Cashew Nuts Market Size (2024 – 2030)

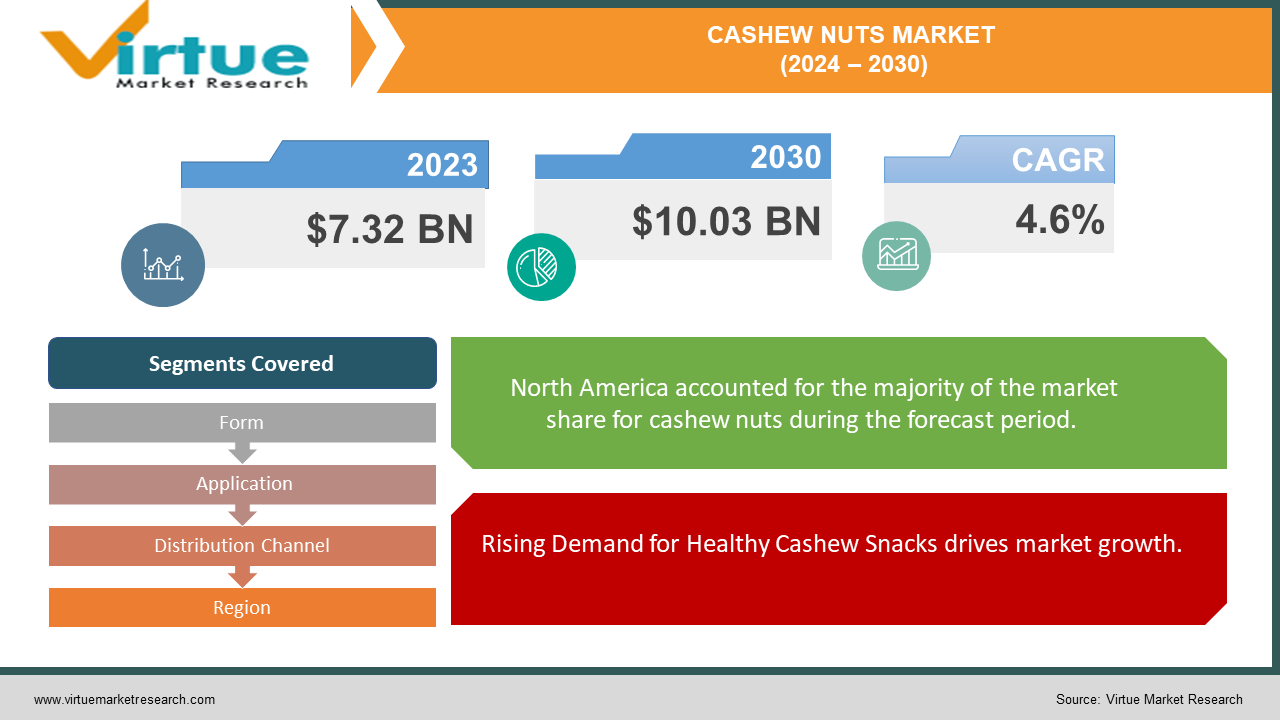

The Cashew Nuts Market was valued at USD 7.32 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 10.03 billion by 2030, growing at a CAGR of 4.6%.

Cashew nuts have emerged as one of the most sought-after edible nuts in the global market. This kidney-shaped nut variety, renowned as the cashew, boasts high levels of protein, vitamin K, fat, and oil content. Before consumption, cashews undergo a roasting process followed by shell removal. The extraction of cashew oil from the nut facilitates the production of plastic. Harvested typically towards the conclusion of summer, cashews thrive in proximity to coastal regions. Widely embraced in the food and beverage industry, cashews find application in confectioneries, ice creams, and various culinary establishments, serving both as a standalone snack and an ingredient. Noteworthy are the manifold health benefits associated with cashews, including cholesterol reduction, cardiovascular disease mitigation, cancer and gallstone prevention, and promotion of cognitive health. Driven by consumer shifts toward healthier dietary choices and the increasing incorporation of cashew nuts in ready-to-consume food products, the cashew nut market is experiencing substantial growth.

Key Market Insights:

The Cashew Export Promotion Council of India (CEPCI), collaborating with the International Nut and Dried Fruit Foundation (INC) in Spain and other key stakeholders in the global cashew industry, has agreed to establish a global task force aimed at enhancing worldwide cashew production.

This initiative entails a plea to the government for financial assistance to support cashew farmers and bolster cashew nut output. Consequently, production levels have surged owing to heightened demand for processed foods containing cashews and substantial governmental backing for cashew growers. These developments are poised to fuel market expansion in the foreseeable future.

Cashew Nuts Market Drivers:

Rising Demand for Healthy Cashew Snacks drives market growth.

For numerous years, cashew nuts have served as a popular snack and a key ingredient in desserts and savory dishes, particularly in Asian cuisine. Moreover, there's been a notable uptick in the utilization of cashews in ice cream, energy bars, biscuits, and muesli. A single ounce of cashews contains a noteworthy 622 micrograms of copper, a mineral crucial for supporting bone health in humans. However, according to the International Nut and Dried Fruit Council, consumption patterns are somewhat influenced by inflationary pressures. In comparison to peanuts, cashews boast relatively high fiber content, which aids in promoting healthy weight management by improving digestive function. Furthermore, cashews offer substantial nutritional advantages, including elevated levels of iron and magnesium compared to peanuts, thereby enhancing enzymatic reactions within the body. Given their rich nutritional profile, snack manufacturers have introduced a variety of cashew-based snacks to meet consumer demand, such as ready-to-drink cashew milk, which serves as a lactose-free milk alternative. Additionally, cashews are abundant in monounsaturated and polyunsaturated fats, serving as an excellent protein source. This high-fat content renders cashews an effortless substitute for heavy cream, increasingly favored in both sweet and savory dishes as a healthier vegan alternative to traditional heavy whipping cream in regions like the United States and Europe.

Cashew Nuts Market Restraints and Challenges:

Stringent Regulations Related to Food Quality hinder market growth.

The operational environment within numerous small-scale cashew-processing units often proves substandard and unhygienic, consequently leading to the production of cashew nuts of inferior quality with heightened levels of contamination. Although the introduction of machinery aims to scale up operations, it also gives rise to specific quality challenges. Moreover, the storage of high-moisture cashew nuts under adverse conditions, particularly in regions like the Ivory Coast and Ghana, poses a significant risk of aflatoxin contamination, thereby exacerbating concerns regarding food safety and ultimately impeding cashew production. Despite these challenges, there exists a growing consumer demand for convenience and health-conscious products, particularly in the realm of premium snack nuts such as cashews. Furthermore, consumer trends are increasingly shaping institutional priorities concerning food safety protocols and certification standards.

Cashew Nuts Market Opportunities:

The surge in global cashew production is attributable to the widespread appeal of cashew-based snacks, driven by their palatability and nutritional advantages. Additionally, the recent uptick in demand for plant-based diets, spurred by shifting lifestyles and heightened awareness, has further bolstered the popularity of cashew-derived products. Notably, the proliferation of cashew milk and nut butter has garnered significant traction worldwide, particularly in regions like North America and Europe. Moreover, findings from a study published in the British Journal of Nutrition underscore the potential health benefits associated with regular nut consumption. Specifically, individuals who consume nuts more than four times a week may experience a 37% reduction in the risk of coronary heart disease. Given these factors, there exists a compelling case for ramping up cashew nut production to meet the escalating demand.

CASHEW NUTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Form, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aryan International, Agrocel Industries Pvt. Ltd., CBL Natural Foods (Pvt) Ltd., Aurora Products Inc., Delicious Cashew Co., Divine Foods LLC , Kalbavi Cashews, Wonderland Foods, Haldiram's, Royal Dry Fruits |

Cashew Nuts Market Segmentation: By Form

-

Whole

-

Roasted

-

Powder

-

Paste

-

Splits

Throughout the forecast period, the whole white kernels segment dominated the market, capturing the largest market share. Renowned for their pristine appearance characterized by a whitish ivory hue devoid of dark black or brown spotting, white kernels represent the epitome of purity within cashew grades. Notably, the market predominantly recognizes grades such as WW-180, WW-210, WW-240, and WW-320 as the most esteemed. Presently, automated solutions for grading the white whole sector and assessing standard criteria, such as color and shape, are conspicuously absent from the market.

Cashew Nuts Market Segmentation: By Application

-

Dairy Products

-

Bakery Products

-

Snacks and Bars

-

Confectionaries

-

Cereals

-

Desserts

-

Beverages

-

Cosmetic Products

-

Others

In recent times, industrial users have shown a growing interest in cashew nuts, incorporating them into various products such as cookies, cereals, and ice cream toppings, while also utilizing them to produce cashew nut butter. This heightened consumption of cashew nuts correlates with the increasing trend towards healthier snacking habits. Notably, spreads and snack bars, particularly those labeled as organic, are increasingly featuring cashew nuts as a key ingredient.

In Germany, the demand for cashews as snacks follows a seasonal pattern, with peak consumption occurring during the winter months and tapering off during the summer seasons. Concurrently, there has been a notable surge in the utilization of cashew nuts across the end-user food and beverage industry.

Given their rich nutritional profile, snack producers have responded to consumer demand by introducing a variety of cashew-based snacks, including ready-to-drink cashew milk, which serves as a lactose-free alternative to traditional dairy milk. Additionally, cashews are prized for their high content of monounsaturated and polyunsaturated fats, as well as their protein content. This abundance of healthy fats positions cashews as a seamless substitute for heavy cream, fueling their increasing use in both sweet and savory dishes as a wholesome vegan alternative to conventional heavy whipping cream, particularly in regions like the United States and Europe.

Cashew Nuts Market Segmentation: By Distribution Channel

-

Supermarkets

-

Retailers

-

Online Stores

-

Others

The hypermarkets & supermarkets segment, which currently holds the lead in the segmental space, is projected to significantly drive segmental expansion in the forthcoming years. This anticipated growth stems from an escalation in the allocation of shelf space within hypermarkets & supermarkets for producers, coupled with a surge in product promotions.

Cashew Nuts Market Segmentation- By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In North America, which currently boasts the largest market share, a steady growth trajectory is anticipated, with a forecasted Compound Annual Growth Rate (CAGR) of 3.2% during the projection period. This growth is primarily driven by the escalating prices of imported cashews, which are expected to outpace consumption volume increases, thereby augmenting the market's overall value. Notably, cashew consumption is concentrated in select states such as California, Florida, New York, Texas, and New Jersey, with a notable uptick observed in their application within the end-user food market across the country.

Asia Pacific emerges as the second-largest region, poised to register a CAGR of 3.3% during the forecast period. Chinese consumers exhibit a growing preference for diverse nut flavors and products, propelling the consumption of cashew nuts at a rapid pace compared to other nuts. Particularly noteworthy is the significant influence of younger consumers, particularly female professionals aged between 19 to 35 years, who are driving the surge in cashew consumption.

Meanwhile, Europe stands as the third-largest region, with Germany emerging as the leading consumer of cashew nuts across European countries. Notably, German companies such as Intersnack play a pivotal role in the processing and packaging of cashews, with operations extending globally, including countries like Australia, India, Vietnam, and Singapore. Furthermore, the presence of major organic food producers like Alnatura, boasting a robust product line of cashew nuts, further fuels the consumption trend in Germany. This trend is expected to persist in the foreseeable future, driven by the escalating demand from the processing industry.

COVID-19 Pandemic: Impact Analysis

The enduring trend favoring products made from natural ingredients, a trend that has been further propelled by factors such as the COVID-19 pandemic, has precipitated a notable surge in the global market. This surge presents a significant growth opportunity for the natural Cashew Nuts segment worldwide, particularly within the domain of functional foods and beverages. Moreover, the production of Cashew Nuts involves labor-intensive processes, particularly evident during harvest and post-harvest phases. Consequently, the industry heavily relies on seasonal workers, a considerable portion of whom are migrants. The onset of the COVID-19 pandemic has had a profound impact on these workers, potentially exposing them to serious health risks. For example, inadequate temporary living conditions and challenges in maintaining adequate social distancing measures may exacerbate health concerns among this vulnerable demographic.

Latest Trends/ Developments:

In September 2022, as part of its diversification efforts into other sectors of the economy, the Nigerian Construction Firm Julius Berger Nigeria PLC unveiled a modern cashew processing plant in Epe, Lagos State, Nigeria. This development not only marks the company's foray into agricultural produce processing but also enhances the cashew processing capacity of the country. In July 2022, Singapore-based company Royal Nuts inaugurated its new cashew nut processing plant in Ivory Coast under its subsidiary Dorado Ivory, with an investment of USD 23 million. This state-of-the-art facility is touted as the world's largest cashew processing plant, boasting an annual capacity of 75,000 Metric tons. The establishment of this plant is poised to significantly bolster the company's cashew trade and manufacturing endeavors.

Key Players:

These are the top 10 players in the Cashew Nuts Market: -

-

Aryan International

-

Agrocel Industries Pvt. Ltd.

-

CBL Natural Foods (Pvt) Ltd.

-

Aurora Products Inc.

-

Delicious Cashew Co.

-

Divine Foods LLC

-

Kalbavi Cashews

-

Wonderland Foods

-

Haldiram's

-

Royal Dry Fruits

Chapter 1. Cashew Nuts Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cashew Nuts Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cashew Nuts Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cashew Nuts Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cashew Nuts Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cashew Nuts Market – By form

6.1 Introduction/Key Findings

6.2 Whole

6.3 Roasted

6.4 Powder

6.5 Paste

6.6 Splits

6.7 Y-O-Y Growth trend Analysis By form

6.8 Absolute $ Opportunity Analysis By form, 2024-2030

Chapter 7. Cashew Nuts Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets

7.3 Retailers

7.4 Online Stores

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Cashew Nuts Market – By Application

8.1 Introduction/Key Findings

8.2 Dairy Products

8.3 Bakery Products

8.4 Snacks and Bars

8.5 Confectionaries

8.6 Cereals

8.7 Desserts

8.8 Beverages

8.9 Cosmetic Products

8.10 Others

8.11 Y-O-Y Growth trend Analysis By Application

8.12 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Cashew Nuts Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By form

9.1.3 By Distribution Channel

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By form

9.2.3 By Distribution Channel

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By form

9.3.3 By Distribution Channel

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By form

9.4.3 By Distribution Channel

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By form

9.5.3 By Distribution Channel

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cashew Nuts Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Aryan International

10.2 Agrocel Industries Pvt. Ltd.

10.3 CBL Natural Foods (Pvt) Ltd.

10.4 Aurora Products Inc.

10.5 Delicious Cashew Co.

10.6 Divine Foods LLC

10.7 Kalbavi Cashews

10.8 Wonderland Foods

10.9 Haldiram's

10.10 Royal Dry Fruits

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Cashews boast relatively high fiber content, which aids in promoting healthy weight management by improving digestive function.

The top players operating in the Cashew Nuts Market are - Aryan International, Agrocel Industries Pvt. Ltd., CBL Natural Foods (Pvt) Ltd., Aurora Products Inc., Delicious Cashew Co., Divine Foods LLC, Kalbavi Cashews, Wonderland Foods, Haldiram's, Royal Dry Fruits.

The enduring trend favoring products made from natural ingredients, a trend that has been further propelled by factors such as the COVID-19 pandemic, has precipitated a notable surge in the global market.

In September 2022, as part of its diversification efforts into other sectors of the economy, the Nigerian Construction Firm Julius Berger Nigeria PLC unveiled a modern cashew processing plant in Epe, Lagos State, Nigeria.

Europe stands as the third-largest region, with Germany emerging as the leading consumer of cashew nuts across European countries.