Cell Counting Market Size (2025 – 2030)

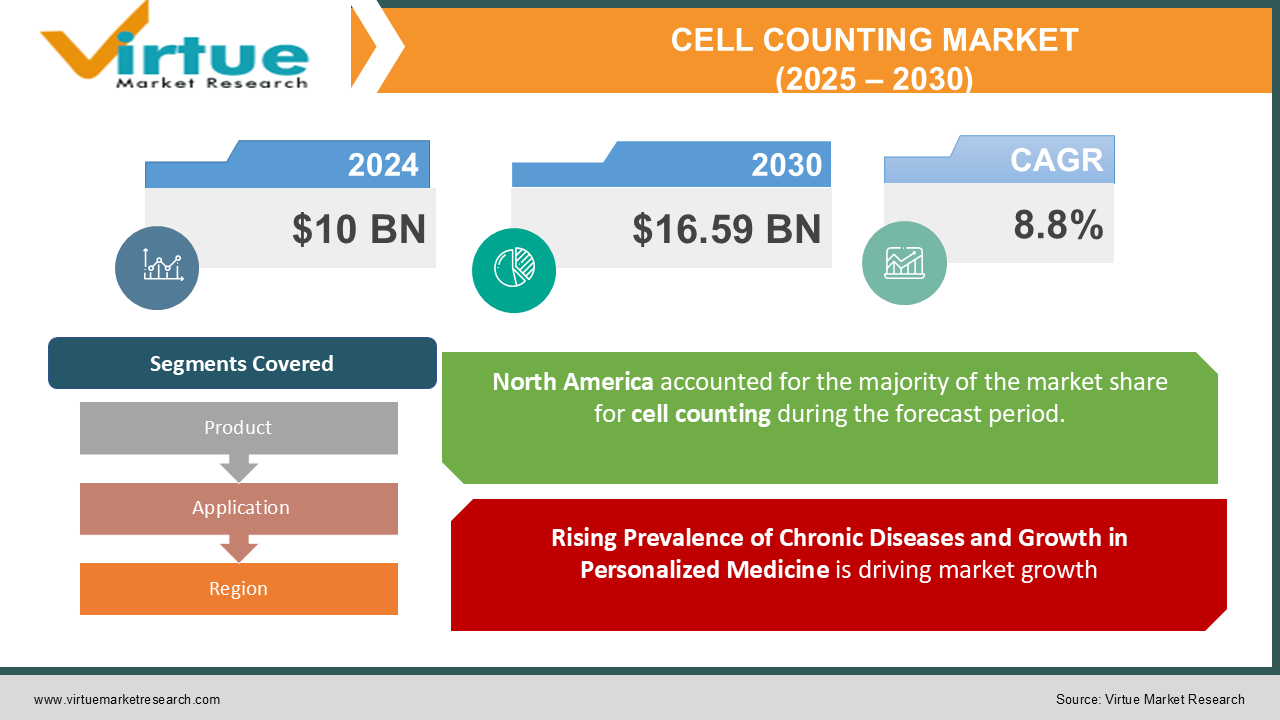

The Global Cell Counting Market was valued at USD 10 billion in 2024 and is projected to grow at a robust CAGR of 8.8% from 2025 to 2030. The market is expected to reach USD 16.59 billion by 2030.

Cell counting involves measuring the concentration or total number of cells in a sample and is critical for applications such as cell therapy, drug discovery, and cancer research. The growing prevalence of chronic diseases, coupled with advancements in imaging and automated counting technologies, is driving the market. Additionally, the adoption of high-throughput and AI-integrated counting solutions is transforming workflows, enabling precise and rapid cell analysis.

Key Market Insights

-

The increasing prevalence of chronic and infectious diseases, such as cancer and COVID-19, has significantly boosted the demand for cell counting in diagnostics and therapeutic monitoring, with 65% of laboratories now employing automated systems.

-

Automated cell counters dominate the market, accounting for 40% of the revenue in 2024, owing to their accuracy, speed, and integration with laboratory workflows.

-

The academic and research institutions segment witnessed a growth of 9% in 2024, driven by government funding for life sciences research and the expansion of cell biology programs.

-

North America is the largest market, contributing 35% of global revenue, due to advanced healthcare infrastructure and extensive R&D activities in biotechnology.

-

The Asia-Pacific region is projected to grow at a CAGR of 9.2% from 2025 to 2030, driven by rising investments in healthcare and biotechnology in countries like China and India.

Global Cell Counting Market Drivers

Rising Prevalence of Chronic Diseases and Growth in Personalized Medicine is driving market growth:

Chronic diseases, including cancer, diabetes, and cardiovascular disorders, have driven the need for advanced diagnostic tools like cell counting. Cell counting plays a pivotal role in monitoring disease progression, evaluating treatment efficacy, and personalizing therapies. For example, cancer research heavily relies on cell counting for tumor analysis, drug efficacy testing, and cell cycle studies. Personalized medicine, a growing field, demands precise cell characterization to develop targeted therapies. According to the World Health Organization (WHO), cancer cases are projected to increase by 50% globally by 2030, emphasizing the importance of innovative diagnostic tools like cell counting.

Advancements in Automated Cell Counting Technologies is driving market growth:

The transition from manual to automated cell counting has revolutionized laboratory workflows, improving efficiency and accuracy. Automated systems offer faster results, reduce human error, and support large-scale studies, making them indispensable in research and clinical settings. Innovations such as AI-powered analyzers, multi-parameter imaging systems, and integrated software for data analysis are propelling the market forward. Flow cytometry, a key technology, enables detailed phenotyping of cells, supporting applications in immunology, hematology, and oncology. The development of portable and user-friendly devices is further expanding adoption across smaller laboratories and clinics.

Expanding Applications in Biotechnology and Pharmaceutical Research is driving market growth:

Cell counting is integral to biotechnology and pharmaceutical R&D, supporting processes like drug discovery, stem cell therapy, and vaccine development. The biopharmaceutical industry relies on precise cell counts for quality control in manufacturing, ensuring consistency in biologics production. The surge in biologics and biosimilars, coupled with growing investments in stem cell research and regenerative medicine, is fueling market demand. Additionally, cell counting’s role in gene therapy and CRISPR technology highlights its significance in cutting-edge scientific advancements.

Global Cell Counting Market Challenges and Restraints

High Costs and Complexities Associated with Advanced Technologies is restricting market growth:

While automated and high-throughput cell counting systems offer superior performance, their high costs pose a significant barrier to adoption, especially for smaller laboratories and clinics in developing regions. The initial investment in advanced instruments like flow cytometers or fluorescence counters, along with maintenance and training costs, can strain budgets. Moreover, these systems often require skilled personnel to operate and interpret data, limiting their accessibility. The lack of standardization in cell counting methodologies further complicates comparisons between different platforms, posing challenges for widespread adoption.

Stringent Regulatory Frameworks and Ethical Concern is restricting market growth:

The cell counting market is subject to stringent regulatory oversight, particularly in clinical diagnostics and therapeutic applications. Agencies like the FDA and EMA mandate rigorous validation and compliance for instruments used in cell-based assays, extending the time and cost for product development and commercialization. Ethical concerns surrounding stem cell research and cell-based therapies also present hurdles, with varying legal restrictions across countries. These challenges can slow down the progress of innovations and impact market growth, especially in regions with restrictive regulatory environments.

Market Opportunities

The global cell counting market presents immense opportunities due to the rising focus on single-cell analysis, a technique crucial for understanding cell heterogeneity in cancer and immunology research. Single-cell analysis enables researchers to uncover insights into cellular behavior, response to treatments, and disease mechanisms, driving demand for advanced counting solutions. The growing adoption of next-generation sequencing (NGS) and CRISPR technologies further underscores the importance of precise cell counting in genetic studies and therapeutic developments. Emerging economies like India, Brazil, and South Africa are witnessing increased investments in biotechnology and healthcare infrastructure, creating opportunities for cell counting manufacturers to penetrate untapped markets. Governments are promoting research initiatives and funding life sciences programs, enhancing the demand for cell counting systems in academic institutions. Sustainability is another key area of focus. The development of energy-efficient and eco-friendly instruments aligns with global efforts to reduce environmental impact. Manufacturers adopting green technologies are likely to gain a competitive edge, especially in regions with stringent environmental regulations. Partnerships between academia, research organizations, and industry players are fostering innovation, paving the way for cost-effective and user-friendly counting solutions.

CELL COUNTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.8% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific, Becton, Dickinson and Company, Bio-Rad Laboratories, Merck KGaA, PerkinElmer, Agilent Technologies, Danaher Corporation, GE Healthcare, Beckman Coulter, Olympus Corporation |

Cell Counting Market Segmentation - By Product

-

Instruments

-

Reagents and Consumables

Instruments dominate the market, accounting for a significant revenue share in 2024 due to their indispensable role in research and clinical applications. Automated and fluorescence-based cell counters are particularly in demand for their precision and efficiency.

Cell Counting Market Segmentation - By Application

-

Research and Development

-

Clinical Diagnostics

-

Drug Discovery

-

Others

Clinical diagnostics lead the application segment, driven by the growing prevalence of diseases and the critical role of cell counting in diagnostic procedures. The segment benefits from advancements in point-of-care testing and personalized medicine.

Cell Counting Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the cell counting market, contributing the largest revenue share due to advanced healthcare infrastructure, extensive R&D activities, and the presence of leading biotechnology and pharmaceutical companies. The U.S., a major contributor, benefits from strong government funding for life sciences research and a robust regulatory framework ensuring high-quality standards. The region also boasts a high adoption rate of advanced technologies, including automated and AI-integrated systems. However, Asia-Pacific is emerging as the fastest-growing region, supported by increasing healthcare investments and expanding research capabilities.

COVID-19 Impact Analysis on the Cell Counting Market

The COVID-19 pandemic had a profound impact on the global cell counting market, underscoring its essential role in research and diagnostics. During the pandemic, cell counting technologies were crucial in vaccine development, testing, and monitoring immune responses. Automated cell counting systems became indispensable for laboratories worldwide, enabling them to handle the surge in testing volume efficiently and safely, especially during periods of high demand. Despite the critical importance of these technologies, the market faced significant challenges due to supply chain disruptions and limited access to laboratories during lockdowns. These disruptions temporarily hindered growth in the sector, causing delays in both the production and distribution of cell counting equipment. The pandemic highlighted the vulnerabilities in global supply chains and the importance of having resilient systems in place to handle unforeseen crises. Additionally, the pandemic emphasized the need for decentralized diagnostic solutions. As healthcare systems struggled with capacity issues, there was an increased focus on developing remote and point-of-care diagnostic technologies to reduce the burden on centralized labs and enable faster testing in more accessible locations. This shift is expected to influence future market dynamics, with a greater emphasis on automation, remote monitoring, and flexible diagnostic solutions. Looking ahead, the lessons learned from the COVID-19 pandemic are likely to reshape the cell counting market. There will be a stronger focus on improving supply chain resilience and adopting more decentralized, automated, and remotely accessible diagnostic technologies. These advancements will not only enhance the efficiency and scalability of cell counting systems but also ensure the healthcare industry is better prepared for future global health challenges.

Latest Trends/Developments

The cell counting market is experiencing rapid evolution, driven by technological innovations and expanding applications. Artificial intelligence (AI) and machine learning are transforming workflows by enabling real-time data analysis and predictive modeling. These technologies significantly enhance the accuracy and efficiency of cell counting, playing a key role in advancing personalized medicine and diagnostics. By automating data interpretation, AI and machine learning allow for faster and more precise decision-making, benefiting both research and clinical settings. A growing emphasis on single-cell analysis is further propelling the demand for advanced counting platforms. These systems, which enable multi-parameter measurements, are crucial for obtaining detailed insights into cellular behavior and heterogeneity. Technologies such as flow cytometry and fluorescence-based systems are gaining popularity for their ability to deliver high-resolution data on individual cells, supporting breakthroughs in genomics, immunology, and cancer research. Sustainability is also becoming an increasingly important factor in the market. Manufacturers are focusing on the development of energy-efficient, portable devices that meet environmental standards. These innovations include more eco-friendly instruments and disposable consumables, which help reduce operational costs and minimize waste. This shift toward sustainable solutions is aligned with the growing push for greener practices in the healthcare and biotechnology sectors. Additionally, collaborations between biotech companies and research institutions are accelerating the commercialization of cutting-edge cell counting technologies. These partnerships are driving innovation and facilitating the broader adoption of advanced solutions across different regions and applications. As a result, the cell counting market is poised for continued growth, with new technologies, sustainability efforts, and collaborative initiatives shaping the future of the industry.

Key Players

-

Thermo Fisher Scientific

-

Becton, Dickinson and Company

-

Bio-Rad Laboratories

-

Merck KGaA

-

PerkinElmer

-

Agilent Technologies

-

Danaher Corporation

-

GE Healthcare

-

Beckman Coulter

-

Olympus Corporation

Chapter 1. Cell Counting Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cell Counting Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cell Counting Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cell Counting Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cell Counting Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cell Counting Market – By Product

6.1 Introduction/Key Findings

6.2 Instruments

6.3 Reagents and Consumables

6.4 Y-O-Y Growth trend Analysis By Product

6.5 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Cell Counting Market – By Application

7.1 Introduction/Key Findings

7.2 Research and Development

7.3 Clinical Diagnostics

7.4 Drug Discovery

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Cell Counting Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cell Counting Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Thermo Fisher Scientific

9.2 Becton, Dickinson and Company

9.3 Bio-Rad Laboratories

9.4 Merck KGaA

9.5 PerkinElmer

9.6 Agilent Technologies

9.7 Danaher Corporation

9.8 GE Healthcare

9.9 Beckman Coulter

9.10 Olympus Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cell Counting Market was valued at USD 10 billion in 2024 and is projected to grow at a robust CAGR of 8.8% from 2025 to 2030. The market is expected to reach USD 16.59 billion by 2030.

Key drivers include the rising prevalence of chronic diseases, advancements in automated technologies, and expanding applications in biotechnology and pharmaceutical research.

Segments include instruments, reagents and consumables, software, and applications like research and development, clinical diagnostics, and drug discovery.

North America leads the market due to advanced healthcare infrastructure, robust R&D activities, and the presence of major industry players.

Major players include Thermo Fisher Scientific, Becton, Dickinson and Company, Bio-Rad Laboratories, Merck KGaA, and PerkinElmer.