Celery and Coriander Produce Market Size (2024 – 2030)

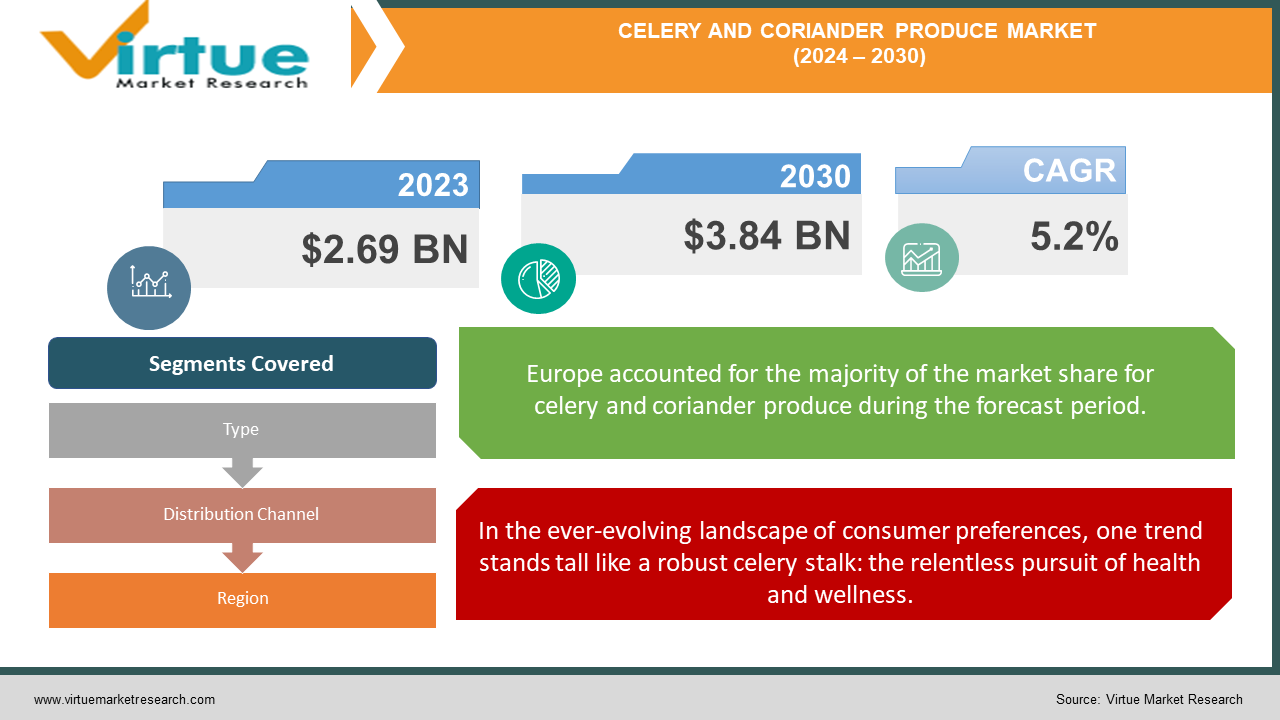

The Global Celery and Coriander Produce Market was valued at USD 2.69 billion in 2023 and is projected to reach a market size of USD 3.84 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

As varied as their culinary uses are, so too is the market for these enormous green veggies. The celery and coriander trade encompasses a large range of production scales and distribution methods, from busy farmers' markets where discriminating buyers scoop up locally grown bunches to enormous industrial farms feeding big retail chains. It's interesting to note that these two crops in the produce section don't merely share shelves. Celery and coriander are rich in vitamins, minerals, and antioxidants, and have outstanding nutritional profiles. Health-conscious customers have taken note of this and are increasingly looking for these substances to incorporate into their wellness regimens. The rising popularity of plant-based diets and holistic therapies has increased demand for these adaptable veggies. The global nature of the celery and coriander market adds another layer of complexity. While some regions boast ideal growing conditions for these crops, others rely heavily on imports to meet demand. This intricate web of international trade is subject to the whims of geopolitics, currency fluctuations, and transportation logistics, creating a dynamic and sometimes volatile market environment. Innovation is the name of the game in this green arena. From hydroponic growing systems that promise year-round harvests to new varietals bred for enhanced flavour or disease resistance, the celery and coriander market is a hotbed of agricultural ingenuity. On the consumer side, value-added products like pre-cut celery sticks, coriander pesto, and dried herb blends are carving out new niches and expanding the market's reach.

Key Market Insights:

Celery accounted for 55% of the total market revenue. Coriander contributed 45% to the overall market revenue.

Fresh coriander sales were valued at $540 million. Organic celery sales comprised 25% of the celery market.

Organic coriander sales represented 20% of the coriander market. Processed celery products generated $150 million in revenue.

The foodservice industry contributed 40% to the market's revenue. Retail sales made up 60% of the total market revenue.

Online sales of celery and coriander grew by 12% in 2023. Conventional celery sales were valued at $495 million.

The total volume of celery produced globally was 1.8 million metric tons. The total volume of coriander produced worldwide was 1.4 million metric tons.

The average price per kilogram of fresh celery was $1.20. The average price per kilogram of fresh coriander was $1.30.

Organic celery fetched an average price of $1.50 per kilogram. Organic coriander was priced at an average of $1.60 per kilogram.

Processed celery products sold at an average price of $2.50 per kilogram. Processed coriander products were priced at an average of $2.80 per kilogram.

Celery and Coriander Produce Market Drivers:

In the ever-evolving landscape of consumer preferences, one trend stands tall like a robust celery stalk: the relentless pursuit of health and wellness.

The health revolution began with a whisper – a murmur about the potential benefits of celery juice. What started as a niche trend quickly snowballed into a full-fledged movement, with social media influencers and wellness gurus touting the miraculous properties of this humble green elixir. Suddenly, celery wasn't just for dipping in hummus or adding crunch to salads; it became a daily ritual for thousands seeking to improve digestion, reduce inflammation, and boost overall vitality. This celery renaissance opened the floodgates for a deeper exploration of its nutritional profile. Consumers discovered that beyond its low-calorie content, celery is a treasure trove of vitamins K and C, folate, and potassium. Its high water and fiber content made it an ideal snack for weight management, while its natural sodium content appealed to athletes looking for natural electrolyte replenishment.

In an era where social media food trends can catapult obscure ingredients to international stardom overnight, the culinary world has become a melting pot of global flavors and techniques.

The popularity of culinary travel and the ease with which other cuisines are now available have broadened consumers' horizons and stoked a love for taste discovery. With its own flavors and scents, coriander and celery have almost taken on the role of culinary emissaries, taking diners to new gastronomic lands and reinventing old favorites. Specifically, coriander has benefited greatly from this worldwide taste revolution. It is a mainstay in a variety of cuisines, from Thai and Middle Eastern to Indian and Mexican, because to its zesty, bright flavors and subtle peppery sting. The demand for fresh coriander has surged as these international tastes have become more and more popular in Western markets. Bunches of aromatic coriander leaves, often called cilantro in North America, are no longer exclusive to specialty shops and can now be found in the vegetable departments of major supermarkets.

Celery and Coriander Produce Market Restraints and Challenges:

One of the most pressing issues facing the industry is climate change and its unpredictable effects on agriculture. Both celery and coriander are notoriously finicky crops, requiring specific growing conditions to thrive. Celery, in particular, demands a cool climate and consistent moisture, making it vulnerable to temperature fluctuations and drought. As global weather patterns become more erratic, farmers find themselves engaged in a high-stakes guessing game, trying to anticipate and adapt to changing conditions. Extreme weather events, from unseasonal frosts to devastating heatwaves, can decimate entire crops in a matter of days. This volatility not only impacts yield but also leads to price fluctuations that can ripple through the entire supply chain. For smaller farmers without the resources to implement advanced climate mitigation strategies, these challenges can be particularly daunting.

Celery and Coriander Produce Market Opportunities:

One of the most exciting opportunities lies in the realm of value-added products. As consumers increasingly seek convenience without compromising on health or flavor, there's a growing market for pre-prepped celery and coriander offerings. Imagine grab-and-go packs of celery sticks paired with healthy dips, or pre-portioned coriander cubes that can be popped straight into a cooking pot. These products not only command higher profit margins but also cater to time-starved consumers looking for easy ways to incorporate fresh produce into their diets. The booming plant-based food industry presents another golden opportunity. As more people embrace vegetarian and vegan lifestyles, celery and coriander are perfectly positioned to shine as versatile, flavorful ingredients in meat alternatives. Innovative food technologists could develop celery-based meat substitutes that capitalize on the vegetable's natural umami flavor and fibrous texture. Meanwhile, coriander's distinctive taste profile could be leveraged to create unique plant-based seasonings and flavor enhancers.

CELERY AND CORIANDER PRODUCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Duda Farm Fresh Foods, Inc., JV Smith Companies, Taylor Farms, Grupo Alta, Pure Pacific Organics, Grimmway Farms, Bolthouse Farms, Mann Packing Co., Inc., Tanimura & Antle, Dole Food Company, Inc., Apio, Inc., Heeren Brothers Produce,. Josie's Organics, Earthbound Farm, Bonduelle Group |

Celery and Coriander Produce Market Segmentation: By Types

-

Fresh Celery

-

Celery Seeds

-

Celery Oil

-

Fresh Coriander (Cilantro)

-

Coriander Seeds

-

Coriander Powder

-

Coriander Oil

Fresh celery remains the dominant force in this market segment. Its versatility in culinary applications, from raw snacking to cooked dishes, ensures a broad consumer base. The recent celery juice trend has significantly boosted its popularity, positioning it as a health food staple. Moreover, celery's long-standing presence in Western cuisines and its role as a crucial ingredient in mirepoix (the aromatic base for many dishes) cements its position as the market leader.

The surge in popularity of global cuisines, particularly Mexican, Indian, and Southeast Asian, has catapulted fresh coriander to the forefront of the market. Its distinctive flavours profile and perceived health benefits have made it a staple in health-conscious households and trendy restaurants alike. The rise of plant-based diets has further accelerated its growth, as coriander provides a burst of flavor to vegetarian and vegan dishes. Additionally, the increasing availability of hydroponically grown coriander has extended its seasonal availability, contributing to year-round demand growth.

Celery and Coriander Produce Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online Retail

-

Farmers Markets

-

Food Service/HoReCa (Hotels, Restaurants, Catering)

-

Direct-to-Consumer

Supermarkets and hypermarkets continue to dominate the distribution landscape for celery and coriander. These establishments benefit from their wide reach, established supply chains, and the convenience they offer to consumers who prefer to physically select their produce. The ability to bundle celery and coriander purchases with other grocery items maintains the appeal of one-stop shopping. Additionally, many supermarkets have expanded their organic and locally sourced offerings, catering to health-conscious consumers without requiring them to shop at specialty stores.

The online retail segment is experiencing explosive growth, driven by changing consumer behaviors and technological advancements. E-commerce platforms offering fresh produce delivery have gained traction, especially in urban areas. The COVID-19 pandemic accelerated this trend, as consumers sought contactless shopping options. Online channels also provide a platform for niche and organic producers to reach a wider audience, bypassing traditional retail gatekeepers. The ability to offer detailed product information, recipe suggestions, and user reviews online enhances the shopping experience, further fueling growth in this channel.

Celery and Coriander Produce Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Europe represents around 30% of the global celery and coriander market, making it the most dominant region in 2023. Celery and coriander are integral to many European cuisines, particularly in Mediterranean countries where these herbs are staples in a variety of dishes. There is a significant trend towards organic farming in Europe, and both celery and coriander are widely available as organic produce. This trend meets the increasing consumer demand for organic and sustainably grown food.

With almost 20% of the worldwide market share in 2023, the Asia-Pacific region is the celery and coriander market with the quickest rate of growth. The demand for fresh vegetables, such as celery and coriander, is rising due to the vast and expanding population. Essential components in many Asian cuisines are coriander and celery. Coriander is a popular spice in places like China, India, and Thailand, whereas celery is used in many different recipes and traditional medical treatments. The demand for fresh vegetables is being driven by the trend of urbanization and the growing consciousness of good eating practices.

COVID-19 Impact Analysis on the Celery and Coriander Produce Market:

Initially, lockdowns and movement restrictions disrupted the production and distribution of crop protection chemicals. Factories faced reduced capacity or temporary closures, leading to supply shortages. Simultaneously, transportation bottlenecks caused by border closures and reduced freight operations created logistical nightmares for distributors. These disruptions were particularly acute for celery and coriander farmers, as both crops are susceptible to pests and diseases that can quickly devastate yields if left unchecked. The pandemic also accelerated existing trends toward more sustainable and organic farming practices. As consumers became increasingly health-conscious during lockdowns, demand for organic produce soared. This shift put pressure on conventional farmers to reduce chemical inputs, driving interest in biopesticides and integrated pest management strategies. Innovative companies in the crop protection sector found opportunities in developing and marketing eco-friendly solutions tailored to celery and coriander cultivation.

Latest Trends/ Developments:

Genetic editing techniques like CRISPR are making waves in crop development. Scientists are exploring ways to enhance disease resistance in celery and coriander, potentially reducing the need for chemical interventions. There's also interest in developing coriander varieties with a milder flavor profile to appeal to consumers who find the herb's taste overpowering. The concept of "plant-based everything" has spurred innovation in product development. Celery leaves, often discarded, are being repurposed into flavouring powders or used in vegetable-based teas. Coriander stems are finding new life as a base for pesto or as a crunchy garnish when fried. This "root-to-stem" approach aligns with consumer interest in reducing food waste and maximizing nutritional value. In the realm of packaging, edible coatings derived from plant materials are being developed to extend the shelf life of fresh celery and coriander. These invisible, tasteless films can help reduce plastic usage while keeping produce fresh for longer periods, addressing both environmental concerns and food waste issues.

Key Players:

-

Duda Farm Fresh Foods, Inc.

-

JV Smith Companies

-

Taylor Farms

-

Grupo Alta

-

Pure Pacific Organics

-

Grimmway Farms

-

Bolthouse Farms

-

Mann Packing Co., Inc.

-

Tanimura & Antle

-

Dole Food Company, Inc.

-

Apio, Inc.

-

Heeren Brothers Produce

-

Josie's Organics

-

Earthbound Farm

-

Bonduelle Group

Chapter 1. Celery and Coriander Produce Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Celery and Coriander Produce Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Celery and Coriander Produce Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Celery and Coriander Produce Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Celery and Coriander Produce Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Celery and Coriander Produce Market – By Types

6.1 Introduction/Key Findings

6.2 Fresh Celery

6.3 Celery Seeds

6.4 Celery Oil

6.5 Fresh Coriander (Cilantro)

6.6 Coriander Seeds

6.7 Coriander Powder

6.8 Coriander Oil

6.9 Y-O-Y Growth trend Analysis By Types

6.10 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Celery and Coriander Produce Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Specialty Stores

7.4 Online Retail

7.5 Farmers Markets

7.6 Food Service/HoReCa (Hotels, Restaurants, Catering)

7.7 Direct-to-Consumer

7.8 Y-O-Y Growth trend Analysis By Distribution Channel

7.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Celery and Coriander Produce Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Celery and Coriander Produce Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Duda Farm Fresh Foods, Inc.

9.2 JV Smith Companies

9.3 Taylor Farms

9.4 Grupo Alta

9.5 Pure Pacific Organics

9.6 Grimmway Farms

9.7 Bolthouse Farms

9.8 Mann Packing Co., Inc.

9.9 Tanimura & Antle

9.10 Dole Food Company, Inc.

9.11 Apio, Inc.

9.12 Heeren Brothers Produce

9.13 Josie's Organics

9.14 Earthbound Farm

9.15 Bonduelle Group

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The increasing consumer preference for healthy and organic food products has boosted the demand for fresh and natural produce, including celery and coriander.

Both celery and coriander have relatively short shelf lives, requiring careful handling, storage, and transportation to maintain quality.

Duda Farm Fresh Foods, Inc., JV Smith Companies, Taylor Farms, Grupo Alta, Pure Pacific Organics, Grimmway Farms, Bolthouse Farms, Mann Packing Co., Inc., Tanimura & Antle.

Europe is the most dominant region in the market, accounting for approximately 35% of the total market share.

Asia Pacific is the fastest-growing region in the market.