Cashew Market Size (2024 – 2030)

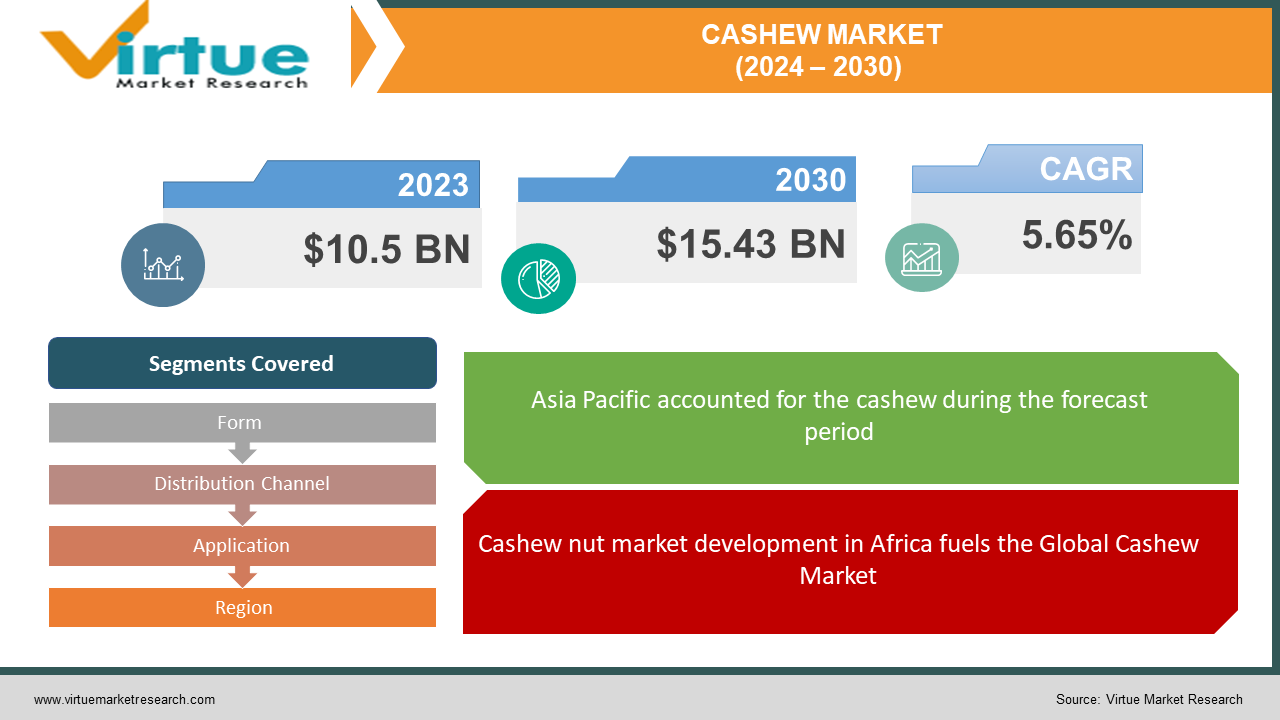

The Global Cashew Market was valued at USD 10.5 billion in 2023 and is projected to reach a market size of USD 15.43 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.65%.

Cashews are one of the most popular foods on the market. Cashews are kidney-like nuts rich in protein, vitamin K, fats and oils. Cashew nuts are roasted and deshelled before eating. The oil obtained from cashews is used to make plastic. Cashew nuts are usually collected near the coast in late summer. The food and beverage industry uses cashews as snacks, as an ingredient in restaurants, and often in candy and ice cream. Cashews have many health benefits, including lowering blood cholesterol, reducing the risk of heart disease, preventing cancer and gallstones, and improving brain health. The cashew industry is growing rapidly as consumers eat more cashews and increase their consumption of ready-made meals.

Key Market Insights:

Cashew products have attracted the attention of consumers young and old by introducing innovations such as cashew butter yogurt in America and cashew oil in India. However, the use of cashew kernels in the diet of South American consumers has remained stable, with many national producers entering the market with different varieties of cashew nuts to suit health habits in the country. On the other hand, Brazil has always been a price-sensitive consumer of cashews. Brazil's economic recovery is being hampered by inadequate economic growth, which has made cashew crops more dependent on inflation.

Increasing demand for cashew-flavored products and government officials are encouraging greater consumption of cashews in the African region. Consumers in West and East Africa do not know about eating cashew seeds whole or split. It can be thought that this situation is because consumers in the region are not accustomed to fast consumption of ready-made cashews in stores. However, the Competitive Cashew Initiative (formerly the African Cashew Initiative) has played an important role in the commercialization of high-quality raw material in Benin, Ivory Coast, Mozambique, and Ghana, as well as in its production and sales. Increase productivity in these countries through a variety of methods, such as supporting SAP software in the cashew chain in Western Ghana.

Cashew Market Drivers:

Cashew nut market development in Africa fuels the Global Cashew Market.

African governments are promoting infrastructure and economic transformation. Many African cashew groups and councils are developing cashew industry disciplines and working with other countries, such as Vietnam, to acquire food processing technology. The African Cashew Initiative was established in 2009 to promote production, marketing, and business linkages as the cashew industry benefits and is largely responsible for the growth of the industry. To bring farmers and ranchers in five African countries (Benin, Burkina Faso, Ivory Coast, Ghana, and Mozambique) up to international standards, the program assists with advice and training at every stage of the production process. The program focuses on helping growers and processes improve yield and product quality and connecting entrepreneurs with supply. As a result, the program expands cashew cultivation in Africa and expands the global cashew market.

Increasing demand for processed foods and strong government support for cashew farmers provide opportunities for international trade which in turn proves a catalyst for market growth.

The global demand for cashew snacks is increasing due to their taste and health benefits, leading to the rise of cashew nuts. Additionally, the demand for plant-based foods has increased in recent years due to changes in lifestyle and increased awareness. Spreads made from milk and nut butter have become popular around the world, especially in North America and Europe. Additionally, according to research published in the British Journal of Nutrition, people who intake cashew nuts more than 4-5 times a week have a 37% lower risk of heart disease. Therefore, cashew nut production needs to be increased.

It has also signed an agreement with the Cashew Export Promotion Council of India (CEPCI), Spain's International Nuts and Dried Fruit Foundation (INC), and other world cashew producers to form a task force for cashew workers worldwide. They suggested the government fund this project to benefit cashew farmers and increase yields. Cashew crops are expanding due to increasing demand for cashew food products and also due to significant support to cashew growers. These changes are expected to support business expansion in the coming years.

Cashew Market Restraints and Challenges:

The rise in the cost of cashews restrains the Cashew market growth.

The cost of cashew processing and refining is quite high so when it comes to market only people with more disposable income can buy cashew. In India, it costs around Rs. 850/kg which is quite high and its derivatives are even costlier so this rise in cost is a main restraint to the growth of the market.

The volatility in cashews price brings a challenge to market growth.

Global cashew prices fluctuate significantly due to factors like crop variations, currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Cashew Market Opportunities:

The surge in the usage of cashews in the Cosmetic Industry.

There is a high demand for cashews as an ingredient of hair oil in the personal care and beauty industry. Cashew oil contains vitamin E, unsaturated fats, magnesium, and zinc, which are important for the body as it acts as an antioxidant. Moreover, cashews contain other acids such as linoleic acid and oleic acid, which can be used for all types of hair problems. So, if any industry plans to launch cosmetic products should give an attempt to cashew-based products.

CASHEW MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.65% |

|

Segments Covered |

By Form, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bata Food, Haldirams, Wonderland Foods, Divine Foods, Delicious Cashew Co., Kalbavi Cashews, Nutty Yogi, Royal Dry Fruits Pvt Ltd., Delphi Organic GmbH, Lafooco and Aryan International |

Cashew Market Segmentation by Form

-

Whole

-

Roasted

-

Powder

-

Splits

-

Paste

In 2023, based on the Form, the Whole segment is projected to grow at a CAGR of 4.86% and is currently leading the charts followed by Roasted and Split. Splits are gaining popularity because sometimes even after every refining process whole contains impurity which is not in the case of splits.

Cashew Market Segmentation by Distribution Channel

-

Online

-

Offline

In 2023, based on Distribution Channel, the offline segment accounted for the largest revenue share with approximately 65% of the market. This could be because locally available cashews are cheaper as compared to branded cashews. Also, as it is very costly people prefer to buy in smaller amounts, and buying small amounts online does not sound economical. But as the market thrives online sector is gaining popularity because of premium quality cashews which have higher nutritional value than local ones and registered a CAGR of 9.56%.

Cashew Market Segmentation by Application

-

Dairy Products

-

Bakery Products

-

Snacks & Bars

-

Confectionaries

-

Desserts

-

Others

In 2023, based on Application, Dairy Products accounted for the largest revenue share with approximately 40% of the market. Bakery products are expected to show a CAGR of 6.7% during the forecasting period higher than anybody else. The reason for the higher CAGR is that bakery products can be stored for longer periods and are easily available on both offline and online channels.

Cashew Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific constitutes the largest region registering a CAGR of 3.6% during the forecasting period. Chinese consumers are interested in a variety of nut flavors and products. For this reason, consumption of cashew nuts is faster than other nuts. Young consumers (19 to 35 years old), especially working women, are now the prime force behind cashew consumption. These factors may promote the consumption of cashews in the market. Also, the most common snacks in China include nuts and seeds, cookies and cakes, dried tofu, and sweets or chocolates. Among all snacks, roasted nuts and seeds such as cashews and almonds are the most popular and marketed. Roasted nuts are the most sold in China's snack food market due to their taste, nutritional value, and health benefits. While dried fruits are used as foodstuffs in other countries, dried fruits are used as snacks in China. Consumers in China usually believe that dried fruit is healthy and nutritious. Based on these views, cashew consumption in China is expected to increase in the future. In India, there are many varieties of sweets available in which cashews serve as prime products. On many occasions, people exchange sweets mainly in which cashew is a main ingredient. This is because the sweets can be stored for a relatively longer time and can be transferred from one place to another without any discrepancies.

North America constitutes the second-largest market and is expected to register a CAGR of 4.4% during the forecast period. Market prices are expected to increase faster than consumption due to the high increase in prices of imported cashews. Just a few states, including California, Florida, New York, Texas, and New Jersey, produce most of the nation's cashews. They are used in snacks. Snacks alone account for approximately 60% of cashew consumption. The country's snack food is expected to grow during the forecast period which in turn accelerates the cashews import. In addition to raw or roasted cashews, they are also used in making butter, which is an effective alternative to peanut butter for humans who are allergic to peanuts. Bulk Nation USA, Bassé Nuts, and Georgia Grinders are the leading cashew butter producers in the United States. Therefore, the increasing demand of the country's population for cashews and the increasing demand of the commercial market are accelerating the consumption of cashews in the country.

Europe is the second runner-up in the market share. Germany is Europe's largest consumer of cashew nuts. The demand for cashews as a snack in Germany is seasonal, peaking in winter and falling in summer. The use of cashew oil to serve consumers in the food and beverage industry is increasing. Recent commercial interest in cashews has led to their use in the production of cookies, cereal, ice cream ingredients, and cashew butter. Cashew consumption is on the rise due to the popularity of snack foods. Additionally, cashews are often used as an ingredient in spreads and snacks. Intersnack is a German company operating in the field of processing and packaging. The company operates in several countries, including Australia, India, Vietnam and Singapore. Alnatura is a German food manufacturer with a wide range of cashew products. Therefore, the increasing demand for cashews in the market has led to the growth of cashews in the country. A similar growth in demand is expected over the forecasting period.

COVID-19 Impact Analysis on the Global Cashew Market:

With the outbreak of COVID-19, the market has seen a setback as the food processing industries were not working because of the lockdown. Also, it made consumer shift their inclination from offline to online buying of nuts. After the pandemic, the demand for cashews will increase because people will want healthier foods that are better for the body.

Latest Trends/ Developments:

Edible cashew nuts have long been used as a snack. Cashew nuts are also used as one of the main ingredients in the preparation of many sweet and savory dishes, especially in Asian cuisine. Cashews are also now used in foods, energy bars, biscuits, chocolate, and ice cream. Cashews are known to be rich in nutrients like copper that improve bone health, as one ounce of cashews contains 622 micrograms of copper. However, according to the International Nut and Dried Fruit Council, cashew consumption patterns are shaped by inflation.

Cashews are also high in fiber compared to peanuts and may help maintain health by improving digestion. These nutritional benefits have led snack companies to offer a variety of snacks to meet demand, from snacks to ready-to-eat milk, which is lactose-free milk. Consumption of cashew nuts is also increasing due to the increasing health awareness of consumers in Europe. Recently, cashews have also increased as an ingredient in spreads and snacks, thus increasing total cashew consumption.

Key Players:

-

Bata Food

-

Haldirams

-

Wonderland Foods

-

Divine Foods

-

Delicious Cashew Co.

-

Kalbavi Cashews

-

Nutty Yogi

-

Royal Dry Fruits Pvt Ltd.

-

Delphi Organic GmbH

-

Lafooco and Aryan International

-

In 2022, Amazon, Alibaba, and other platforms facilitated wider market reach for niche players and direct farmer-to-consumer sales.

-

In 2022, Emery Nuts focused on organic and fair-trade cashews, catering to growing consumer demand for ethical products.

Chapter 1. Cashew Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cashew Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cashew Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cashew Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cashew Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cashew Market – By Form

6.1 Introduction/Key Findings

6.2 Whole

6.3 Roasted

6.4 Powder

6.5 Splits

6.6 Paste

6.7 Y-O-Y Growth trend Analysis By Form

6.8 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Cashew Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online

7.3 Offline

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Cashew Market – By Application

8.1 Introduction/Key Findings

8.2 Dairy Products

8.3 Bakery Products

8.4 Snacks & Bars

8.5 Confectionaries

8.6 Desserts

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Cashew Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Form

9.1.3 By Distribution Channel

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Form

9.2.3 By Distribution Channel

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Form

9.3.3 By Distribution Channel

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Form

9.4.3 By Distribution Channel

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Form

9.5.3 By Distribution Channel

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cashew Market – Company Profiles – (Overview, By Form Portfolio, Financials, Strategies & Developments)

10.1 Bata Food

10.2 Haldirams

10.3 Wonderland Foods

10.4 Divine Foods

10.5 Delicious Cashew Co.

10.6 Kalbavi Cashews

10.7 Nutty Yogi

10.8 Royal Dry Fruits Pvt Ltd.

10.9 Delphi Organic GmbH

10.10 Lafooco and Aryan International

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cashew Market was valued at USD 10.5 billion in 2023 and is projected to reach a market size of USD 15.43 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.65%.

The segments under the Global Cashew Market by Form are Whole, Roasted, Powder, Splits, and Paste.

Asia-Pacific region is the dominant Global Cashew Market.

Bata Food, Haldirams, Wonderland Foods, Divine Foods., Delicious Cashew Co., Kalbavi Cashews, Nutty Yogi, Royal Dry Fruits Pvt Ltd., Delphi Organic GmbH, Lafooco and Aryan International.

With the outbreak of COVID-19, the market has seen a setback as the food processing industries were not working because of the lockdown. Also, it made consumer shift their inclination from offline to online buying of nuts. After the pandemic, the demand for cashews will increase because people will want healthier foods that are better for the body.