Casino Management Systems (CMS) Market Size (2024 – 2030)

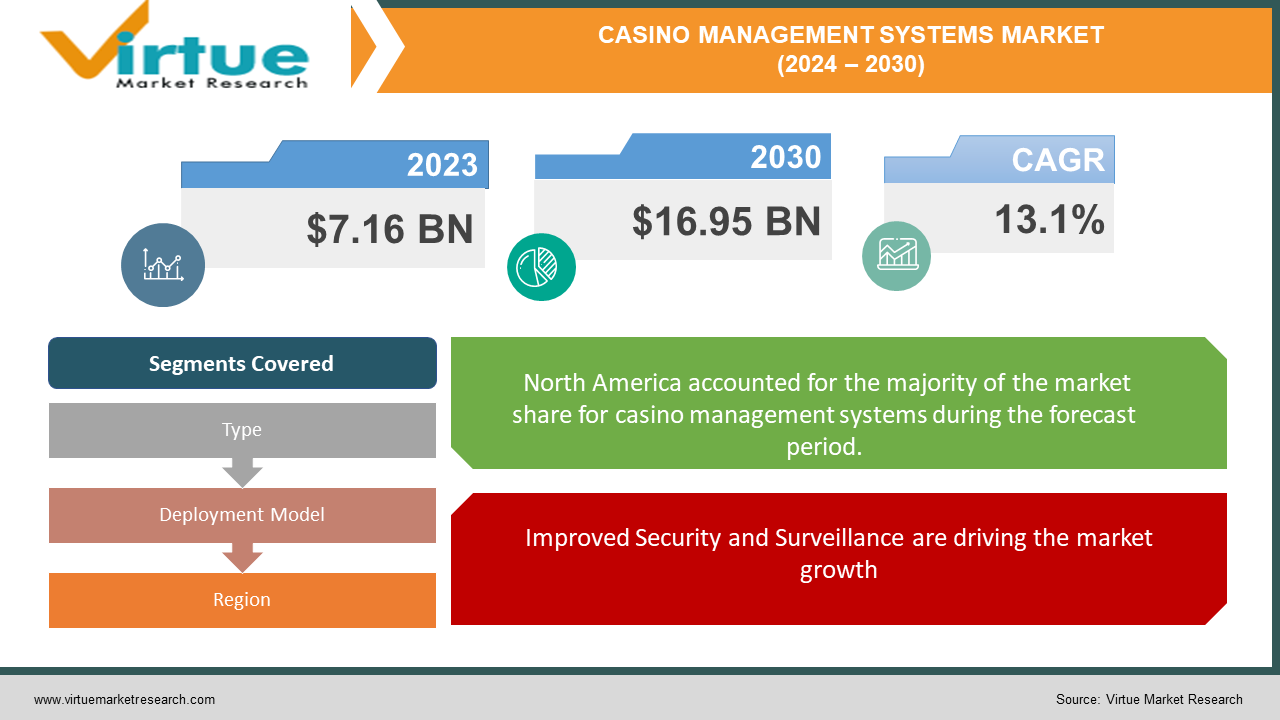

The Global Casino Management Systems (CMS) Market was valued at USD 7.16 billion in 2023 and will row at a CAGR of 13.1% from 2024 to 2030. The market is expected to reach USD 16.95 billion by 2030.

The Casino Management Systems (CMS) market is experiencing a boom, driven by the growth of casinos and the increasing demand for operational efficiency. These systems act as the central nervous system of a casino, managing everything from slot machines and table games to security and customer loyalty programs. A key trend is the growing importance of data analytics. CMS is incorporating advanced features to track player behavior, identify trends, and personalize marketing efforts. This allows casinos to optimize their operations, maximize profits, and provide a more engaging experience for customers. Additionally, security and surveillance are a major focus, with CMS integrating facial recognition and other technologies to prevent fraud and ensure safety. Looking ahead, the rise of cashless gambling and the potential for integration with online platforms are creating exciting opportunities for further growth and innovation in the CMS market.

Key Market Insights:

A key feature of casino management systems is player tracking. These systems leverage advanced technology like card readers and RFID tags to collect data on players' behavior and spending habits.The Asia-Pacific region is expected to witness significant growth in the casino management system market and has a market share of 17 % due to the expansion of the casino industry in this region.Casinos around the world are increasingly adopting advanced casino management systems to improve operational efficiency (streamlining tasks, optimizing resource allocation), customer experiences (personalized loyalty programs, targeted promotions), and regulatory compliance. The rise of international tourism and the legalization of gambling in new regions are creating a fertile ground for casino expansion. This directly translates to an increased need for robust casino management systems to manage these new facilities effectively

Global Casino Management Systems (CMS) Market Drivers:

Improved Security and Surveillance are driving the market growth

Advanced Casino Management Systems (CMS) are taking security to the next level with features that deter crime and create a safer environment for everyone. Facial recognition technology integrated with CMS allows casinos to identify banned individuals or known cheaters upon entry, preventing them from causing trouble. Real-time monitoring through strategically placed cameras provides security personnel with a constant eye on the casino floor, enabling them to quickly respond to suspicious activity or emergencies. Additionally, access control features within the CMS restrict access to sensitive areas like counting rooms or server bays, ensuring only authorized personnel can enter. This layered approach deters theft, minimizes disruptions, and fosters a sense of security for both casino staff and patrons. By proactively addressing potential threats, advanced CMS empowers casinos to create a safe and enjoyable experience for everyone, allowing players to focus on having fun and potentially winning big.

Enhanced Player Experience is driving the market growth

Casino Management Systems (CMS) are revolutionizing the player experience by enabling casinos to personalize visits for each customer. This goes beyond the traditional loyalty card. Imagine a player receiving special offers on their favorite slots upon entering the casino, or having their preferred table game and dealer readily available. CMS can track preferences and use data to suggest new games that align with a player's interests, keeping them engaged and exploring new options. Furthermore, targeted promotions can be delivered through the CMS, offering free spins, cashback bonuses, or discounts on dining based on a player's habits. This level of personalization fosters a sense of value and recognition for the player, leading to higher satisfaction and potentially increased spending. Essentially, CMS allows casinos to create a tailored experience that caters to each player's individuality, making them feel like a valued guest and encouraging them to return for more entertainment.

Integration with Emerging Technologies is driving the market growth

Casino Management Systems (CMS) are breaking down barriers and creating a more interconnected casino experience. Integration with cashless payment systems allows players to ditch bulky wallets and seamlessly move between games, restaurants, and shops using a single card or mobile app. This convenience eliminates wait times and frustrations, keeping players engaged in the action. Furthermore, mobile apps powered by CMS can provide real-time information on game availability, loyalty points, and targeted promotions directly to players' smartphones. This fosters a sense of control and allows them to plan their visit or even place bets remotely. The potential for integration with online gambling platforms opens doors to a whole new level of synergy. Imagine players seamlessly switching between physical casino games and online options, all managed through a unified system. This flexibility caters to a wider audience and creates exciting new revenue streams for casinos. By embracing these technological advancements, CMS is not only enhancing the player experience but also creating a more dynamic and profitable casino ecosystem.

Global Casino Management Systems (CMS) Market challenges and restraints:

High Implementation Costs are restricting the market growth

High implementation costs are a major roadblock for wider adoption of Casino Management Systems (CMS), especially for smaller casinos. These systems often require upfront licensing fees, software installation costs, and ongoing maintenance expenses. Additionally, customization to fit a casino's specific needs can significantly inflate the price tag. This can be daunting for smaller establishments with limited budgets. For instance, integrating loyalty programs, cashless transactions, or advanced security features requires additional investment. The ongoing costs associated with technical support, software updates, and employee training further strain their resources. This creates a dilemma: smaller casinos understand the potential benefits of a CMS for improved efficiency and customer experience, but the initial financial outlay and ongoing costs can be prohibitive.

Regulatory Compliance is restricting the market growth

Casino Management Systems (CMS) face a constant challenge in keeping pace with the evolving regulatory landscape. Casinos are obligated to adhere to a complex web of regulations regarding anti-money laundering (AML), Know Your Customer (KYC) protocols, and responsible gambling practices. A non-compliant CMS can expose casinos to hefty fines, license suspensions, or even closure. Therefore, a key factor for casinos is choosing a CMS that is adaptable and integrates seamlessly with these regulations. The system should be able to track and report financial transactions to flag suspicious activity, verify customer identities to prevent money laundering, and implement responsible gambling features like self-exclusion programs or spending limits. Furthermore, a future-proof CMS should be designed to accommodate potential regulatory changes This ensures casinos can operate with confidence, knowing their CMS is a strong partner in regulatory compliance

Market Opportunities:

The Casino Management Systems (CMS) market is brimming with exciting opportunities fueled by technological advancements and a growing global gaming industry. The rising popularity of cashless transactions presents a lucrative avenue for CMS providers to develop secure and integrated solutions. This caters to the evolving customer preference for contactless payments and strengthens security measures. Furthermore, the demand for enhanced player experiences creates an opportunity for CMS to integrate with loyalty programs, personalized marketing tools, and data-driven player analytics. These features personalize the casino experience, fostering customer engagement and loyalty. The burgeoning legal online gambling market in many regions offers another growth opportunity. CMS providers can tailor their solutions to meet the specific needs of online platforms, ensuring secure transactions, responsible gambling practices, and seamless integration with existing online gaming infrastructure. By focusing on innovation, adaptability, and addressing the evolving needs of casinos, CMS providers are well-positioned to capitalize on the vast potential of this dynamic market.

CASINO MANAGEMENT SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.1% |

|

Segments Covered |

By Type, Deployment Model, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

International Game Technology (IGT), Light & Wonder, Inc. (formerly Scientific Games), Novomatic AG, Konami Gaming Inc, Aristocrat Leisure Limited, Agilysys Inc., Winsystems Inc., Oracle Corporation, NCR Corporation, Amatic Industries GmbH, Apex Gaming Technology GmbH |

Casino Management Systems (CMS) Market segmentation - By Type

-

Commercial Casinos

-

Tribal Casinos

While both commercial and tribal casinos utilize Casino Management Systems (CMS), commercial casinos likely hold the dominant market share. This dominance stems from their profit-driven nature. Commercial casinos prioritize features within the CMS that directly translate to increased revenue, such as loyalty program management and targeted marketing tools. These features allow them to personalize the player experience, incentivize repeat visits, and ultimately maximize their bottom line. Tribal casinos, while employing CMS for core functionalities, might have a broader focus beyond just revenue generation. Regulatory requirements specific to tribal governance or a commitment to community engagement could influence their choice of CMS features. However, the intense competition within the commercial casino industry creates a strong driver for adopting revenue-enhancing CMS functionalities, solidifying their position as the dominant market segment

Casino Management Systems (CMS) Market segmentation - By Deployment Model

-

On-Premise CMS

-

Cloud-Based CMS

The dominance between On-Premise and Cloud-based Casino Management Systems (CMS) is currently in a state of flux. Traditionally, On-Premise systems held sway due to casinos' desire for complete control over their data and mission-critical operations. These systems offer greater security and customization but come with the burden of maintaining significant IT infrastructure and technical expertise. However, Cloud-based CMS are gaining traction due to their scalability, remote access capabilities, and potentially lower upfront costs. Cloud solutions eliminate the need for extensive in-house IT support and allow for easier updates and maintenance. However, concerns regarding data security and reliance on a strong internet connection are still factors for casinos to consider. As cloud technology continues to mature and security measures improve, Cloud-based CMS has the potential to become the dominant force in the market, especially for smaller or mid-sized casinos that might not have the resources for extensive on-premise IT infrastructure.

Casino Management Systems (CMS) Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently reigns supreme in the Casino Management Systems (CMS) market. This dominance can be attributed to a well-established and highly saturated casino industry in the region. The presence of major technology providers coupled with a growing demand for advanced CMS solutions to enhance operational efficiency and cater to a tech-savvy customer base are key drivers. However, the Asia-Pacific (APAC) region is showing impressive growth potential due to factors like economic expansion, rising disposable income, and the legalization of gambling activities in certain countries. While North America holds the current lead, the future of the CMS market might witness a power shift toward the dynamic and rapidly growing APAC region.

COVID-19 Impact Analysis on the Global Casino Management Systems (CMS) Market

The COVID-19 pandemic delivered a knockout punch to the Casino Management Systems (CMS) market. Lockdowns forced casinos to shutter their doors for months, leading to a sharp decline in revenue and stalling new CMS implementations. Existing systems became underutilized, hindering the need for upgrades or expansions. Disruptions in supply chains also hampered the installation and maintenance of CMS solutions. However, the impact is expected to be a temporary setback. As casinos reopened and adapted to social distancing protocols, the demand for CMS with features like contactless payments and enhanced hygiene monitoring began to rise. This focus on safety and security presents an opportunity for CMS providers to develop innovative solutions. Furthermore, the accelerated shift towards online gambling platforms during lockdowns has created a new market for CMS providers. By developing online-compatible systems that ensure secure transactions and responsible gaming practices, CMS companies can capitalize on the long-term growth potential of the online gambling sector. Overall, while COVID-19 caused a temporary slump, the CMS market is poised for a rebound as casinos adapt to the new landscape and leverage technology to enhance safety, security, and the overall gaming experience.

Latest trends/Developments

Driven by technological advancements and a constantly evolving gaming landscape, Casino Management Systems (CMS) are undergoing exciting transformations. The hottest trends include cashless transactions for enhanced convenience and security, data-driven marketing that personalizes promotions and fosters loyalty, cloud-based solutions for scalability and cost-efficiency, a focus on responsible gambling with features like self-exclusion and behavior monitoring, and integration with online gambling platforms to cater to this burgeoning market segment. By embracing these trends, CMS providers are not only staying ahead of the curve but also creating a win-win situation for casinos and players alike.

Key Players:

-

International Game Technology (IGT)

-

Light & Wonder, Inc. (formerly Scientific Games)

-

Novomatic AG

-

Konami Gaming Inc.

-

Aristocrat Leisure Limited

-

Agilysys Inc.

-

Winsystems Inc.

-

Oracle Corporation

-

NCR Corporation

-

Amatic Industries GmbH

-

Apex Gaming Technology GmbH

Chapter 1. Casino Management Systems (CMS) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Casino Management Systems (CMS) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Casino Management Systems (CMS) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Casino Management Systems (CMS) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Casino Management Systems (CMS) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Casino Management Systems (CMS) Market – By Type

6.1 Introduction/Key Findings

6.2 Commercial Casinos

6.3 Tribal Casinos

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Casino Management Systems (CMS) Market – By Deployment Model

7.1 Introduction/Key Findings

7.2 On-Premise CMS

7.3 Cloud-Based CMS

7.4 Y-O-Y Growth trend Analysis By Deployment Model

7.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 8. Casino Management Systems (CMS) Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Deployment Model

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Deployment Model

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Deployment Model

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Deployment Model

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Deployment Model

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Casino Management Systems (CMS) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 International Game Technology (IGT)

9.2 Light & Wonder, Inc. (formerly Scientific Games)

9.3 Novomatic AG

9.4 Konami Gaming Inc.

9.5 Aristocrat Leisure Limited

9.6 Agilysys Inc.

9.7 Winsystems Inc.

9.8 Oracle Corporation

9.9 NCR Corporation

9.10 Amatic Industries GmbH

9.11 Apex Gaming Technology GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Casino Management Systems (CMS) Market was valued at USD 7.16 billion in 2023 and will row at a CAGR of 13.1% from 2024 to 2030. The market is expected to reach USD 16.95 billion by 2030.

Improved Security and Surveillance and integration with Emerging Technologies are the reasons that are driving the market.

Based on deployment type it is divided into two segments – On-Premise CMS, Cloud-Based CMS

North America is the most dominant region for the Casino Management Systems (CMS) Market.

International Game Technology (IGT), Light & Wonder, Inc. (formerly Scientific Games), Novomatic AG, Konami Gaming Inc.