Carotenoids-based Natural Food Colorants Market Size (2025-2030)

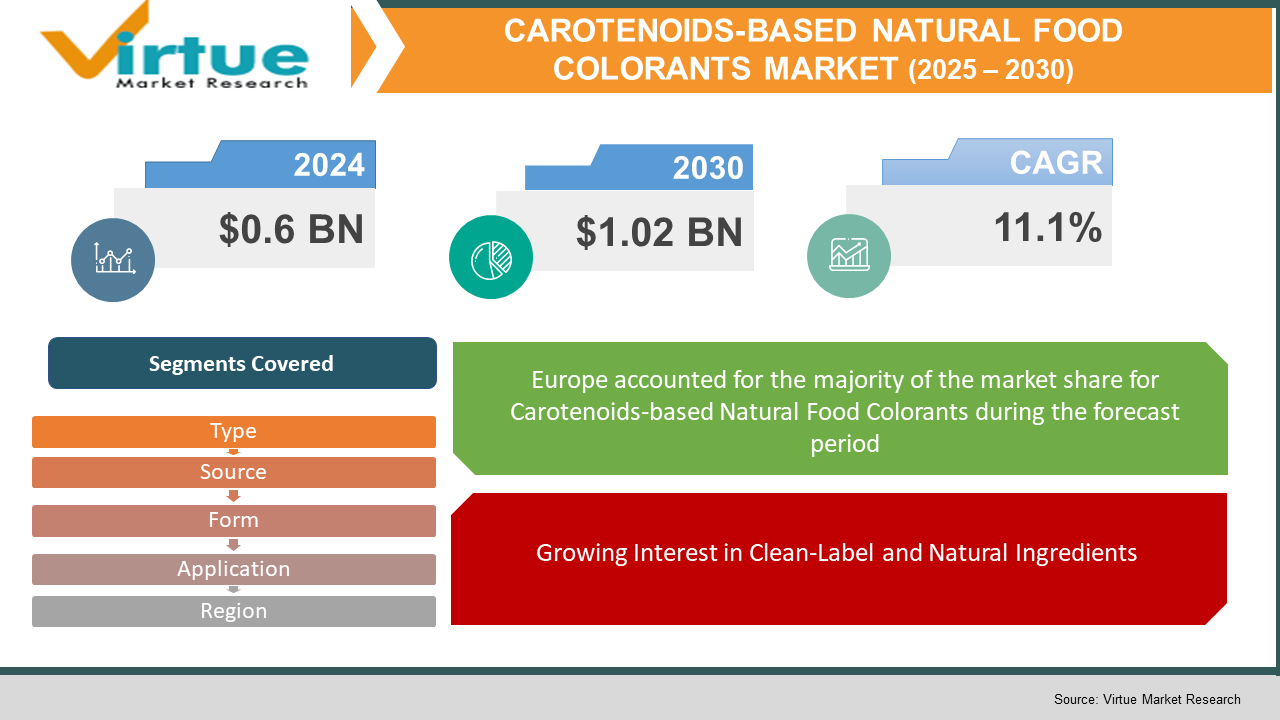

The Carotenoids-based Natural Food Colorants Market was valued at $0.6 billion in 2024 and is projected to reach a market size of $1.02 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.1%.

Carotenoids are popular pigments found in plants, algae, and bacteria. They’re known for their bright colors and health benefits, which is why many food producers are using them to make their products look better and appeal to health-conscious customers. As more people want natural food coloring, companies are upgrading their processes and increasing production to keep up with demand. This not only helps cut costs but also allows them to respond better to market changes. There’s a big push to create new products that focus on clean labels and organic options since consumers are increasingly looking for natural and clear ingredient lists. To boost their presence in the market, businesses are making strategic purchases and teaming up to expand their distribution networks. With more people becoming aware of health issues, there’s been a rise in eating functional foods, taking dietary supplements, and using fortified products—all of which benefit from carotenoids for their antioxidant effects and support for eye, heart, and immune health. Carotenoids are also finding uses in pharmaceuticals, animal feed, and cosmetics, leading companies to offer tailored solutions for different industries. The versatility of carotenoids—combining beauty, nutrition, and health benefits—keeps them important in various fields, making them a key player in the natural colorants market.

Key Market Insights:

More than 65% of consumers around the world prefer food that uses natural colorants, which has boosted the demand for pigments made from carotenoids. With the clean-label trend, many companies are replacing synthetic dyes with natural options like beta-carotene, lutein, and lycopene. This trend is making carotenoids a key ingredient for revamping products in food and drinks.

About 58% of people think about health benefits when picking food products. This is making carotenoids more popular thanks to their antioxidant qualities and advantages for eye, immune, and heart health. You can see this demand, especially in fortified foods, functional products, and dietary supplements.

Roughly 40% of manufacturers are expanding their carotenoid ranges through research and partnerships. These collaborations help create customized solutions for sectors like food, pharmaceuticals, cosmetics, and animal nutrition, leading to more market reach.

Around 70% of shoppers are looking for sustainability and clarity in ingredient lists. Carotenoids are a good fit because they're sourced from renewable resources like algae, plants, and bacteria. Because of this, brands are using carotenoid-based colorants to meet consumer demands for ethical sourcing and environmental care.

As the demand for carotenoids rises, more than 50% of large producers are putting money into better extraction and formulation techniques. These advancements have helped cut production costs by as much as 20% in some cases while also improving how stable and long-lasting the pigments are. This makes carotenoids a better choice for use in various industries.

Carotenoids-based Natural Food Colorants Market Key Drivers:

Growing Interest in Clean-Label and Natural Ingredients.

More and more people want to know what's in their food, which is pushing up the demand for clean-label and natural ingredients. Carotenoids, which come from sources like carrots, tomatoes, and algae, provide a natural option instead of synthetic colorants. They not only add bright colors but are also seen as healthier, making them popular in the food and drink industry.

Health Benefits Fueling Consumer Choice.

Carotenoids aren’t just about adding color; they also come with health perks like being antioxidants and helping with eye health and immune support. This makes them appealing to health-minded shoppers, leading to more use of functional foods, supplements, and nutraceuticals. As people learn more about these benefits, it's driving the market forward.

Growth in Food and Drink Uses.

Carotenoids are versatile, which is why you see them in a wide range of food and drink products. From dairy and baked goods to beverages and snacks, manufacturers are adding carotenoids to boost visual appeal and satisfy the demand for natural ingredients. This wide range of uses is helping the market grow steadily.

Carotenoids-based Natural Food Colorants Market Restraints and Challenges:

Challenges Facing the Carotenoids-Based Natural Food Colorants Market.

The market for carotenoid-based natural food colorants is dealing with a few bumps along the road. One major issue is the high production costs. The extraction process can be complicated and needs advanced tech and a lot of energy, which makes the final products pricey and hard to find in budget-conscious markets. Plus, carotenoids are pretty delicate – they don't do well with heat, light, or changes in acidity. This affects their color and nutrition, which can limit how they’re used. Sometimes, stabilizers are needed, but they can clash with a clean-label image. Regulatory challenges also add to the mix, as there are tight rules on safety, labeling, and usage. Meeting these requirements can be costly, especially for smaller companies. The market also faces stiff competition from synthetic colorants, which are cheaper and more stable, even though more consumers want natural options. Seasonal changes and reliance on agricultural materials

can lead to price and supply swings, making it hard to keep things consistent. To tackle these issues, businesses need to invest in better extraction methods, boost pigment stability, and come up with affordable solutions while keeping up with complex regulations and sourcing raw materials sustainably.

Carotenoids-based Natural Food Colorants Market Opportunities:

Exploring New Chances in the Carotenoids-Based Natural Food Colorants Market.

The market for carotenoid-based natural food colorants is looking to grow thanks to some new opportunities that fit what consumers want and what's trending in the industry. Better extraction methods, like supercritical CO₂ extraction and fermentation, are making it easier and more sustainable to get carotenoids from natural sources. This makes them more available for all sorts of uses. These updates not only help keep production costs down but also meet the rising demand for natural and clean-label products. Plus, carotenoids are finding their way into functional foods, dietary supplements, and cosmetics, opening up more growth opportunities. Carotenoids like beta-carotene, lutein, and lycopene are known for their antioxidant benefits and potential health perks, making them popular for products that support eye health, skin health, and overall wellness. On top of that, more people are looking for plant-based and organic options, which has boosted the demand for carotenoid-rich ingredients from fruits, veggies, and algae. As rules continue to favor natural additives and shoppers become more aware of health and environmental issues, the market for carotenoid-based natural food colorants is set to take advantage of these new opportunities, leading to innovation and growth across different industries.

CAROTENOIDS-BASED NATURAL FOOD COLORANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.1% |

|

Segments Covered |

By Type, source, form, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DSM-Firmenich, BASF SE, Givaudan SA, Sensient Technologies Corporation, Archer Daniels Midland Company (ADM), Kalsec Inc., Lycored Ltd., Kemin Industries, Inc., Döhler GmbH, Allied Biotech Corporation |

Carotenoids-based Natural Food Colorants Market Segmentation:

Carotenoids-based Natural Food Colorants Market Segmentation: By Type

- Beta-Carotene

- Lutein

- Lycopene

- Canthaxanthin

- Other Carotenoids

Beta-carotene is still the top carotenoid in natural food coloring, thanks to its popularity and health benefits. It helps with vision and the immune system since it turns into vitamin A. Food makers like it for its bright orange color, which works well in drinks, dairy, and baked goods. As more people want natural ingredients and shy away from synthetic additives, beta-carotene stays strong in the market.

Lycopene is quickly becoming a favorite, mainly because of its strong antioxidant power and health benefits. Found mostly in tomatoes, it gives food a deep red color and is popular in drinks and supplements. People are more aware of lycopene’s heart health benefits and its potential for cancer prevention, boosting its use. Improvements in extraction and stabilization are also helping lycopene find its way into more food and drink products.

Carotenoids-based Natural Food Colorants Market Segmentation: By Source

- Natural Carotenoids

- Synthetic Carotenoids

Natural carotenoids are quickly taking over the food colorant market as more people want clean and healthy products. These pigments come from plants like carrots, tomatoes, and algae and are seen as safer options compared to synthetic colorants. Better extraction methods and fermentation have made it easier and cheaper to produce these natural pigments, aligning with the demand for natural ingredients as consumers worry about synthetic additives.

Still, synthetic carotenoids lead the market. Made through chemical processes, they provide reliable color quality and stability, which are important for mass production. Their bright colors and durability are why many manufacturers still choose them. Despite this, growing consumer interest in natural ingredients and tougher regulations are pushing companies to look more into natural carotenoids.

Carotenoids-based Natural Food Colorants Market Segmentation: By Form

- Liquid

- Powder

Powdered carotenoids are quickly gaining popularity in the natural food color market. They have several benefits over liquid forms, like better stability, longer shelf life, and less oxidation, which makes them great for dry foods, seasonings, and mixes. They can be stored at normal room temperature, cutting storage costs and making transport easier, especially in less accessible areas. Plus, they allow for accurate measurements, ensuring consistent color in final products. This growing interest in natural additives is pushing the use of powdered carotenoids across many applications.

Despite this growth, liquids still dominate the market. They hold a big share thanks to their versatility and ease of use in various food and drink items. Liquid carotenoids mix well into beverages, sauces, and dressings, providing even coloring and avoiding clumps. They also offer precise dosing and fit seamlessly into production processes, making manufacturing smoother. The rise of ready-to-drink beverages and more liquid food products keep boosting the demand for liquid natural colors, solidifying their top spot in the industry.

Carotenoids-based Natural Food Colorants Market Segmentation: By Application

- Bakery and Confectionery Products

- Beverages

- Seasonings

- Other Applications

In the market for natural food colorants made from carotenoids, the Bakery and Confectionery Products segment is the biggest player, making up around 40% of the market. This is mainly because carotenoids like beta-carotene are widely used to add bright yellow and orange colors to items like cakes and candies. The push for clean-label products and a preference for natural ingredients are boosting their use in this area.

On the flip side, the Beverages segment is growing the fastest, with an expected growth rate of about 9.68% per year. This surge is due to the rising demand for natural ingredients in drinks like juices and smoothies. Carotenoids, especially beta-carotene and lycopene, are popular for their attractive colors and antioxidant properties, matching the health trends of consumers.

Carotenoids-based Natural Food Colorants Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The market for natural food colorants made from carotenoids varies across different regions. Europe leads the way, making up about 33% of the market in 2024, due to strict rules that support natural ingredients and a strong consumer interest in clean-label products in countries like Germany, France, and the UK. North America comes next with around 27%, bolstered by well-established food processing and a growing number of health-focused consumers. The Asia-Pacific area holds about 22%, driven by rapid urbanization and rising incomes in places like China and India. Latin America has around 10%, while the Middle East and Africa account for about 8%. Both of these regions are slowly growing as more people become aware of and start using natural food colorants. This setup shows Europe’s strong position and the potential for growth in Asia-Pacific, influencing the future of the carotenoids-based natural food colorants market worldwide.

COVID-19 Impact Analysis on the Carotenoids-based Natural Food Colorants Market:

The COVID-19 pandemic really shook up the market for natural food colorants made from carotenoids. Lockdowns led to manufacturing plants shutting down, messed up supply chains, and raised production costs since it was harder to get raw materials and labor. Because of this, there were delays in getting new products out and fewer carotenoid colorants available for sale. Plus, with restaurants closing and people cutting back on spending, the demand for certain carotenoids—especially in food service—took a hit. On the flip side, more people became interested in their health and wellness during the pandemic. This shift increased the demand for natural and clean-label products, which helped the carotenoid market since these are seen as healthier than artificial colorants. There was also a spike in interest in dietary supplements as folks looked to boost their immune systems, which further helped the growth of carotenoid products. Now that the global economy is starting to bounce back and people are leaning more toward natural ingredients, the market for carotenoids is likely to pick up steam and grow in the post-pandemic world.

Trends/Developments:

In January 2023, GNT Group rolled out EXBERRY® Shade Pink - OD, a natural colorant meant for fat-based products. This new shade adds to their lineup and meets the growing interest in natural color options for food.

Key Players:

- DSM-Firmenich

- BASF SE

- Givaudan SA

- Sensient Technologies Corporation

- Archer Daniels Midland Company (ADM)

- Kalsec Inc.

- Lycored Ltd.

- Kemin Industries, Inc.

- Döhler GmbH

- Allied Biotech Corporation

Chapter 1. Carotenoids-based Natural Food Colorants Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Carotenoids-based Natural Food Colorants Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Carotenoids-based Natural Food Colorants Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Carotenoids-based Natural Food Colorants Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Carotenoids-based Natural Food Colorants Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Carotenoids-based Natural Food Colorants Market– By Type

6.1 Introduction/Key Findings

6.2 Beta-Carotene

6.3 Lutein

6.4 Lycopene

6.5 Canthaxanthin

6.6 Other Carotenoids

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Carotenoids-based Natural Food Colorants Market– By Source

7.1 Introduction/Key Findings

7.2 Natural Carotenoids

7.3 Synthetic Carotenoids

7.4 Y-O-Y Growth trend Analysis By Source

7.5 Absolute $ Opportunity Analysis By Source , 2025-2030

Chapter 8. Carotenoids-based Natural Food Colorants Market– By Form

8.1 Introduction/Key Findings

8.2 Liquid

8.3 Powder

8.4 Y-O-Y Growth trend Analysis Form

8.5 Absolute $ Opportunity Analysis Form , 2025-2030

Chapter 9. Carotenoids-based Natural Food Colorants Market– By Application

9.1 Introduction/Key Findings

9.2 Bakery and Confectionery Products

9.3 Beverages

9.4 Seasonings

9.5 Other Applications

9.6 Y-O-Y Growth trend Analysis Application

9.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 10. Carotenoids-based Natural Food Colorants Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Form

10.1.4. By Source

10.1.5. Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Form

10.2.4. By Source

10.2.5. Application

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Application

10.3.4. By Source

10.3.5. Form

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Application

10.4.3. By Source

10.4.4. By Type

10.4.5. Form

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Form

10.5.3. By Application

10.5.4. By Source

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. CAROTENOIDS-BASED NATURAL FOOD COLORANTS MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 DSM-Firmenich

11.2 BASF SE

11.3 Givaudan SA

11.4 Sensient Technologies Corporation

11.5 Archer Daniels Midland Company (ADM)

11.6 Kalsec Inc.

11.7 Lycored Ltd.

11.8 Kemin Industries, Inc.

11.9 Döhler GmbH

11.10 Allied Biotech Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

It’s mainly driven by people becoming more health-conscious, wanting clean-label products, and stricter rules around synthetic additives.

The main users are food and beverage, nutraceuticals, cosmetics, and animal feed. They appreciate carotenoids for their eye-catching colors and health perks

New extraction techniques, microencapsulation, and bioengineering are making these products more stable, longer lasting, and easier to absorb

Europe is at the forefront, thanks to a rise in demand for functional foods, followed by North America and Asia-Pacific

We’re seeing trends like clean-label innovations, sustainable sourcing, plant-based products being launched, and these colorants being added to functional and fortified foods.