 TE Connectivity

10.16 Dow Chemical Company

10.17 Global Solar Film

10.18 Saint-Gobain Performance Plastics

10.19 SunTek Films

10.20 Rayno Window Film

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Ceramic Film Market is valued at USD 7.27 Billion in 2024 and is projected to reach a market size of USD 9.53 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.56%.

Growing Demand for Energy-Efficient Solutions, Technological Advancements in Ceramic Film Production, Rising Consumer Awareness for Health and Safety & Regulatory Support for Sustainable Materials are the major drivers of Ceramic Film Market.

Heat Rejection, UV Protection, Glare Reduction & Decorative/Privacy Films are the segments under the Ceramic Film Market by Application.

Asia Pacific is the most dominant region for the Ceramic Film Market.

Asia Pacific is the fastest-growing region in the Ceramic Film Market.