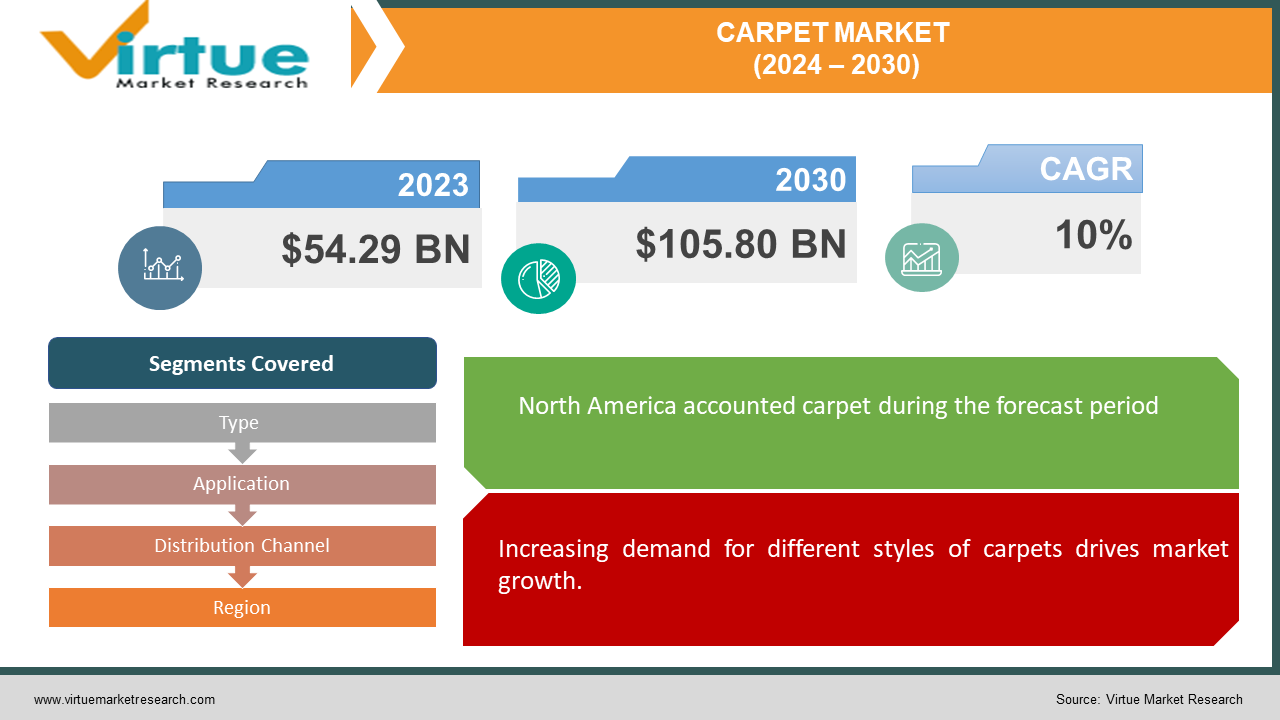

Carpet Market Size (2024 – 2030)

The Carpet Market was valued at USD 54.29 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 105.80 billion by 2030, growing at a CAGR of 10%.

Carpets and rugs are commonly recognized for their ability to enhance the ambiance of a space, providing both comfort and warmth. They serve to cushion the flooring, contributing to a more inviting environment. A variety of rug types, including those suitable for bedrooms, living rooms, offices, and made from materials such as wool, are favored among consumers. The market is witnessing a trend towards carpets crafted from innovative fibers like jute, linen, and hemp, often blended using advanced manufacturing techniques. Additionally, there is a growing consumer preference for environmentally sustainable options, leading to increased interest in carpets and rugs made from recycled materials, including discarded products and waste materials.

Key Market Insights:

Carpets and rugs are esteemed for their aesthetic appeal and functional attributes, enhancing the visual appeal of both residential and commercial spaces. Despite the dominance of machine-made carpets, handmade rugs hold a significant market share, accounting for approximately 30% of the global carpet and rug market value, driven by the premium quality, unique designs, and artisanal craftsmanship, according to Statista.

In June 2022 Mannington Commercial unveiled a groundbreaking initiative wherein all newly introduced and updated carpet, luxury vinyl tile (LVT), rubber, and resilient sheet products in 2022 will be 105% carbon offset. This commitment ensures that customers can make environmentally conscious purchases, as the products will either be carbon-negative or carbon-neutral. By mitigating carbon dioxide emissions throughout the entire lifecycle of these products — from raw material extraction to manufacturing — Mannington Commercial aims to accelerate the decarbonization of its operations and supply chain. Furthermore, this initiative addresses critical environmental challenges facing the flooring industry, including greenhouse gas emissions, sustainable energy utilization, and waste management.

Carpet Market Drivers:

Increasing demand for different styles of carpets drives market growth.

The demand for a diverse range of carpet styles is on the rise, prompting companies to expand their offerings tailored to various flooring types and design preferences. These styles encompass tile flooring, wooden parquet flooring, laminate flooring, area rugs, kitchen rugs, affordable options, runner rugs, Berber carpet, carpet flooring, stair runners, gray carpets, carpet squares, grass carpets, custom rugs, oriental rugs, carpet runners, Ikea's offerings, carpet padding, bedroom rugs, wool carpets, shaggy rugs, black carpets, living room carpets, artificial grass carpets, white carpets, Christmas-themed rugs, kitchen carpets, round carpets, green grass carpets, and floor runners.

For example, in August 2022, Ikea Systems introduced a collection inspired by Thai street style, reflecting affordability and versatility, drawing inspiration from recycling, reusing, and creative repurposing. This collection integrates elements of Thai street fashion with expertise in home furnishing, offering items such as cushions and rugs crafted from recycled PET bottles.

Moreover, the escalating demand for rugs and carpets correlates with increasing urbanization rates and rising standards of living among consumers. Additionally, a notable shift in consumer preferences towards eco-friendly flooring options, such as those made from bamboo, wool, and other sustainable materials, is further propelling market growth.

Carpet Market Restraints and Challenges:

High cost of raw materials affects market growth.

Market growth is being hindered by fluctuations in the cost of crude oil, which directly impacts the prices of nylon and other fibers essential for carpet and rug manufacturing. As the cost of raw materials rises, manufacturers face increased production expenses, leading to elevated prices for carpets and rugs. This economic factor presents a significant constraint on market expansion.

Carpet Market Opportunities:

Use of carpet in interior designing creates opportunities.

Carpet rugs serve as fundamental floor coverings widely employed by interior designers to enhance the aesthetic appeal of spaces. Rugs play a crucial role in augmenting the beauty of floors while providing essential thermal insulation. Particularly during colder seasons, they act as a protective barrier, shielding feet from the chill of tiles. Moreover, carpet rugs contribute significantly to elevating the ambiance of a room, often serving as exclusive pieces meticulously crafted by artisans to complement the overall interior design. As such, carpet rugs are increasingly gaining recognition within the realm of interior design, with their extensive use being a notable driving force behind the growth of the global carpet market.

CARPET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mohawk Industries, Inc., Genie Carpet Manufacturers, Shaw Industries Group Inc., Lowe's, Beaulieu International Group , Interface, Inc., Tarkett, Orientals Weavers Dixie Group, Inc., Marwar Carpets International |

Carpet Market Segmentation: By Type

-

Tufted Carpets

-

Woven Carpets

The Tufted segment dominates the Carpets and Rugs market, holding a significant share of approximately 30-35% in terms of revenue. This is primarily attributed to the increasing demand for carpets and rugs, which has subsequently boosted the demand for tufted products within the overall market. Tufted rugs are crafted using a hand-held tufting gun, enabling manufacturers to closely replicate the intricate designs found in handmade oriental rugs. Moreover, these rugs offer key advantages, including the ability to be customized in any size and shape, seam-free construction, and exceptional durability, ensuring longevity. Tufted carpets and rugs are available in two main types: hand-tufted and machine-tufted, catering to diverse consumer preferences and requirements.

Carpet Market Segmentation: By Application

-

Residential

-

Commercial

The Residential segment commands the largest share in the market, driven by the burgeoning demand for decorative and stylish carpets and rugs worldwide. It is estimated that approximately 50% of this segment's growth is attributed to increasing demand for enhancing the aesthetic appeal of residential spaces, along with the desire for improved sound and thermal insulation. Carpets and rugs come in a wide array of colors, styles, and textures, providing the perfect finishing touch to interior decoration schemes.

Carpet Market Segmentation: By Distribution Channel

-

Offline

-

Online

-

Other Distribution Channels

The Offline segment reigns supreme in the market, largely due to the inherent trust individuals place in their own instincts when purchasing carpets. In the offline market, consumers have the advantage of physically touching and inspecting carpets before making a purchase decision, a luxury not afforded by online platforms. This tactile experience plays a significant role in driving consumer preference towards offline distribution channels, as individuals feel more confident in their selections when they can personally assess the quality and texture of carpets. Consequently, despite the growing popularity of online shopping, many people continue to prefer purchasing carpets in brick-and-mortar stores.

Carpet Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The North America region maintains dominance in the global carpets and rugs market, a position expected to persist in the coming years. This leadership is attributed to the rapid expansion of construction and housing activities, particularly in the United States. The burgeoning interest in interior decoration among consumers in the United States significantly contributes to the market's growth trajectory. Additionally, increased renovation and remodeling endeavors within the real estate sector have spurred substantial demand for carpets and rugs in recent years.

Furthermore, the region's culture of innovation plays a pivotal role in propelling market growth, while high disposable income levels drive investments and elevate living standards. Notably, the United States stands out as one of the leading revenue generators in the market.

In the Asia-Pacific region, the carpets market secures the second-largest market share, propelled by escalating construction activities and growing demand across residential and commercial sectors. Noteworthy initiatives such as IKEA's 'Made in India' collection, featuring eco-friendly products crafted from rice straw under the brand name FORANDRING, exemplify the region's commitment to sustainability and environmental consciousness. This collection includes rugs, lamp shades, and other decorative items, reflecting a broader push towards eco-friendly agriculture and pollution reduction.

COVID-19 Pandemic: Impact Analysis

The outbreak of the coronavirus has had a detrimental impact on the carpets market. Government-imposed nationwide lockdowns aimed at curbing the spread of the virus, originating from Wuhan, led to significant disruptions in the supply chain of raw materials, thereby disrupting the production cycle of the global carpet market. Furthermore, stringent government restrictions on establishments such as hotels, restaurants, and offices resulted in a notable decline in demand for carpet rugs. The pandemic-induced constraints on supermarkets, hypermarkets, and brand stores further exacerbated disruptions in the distribution channel.

However, amidst these challenges, e-commerce emerged as a crucial facilitator in reviving the supply chain and distribution channel for carpets. With growing concerns about the transmission of coronavirus, consumers increasingly shifted towards online purchases, opting to avoid in-store transactions. This shift in consumer behavior has underscored the importance of e-commerce platforms in sustaining market operations during times of crisis.

Latest Trends/ Developments:

January 2022: Tarkett and Reader's Wholesale Distributors have officially announced their strategic partnership. Reader's will serve as the representative for Tarkett's extensive product portfolio in both commercial and residential sectors across southern Texas, southern Louisiana, as well as central and south Mississippi. By expanding its distribution network through this collaboration, Tarkett aims to effectively address the needs of its clients in these vital regions. The alliance between Tarkett and Reader's underscores a commitment to fostering long-term, sustainable growth through a robust distribution network, while simultaneously prioritizing exceptional customer service across all market segments.

Key Players:

These are top 10 players in the Carpet Market: -

-

Mohawk Industries, Inc.

-

Genie Carpet Manufacturers

-

Shaw Industries Group Inc.

-

Lowe's

-

Beaulieu International Group

-

Interface, Inc.

-

Tarkett

-

Orientals Weavers

-

Dixie Group, Inc.

-

Marwar Carpets International

Chapter 1. Carpet Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carpet Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Carpet Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Carpet Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Carpet Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carpet Market – By Type

6.1 Introduction/Key Findings

6.2 Tufted Carpets

6.3 Woven Carpets

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Carpet Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Carpet Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Online

8.4 Other Distribution Channels

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Carpet Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Carpet Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Mohawk Industries, Inc.

10.2 Genie Carpet Manufacturers

10.3 Shaw Industries Group Inc.

10.4 Lowe's

10.5 Beaulieu International Group

10.6 Interface, Inc.

10.7 Tarkett

10.8 Orientals Weavers

10.9 Dixie Group, Inc.

10.10 Marwar Carpets International

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The demand for a diverse range of carpet styles is on the rise, prompting companies to expand their offerings tailored to various flooring types and design preferences.

The top players operating in the Carpet Market are - Mohawk Industries, Inc., Genie Carpet Manufacturers, Shaw Industries Group Inc., Lowe's, Beaulieu International Group.

stringent government restrictions on establishments such as hotels, restaurants, and offices resulted in a notable decline in demand for carpet rugs. The pandemic-induced constraints on supermarkets, hypermarkets, and brand stores further exacerbated disruptions in the distribution channel.

Carpet rugs contribute significantly to elevating the ambiance of a room, often serving as exclusive pieces meticulously crafted by artisans to complement the overall interior design. As such, carpet rugs are increasingly gaining recognition within the realm of interior design, with their extensive use being a notable driving force behind the growth of the global carpet market.

The Asia-Pacific region, the carpets market secures the second-largest market share, propelled by escalating construction activities and growing demand across residential and commercial sectors.